Virginia Printable 1099 Form Virginia Department of Taxation eForms W2 1099 Guide Rev 09 27 2021 Page 3 of 16 Overview Virginia s eForms system is a free and secure system using fillable electronic forms to electronically file your wage and tax statements to the Virginia Department of Taxation Department

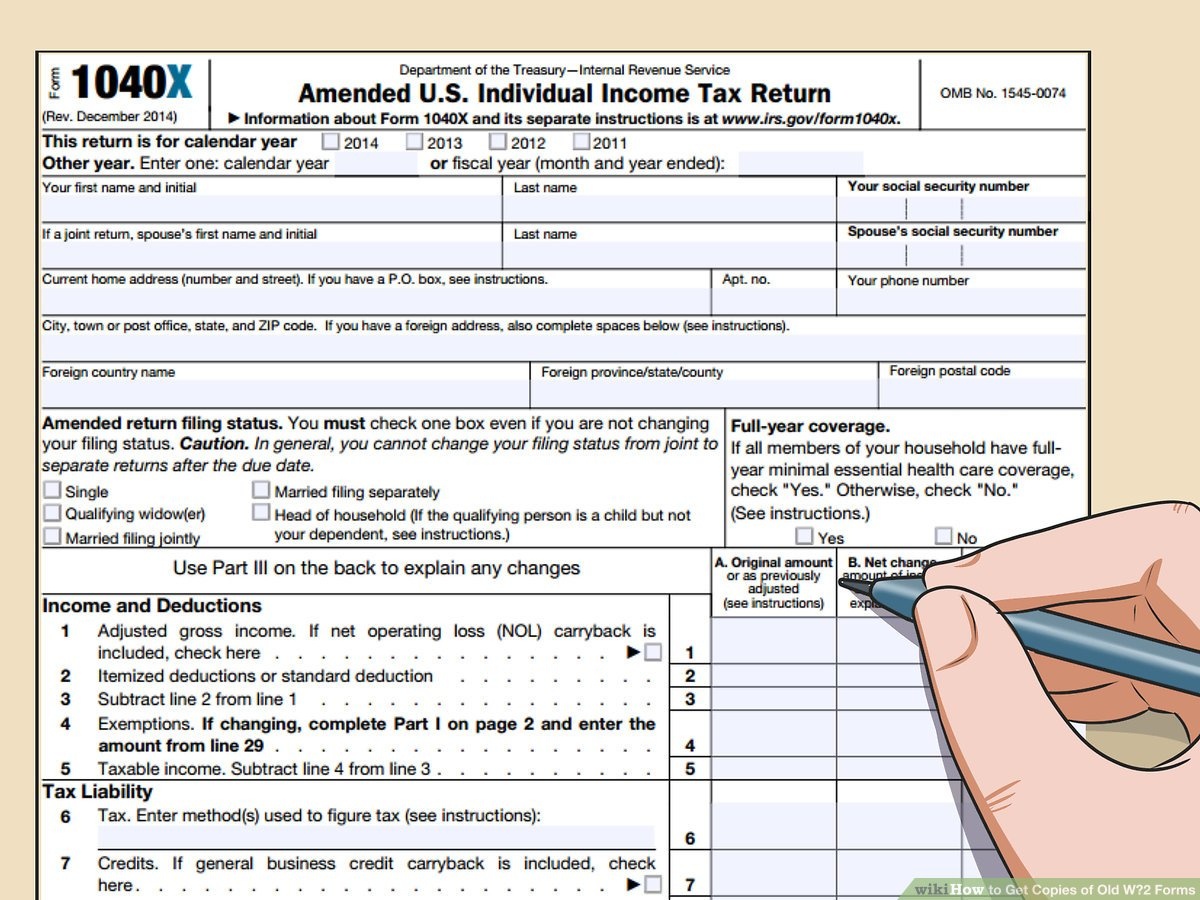

You will be mailed a 1099 G form to your address of record with the VEC by February 4 2022 You should receive your 1099 G by February 16 2022 1099 G forms will be available online for self printing The department provides that 1 taxpayers need their adjusted gross income the tax year of their return and their Social Security number from their most recently filed state tax return to look up the forms online 2 Form 1099 G doesn t include any information on unemployment benefits received last year 3 the Virginia Employment Commission

