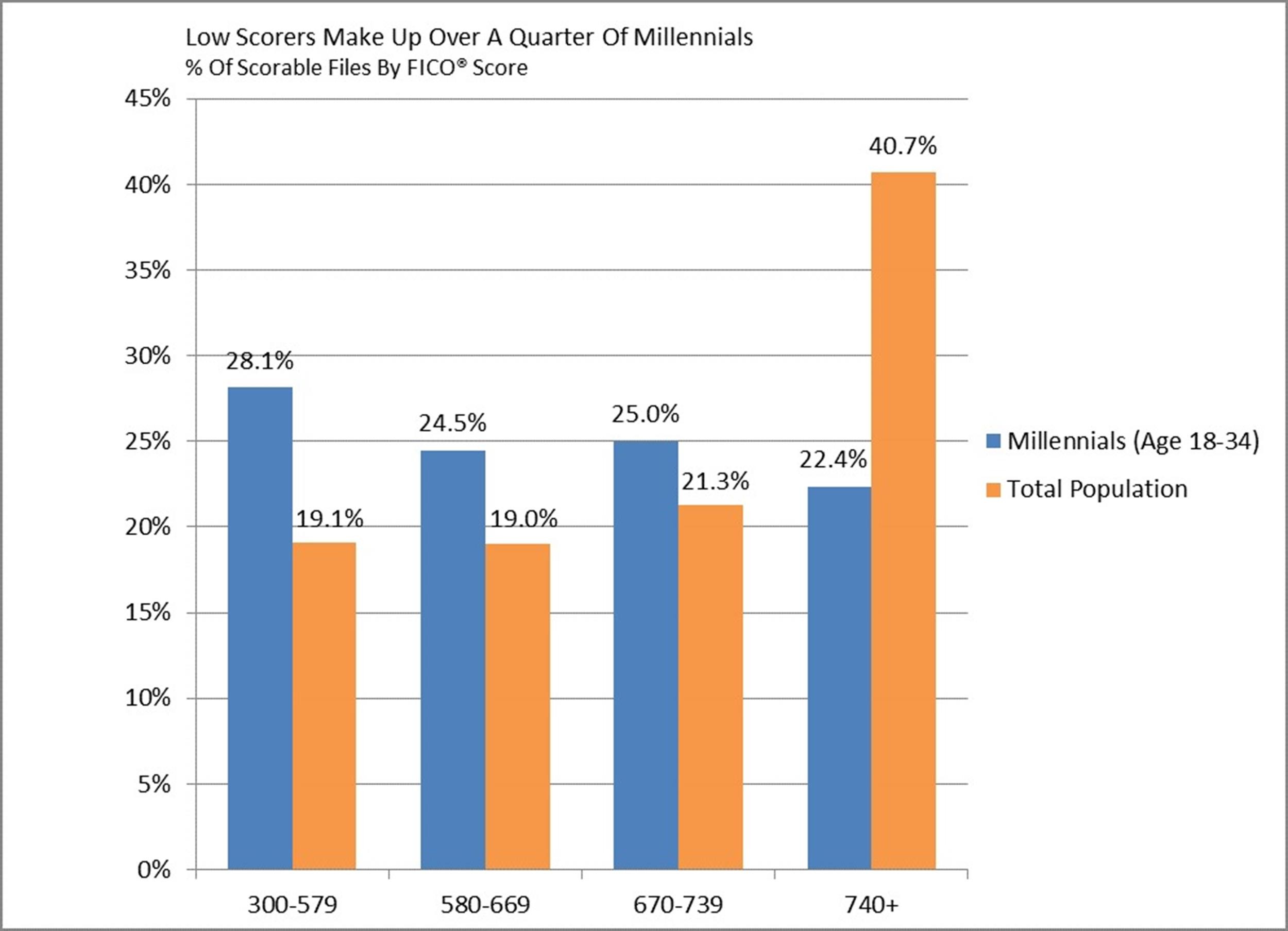

Printable Credit Score Chart The bottom range for the FICO Score model runs from 300 to 579 and happily has the fewest number of people at just 17 Realistically it s highly unlikely for someone to have such horrible credit as to have a 300 score those who have been through a messy bankruptcy could easily wind up at 400 or below

1 The FICO Credit Score Range The Fair Isaac Corporation better known as FICO is the original credit scoring company The FICO credit score is the most used scoring model with about 90 of top lenders using The three biggest are Equifax Experian and TransUnion Consumer Financial Protection Bureau Several variables affect your credit score including How many credit accounts you have How long you ve had those accounts How close you are to your credit limit How often your payments have been late Other factors How to raise your score

