Sample W2 Printable Form Do not print and file Copy A downloaded from this website with the SSA a penalty may be imposed for filing forms that can t be scanned See the penalties section in the current General Instructions for Forms W 2 and W 3 available at

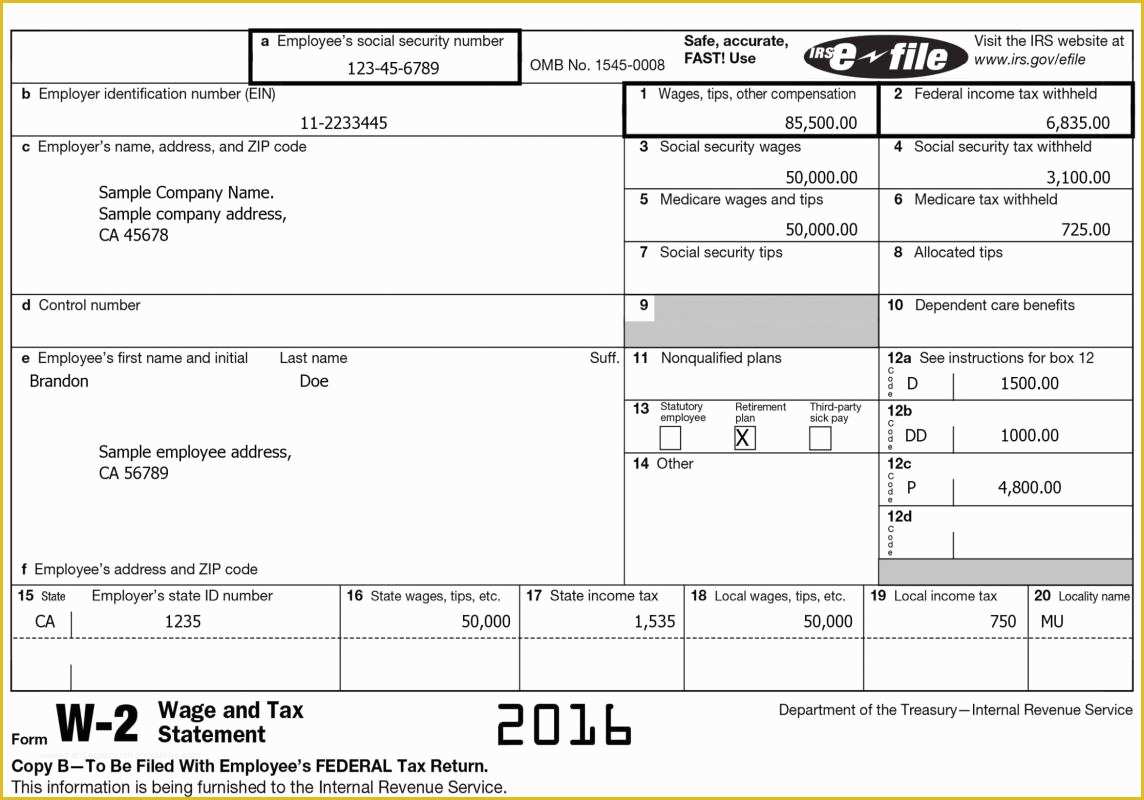

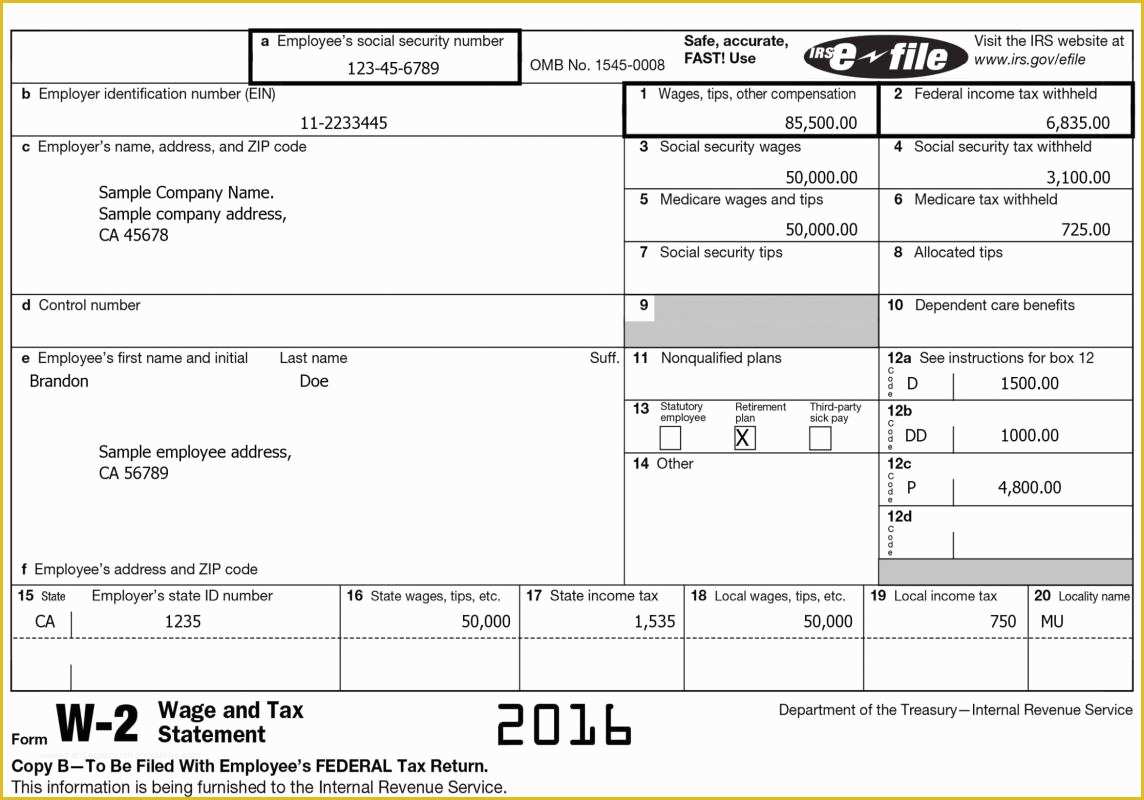

Who must file Form W 3 Anyone required to file Form W 2 must file Form W 3 to transmit Copy A of Forms W 2 Make a copy of Form W 3 and a copy of each Form W 2 Copy A For SSA to keep for your records for at least 4 years Be sure to Form W 2 2016 Form W 2 officially the Wage and Tax Statement is an Internal Revenue Service IRS tax form used in the United States to report wages paid to employees and the taxes withheld from them Employers must complete a Form W 2 for each employee to whom they pay a salary wage or other compensation as part of the

