401k Form For Taxes Printable File with Form 1096 For Privacy Act and Paperwork Reduction Act Notice see the 2023 General Instructions for Certain Information Returns within 5 years 11 1st year of desig Roth contrib 12 FATCA filing requirement 13 Date of payment Cat No 14436Q www irs gov Form1099R

Fidelity does not provide legal or tax advice The information herein is general and educational in nature and should not be considered legal or tax advice Tax laws and regulations are complex and subject to change which can materially impact investment results Fidelity cannot guarantee that the information herein is accurate complete or Complete the items below If you and or your spouse have one or more jobs then enter the total taxable annual pay from all jobs plus any income entered on Form W 4 Step 4 a for the jobs less the deductions entered on Form W 4 Step 4 b for the jobs Otherwise enter

401k Form For Taxes Printable

401k Form For Taxes Printable

401k Form For Taxes Printable

https://www.pdffiller.com/preview/388/519/388519550/large.png

Retirement income can be reported on one of the forms in the Form 1099 R Series Form 1099 R Distributions From Pensions Annuities Retirement or Profit Sharing Plans IRAs Insurance Contracts etc Form CSA 1099 R Statement of Annuity Paid civil service retirement payments Form CSF 1099 R Statement of Survivor Annuity Paid and

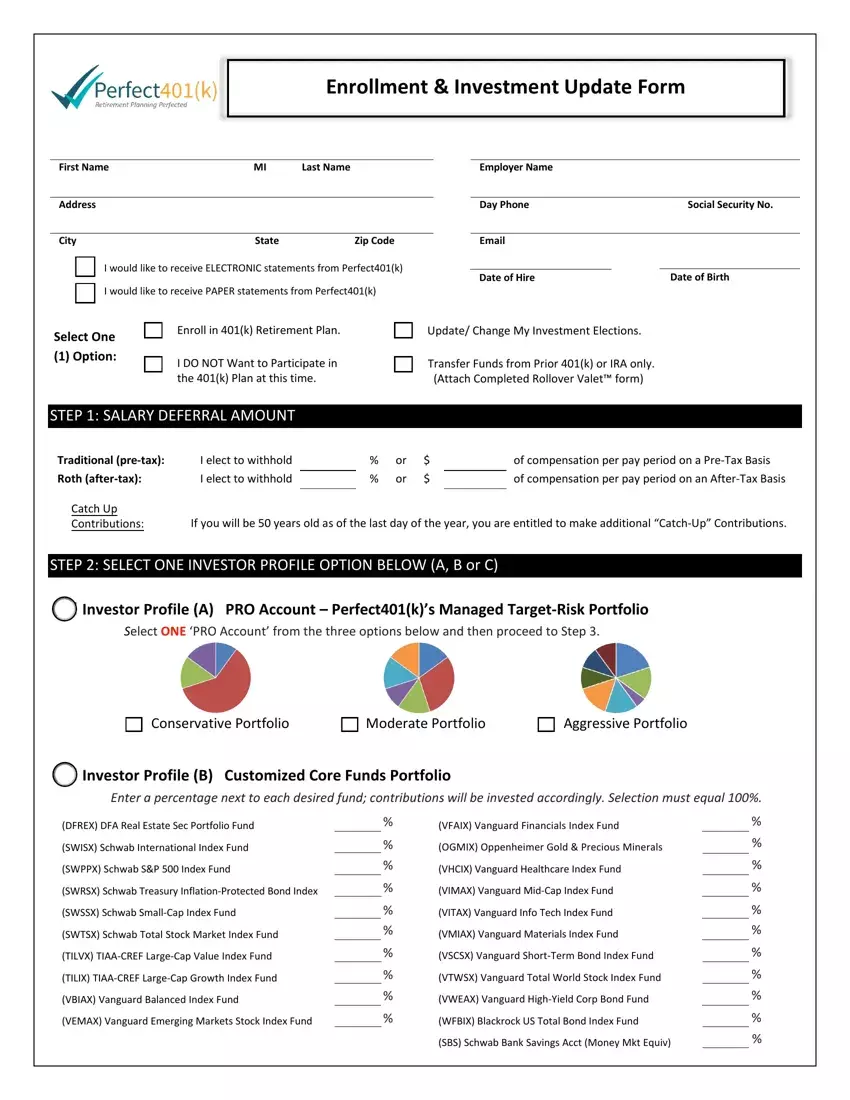

Pre-crafted templates offer a time-saving service for producing a diverse series of documents and files. These pre-designed formats and layouts can be used for various personal and professional tasks, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, improving the content production procedure.