Printable Credit Score Chart

Printable Credit Score Chart

Printable Credit Score Chart

http://moussyusa.com/wp-content/uploads/2018/11/credit-score-chart-_020.jpg

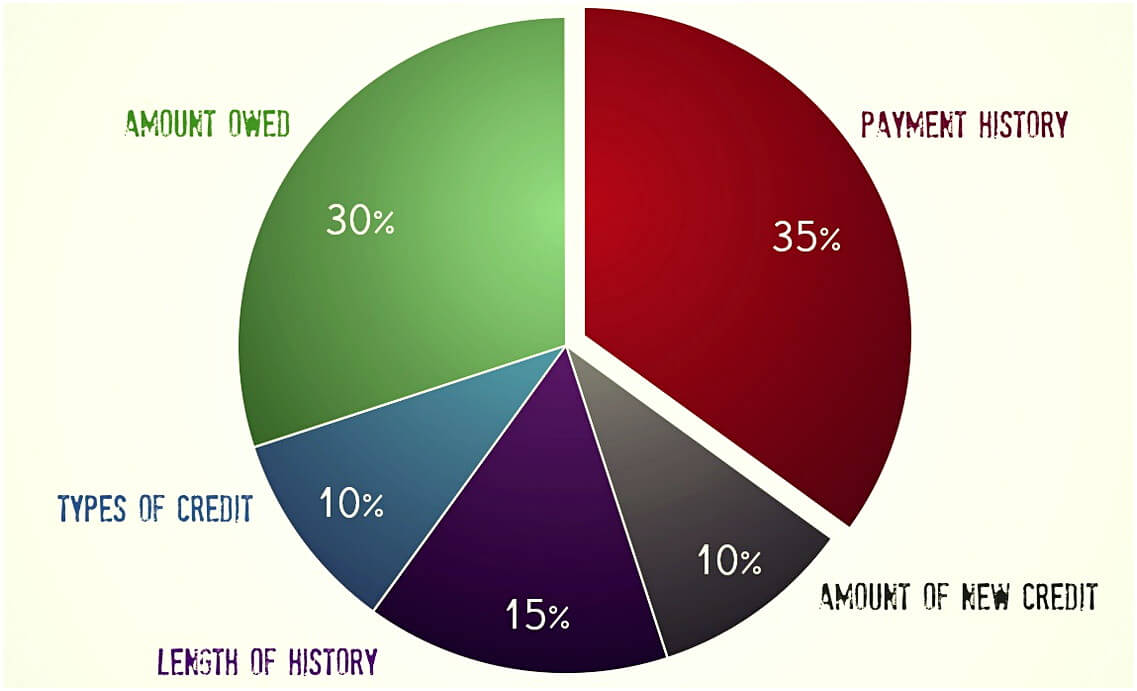

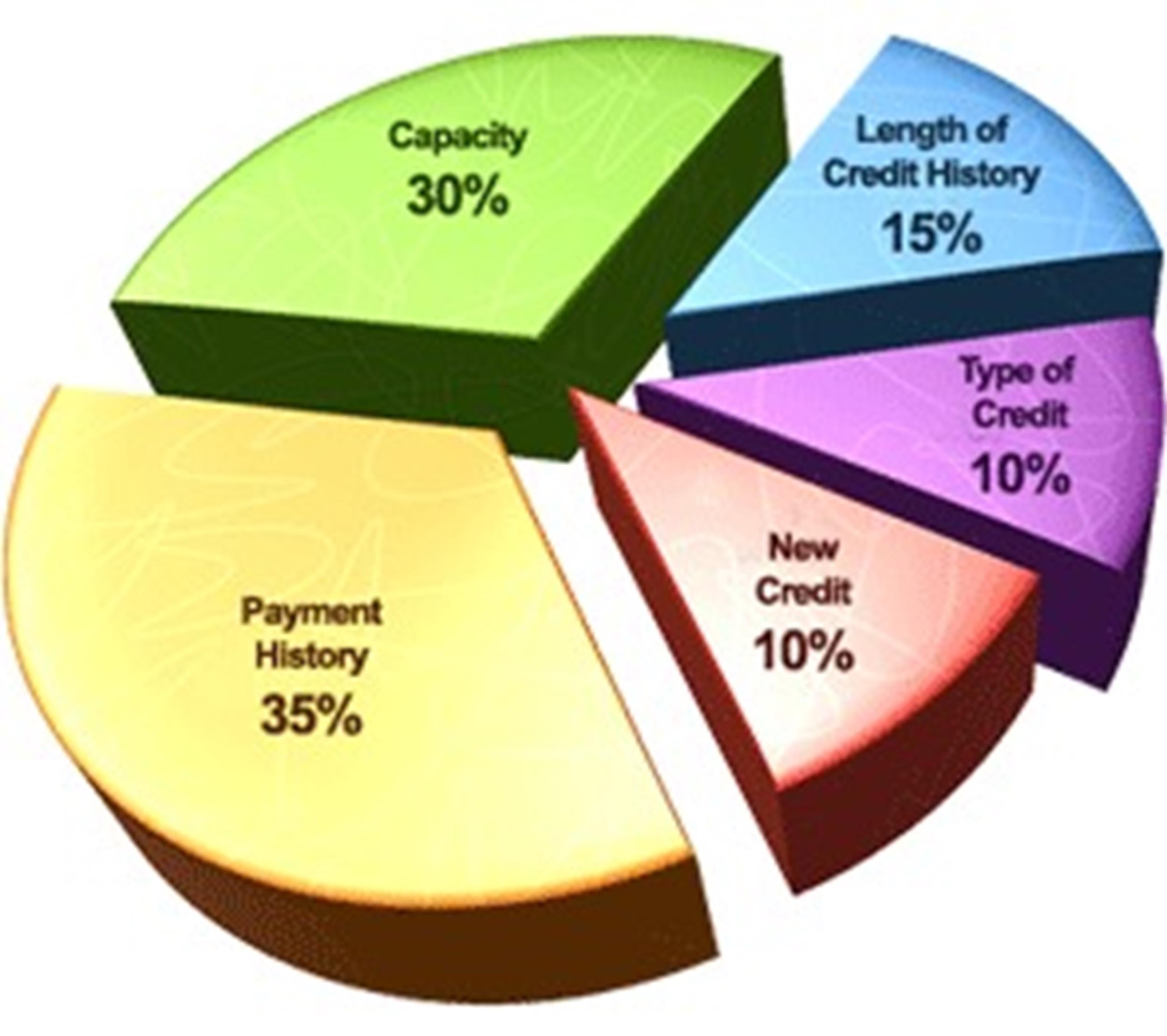

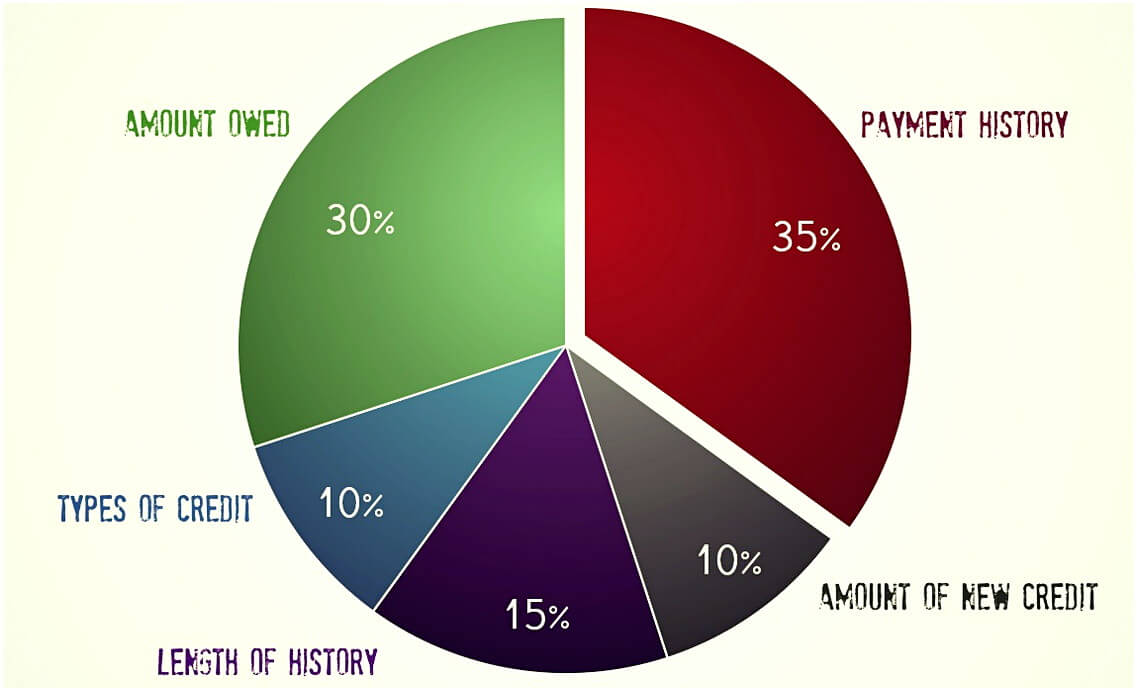

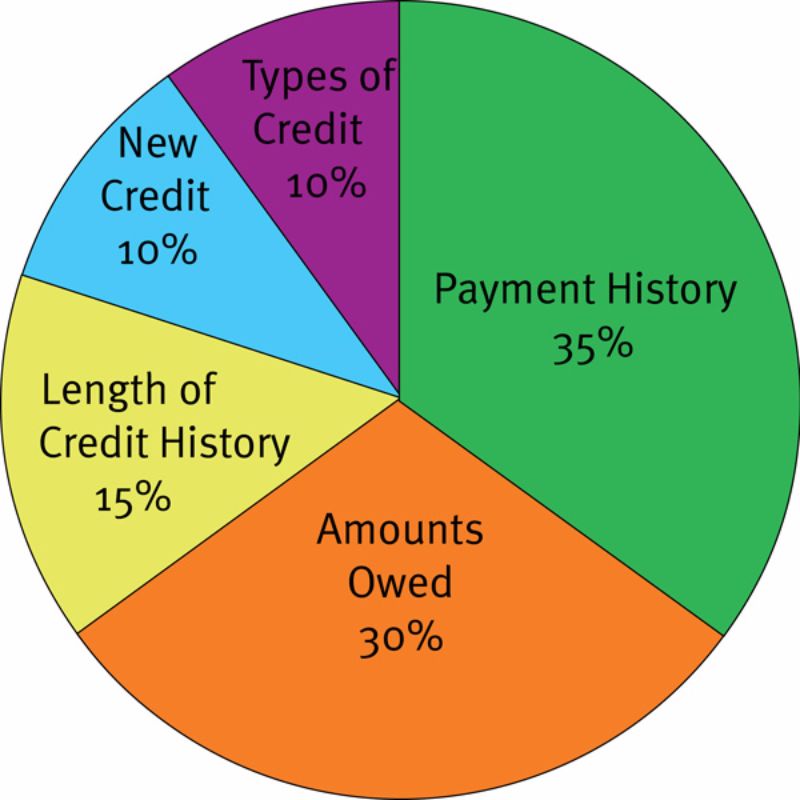

Credit scores are usually calculated by taking the following into account Payment history credit utilization or the percentage of your credit limits you re using length of credit history and mix of credit accounts amounts you owe recent credit behavior and

Pre-crafted templates offer a time-saving option for developing a diverse variety of files and files. These pre-designed formats and designs can be utilized for numerous personal and expert tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, enhancing the content production process.

Printable Credit Score Chart

30 Credit Score Charts Ranges What Is A Good Credit Score

19 Unique Experian Credit Score Chart

30 Credit Score Charts Ranges What Is A Good Credit Score

30 Credit Score Charts Ranges What Is A Good Credit Score

Credit Card Debt Tracker Printable

Thank You Printable Printable Chore Chart Chore Chart Kids

https://www.experian.com//brochures/credit-score-basics.pdf

The lender must make that decision For many years lenders reviewed credit reports and application information manually using simple paper worksheets They identified elements in credit histories and sometimes other application information that signaled lending risk by studying repayment patterns

https://www.discover.com/credit-cards/card-smarts/credit-score-chart

Very Good The very good range usually means you have a credit score of 744 799 People in this range are considered dependable borrowers Good If your score is between 670 739 you ll fall into the good range

