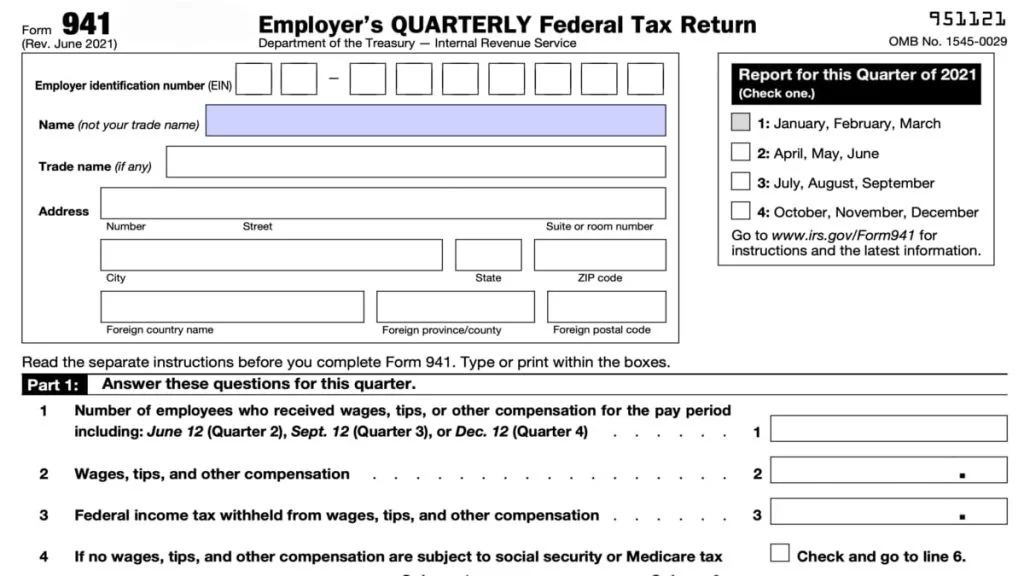

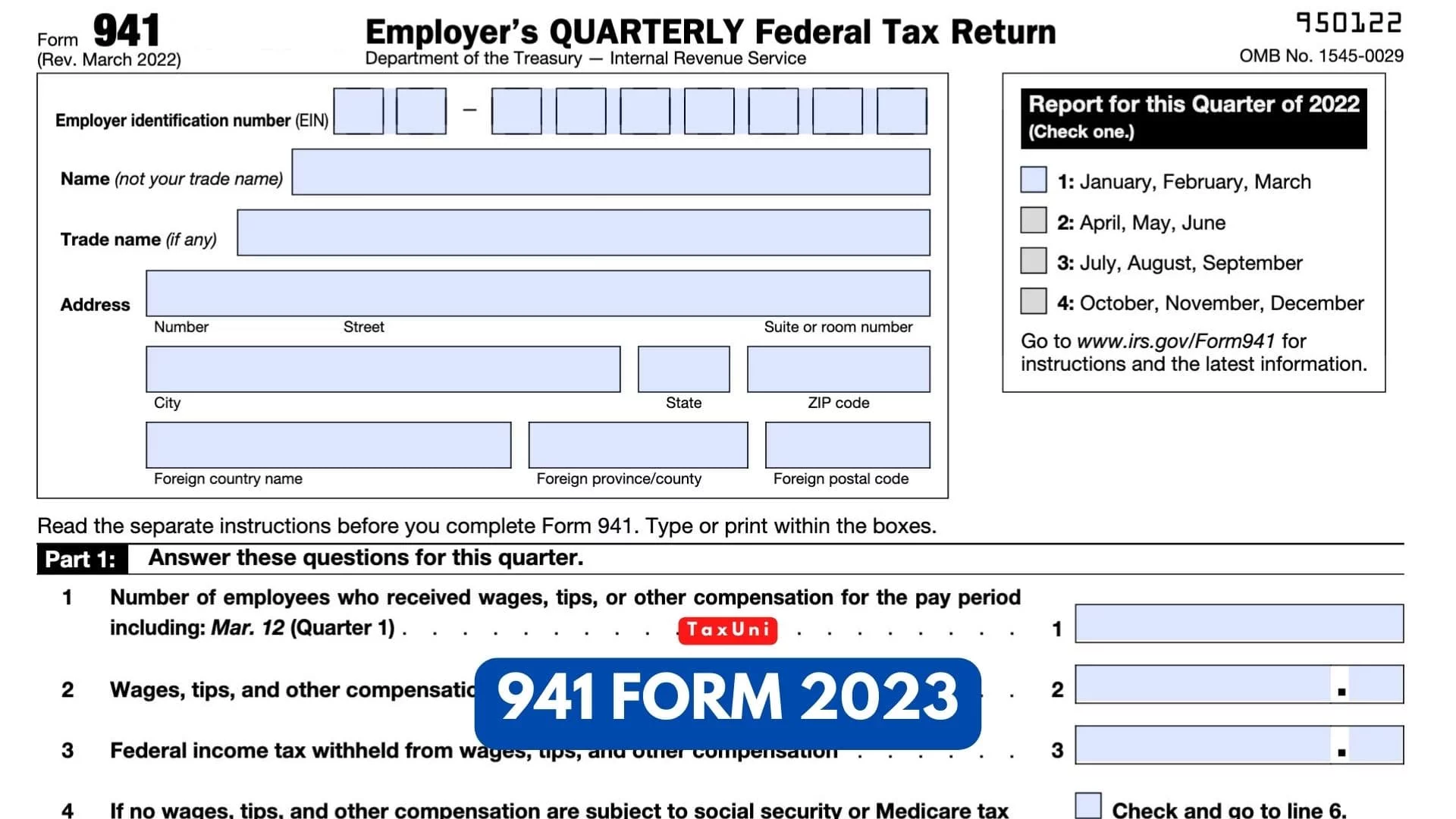

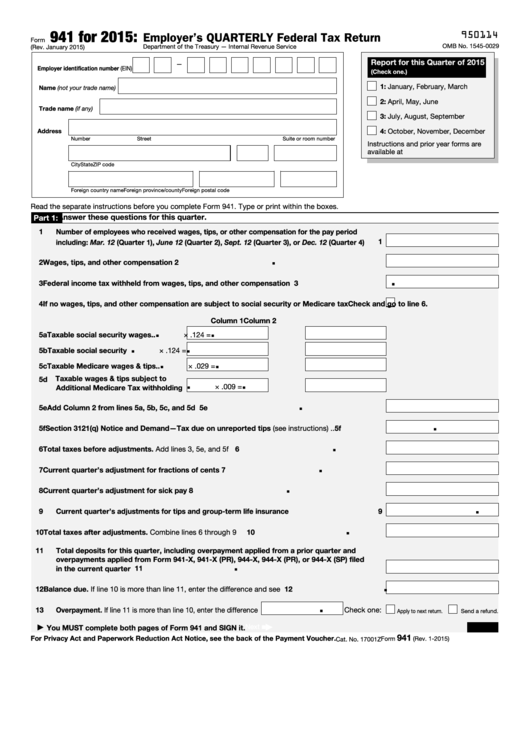

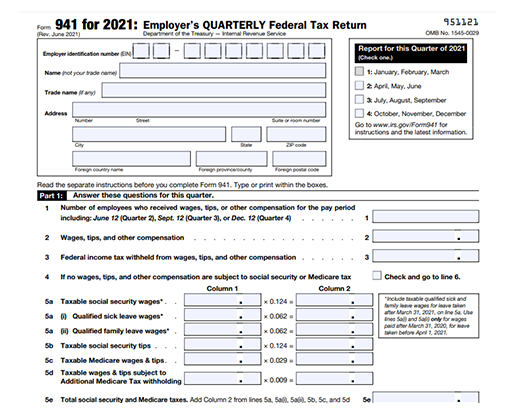

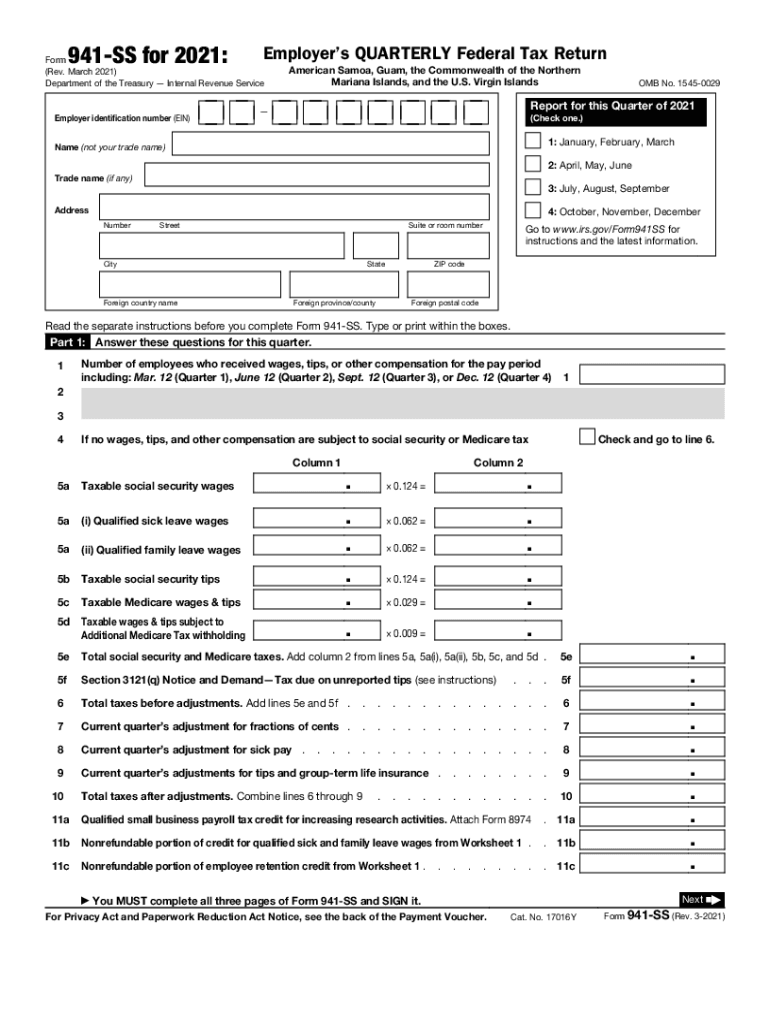

Free Printable Form 941 IRS Form 941 is a three page form It has five parts and a payment voucher at the end if you re submitting the form by mail with payment Here s a step by step guide and instructions for filing

