Required Minimum Distribution Inherited Ira Table 1 Printable Format Inherited IRA RMD MRD Minimum Required Distribution determined from running balance of an IRA 401K or 403B retirement account with a full schedule of withdrawal amounts and account earnings for all the years retired from an inherited IRA based on the IRS single life expectancy table Note that the minimum is different for spouses and

RMD Required Minimum Distribution The withdrawal options for beneficiaries that inherited from an original depositor that passed away on or after January 1 2020 are not yet finalized As of February 2022 the regulations were proposed by the Internal Revenue Service IRS We anticipate the IRS to publish final regulations in the near future Key Takeaways Individual retirement account assets are passed to the named beneficiaries often the person s spouse upon death Spousal IRA beneficiaries have different rules and more options to

Required Minimum Distribution Inherited Ira Table 1 Printable Format

Required Minimum Distribution Inherited Ira Table 1 Printable Format

Required Minimum Distribution Inherited Ira Table 1 Printable Format

https://alquilercastilloshinchables.info/wp-content/uploads/2020/05/RMD-Table-Required-Minimum-Distribution.jpg

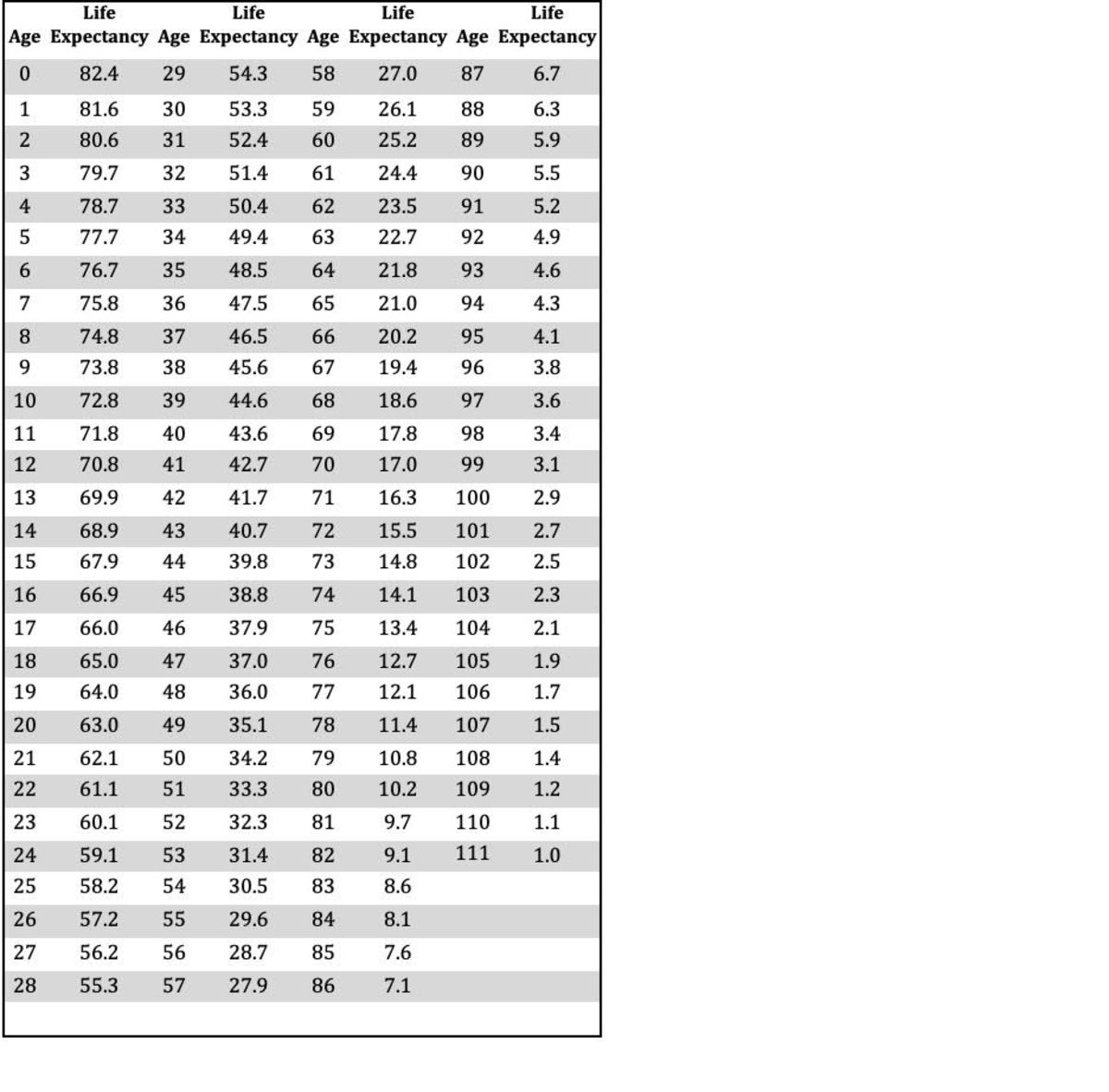

Distribution period from the table for your age on your birthday this year Line 1 divided by number entered on line 2 This is your required minimum distribution for this year from this IRA Repeat steps 1 through 3 for each of your non inherited IRAs

Pre-crafted templates use a time-saving solution for developing a varied range of files and files. These pre-designed formats and layouts can be used for various individual and professional jobs, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the content development process.

Required Minimum Distribution Inherited Ira Table 1 Printable Format

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

Annuity Life Expectancy Table

Required Minimum Distribution Table For Inherited Ira Elcho Table

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

Inherited Ira Distribution Table 1 Brokeasshome

Ira Required Minimum Distribution Table

https://required-minimum-distribution.com/rmd-table

RMD Table The required min i mum dis tri b u tion table rmd table for those who reach age

https://www.journalofaccountancy.com/issues/2023/apr/beneficiary-ira…

Sec 401 a 9 H i lengthens the required distribution period from five years to 10 years and applies the rule to all designated beneficiaries regardless of whether the decedent had begun RMDs Sec 401 a 9 H ii also introduces the concept of the eligible designated beneficiary

https://www.irs.gov/retirement-plans/plan-participant-employee/

Calculating the required minimum distribution The required minimum distribution for any year is the account balance as of the end of the immediately preceding calendar year divided by a distribution period from the IRS s Uniform Lifetime Table

https://www.irs.gov/pub/irs-tege/jlls_rmd_worksheet.pdf

IRA Required Minimum Distribution Worksheet If your spouse1 is the sole beneficiary of your IRA and he or she is more than 10 years younger than you use this worksheet to calculate this year s required withdrawal for your traditional IRA Deadline for receiving required minimum distribution

https://www.fool.com//inherited-iras/required-minimum-distributions

The table below explains some must know terms about IRA RMDs for an account you ve inherited Data source IRS You ll see the relevance of these terms in the next table which details the

If you ve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawals also known as required minimum distributions RMDs Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age If an IRA goes to a non designated beneficiary the entire IRA balance must be distributed by the end of the fifth year after the death of the IRA owner No distributions are required for years

What s an RMD The IRS requires that most owners of IRAs withdraw part of their tax deferred savings each year starting at age 73 or after inheriting any IRA account for certain individual beneficiaries That withdrawal is known as a