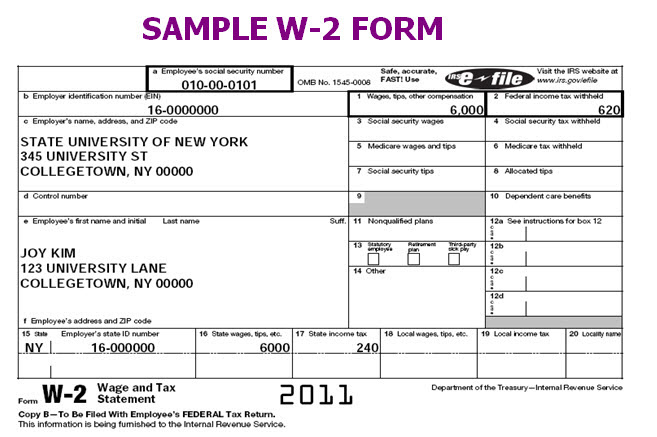

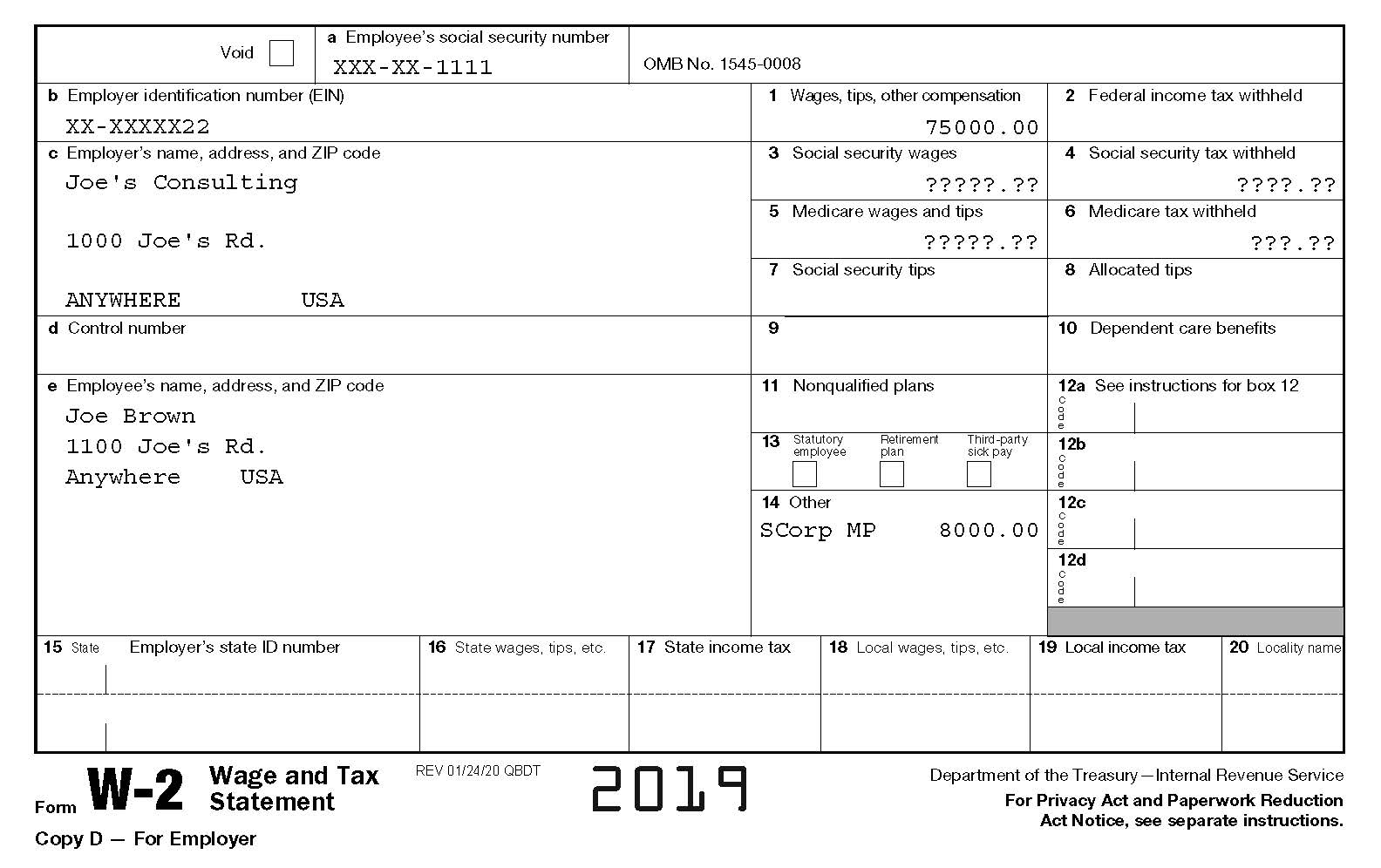

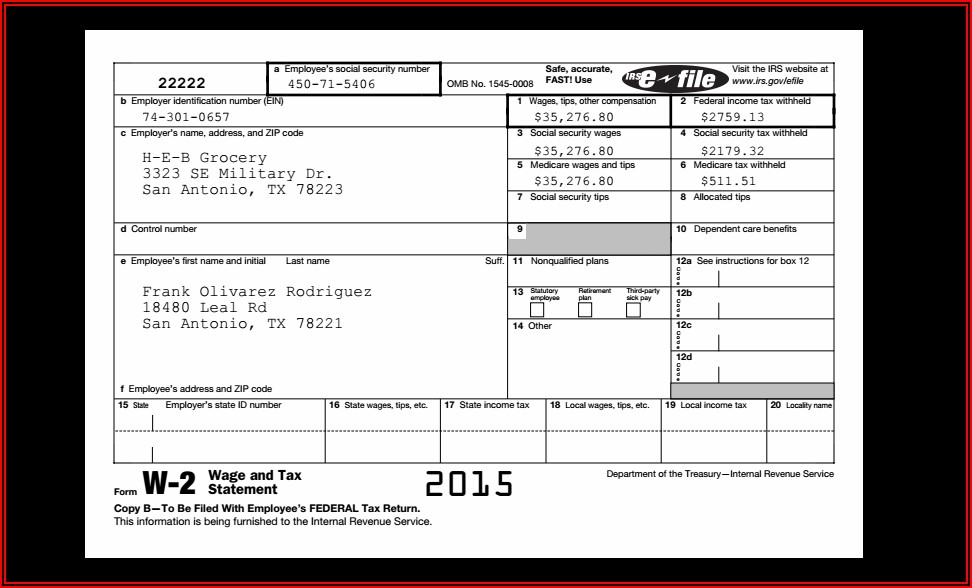

Sample W2 Printable Form

Sample W2 Printable Form

Sample W2 Printable Form

https://www.heritagechristiancollege.com/wp-content/uploads/2019/05/free-2016-w2-template-of-w2-template-2016-of-free-2016-w2-template.jpg

Understanding the W 2 A W 2 can be broken down into three parts the left side of the form the right side of the form and the bottom of the form each with its own specialty The left side of the form reports the personal information of the taxpayer such as social security number employer EIN and employer address The right side of the form

