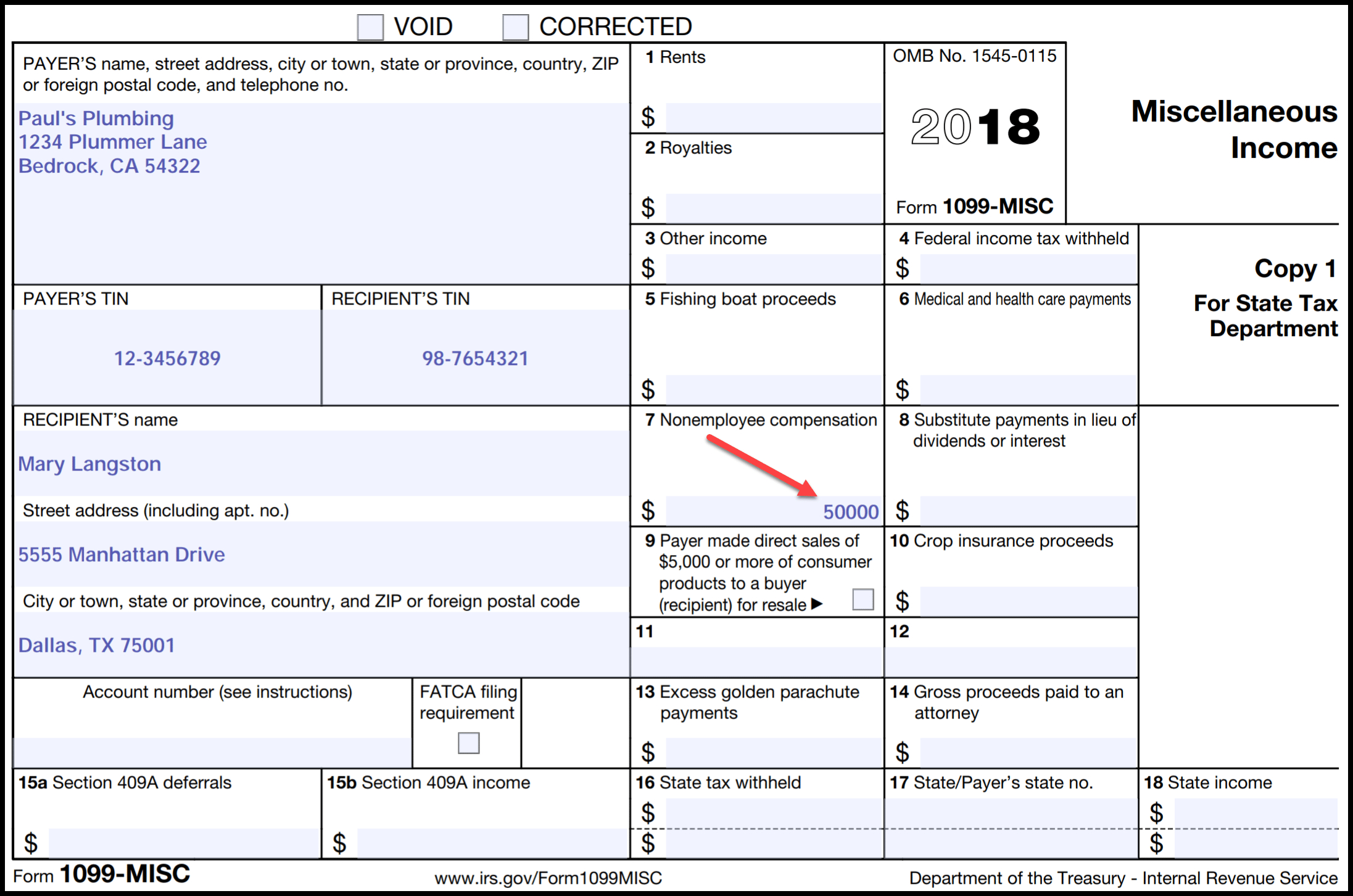

Tax Form 100 Misc Printable Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

The following forms and schedules can be used to help you complete your tax return Steps Download or view your return and provincial forms File Form 1099 MISC by February 28 2022 if you file on paper or March 31 2022 if you file electronically Specific Instructions for Form 1099 MISC File Form 1099 MISC Miscellaneous Information for each person in the course of your business to whom you have paid the following during the year

Tax Form 100 Misc Printable

Tax Form 100 Misc Printable

Tax Form 100 Misc Printable

https://i.pinimg.com/736x/70/68/57/706857b0f448b08bd033de1a6f650cd1.jpg

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

Templates are pre-designed files or files that can be used for various purposes. They can conserve effort and time by providing a ready-made format and layout for producing various kinds of material. Templates can be utilized for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Tax Form 100 Misc Printable

1099 Misc Printable Template Free

Polish Tax Form 100 Pln Stock Photo And Royalty free Images On

Freelance Fillable Tax Form 1099 Printable Forms Free Online

Printable Irs Form 1099 Int Printable Forms Free Online

Navajo Form 100 Fill Out Sign Online DocHub

Nc Fillable Tax Forms Printable Forms Free Online

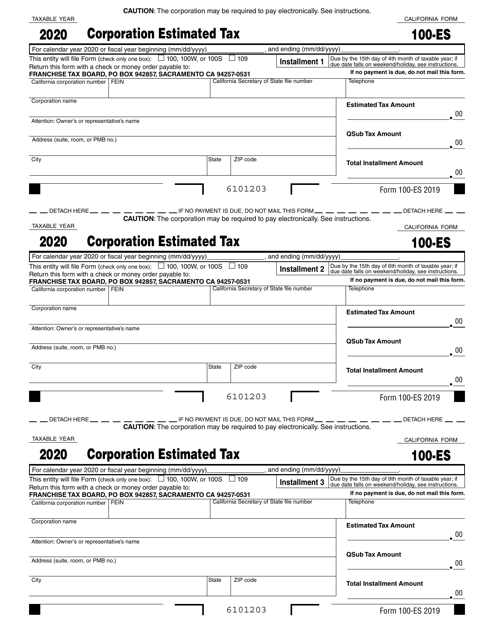

Printing PDF forms Before you print set the page size in the Adobe Reader print properties to legal or letter based on the size of the document Need a signature If a signature is required completed forms must be printed and signed by hand If you experience problems printing a PDF

A return envelope If you don t receive your package by February 20 2023 you can view download and print the package at canada ca taxes general package order the package online at canada ca get cra forms order a package by calling the CRA at 1 855 330 3305 be ready to give your social insurance number

Instructions for Recipient Recipient s taxpayer identification number TIN For your protection this form may show only the last four digits of your social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN

Get a paper or online version of 2022 income tax package for the province or territory where you reside including specific tax return or form required for other tax situations

File Form 1099 MISC for each person to whom you have paid during the year At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest At least 600 in Rents Prizes and awards Other income payments Medical and health care payments Crop insurance proceeds

A 1099 MISC form is an IRS tax form typically used by businesses to report miscellaneous non salary income exceeding 600 paid to non employees such as independent contractors consultants and landlords i e rent payments This form was developed by OREA for the use and reproduction by its members and licensees only Any other use or reproduction is prohibited except with prior written consent of OREA Do not alter when printing or reproducing the standard pre set portion OREA bears no liability for your use of this form Agreement of Purchase and Sale Form 100

If you believe you are an employee and cannot get the payer to correct this form report the amount shown in box 1 on the line for Wages salaries tips etc of Form 1040 1040 SR or 1040 NR You must also complete Form 8919 and attach it to your return For more information see Pub 1779 Independent Contractor or Employee