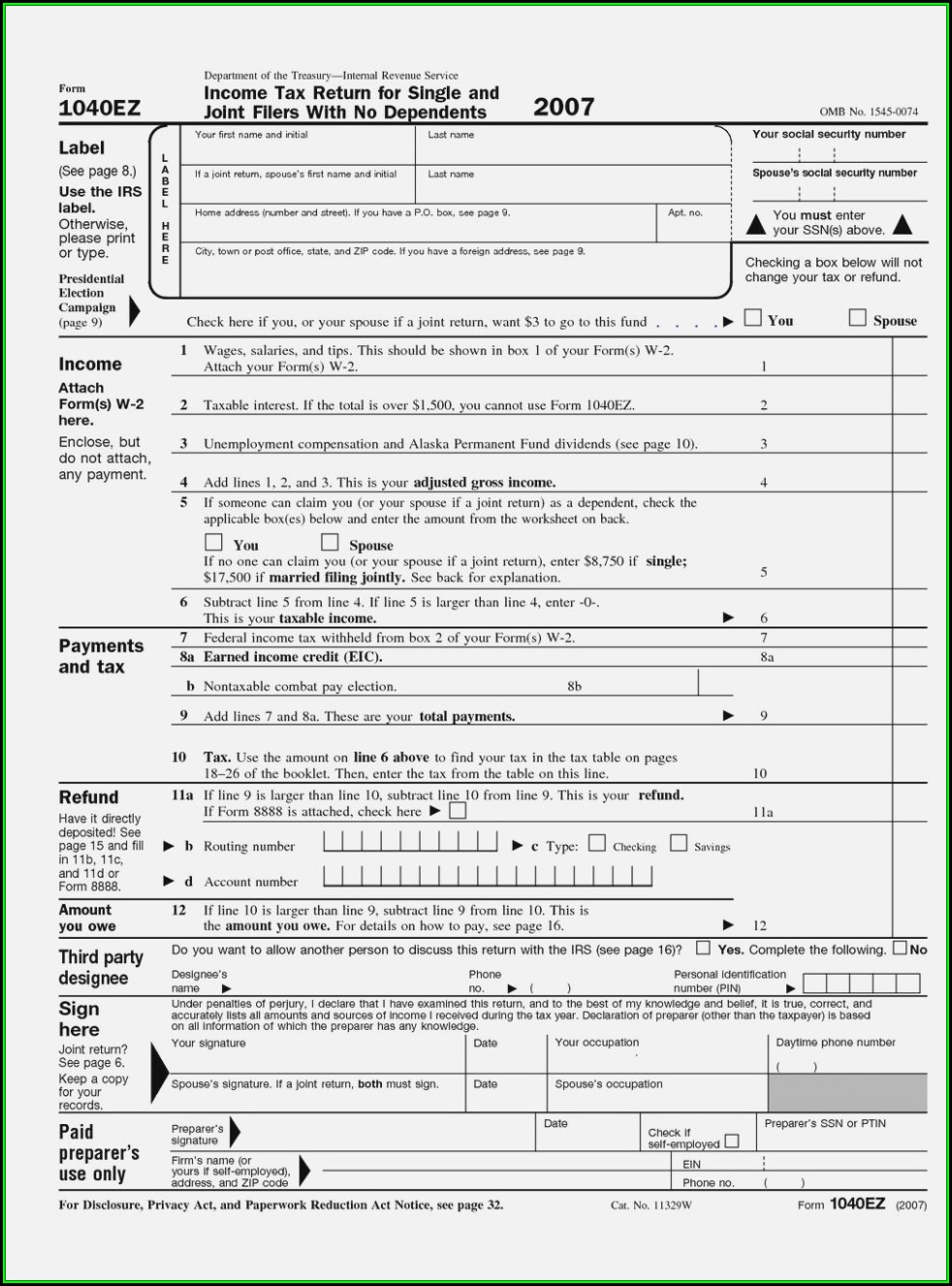

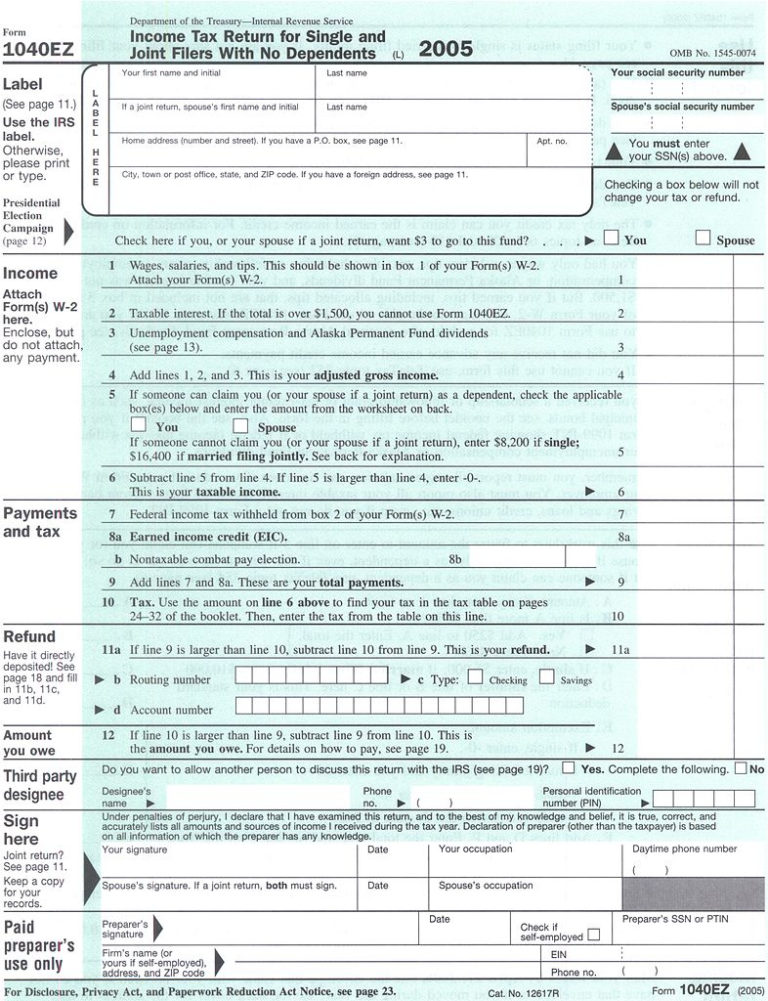

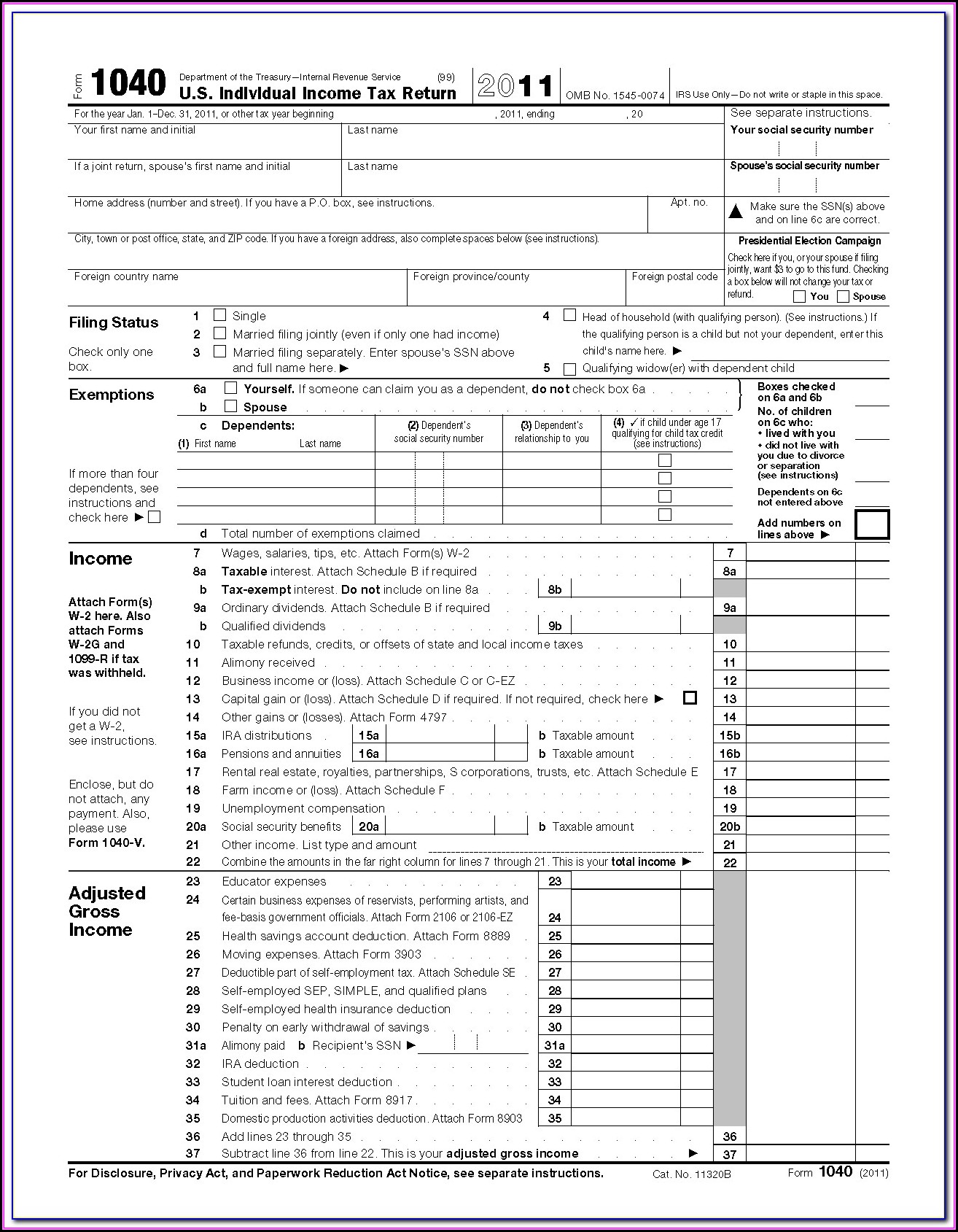

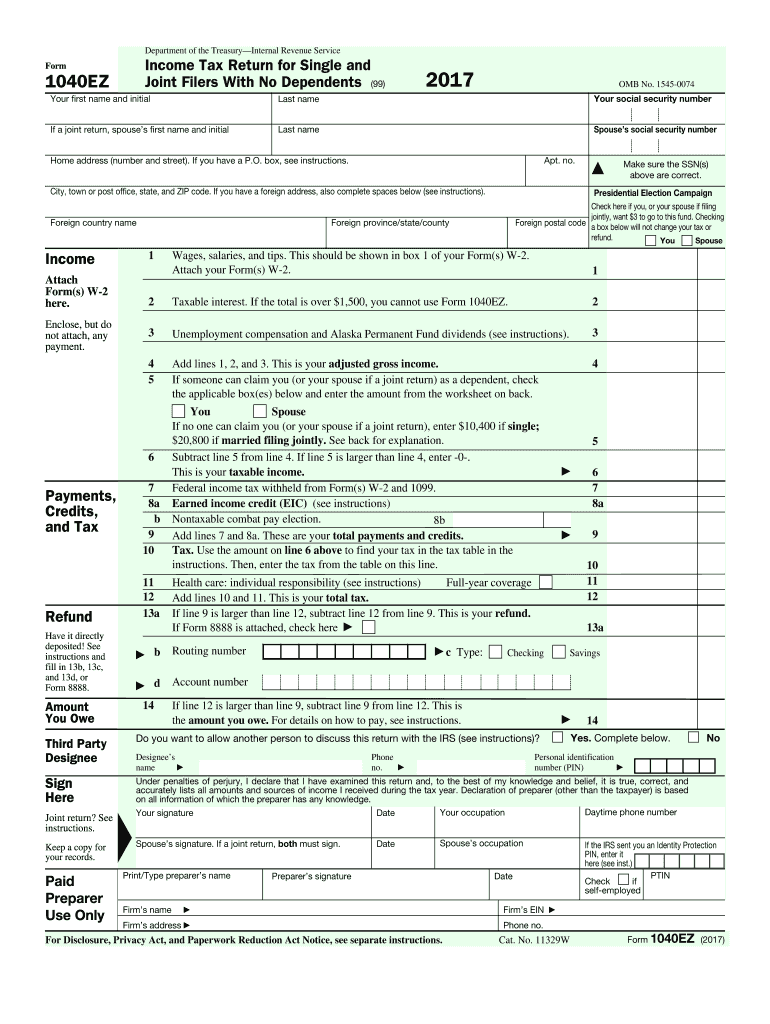

W2 Form 1040ez Printable Form Using Your W 2 and Form 1099 INT to File Your 1040EZ In this simulation you will take on the role of Tasha Miller in order to learn how to use the information from Forms W 2 and 1099 INT to complete Form 1040EZ

Sim 2 Using Your W 2 to File Your 1040EZ You are employed as a coach earning an annual salary of 27 500 Congratulations You received a small raise in June It s the end of the tax year You receive your W 2 from the school Your Form W 2 Form 1040 Form 1040 Instructions Form W 9 Form 4506 T Form W 4 Form 941 Form W 2 Form 9465 POPULAR FOR TAX PROS Form 1040 X Form 2848 Form W 7 Circular 230

W2 Form 1040ez Printable Form

W2 Form 1040ez Printable Form

W2 Form 1040ez Printable Form

http://apps.irs.gov/app/understandingTaxes/hows/mod02/media/sim_mod02_05.gif

