Printable Form 4562 For Year 2017l Irs Form 4562 Get a fillable 4562 Form 2017 template online Complete and sign it in seconds from your desktop or mobile device anytime and anywhere

Form 4562 is also used for Section 179 expense deductions and special bonus depreciation for the year IRS Form 4562 is used to claim deductions for depreciation and amortization It s also used to expense certain types of property using an accelerated depreciation deduction under Section 179 of the Internal Revenue Code IRS Form 4562 is used to depreciate any big ticket items you may have purchased for your business Learn what assets should be included on Form 4562 as well as how often this form should be filed

Printable Form 4562 For Year 2017l

Printable Form 4562 For Year 2017l

Printable Form 4562 For Year 2017l

https://www.pdffiller.com/preview/584/888/584888630/large.png

Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2017 or tax year beginning 2017 ending 20 Go to www irs gov Form1120 for instructions and the latest information

Templates are pre-designed files or files that can be utilized for various functions. They can conserve time and effort by supplying a ready-made format and layout for creating various sort of content. Templates can be utilized for personal or professional jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Printable Form 4562 For Year 2017l

Rental Property Amortization Schedule OrlaKrishna

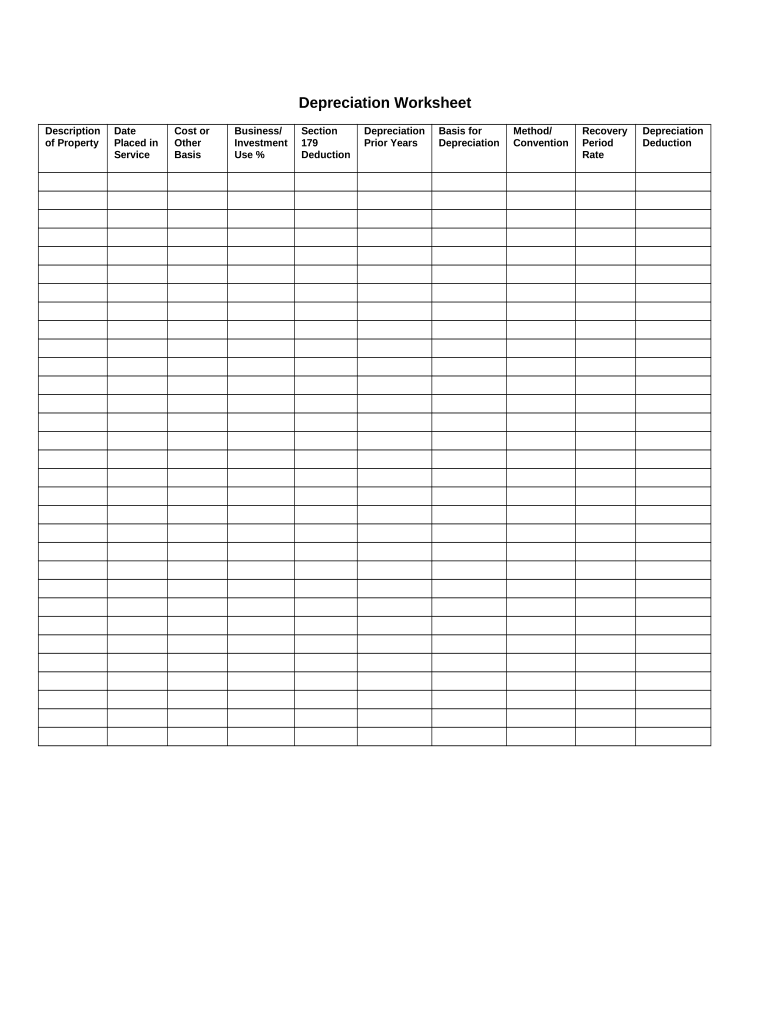

Form 4562 Depreciation And Amortization Worksheet

Depreciation Worksheet Fill Out Sign Online DocHub

Form 4562 Edit Fill Sign Online Handypdf

Irs Form 4562 Year 2014 Form Resume Examples l6YN7007V3

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png)