Virginia Printable 1099 Form

Virginia Printable 1099 Form

Virginia Printable 1099 Form

https://www.pbmares.com/wp-content/uploads/2020/11/IRS-Form-1099-new.png

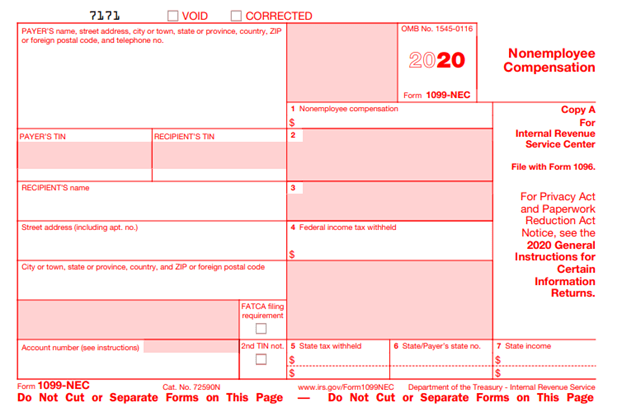

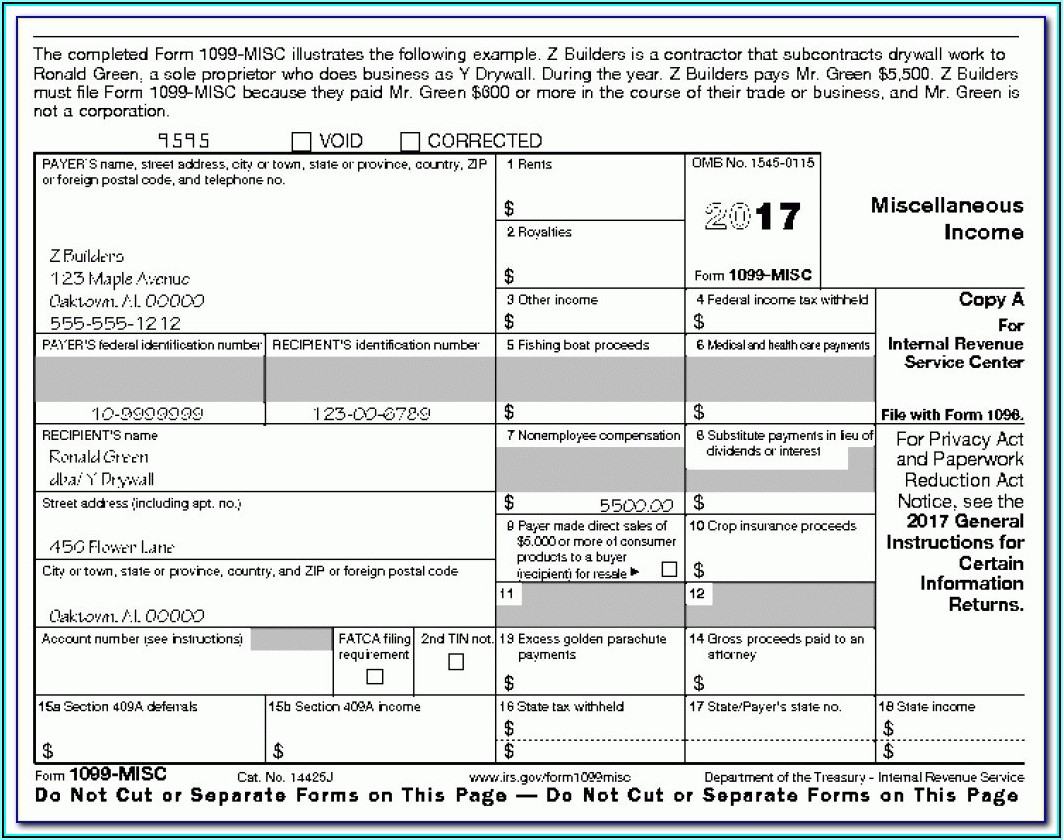

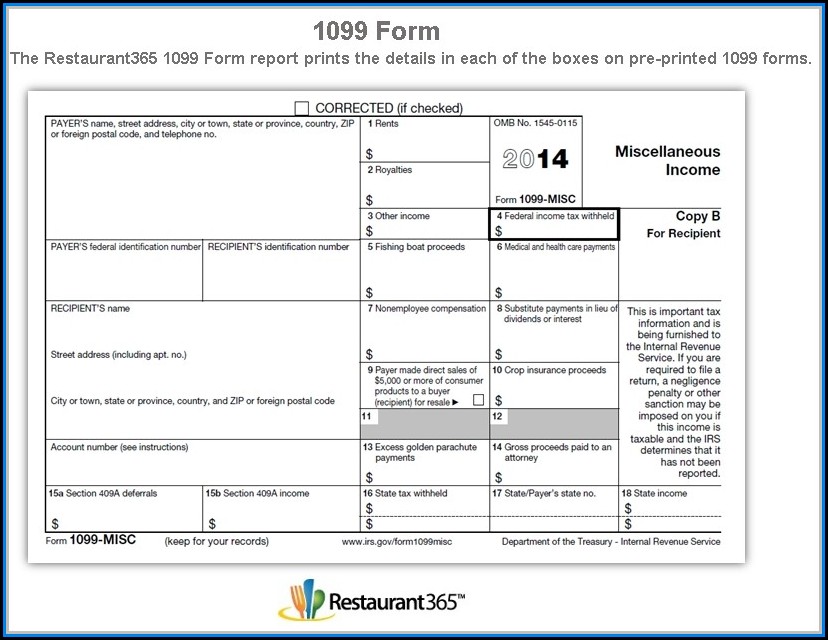

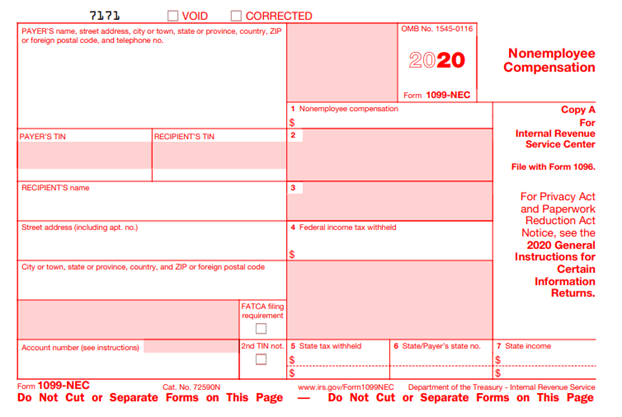

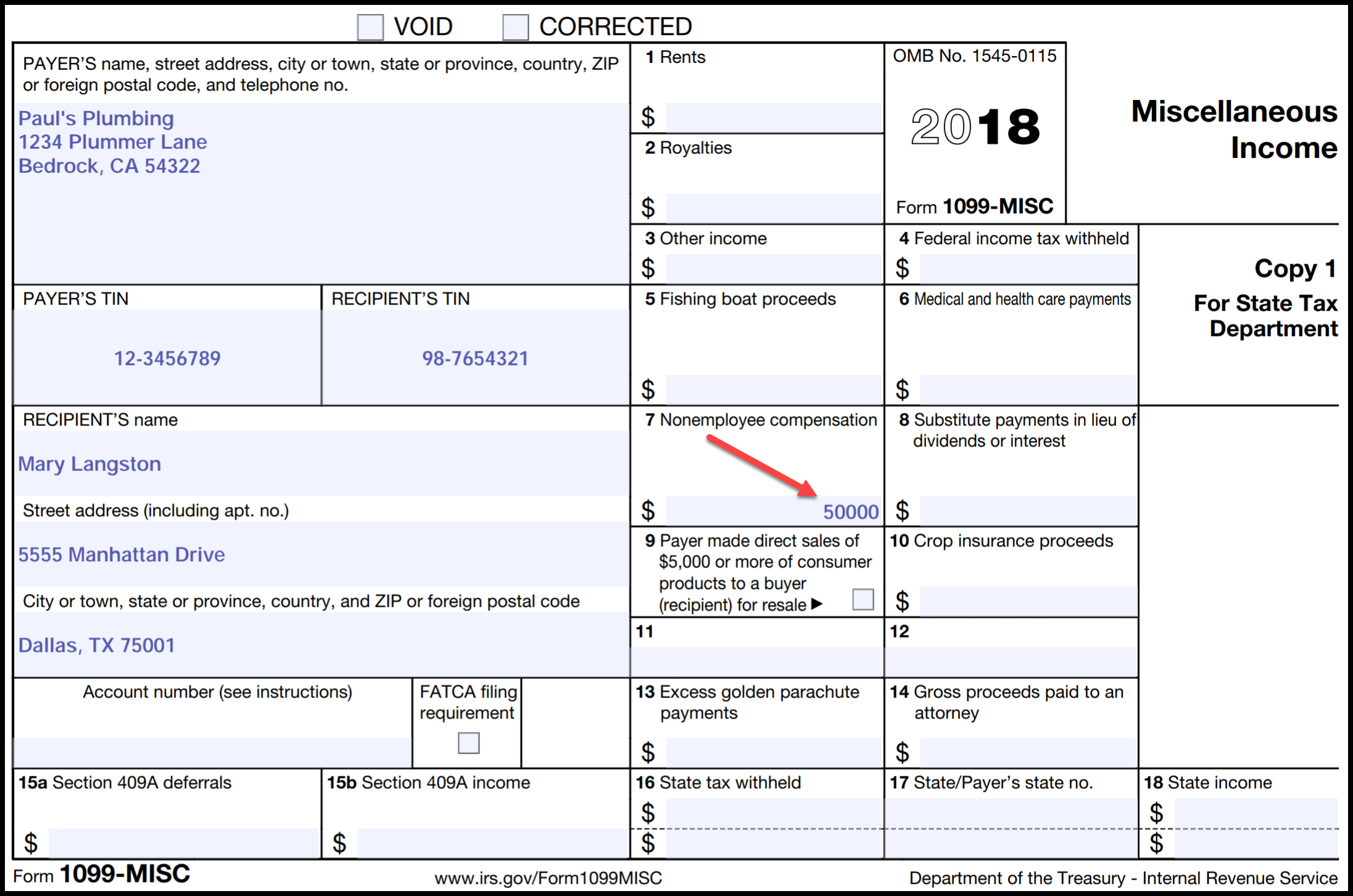

Form 1099 NEC box 2 Payers may use either box 2 on Form 1099 NEC or box 7 on Form 1099 MISC to report any sales totaling 5 000 or more of consumer products for resale on a buy sell a deposit commission or any other basis For further information see the instructions later for box 2 Form 1099 NEC or box 7 Form 1099 MISC

Pre-crafted templates use a time-saving solution for creating a diverse series of documents and files. These pre-designed formats and layouts can be utilized for different individual and expert projects, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, improving the content creation procedure.

Virginia Printable 1099 Form

Free 1099 Form 2013 Printable Free Printable A To Z

1099 Int Tax Form Printable Form Resume Examples AjYdk6w9l0

Fillable Form 1099 Form Resume Examples xz20gvGVql

Printable Form Ssa 1099 Printable Form 2023

1099 Form Printable 2018 MBM Legal

Irs Forms 1099 Misc 2019 Form Resume Examples N8VZwx42we

https://www.tax.virginia.gov/withholding-tax

Form 1099 K Household Employer Nanny Tax Filing Requirements As an employer required to file withholding returns you must register for withholding tax file income tax withholding returns and pay the income tax to Virginia Tax Employers must file withholding returns whether or not there is withholding tax owed

