W9 Vs 1099 Printable Categories Form W 9 How are forms W 9 and 1099 NEC different from each other This quick guide will help you understand the fundamental differences between these most used IRS forms Form W 9 and Form 1099 NEC are some of the most used informational forms used in business taxes

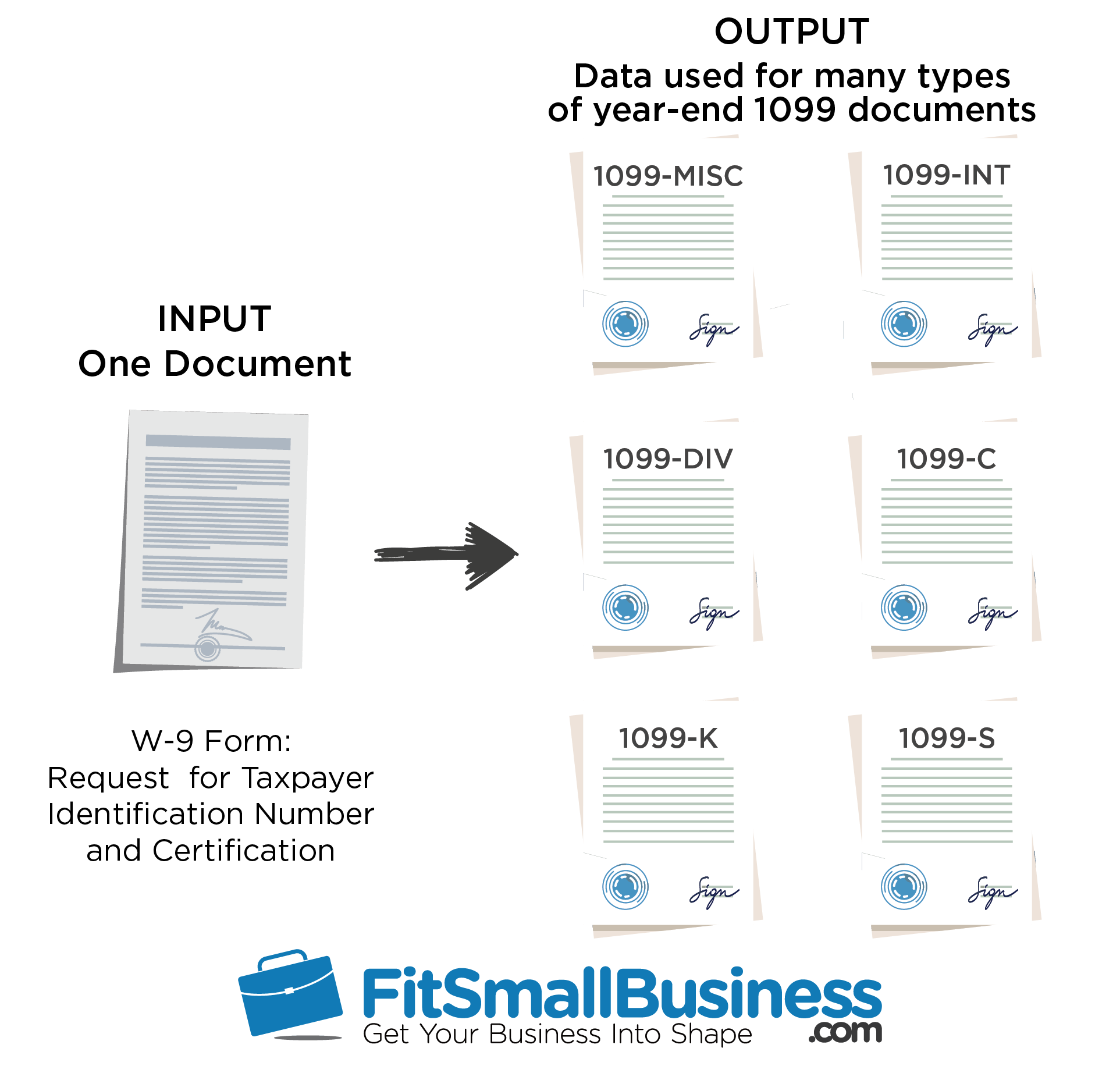

What s the difference between a W9 and form 1099 A W9 is sued to gather personal information about a contractor so that their earnings can be reported at the end of the year Whereas form 1099 is used to show how much that contractor was paid The difference between 1099 vs W 9 is a straightforward one the contractor fills out the W 9 form to provide information to the business they work for and that business later reports the contractor s yearly earnings on the 1099 form