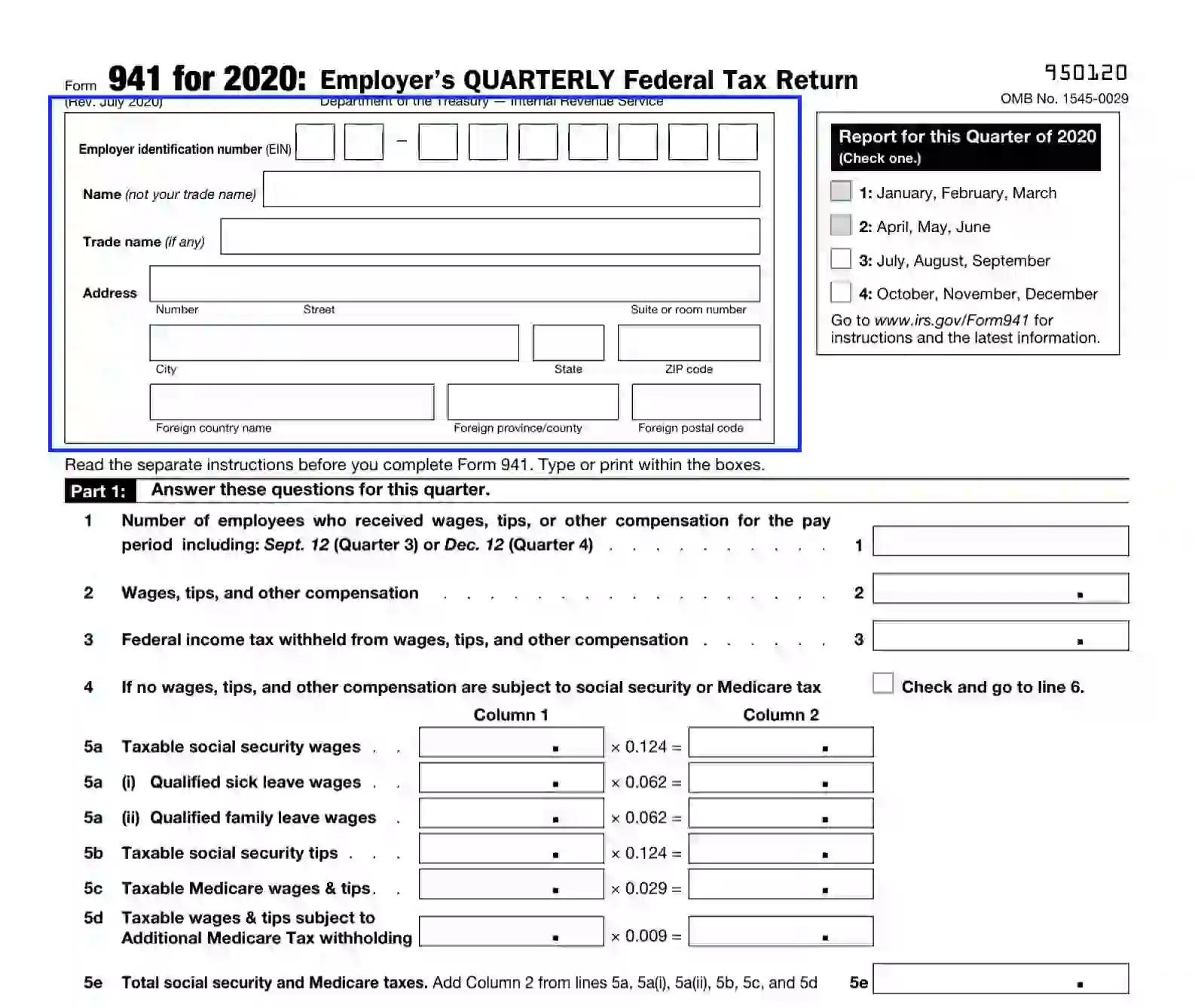

What is a Form 941 A Form 941 will be used by employers in order to report certain taxes related withheld income tax social security tax or Medicare tax It is known as an Employer s Quarterly Federal Tax Return and will be reported to the United States Internal Revenue Service The form must be completed for each quarter of the tax year We last updated the Employer s Quarterly Federal Tax Return in July 2022 so this is the latest version of Form 941 fully updated for tax year 2022 You can download or print current or past year PDFs of Form 941 directly from TaxFormFinder You can print other Federal tax forms here

Free Printable Form 941

Free Printable Form 941

Free Printable Form 941

https://www.taxuni.com/wp-content/uploads/2022/01/941-Form-2022-1024x576.jpg

2022 Form 941 Author W CAR MP FP Subject Employer s QUARTERLY Federal Tax Return Created Date 8 23 2023 2 41 09 PM

Templates are pre-designed files or files that can be used for numerous functions. They can save time and effort by supplying a ready-made format and design for producing various type of content. Templates can be used for individual or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Free Printable Form 941

Form 941 2023 Fillable Printable Forms Free Online

Printable 941 03 Form Of Demand Fl Printable Forms Free Online

Fillable 941 Quarterly Form 2022 Printable Form Templates And Letter

Free Printable 941 Form For2019 Printable Forms Free Online

Form 941 X Mailing Address Fill Online Printable Fillable Blank

Fillable Form 941 2023 Printable Forms Free Online

https://www.irs.gov/forms-pubs/about-form-941

Information about Form 941 Employer s Quarterly Federal Tax Return including recent updates related forms and instructions on how to file Form 941 is used by employers who withhold income taxes from wages or who must pay social security or Medicare tax