https://snappyrates.ca/credit-score-canada

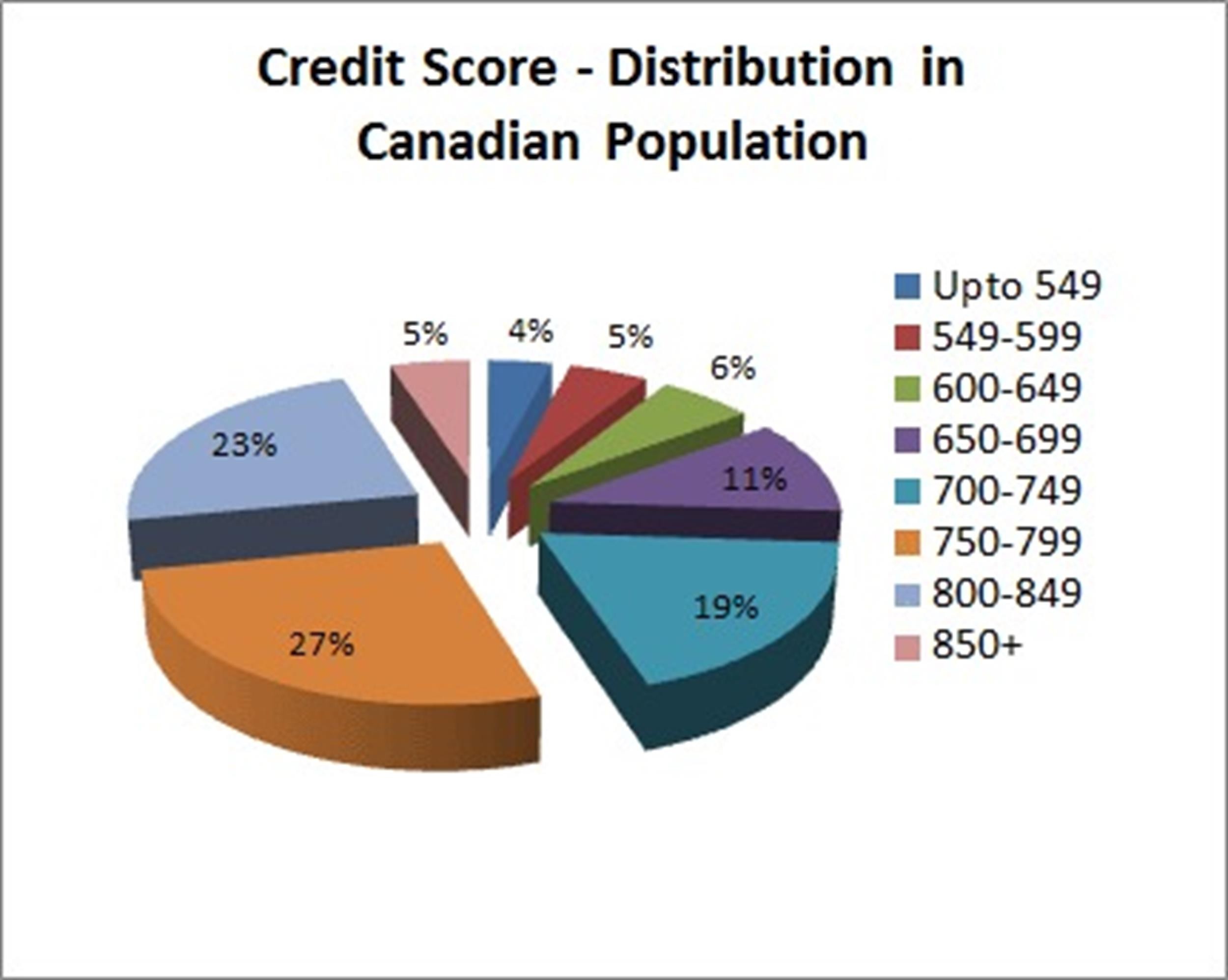

Table of Contents Show What is a Good Credit Score in Canada The two major credit bureaus in Canada Equifax and Transunion calculate your credit score using proprietary formulas While the score you obtain from either credit bureau may vary generally they are as follows

https://www.rate.com/resources/credit-score-chart

For a better understanding of the different credit score ranges let s take a look at the credit score chart from TransUnion

https://www.experian.com/blogs/ask-experian/infographic-what-are-the-

June 23 2020 11 min read By Jim Akin Experian TransUnion and Equifax now offer all U S consumers free weekly credit reports through AnnualCreditReport In this article Credit Scoring Models Credit Score Ranges What Is Good Credit Anyway How Credit Scores Are Calculated Other Factors to Consider

Most credit scores range from 300 to 850 A higher credit score means you are predicted to be less of a risk Usually a high credit score makes it easier to get a loan and may result in a better interest rate but lenders have their own cutoffs to determine eligibility FICO credit scores VantageScore 3 0 BUILDING BLOCKS STUDENT HANDOUT KEY INFORMATION Building block Financial knowledge and decision making skills Grade level High school 9 12 Age range 13 19 Topic Borrow Getting loans Managing credit School subject CTE Career and technical education English or language arts Social studies or history Teaching strategy Direct instruction

1 Payment History and the Credit Score Chart The single biggest factor on the credit score chart making up 35 of your score is simply paying your debts on time Missing just one payment can lower your score as much as 100 points