W9 Vs 1099 Printable

W9 Vs 1099 Printable

W9 Vs 1099 Printable

https://paperspanda.com/wp-content/uploads/2021/07/michigan-w9-tax-form.png

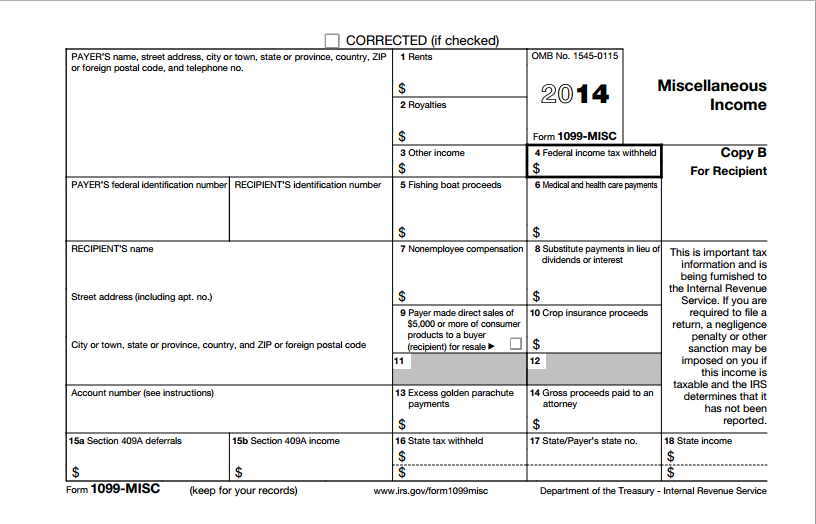

1099 forms are filed with your taxes showing how much you made Anyone who paid you more than 600 for a job should send you one at the end of the year W 9s are not sent to the IRS They are a form to help contractors and those who work with contractors make sure all the tax information is correct on the 1099s

Templates are pre-designed files or files that can be used for different functions. They can save time and effort by offering a ready-made format and design for producing different sort of material. Templates can be used for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

W9 Vs 1099 Printable

1099 Vs W9 Which Is Better For Employers And Why LendThrive

Printable 2014 Form 1099 MISC Instructions

W9 Vs 1099 Form The Differences Apply For

W9 Vs 1099 Freelancer Paperwork Explained 1099 Cafe

W9 Vs 1099 IRS Forms Differences And When To Use Them 2019

W2 Vs W9 Vs 1099 Contractors Differences

https://www.tax1099.com/blog/w-9-vs-1099-understanding-the-differences

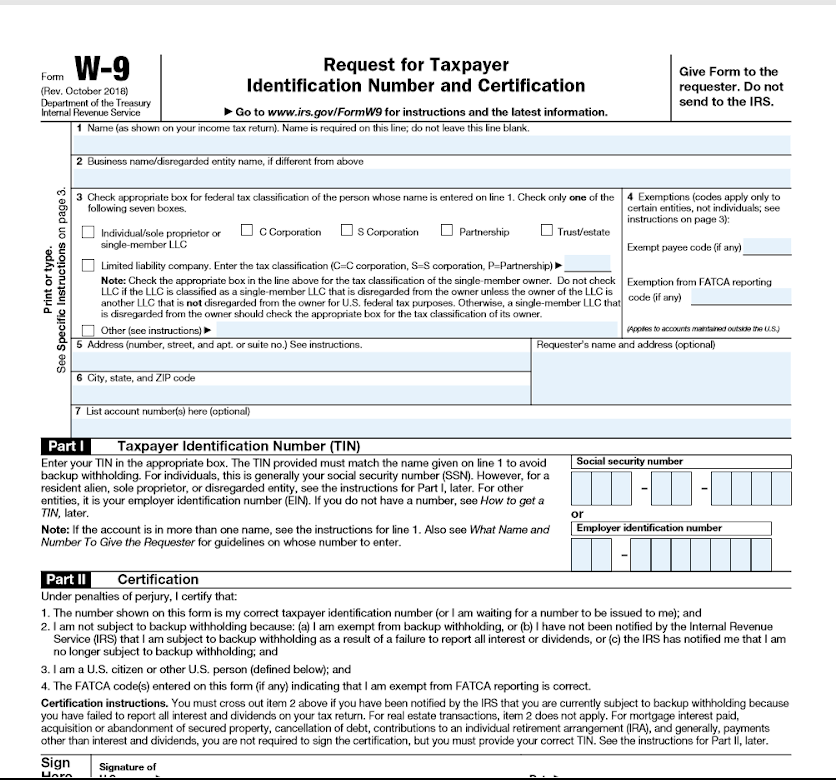

Form W 9 Vs Form 1099 The Key Differences The primary difference between these two forms is that Form W 9 is used to request information from the individual being paid while Form 1099 is used to report income to the IRS Form W 9 requests the taxpayer s information such as name address and Social Security number

