Printable Pennsylvania 6 Sales Tax Chart The base state sales tax rate in Pennsylvania is 6 Local tax rates in Pennsylvania range from 0 to 2 0 making the sales tax range in Pennsylvania 6 0 to 8 0 Find your Pennsylvania combined state and local tax rate Pennsylvania sales tax rates vary depending on which county and city you re in which can make finding the right sales

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 6 34 Groceries clothing prescription drugs and non prescription drugs are exempt from the Pennsylvania sales tax Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 8 The state wide sales tax in Pennsylvania is 6 There are additional levels of sales tax at local jurisdictions too Pennsylvania has an origin based sales tax system which keeps it simple for you If you re a local business then you must charge the tax rate according to your location in Pennsylvania

Printable Pennsylvania 6 Sales Tax Chart

Printable Pennsylvania 6 Sales Tax Chart

Printable Pennsylvania 6 Sales Tax Chart

https://i.pinimg.com/originals/eb/d0/12/ebd012367aea2136501f212e3969847d.jpg

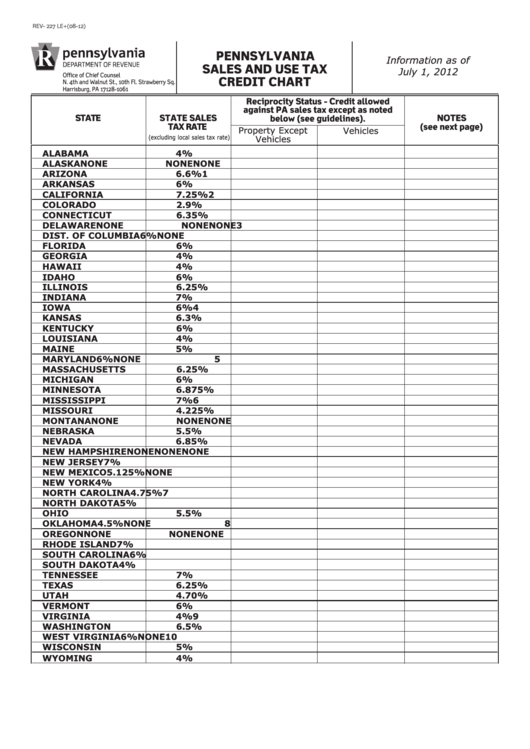

PA 1 Online Use Tax Return Pennsylvania Online Business Tax Registration REV 221 Sales and Use Tax Rates REV 227 Pennsylvania Sales and Use Tax Credit Chart REV 588 Starting a Business in Pennsylvania A Guide to Pennsylvania Taxes REV 72 Application For Sales Tax Exemption

Templates are pre-designed files or files that can be utilized for various functions. They can conserve time and effort by offering a ready-made format and design for developing various sort of material. Templates can be utilized for personal or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Printable Pennsylvania 6 Sales Tax Chart

