Printable Child Disability Form If you are a non disabled spouse or child 18 years of age or older who is not attending high school or postsecondary school full time you can receive up to 200 a month in net earnings with no reduction in your income support Transition Child Benefit Find out if you are eligible for the Transition Child Benefit and how it affects your ODSP case

If you are a parent or guardian you can request the child rearing provision and the children s benefit both included in the application form If you are unable to fill out the forms a family member or a friend can help you Ontario Disability Support Program Member ID The Ontario Disability Support Program ODSP provides income and other supports to people with disabilities Every person And you will not need to complete any medical forms first If your medical review date has passed you will get a new medical review date 7 MyBenefits account

Printable Child Disability Form

Printable Child Disability Form

Printable Child Disability Form

https://child-disability.com/wp-content/uploads/2014/05/cdheader1.jpg

Child disability benefit CDB amounts per month for one to three eligible dependants Child disability benefit CDB guideline table effective July 2021 June 2022 2020 base year Adjusted family net income

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can save effort and time by supplying a ready-made format and design for developing different type of material. Templates can be utilized for individual or expert jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Printable Child Disability Form

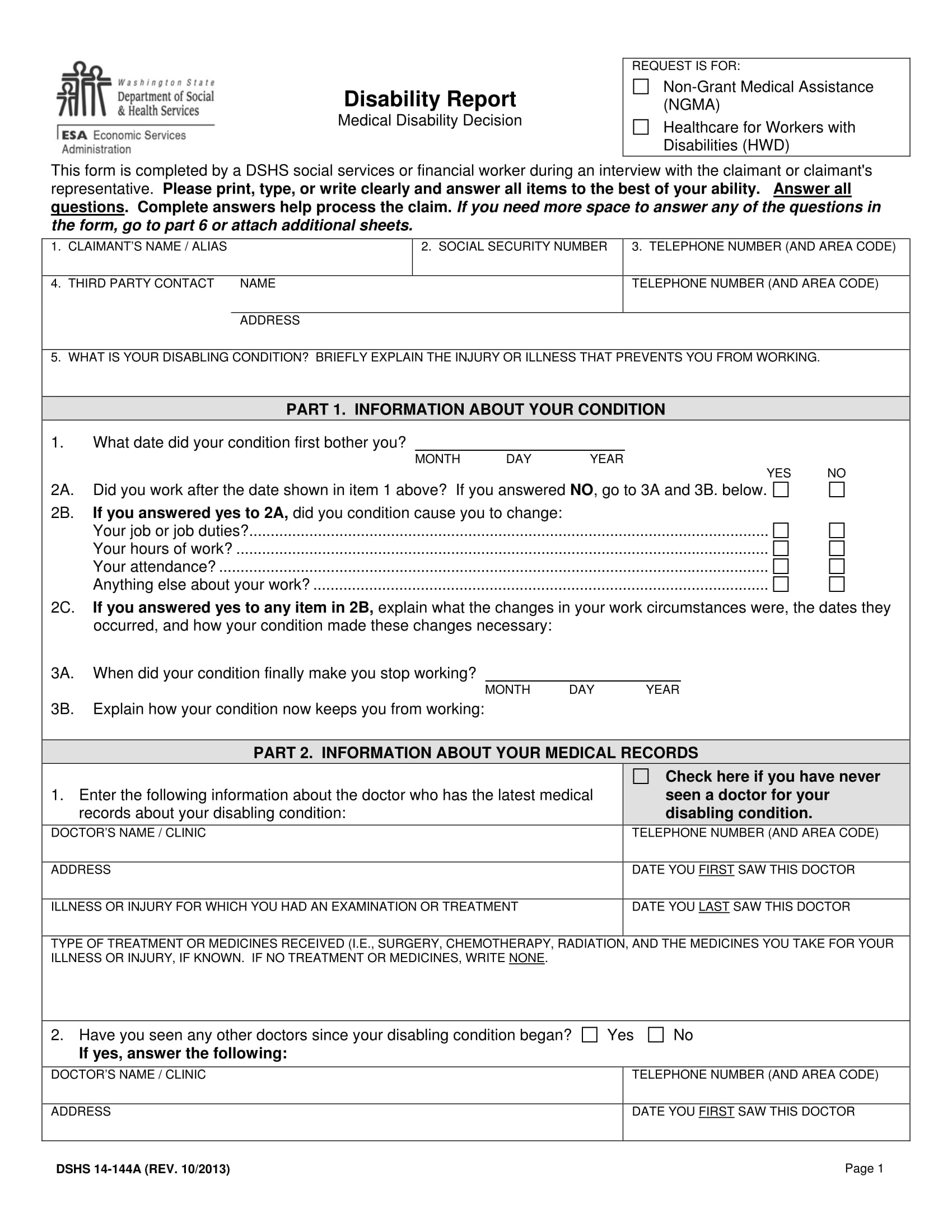

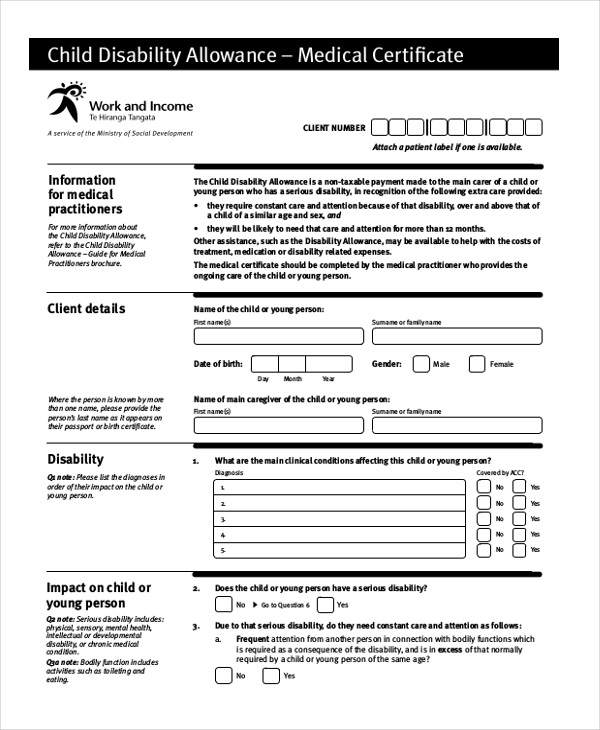

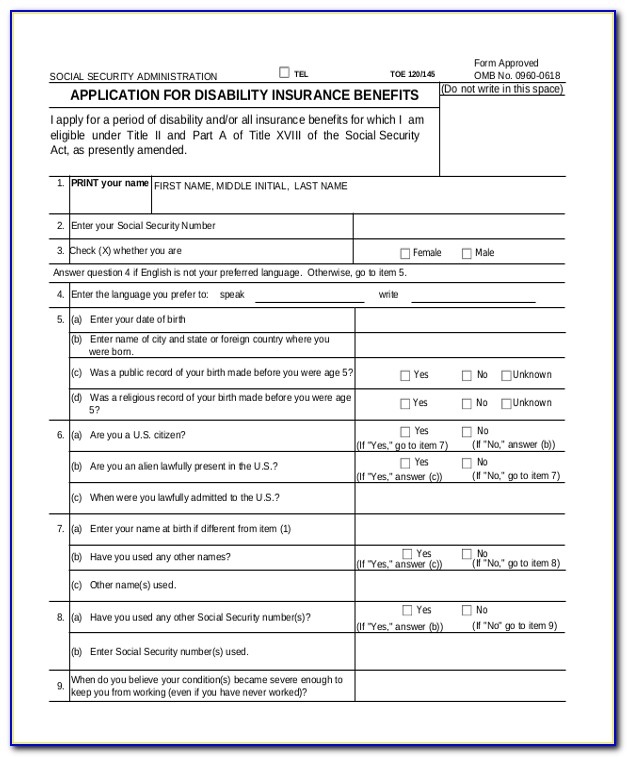

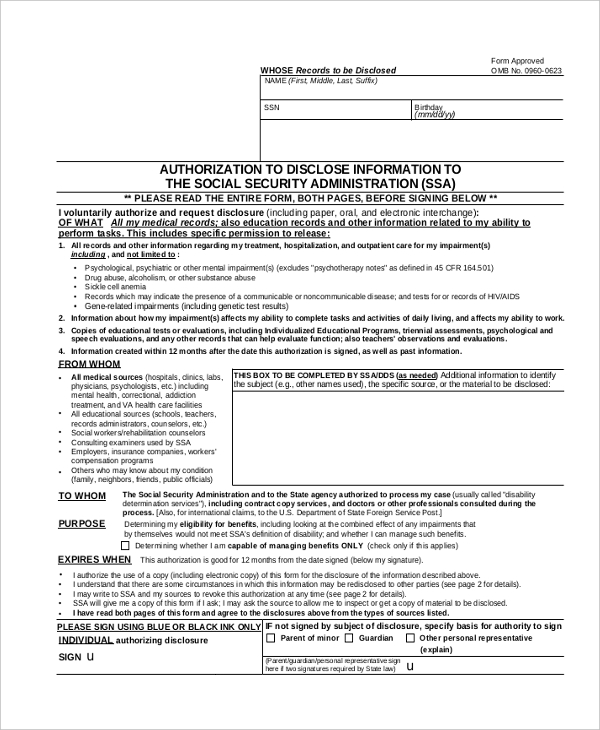

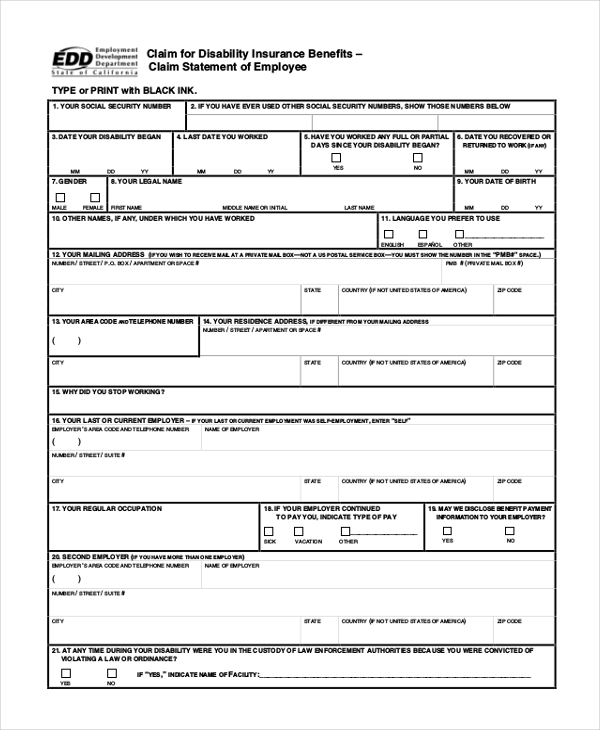

FREE 14 Disability Report Forms In PDF

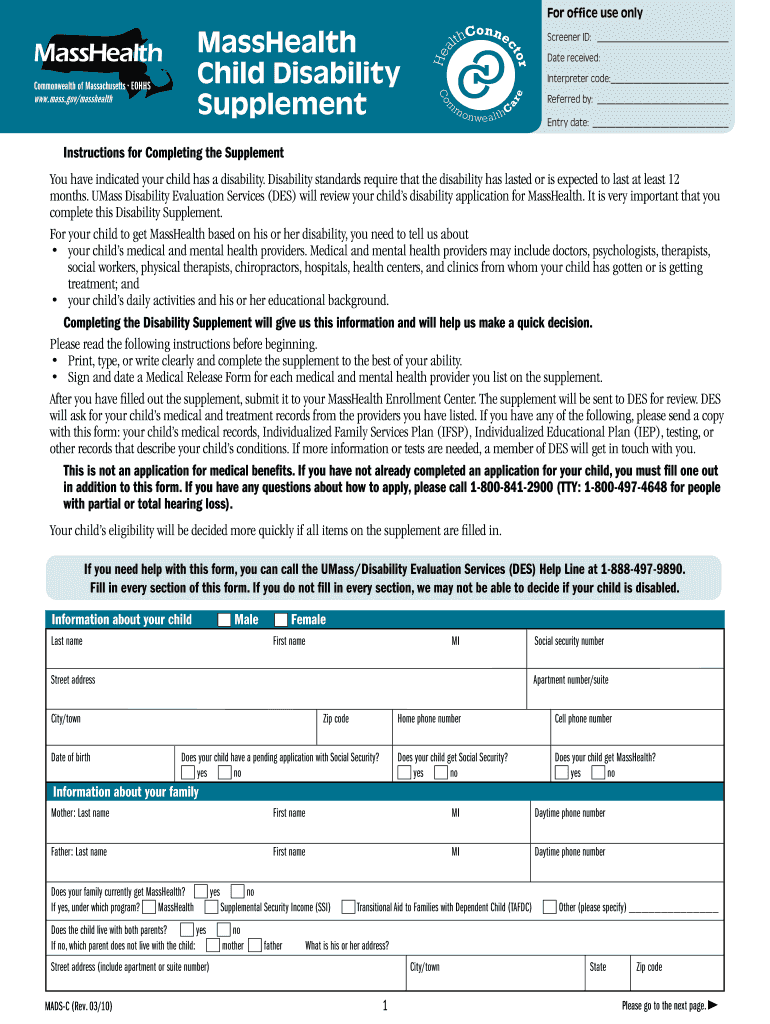

Masshealth Child Disability Supplement Fillable Form Printable Forms

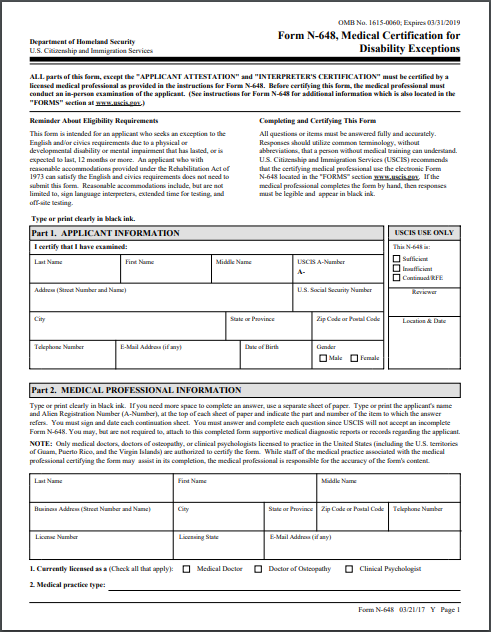

Disability Forms Printable Printable Forms Free Online

FREE 23 Sample Disability Forms In PDF Word Excel

De 2501 Form Printable

Social Security Administration Printable Dr Form For Disabilit

