Printable File 941 Quarterly Form 941 is due on a quarterly basis at the end of the month following the end of the quarter For example for the first quarter of the year Form 941 is due on April 30 Download a PDF or Word Template

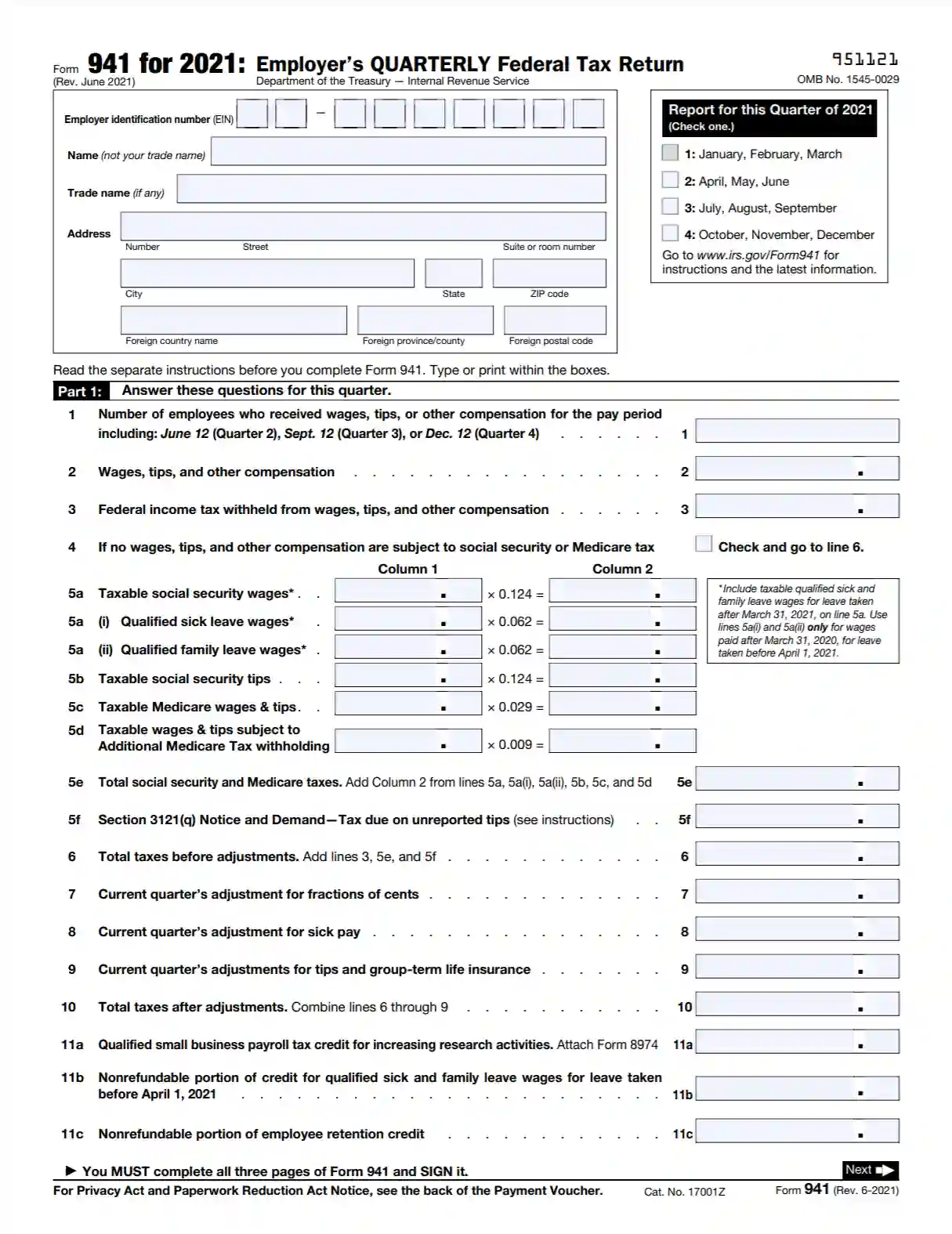

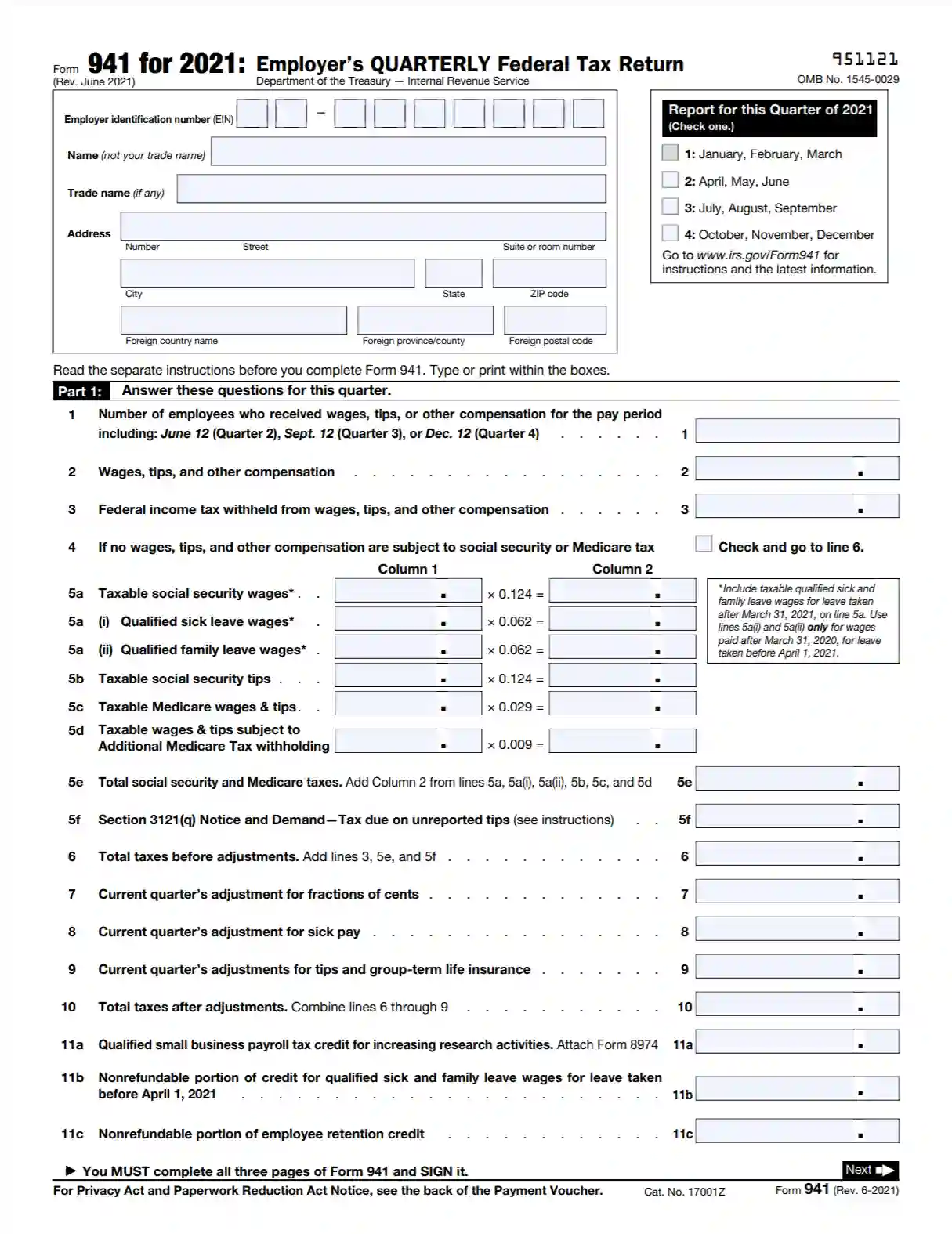

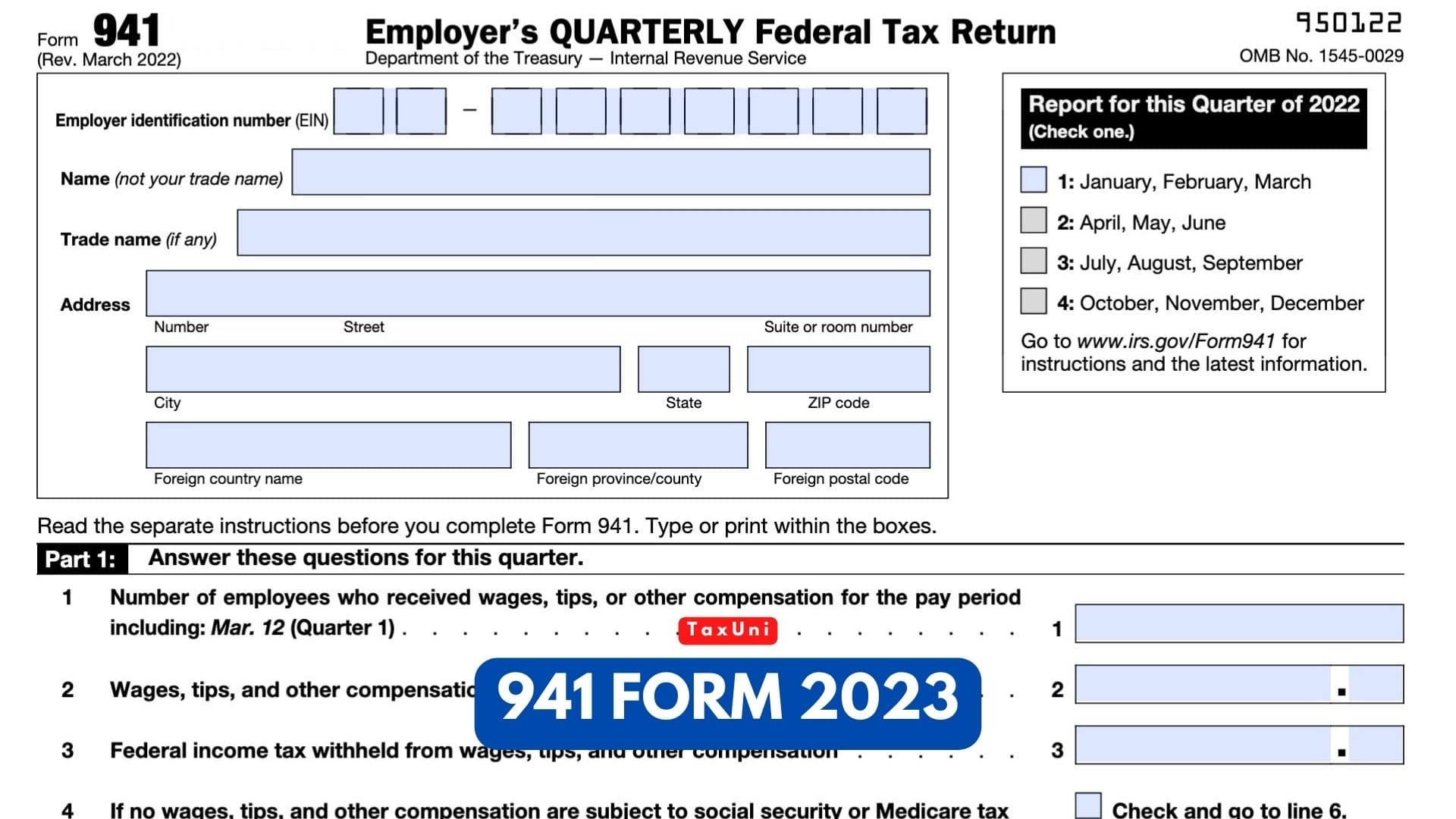

Download the current Form 941 revised March 2023 Above is a fillable PDF version that you can print or download Here s a guide to how the revised 941 works with instructions for completing yours and a downloadable PDF of What is Form 941 IRS Form 941 also known as the Employer s Quarterly Federal Tax Return is where businesses report the income taxes and payroll taxes that they withheld from their

Printable File 941 Quarterly

Printable File 941 Quarterly

Printable File 941 Quarterly

https://formspal.com/wp-content/uploads/2021/09/irs-form-941-rev-06-2021.webp

Form 941 is generally due by the last day of the month following the end of the quarter You are required to file Form 941 for each quarter First quarter JAN FEB MAR is due on May 01 2023 Second quarter APR MAY JUN on July 31 2023 Third quarter JUL AUG SEP on October 31 2023

Pre-crafted templates provide a time-saving solution for producing a diverse series of files and files. These pre-designed formats and designs can be utilized for various personal and expert projects, including resumes, invites, leaflets, newsletters, reports, discussions, and more, enhancing the material development process.