401k Form For Taxes Printable

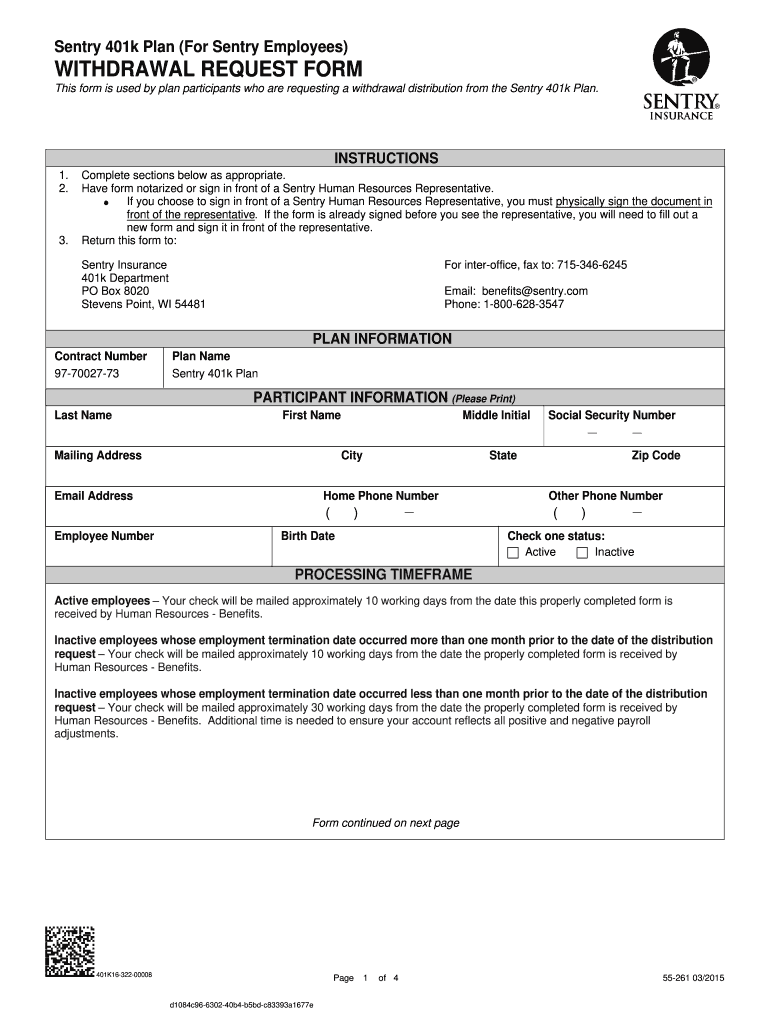

Sentry 401K Login Fill Out And Sign Printable PDF Template SignNow

Charles Schwab Individual 401k 2012 2022 Fill And Sign Printable

Wells Fargo 401k Loan Payoff Fill Online Printable Fillable Blank

Fidelity 401k Enrollment Form Fill Out Sign Online DocHub

401k Closed Without Distribution Form Fill Out Sign Online DocHub

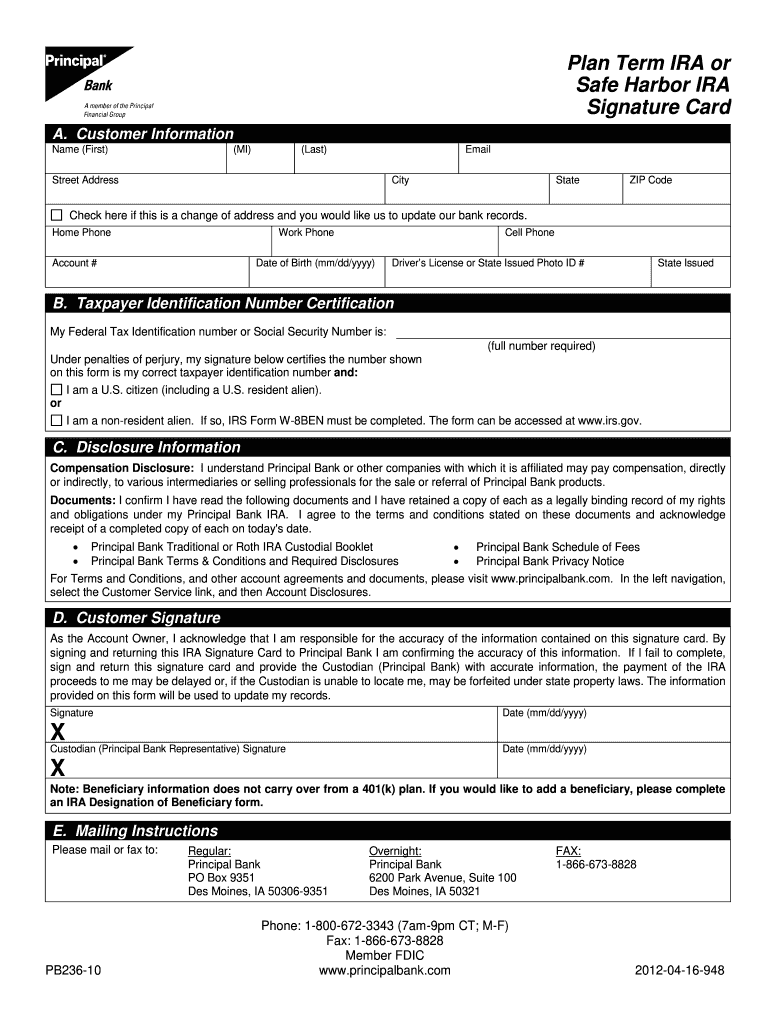

Principal 401k Withdrawal Terms And Conditions Fill Online Printable

https://www.irs.gov/retirement-plans/401k-plans

Learn about Internal Revenue Code 401 k retirement plans and the tax rules that apply to them A 401 k is a feature of a qualified profit sharing plan that allows employees to contribute a portion of their wages to individual accounts

https://www.irs.gov/pub/irs-pdf/f8880.pdf

The amount on Form 1040 1040 SR or 1040 NR line 11 is more than 34 000 51 000 if head of household 68 000 if married filing jointly The person s who made the qualified contribution or elective deferral

https://www.irs.gov/retirement-plans/401k-resource-guide

General information on 401 k plans Starting up your plan What to know before adopting a plan Plan qualification requirements Language needed in your plan Contribution limits 401 k plan contribution limits catch up contributions and excess deferrals General distribution rules

https://www.irs.gov/pub/irs-prior/fw4p--2021.pdf

Form W 4P is for U S citizens resident aliens or their estates who are recipients of pensions annuities including commercial annuities and certain other deferred compensation Use Form W 4P to tell payers the correct amount of federal income tax to withhold from your payment s

https://www.irs.gov/retirement-plans/plan-sponsor/401k-plan-overview

There are several types of 401 k plans available to employers traditional 401 k plans safe harbor 401 k plans and SIMPLE 401 k plans Different rules apply to each For tax favored status a plan must be operated in

Designated Roth accounts in a 401 k or 403 b plan are subject to the RMD rules for 2022 and 2023 However for 2024 and later years RMDs are no longer required from designated Roth accounts 2023 RMDs due by April 1 2024 are still required Your required minimum distribution is the minimum amount you must withdraw from your account each Get federal tax return forms and file by mail Get paper copies of federal and state tax forms their instructions and the address for mailing them Find easier to read tax forms for seniors and people with different needs Find out how to get and where to mail paper federal and state tax forms Learn what to do if you don t get your W 2 form

Form W 4 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS OMB No 1545 0074 2023 Step 1 Enter Personal Information a