W9 Or 1099 Printable Form When reporting payments you make to a contractor use a 1099 form Alternately the W 9 captures the contractor s tax information Learn how to fill out each form

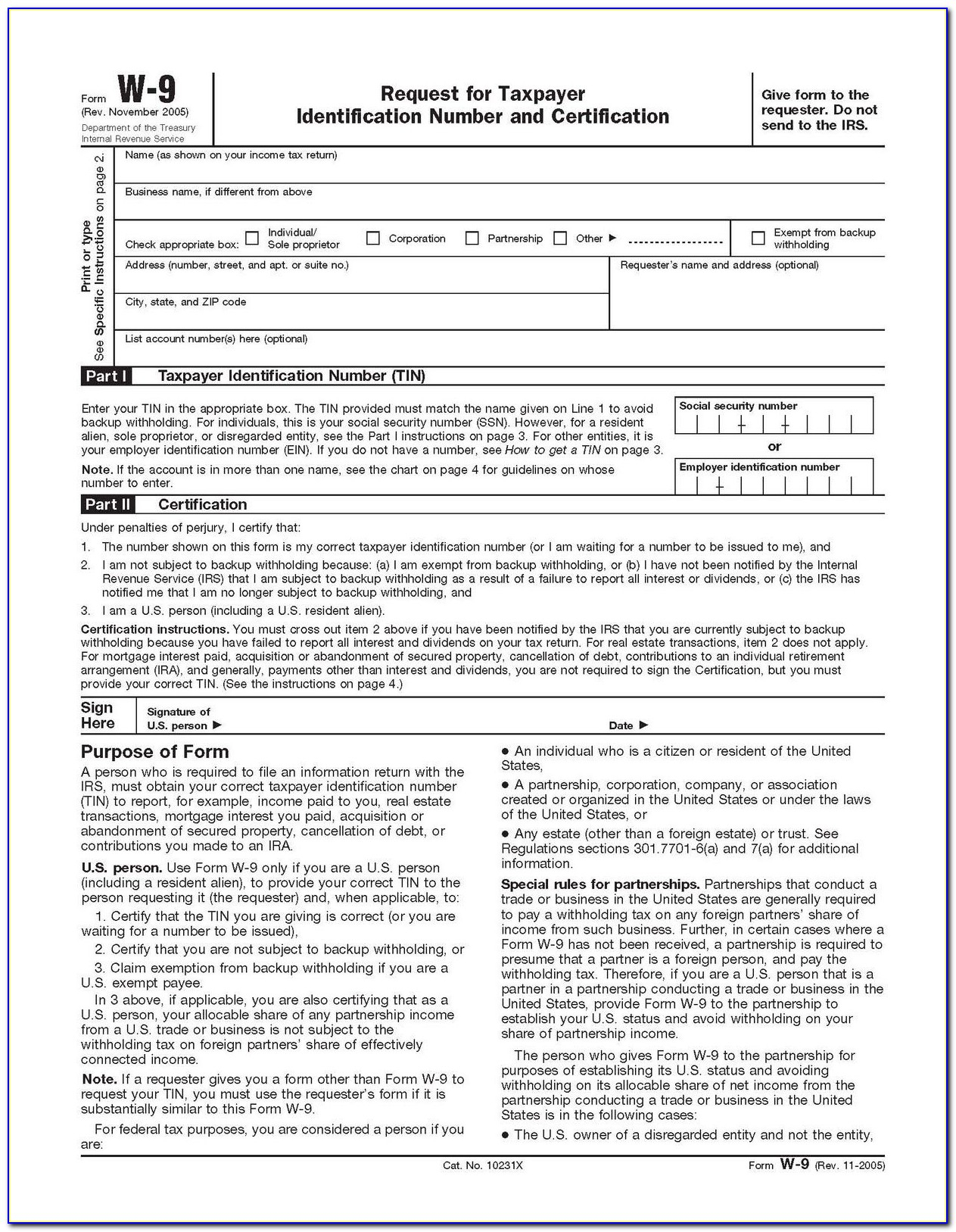

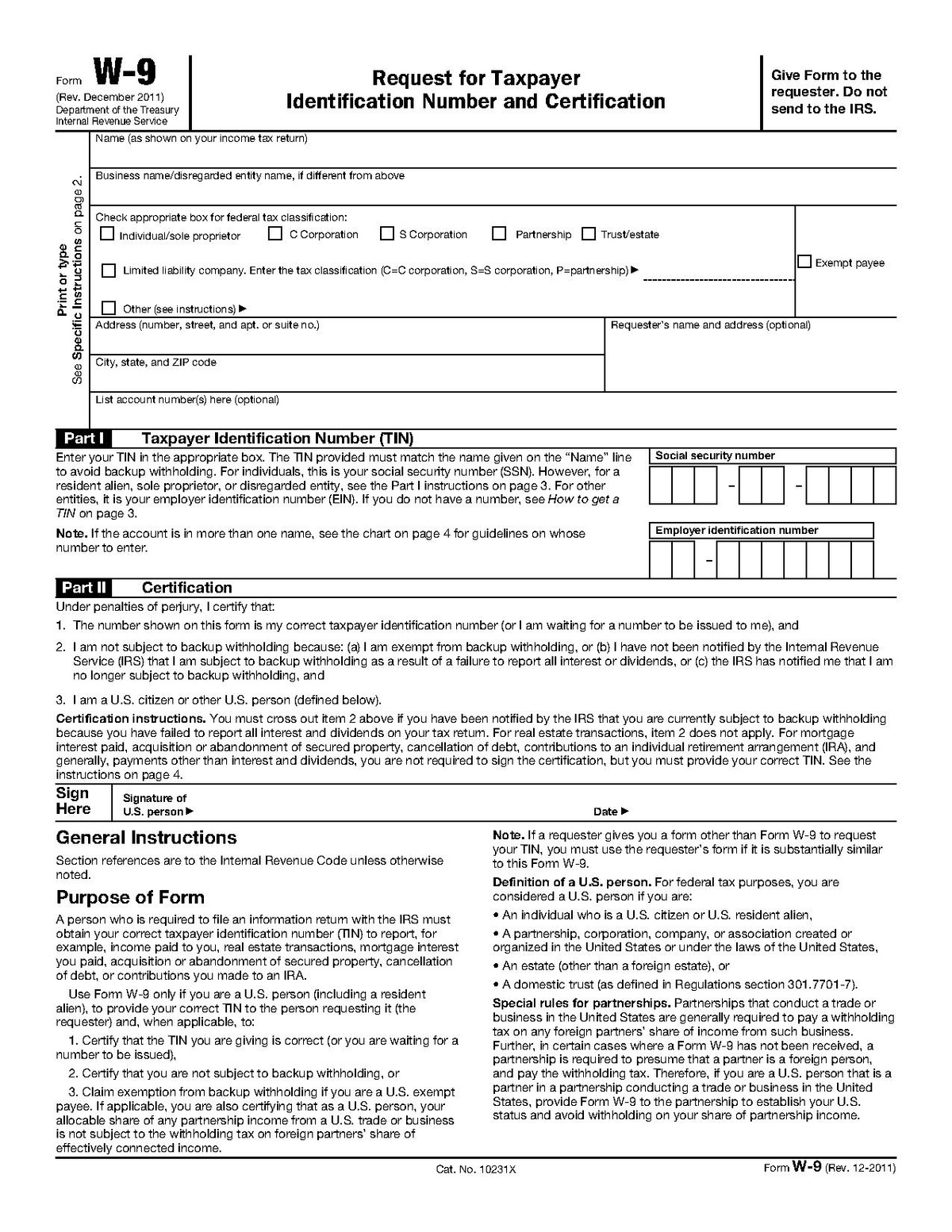

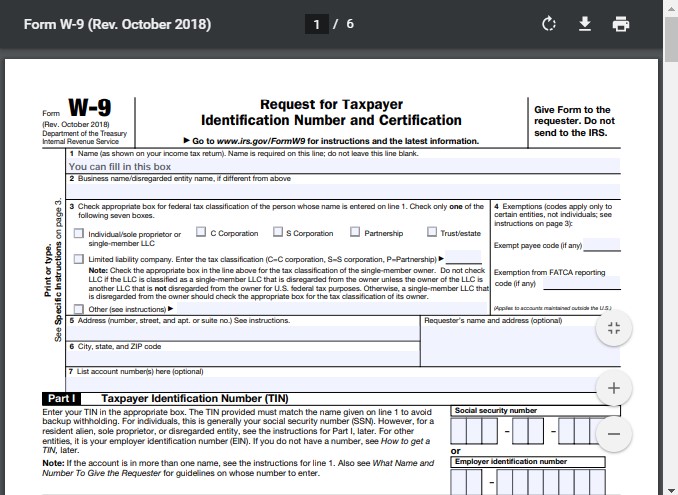

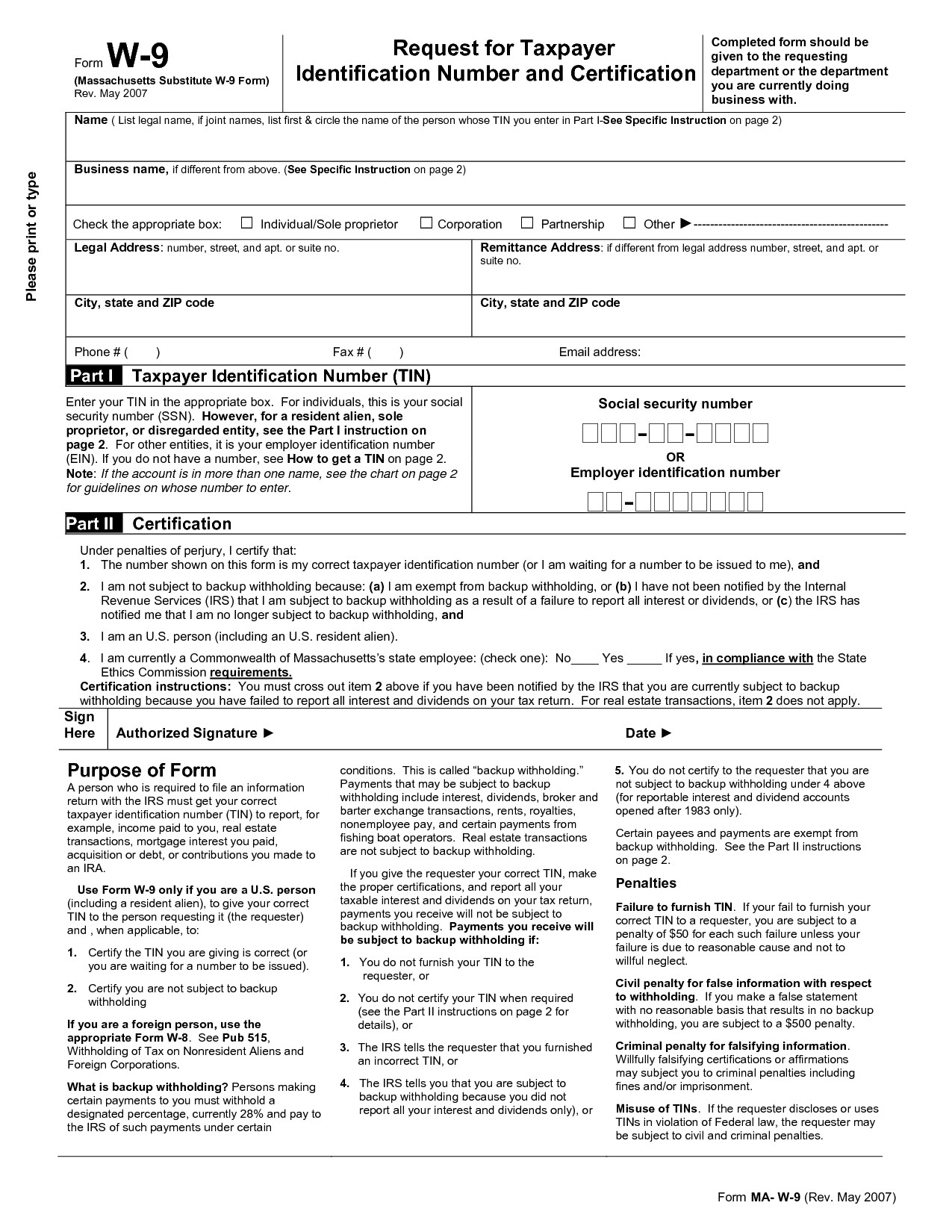

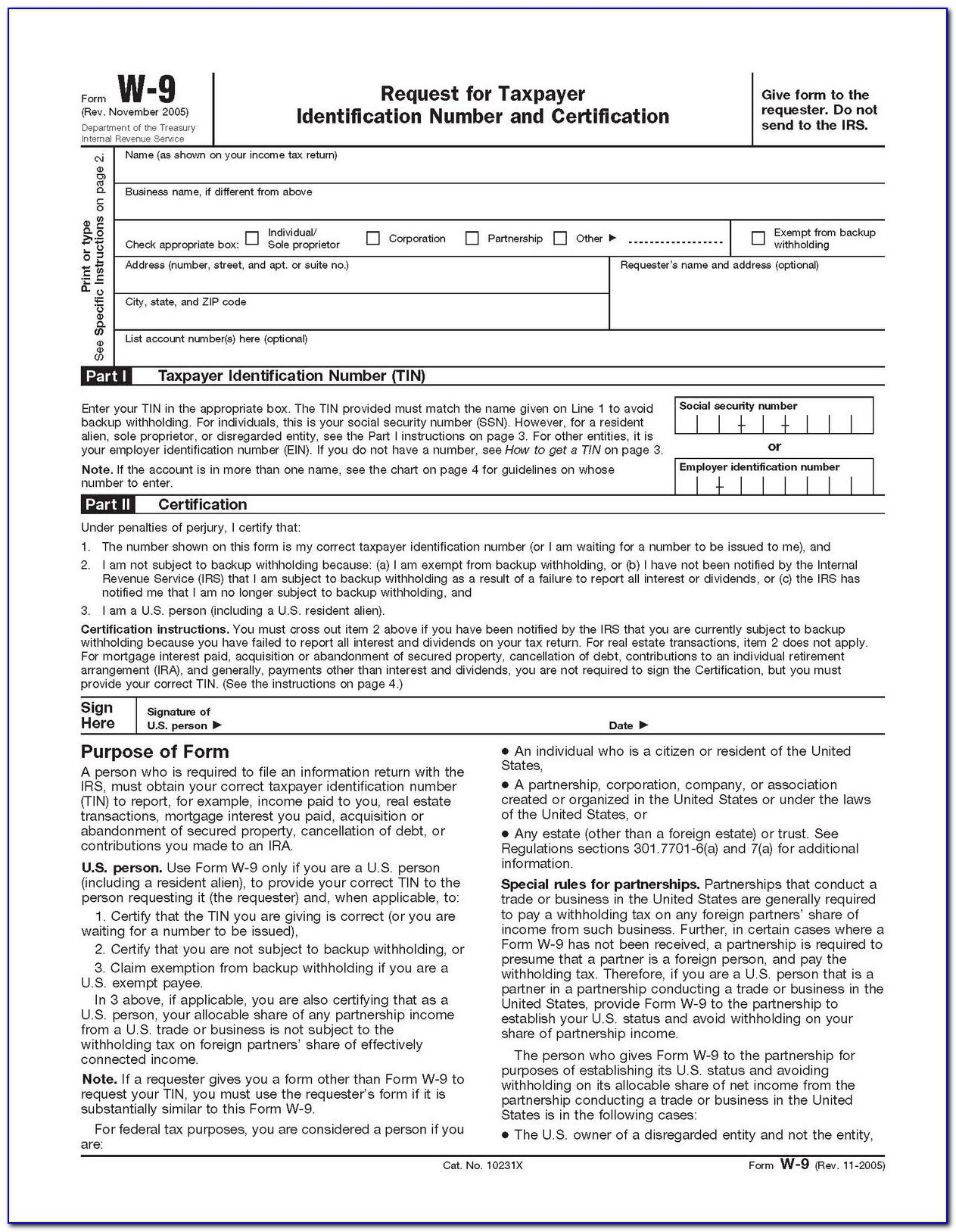

Use Form W 9 to request the taxpayer identification number TIN of a U S person including a resident alien and to request certain certifications and claims for exemption See Purpose of Form on