See General information for details You can view this form in PDF t2201 22e pdf PDF fillable saveable t2201 fill 22e pdf For people with visual impairments the following alternate formats are also available E text t2201 22e txt Large

6729 Protected B when completed Use this form toapply for the disability tax credit DTC Being eligible for this credit may reduce your income tax and open the door to other programs For more information go to www cra gc ca dtc Step 1 Complete only the sections of Part A that apply to you Remember to sign this form

Verification of Disability Impairment Ministry Helping to improve outcomes for children youth families and individuals who need support and advancing the interests of women across Ontario

Apply for this monthly payment if you receive Canada Pension Plan disability benefits and have eligible dependent children under the age of 25 in your care and custody Disability benefits for Veterans Disability benefits are a tax free financial recognition for the impact a service related injury or disease can have on your life

Fill out the application You may apply for the DTC using the digital form or the printed paper form Choose 1 method to apply If you already applied using the paper form do not apply again using the digital form This will delay your application

Two forms are needed to apply for the Child Disability Benefit you must apply for the Canada Child Benefit and the Disability Tax Credit You can apply for CCB through birth registration fill out Form RC66 or apply through your online account For the DTC you must fill out T2201 and submit it to the proper parties disabled contributor s child s benefit or surviving child s benefit You must complete the declaration form when you first apply for a benefit at the beginning of every school year and or semester and when you return to school after having left for a time You can renew your benefits online see details below

Ontario has raised the maximum Assistance for Children with Severe Disabilities ACSD payments by 6 5 In July 2023 the maximum monthly amount for ACSD increased by 6 5 to 618 per month per child based on inflation This is in addition to the 5 increase applied in September 2022 bringing the total to almost 12 over the last 12