Form 4562 Depreciation And Amortization Definition

https://www.pdfrun.com/form/4562-2017

Get a 4562 2017 here Edit Online Instantly This form is used to claim deductions for the depreciation or amortization of a piece of property

https://www.irs.gov/pub/irs-prior/i4562--2017.pdf

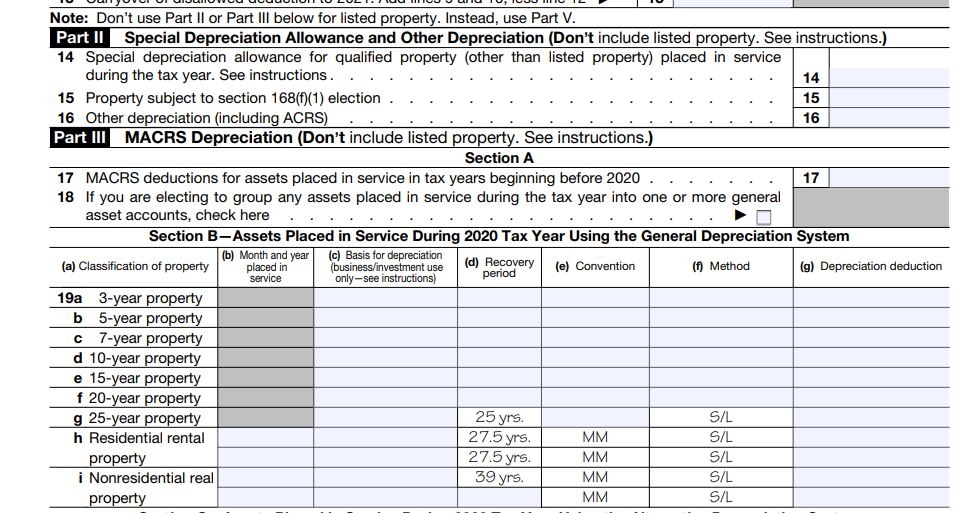

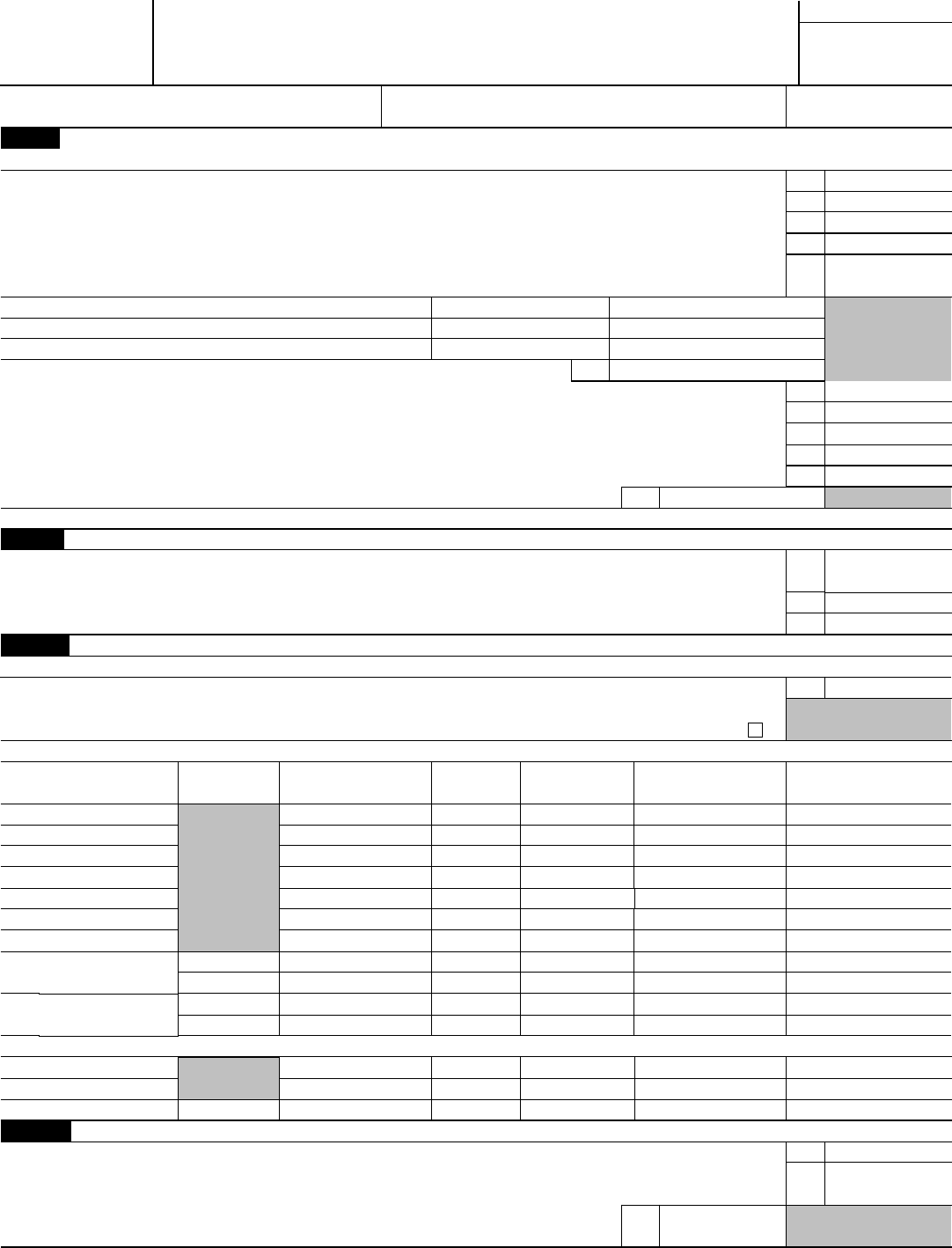

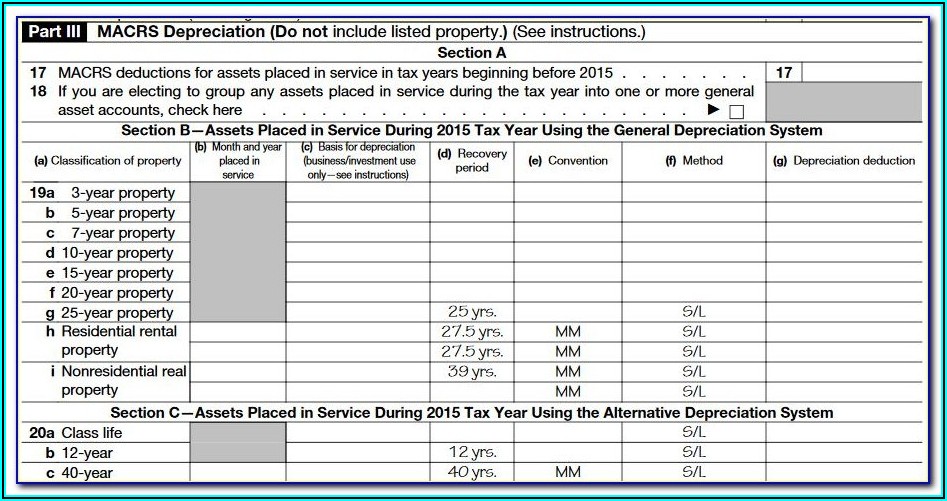

Use Form 4562 to Claim your deduction for depreciation and amortization Make the election under section 179 to expense certain property and Provide information on the business investment use of automobiles and other listed property Who Must File Except as otherwise noted complete and file Form 4562 if you are claiming any of the following

https://pdf4pro.com/view/2017-form-4562-300a39.html

2017 Form 4562 form 4562 Depreciation and Amortization Including Information on Listed Property OMB No 1545 0172 2017 Attach to your tax return Department of the Treasury Attachment internal revenue Service 99 Go to for instructions and the latest information Sequence No 179

https://www.formsbank.com/template/362713/form-4562-depreciation-and

View download and print fillable 4562 Depreciation And Amortization 2017 in PDF format online Browse 2 Form 4562 Templates collected for any of your needs

https://www.irs.gov/forms-pubs/about-form-4562

Home About Form 4562 Depreciation and Amortization Including Information on Listed Property Use Form 4562 to Claim your deduction for depreciation and amortization Make the election under section 179 to expense certain property Provide information on the business investment use of automobiles and other listed property

Get a fillable Instructions 4562 Form 2017 2023 template online Complete and sign it in seconds from your desktop or mobile device anytime and anywhere Go to catalog 2017 Form 4562 IRS tax forms Section B Assets Placed in Service During 2017 Tax Year Using the General Depreciation System a Classification of property b Month and year placed in service c Basis for depreciation business investment use only see instructions d Recovery period e Convention f

50 bonus first year depreciation can be elected over the 100 expensing for the first tax year ending after September 27 2017 Filing Form 4562 File Form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a Section 179 election