Pre-crafted templates offer a time-saving solution for producing a diverse variety of documents and files. These pre-designed formats and designs can be made use of for various individual and expert tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the content development procedure.

Sample W2 Printable Form

Swppp Inspection Form Utah Form Resume Examples EAkwAp15gY

How To Fill Out A W 2 Form

21 FAQ s About Filing Tax Returns For International Students In The USA

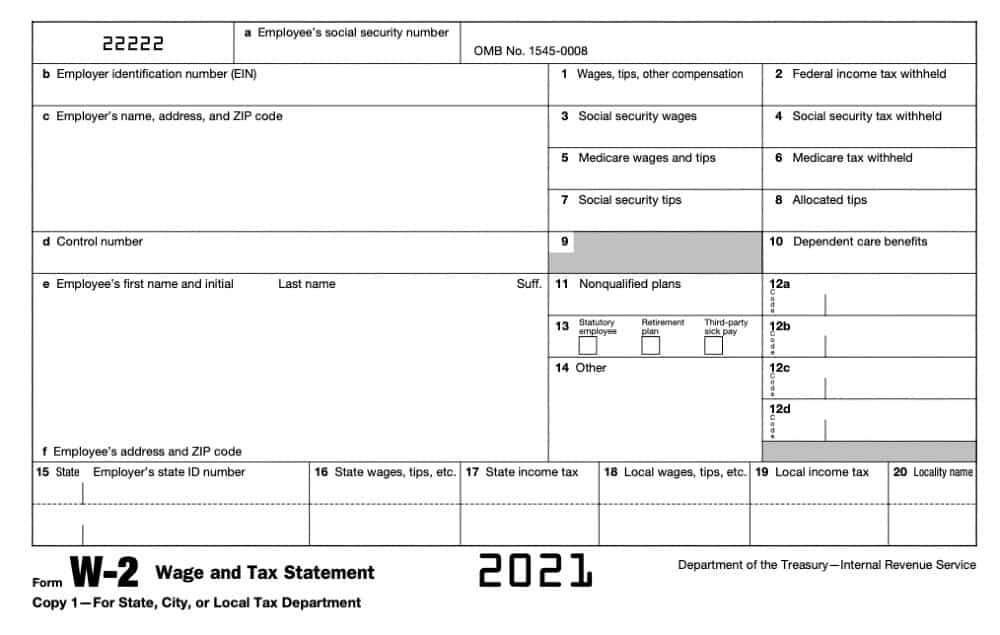

Exact W2 Form Printable Blank PDF Online

W2 Form Sample Tax Year 2019 CPA Certified Public Accountant Income

An Employer s Guide To Easily Completing A W 2 Form Gift CPAs

https://www.irs.gov/pub/irs-pdf/fw2.pdf

You may file Forms W 2 and W 3 electronically on the SSA s Employer W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer

https://formswift.com/w2

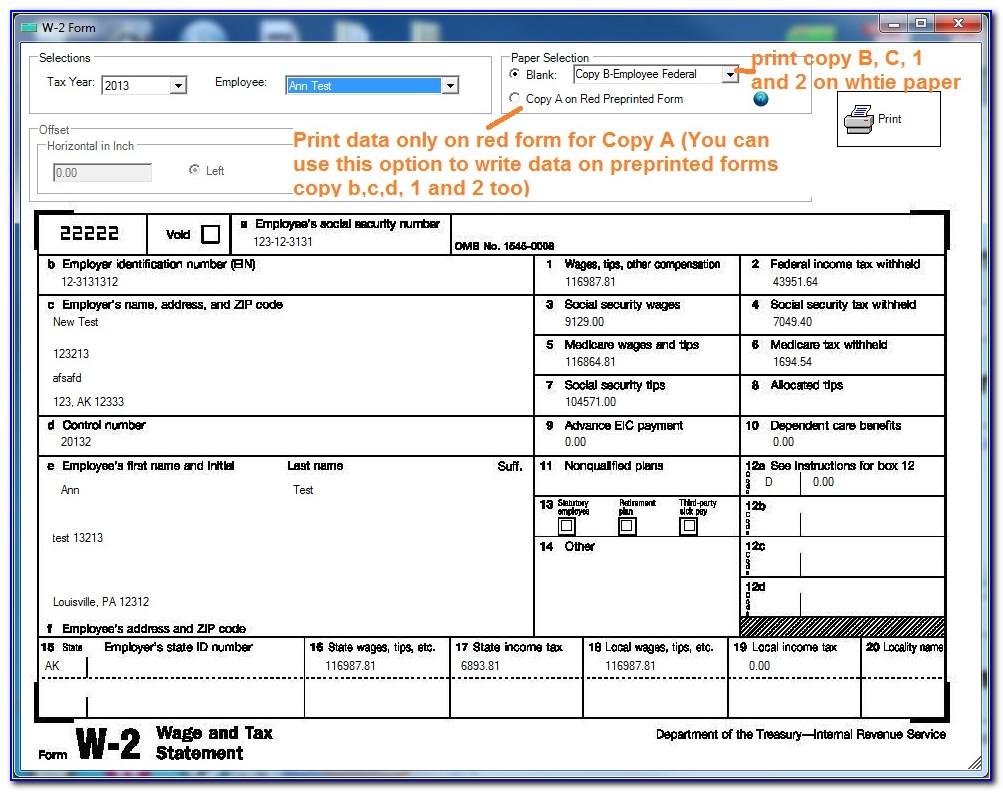

Common errors on the W 2 Form when completing it by hand include making entries using ink that is too light or making entries that are too small or too large Make sure to use black ink and clear writing if you complete it by hand