https://www.tax.virginia.gov/form-1099g1099int

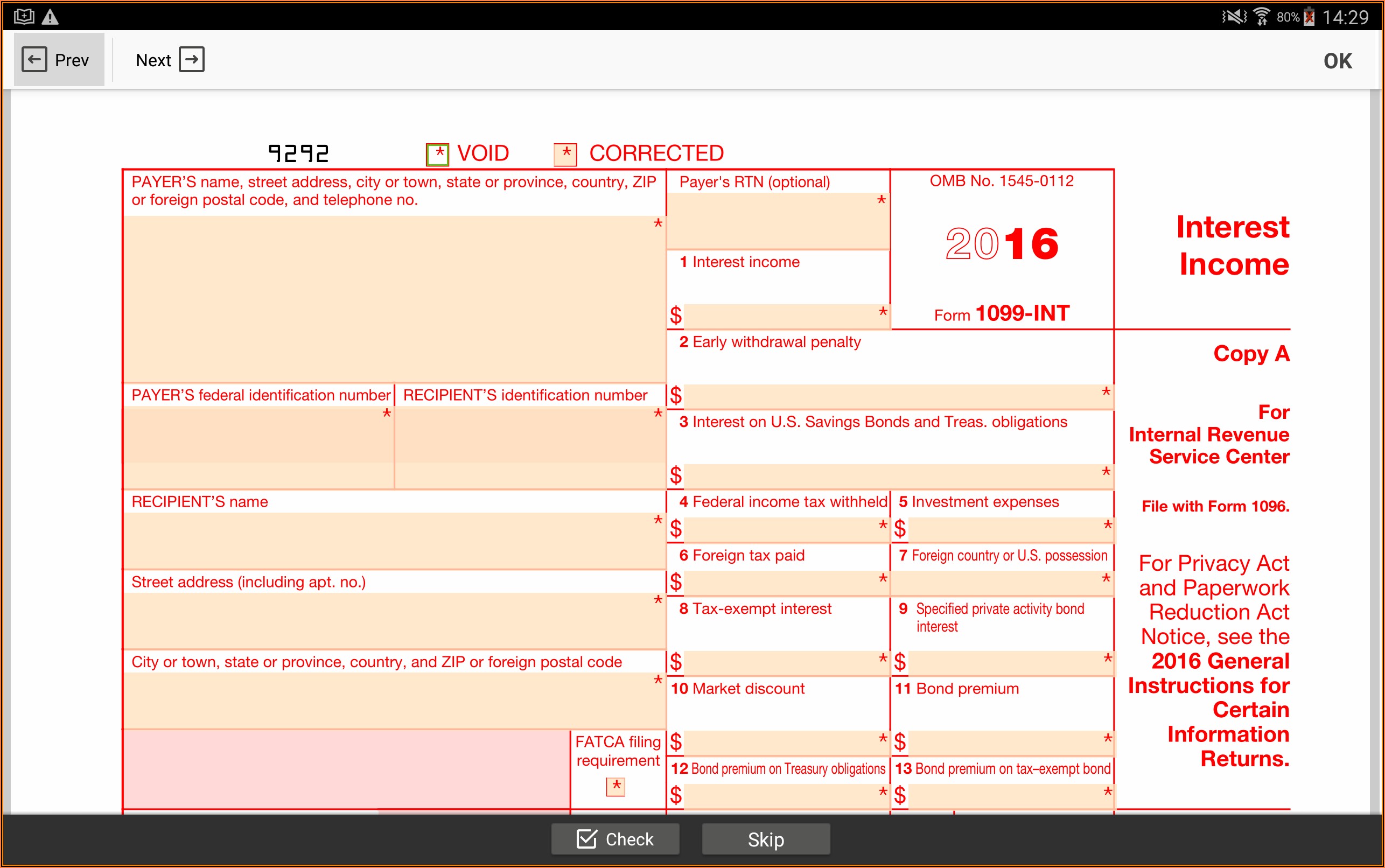

Form 1099G 1099INT is a report of income you received from Virginia Tax during 2022 The IRS requires government agencies to report certain payments made during the year because those payments are considered taxable income for the recipients

https://www.tax.virginia.gov/news/1099-g1099-ints-now-available

1099 G 1099 INTs are now available To look up your Form 1099 G 1099 INT online you ll need the following information from your most recently filed Virginia tax return If you filed a part year return add together the amounts from both columns Line 1

https://www.tax.virginia.gov/eforms

EForms are a fast and free way to file and pay state taxes online Select an eForm below to start filing If you haven t filed or paid taxes using eForms and need more information see Guidelines for electronic W 2s and 1099s Electronic Payment Guide pdf for EFT details and ACH Credit Stay informed with email updates