Printable File 941 Quarterly

941 X Amended Quarterly Return DAS

Irs Form Fillable And Savable Printable Forms Free Online

Form 941 X Mailing Address Fill Online Printable Fillable Blank

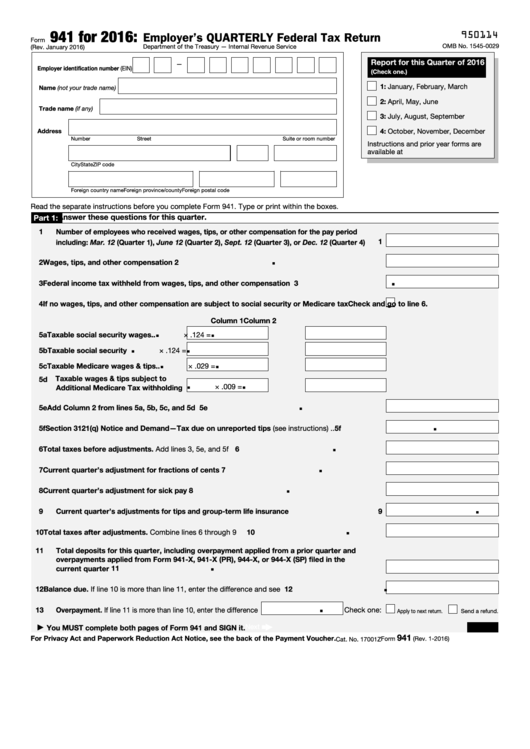

Fillable Form 941 Employer s Quarterly Federal Tax Return 2016

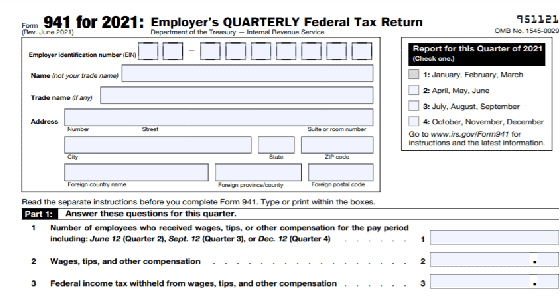

File 941 Online For 2021 E File 941 E file For 4 95

2020 Form 941 Employer s Quarterly Federal Tax Return Part 3 Business

https://www.irs.gov/forms-pubs/about-form-941

Information about Form 941 Employer s Quarterly Federal Tax Return including recent updates related forms and instructions on how to file Form 941 is used by employers who withhold income taxes from wages or who must pay social security or Medicare tax

https://www.zillionforms.com/2022/F2231500961.PDF

Form 941 for 2022 Rev March 2022 Employer s QUARTERLY Federal Tax Return Department of the Treasury Internal Revenue Service 950122 OMB No 1545 0029 Employer identification number EIN Name not

https://www.irs.gov/pub/irs-pdf/i941.pdf

Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands and Form 941 PR Planilla para la Declaraci n Federal TRIMESTRAL del Patrono will no longer be available after the fourth quarter of 2023

https://www.irs.gov/pub/irs-prior/f941--2022.pdf

2022 Form 941 Author W CAR MP FP Subject Employer s QUARTERLY Federal Tax Return Created Date 8 23 2023 2 41 09 PM

https://www.thebalancemoney.com/how-and-when-to-file-form-941-for

IRS Form 941 is the Employer s Quarterly Tax Return This form reports withholding of federal income taxes from employees wages or salaries as well as Medicare and Social Security withholdings FICA taxes Employers can use Form 941 to calculate how much they must contribute to their employees Medicare and Social Security taxes

What is Form 941 IRS Form 941 Employer s Quarterly Federal Tax Return reports payroll taxes and employee wages to the IRS Form 941 reports federal income and FICA taxes each quarter You must file Form 941 unless you Filed a final return Are a seasonal employer Employ a household employee e g nanny Have farm employees We provide a free printable template of the 941 tax form allowing you to download it in PDF and print it out when needed This convenient option ensures that you are using the most up to date version of the template Can I complete and

You can only e file the forms for the current quarter To get your work done you may pull up and print the said form just make sure to select the correct quarter and file it manually to the IRS You also have the option to gather the 941 form s data and download the form from the IRS website and mail it to them