You had taxable income of less than 100 000 with less than 1 500 of interest income You claimed no dependents This form made it easier and faster to report basic tax situations Now through at least 2025 most taxpayers will use either Form 1040 or 1040 SR to prepare their taxes and file with the IRS What is IRS Form 1040

Templates are pre-designed documents or files that can be used for different functions. They can conserve effort and time by offering a ready-made format and layout for creating different sort of content. Templates can be utilized for individual or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

W2 Form 1040ez Printable Form

Printable Tax Forms 1040ez 2019 Form Resume Examples vq1PyQrKkR

1040ez Tax Forms And Instructions Form Resume Examples A19XQ4dY4k

File Form 1040EZ 2005 Jpg Wikipedia 2021 Tax Forms 1040 Printable

Irs 1040 Ez 1040Ez Form 2020 Printable The New 1040 Form For 2018 H R

Copy Of Form 1040ez Universal Network

1040ez Printable Form Carfare me 2019 2020

https://www.irs.gov/forms-pubs/about-form-w-2

Information about Form W 2 Wage and Tax Statement including recent updates related forms and instructions on how to file Form W 2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes

https://apps.irs.gov/app/understandingTaxes/hows/mod02/sim_mod02_0…

Using Your W 2 to File Your 1040EZ In this simulation you will take on the role of Cicely King in order to learn how to use the information from Form W 2 to complete Form 1040EZ

https://www.irs.gov/e-file-providers/free-file-fillable-forms

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free enabling you to Choose the income tax form you need Enter your tax information online Electronically sign and file your return Print your return for recordkeeping

https://www.irs.gov/pub/irs-prior/fw2--2022.pdf

W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA You may also print out copies for filing with state or local governments distribution to your employees and for your records

https://www.irs.gov/pub/irs-prior/fw2--2020.pdf

W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA You may also print out copies for filing with state or local governments distribution to your employees and for your records

On Line 1 include the income reported on your Form W 2 and attach your W 2 to the 1040EZ On Line 2 you should report the taxable interest you earned Remember if this is more than 1 500 you cannot use Form 1040EZ Attach Form s W 2 here Also attach Forms W 2G and 1099 R if tax was withheld If you did not get a Form W 2 see instructions 1 a Total amount from Form s W 2 box 1 see instructions 1a b 2022 Form 1040 Author SE W CAR MP Subject U S Individual Income Tax Return

Get federal tax return forms and file by mail Get paper copies of federal and state tax forms their instructions and the address for mailing them Find easier to read tax forms for seniors and people with different needs Find out how to get and where to mail paper federal and state tax forms