https://www.zillionforms.com/2021/F2131000776.PDF

1 January February March 2 April May June 3 July August September 4 October November December Go to www irs gov Form941 for instructions and the latest information Read the separate instructions before you complete Form 941 Type or print within the boxes Part 1 Answer these questions for this quarter

https://www.irs.gov/form

Form 941 Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax

https://www.irs.gov/pub/irs-prior/f941--2020.pdf

Title Form 941 Rev July 2020 Author W CAR MP FP Subject Employer s QUARTERLY Federal Tax Return Keywords Fillable Created Date 10 19 2020 10 14 40 AM

https://www.irs.gov/pub/irs-pdf/i941.pdf

Form 941 SS Employer s QUARTERLY Federal Tax Return American Samoa Guam the Commonwealth of the Northern Mariana Islands and the U S Virgin Islands and Form 941 PR Planilla para la Declaraci n Federal TRIMESTRAL del Patrono will no longer be available after the fourth quarter of 2023

File type PDF Use our library of forms to quickly fill and sign your IRS forms online The Internal Revenue Service IRS is a government agency responsible for collecting taxes and administering the federal statutory tax laws of the United States The IRS provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings If you are looking for a printable form 941 in PDF format you found the right service With PDFLiner you can easily fill out the form and click Print in the Done menu if you need a paper version Filing Considerations for 941 Tax Form 2023 First of all open a

File Form 941 online Below you can get the online fillable PDF version of Form 941 for the 2022 quarters This version of Form 941 is an efficient way to file it on your computer where you can print out a paper copy once completed However don t mistake this with e filing as you ll need to do it through a tax preparation service