Form W 9 Withholding agents may require signed Forms W 9 from U S exempt recipients to overcome a presumption of foreign status Individual Taxpayer Identification Number ITIN Form W 9 or an acceptable substitute is used by persons required to file information returns with the IRS to get the payee s or other person s correct name and TIN For individuals the TIN is generally a social security number SSN

W9 Or 1099 Printable Form

W9 Or 1099 Printable Form

W9 Or 1099 Printable Form

https://paperspanda.com/wp-content/uploads/2022/03/free-printable-w9-form.jpg

The title of Form W 9 is officially Request for Taxpayer Identification Number and Certification Employers use this form to get the Taxpayer Identification Number TIN from contractors freelancers and vendors The form also provides other personally identifying information like your name and address

Templates are pre-designed files or files that can be used for different purposes. They can conserve effort and time by offering a ready-made format and layout for creating various kinds of content. Templates can be utilized for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

W9 Or 1099 Printable Form

W9 Tax Form Printable PapersPanda

Printable W9 2022 Example Calendar Printable

W9 Form 2020 Fillable W9 Form 2020 Printable

Printable W9 Form 2022 Free Customize And Print

2020 W 9 Form Printable Example Calendar Printable

Blank 2020 W9 Form Calendar Template Printable

https://www.irs.gov/businesses/small-businesses-self-employed/forms

Find Form W 9 Form 1099 and instructions on filing electronically for independent contractors Form W 9 If you ve made the determination that the person you re paying is an independent contractor the first step is to have the contractor complete Form W 9 Request for Taxpayer Identification Number and Certification

https://www.irs.gov/forms-pubs/about-form-w-9

Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example Income paid to you Real estate transactions Mortgage interest you paid Acquisition or abandonment of secured property Cancellation of debt Contributions you made to an IRA

https://www.forbes.com/advisor/business/w9-vs-1099

You can download and print both the W9 and 1099 forms directly from the IRS website at IRS gov On the website you will see a search bar here you will type in W 9 form or for instant