7 25 Sales Tax Chart Printable Printable Word Searches

Gibbons Beer 1963 PA Sales Tax Chart This Is Its Other Sid Flickr

Total Sales Tax Per Dollar By City Oklahoma Watch

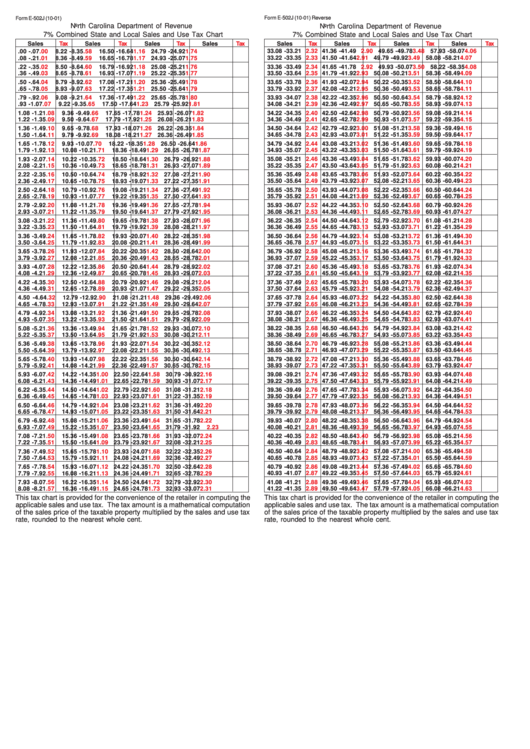

Form E 502j 7 Combined State And Local Sales And Use Tax Chart

Sales Tax Calculator Amazon au Appstore For Android

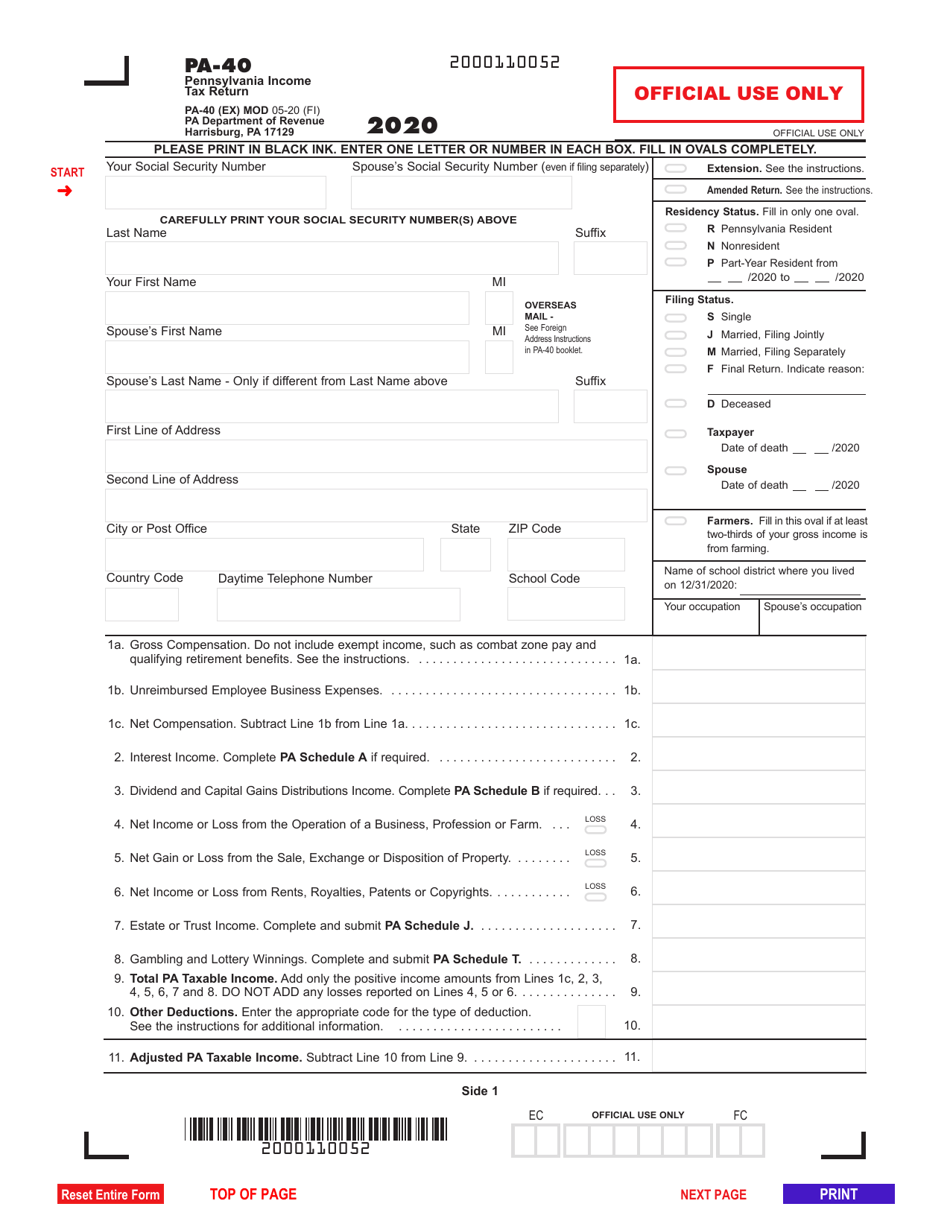

Form PA 40 Download Fillable PDF Or Fill Online Pennsylvania Income Tax

https://www.sales-taxes.com/pa/sales-tax-table

To make a custom Pennsylvania sales tax chart just change the sales tax rate starting price and price increment in the generator below By default this page is displaying a 6 sales tax table based on the Pennsylvania state sales tax rate Sales Tax Rate Table Starting Price Table Increment Pennsylvania Sales Tax Table at 6

https://www.revenue.pa.gov/FormsandPublications/FormsforBu…

6 RATES From Through Tax Amount 10 20 30 40 50 60 70 80 90 100 200 300 400 500 600 700 800 900 1000 2000 3000 Tax 60 1 20 1 80 2 40 3 00 3 60 4 20 4 80 5 40 6 00 12 00 18 00 24 00 30 00 36 00 42 00 48 00 54 00 60 00 120 00 180 00

https://www.revenue.pa.gov/TaxTypes/SUT

The Pennsylvania sales tax rate is 6 percent By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia

https://www.sales-taxes.com/pa

Pennsylvania s base sales tax rate of 6 is set by default Purchase Amount Sales Tax Rate Sales Tax 6 00 Purchase Price Tax 106 00 Protip Print out a free 6 sales tax table for quick sales tax calculations Pennsylvania Sales Tax By Zip Code Look up sales tax rates in Pennsylvania by ZIP code with the tool below

https://www.avalara.com/taxrates/en/state-rates/pennsylvania.html

Pennsylvania state sales tax rate range 6 0 8 0 Base state sales tax rate 6 Local rate range 0 2 0 Total rate range 6 0 8 0 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates

Pennsylvania is an origin based sales tax state So if you live in Pennsylvania collecting sales tax is fairly easy Collect sales tax at the tax rate where your business is located You can look up your local sales tax rate with TaxJar s Sales Tax Calculator The base level state sales tax rate in the state of Pennsylvania is 6 Additional sales tax is then added on depending on location by local government Putting everything together the average cumulative sales tax rate in the state of Pennsylvania is 6 17 with a range that spans from 6 to 8

Pennsylvania Sales and Use Tax Rate Table 6 RATES 1 RATES If the purchase price is more than 10 6 percent 6 state Sales Tax and or one percent 1 local Sales Tax of each dollar plus the above bracket charges upon any fractional part of