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

On this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 8938 Box 14 Shows your total compensation of excess golden parachute payments subject to a 20 excise tax See your tax return instructions for where to report

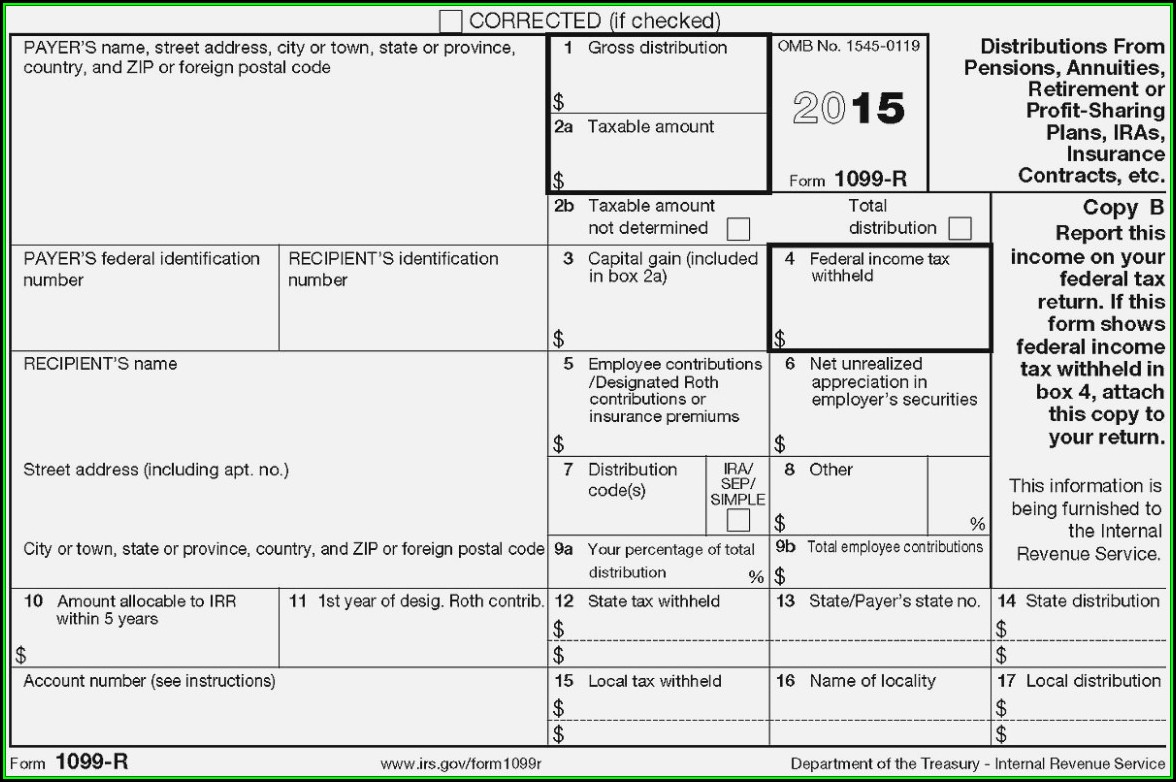

You will be mailed a 1099 G form to your address of record with the VEC by February 4 2022 You should receive your 1099 G by February 16 2022 1099 G forms will be available online for self printing Download 1099 E File Software File the following forms with the state of Virginia 1099 MISC 1099 NEC and 1099 R Filing due dates File the state copy of form 1099 with the Virginia taxation agency by February 28 2021 January 31 in some cases Reporting threshold If you file 250 or more 1099 forms with Virginia you must file

Form 1099 NEC Independent Contractors What s the difference between a Form W 2 and a Form 1099 MISC or Form 1099 NEC How do you determine if a worker is an employee or an independent contractor Back to Frequently Asked Questions Page Last Reviewed or Updated 15 Jun 2023 Share