https://www.irs.gov/pub/irs-prior/fw2--2021.pdf

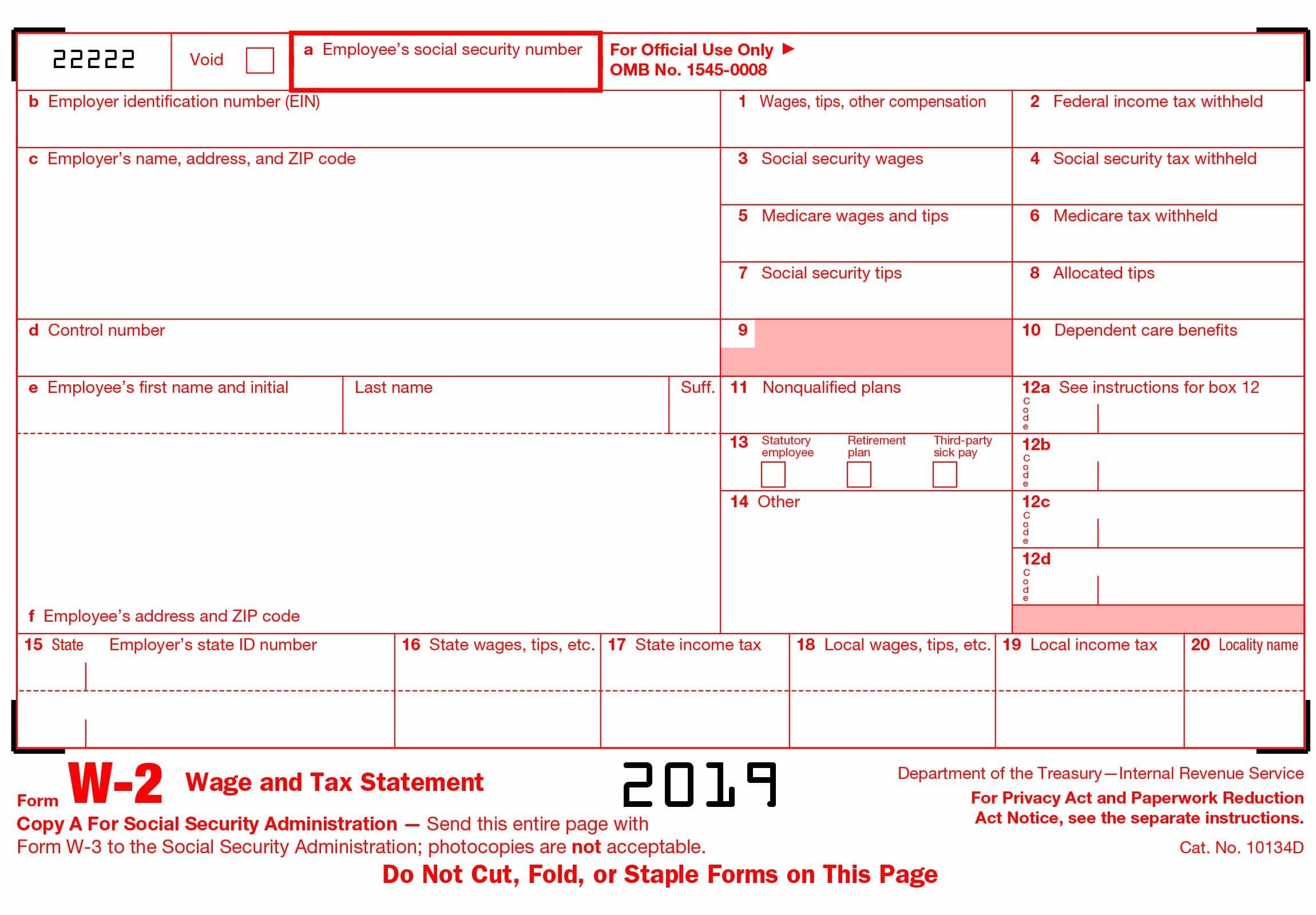

Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of this IRS form is scannable but the online version of it printed from this website is not Do not print and file Copy A downloaded from this website with the SSA a penalty

https://onpay.com/payroll/process/form-w-2-instructions

Above is a fillable Form W 2 that you can print or download If you need a W 2 form from the previous year it is available to download below Download the 2022 version of Form W 2

https://www.investopedia.com/terms/w/w2form.asp

Form W 2 is an IRS form that employers must send to an employee and the IRS every year The form reports an employee s annual wages and the taxes withheld

What is a W 2 Form Who Needs a W 2 Form When Should I Send a W 2 Form to My Employees Why Should I Send a W 2 Form to My Employees How Do I Submit W 2 Forms to Employees and the Government W 2 Form Sample What is a W 2 Form A W 2 known officially as a Wage and Tax Statement is a tax form employees W2 Printable Form Essential Filling Rules to Consider Filling out the IRS printable W2 form accurately can ensure a smooth tax time on your end and can help your employer process your annual return efficiently

Federal income tax withheld Social Security and Medicare taxes withheld Any state and local taxes withheld if applicable Any other deductions or withholding if applicable Fill Now Printable W 2 Tax Form VS Fillable PDF