https://www.irs.gov/forms-pubs/about-form-w-9

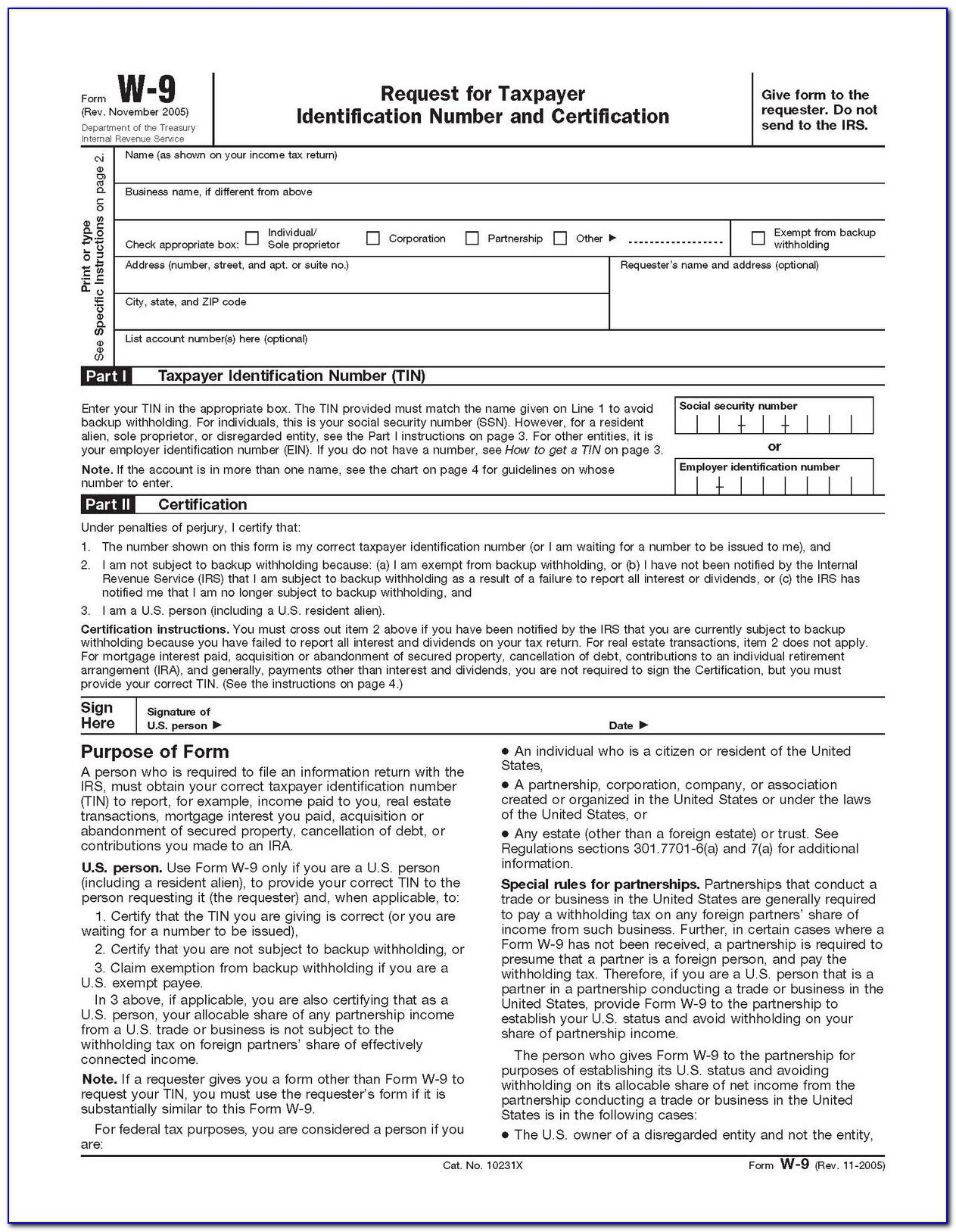

Information about Form W 9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file Form W 9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS

https://www.irs.gov/businesses/small-businesses

Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification This form can be used to request the correct name and Taxpayer Identification Number or TIN of the payee

https://www.northone.com/blog/accounting/w9-vs-1099

What are the key differences between the W9 vs 1099 Business owners are obligated to provide certain information to the IRS when working with independent contractors or freelancers The two key information return forms to collect and submit to the IRS are the W9 and the 1099

https://www.runpollen.com/articles/clear

In this practical guide we ll delve into the clear differences between W9 and 1099 forms W9 vs 1099 What s the difference A W9 or Request for Taxpayer Identification Number and Certification is a form that an independent contractor or freelancer fills out and gives to the company or individual they re working for

The main difference between a W 9 and a 1099 is that a W 9 is used by a business to collect information about a contractor that does work worth over 600 for the business whereas a 1099 is used by the business to report to the IRS how much it What s the Difference Between a W 9 and 1099 The W 9 is simply the form that businesses send to contractors to obtain that information in the first place Its sole purpose is to serve as reference material and should not be submitted to the IRS The 1099 is the tax form that businesses send to their independent contractors and the IRS each

W 9 Form A W 9 form is an Internal Revenue Service IRS form also known as a Request for Taxpayer Identification Number and Certification form which is used to confirm a person s taxpayer