https://www.bench.co/blog/tax-tips/w9-vs-1099

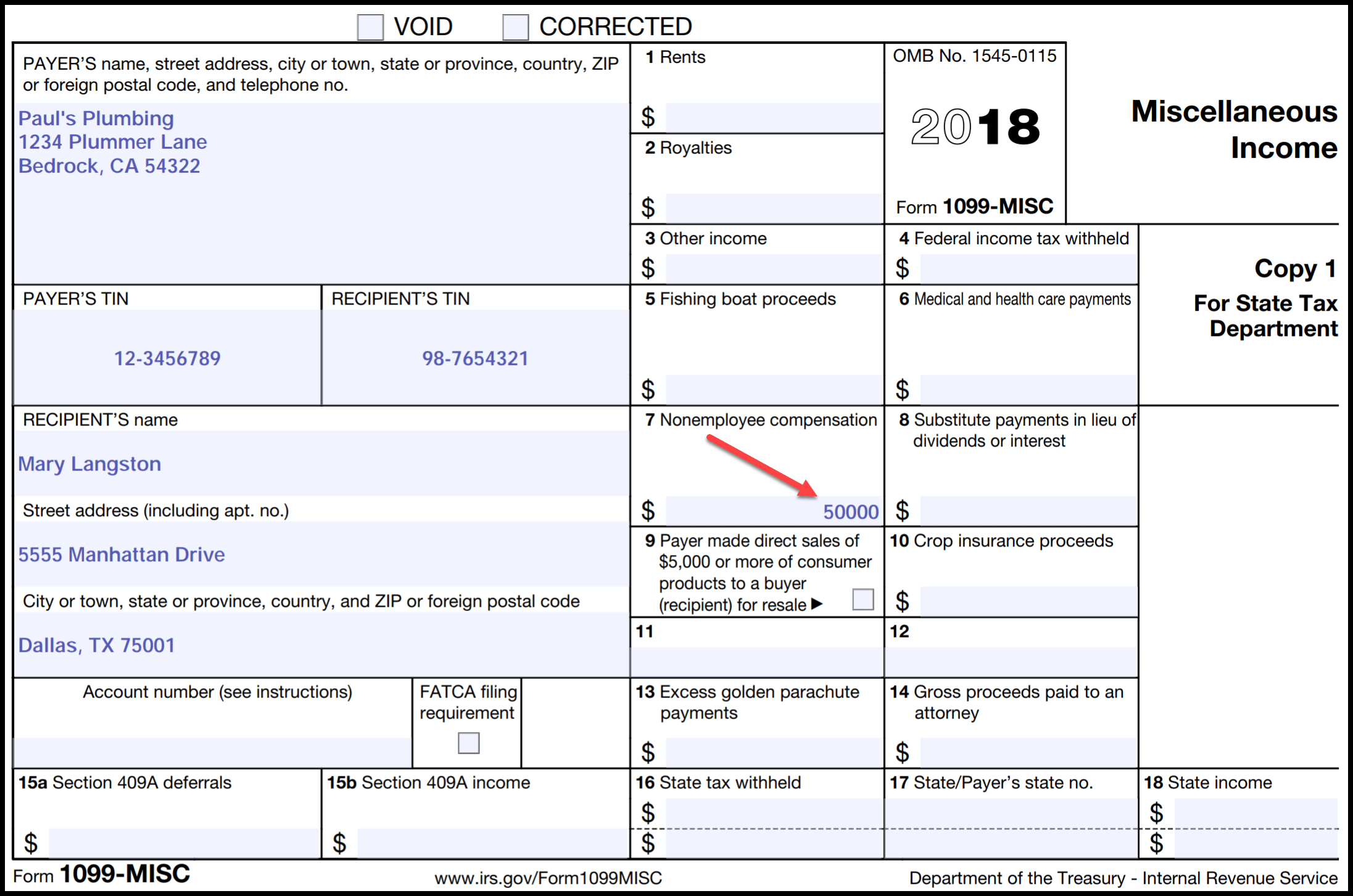

November 4 2022 Form W 9 and Form 1099 are both tax forms and they re both sent to independent contractors But they accomplish different things What s Bench What is Form W 9 A W 9 is sent by a client to a contractor to collect their contact information and tax number Then the client uses that info to fill out a Form 1099

https://www.g2.com/articles/w9-vs-1099

Yes a W 9 is used to collect information from independent contractors and a 1099 is used to record how much they ve paid that independent contractor You need both to file your taxes At a very high level the difference between these two forms is simple A W 9 form is used by the IRS to gather information about an independent contractor so

What is a W9 form Employers primarily use a W9 tax form to gather the tax information of a contractor freelancer or nonemployee worker so they can report income paid to them The information taken from a W 9 form is often used to generate a 1099 tax form which is required for income tax filing purposes

W 9 vs 1099 Tax Forms Definitions Differences and FAQs Jessica Hinkle Updated July 1 2023 Completing required tax documents successfully is important for staying compliant with applicable tax laws and regulations W 9 and 1099 forms are two tax documents businesses and independent contractors commonly use when they work