Printable W2 Form For Employees Claim For Dependents 0 min read Your dependent child must file a return if either of these is true about your child s income The child has unearned income over 1 050 The child has earned income over 12 950 The child has gross income earned and unearned which is more than the larger of these 1 050 Earned income up to 6 300 plus 350

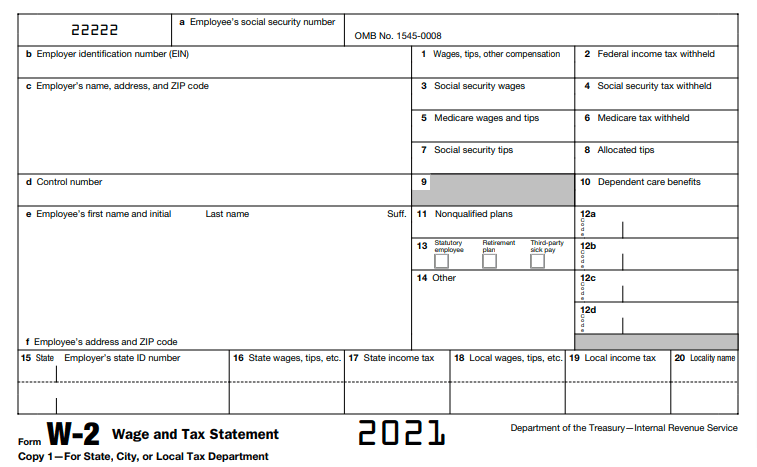

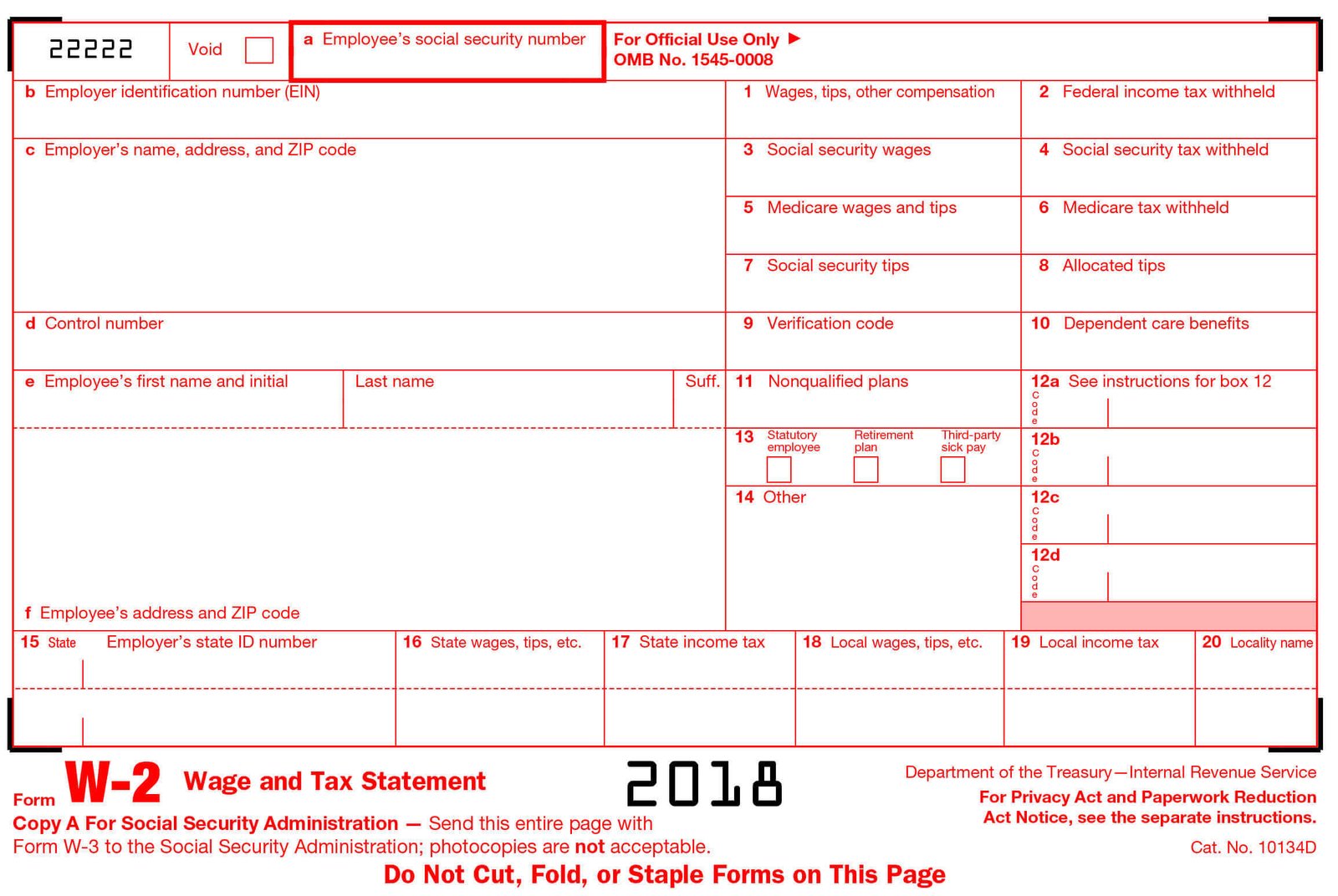

What Is a W 2 Form There s a reason why a W 2 is referred to as a wage and tax statement Put simply it s a form that shows how much money an employee has earned for the year and the amount of taxes that employers have already handed over to the IRS Not everyone needs a W 2 form W 2 Form The W 2 form is the form that an employer must send to an employee and the Internal Revenue Service IRS at the end of the year The W 2 form reports an employee s annual wages and the

Printable W2 Form For Employees Claim For Dependents

Printable W2 Form For Employees Claim For Dependents

Printable W2 Form For Employees Claim For Dependents

https://i2.wp.com/childforallseasons.com/wp-content/uploads/2019/11/w2-form-for-new-employees.jpg

The maximum amount employees may claim using this method has been increased to 500 it was 400 in the 2020 tax year for the maximum of 250 working days 200 days in the 2020 tax year Forms T2200S and T777S will again be used for the 2021 tax year These forms have been updated for 2021 and were made available to

Pre-crafted templates use a time-saving service for producing a varied range of files and files. These pre-designed formats and designs can be utilized for numerous individual and professional jobs, including resumes, invitations, flyers, newsletters, reports, discussions, and more, improving the material creation process.

Printable W2 Form For Employees Claim For Dependents

W 4 2023 Printable Form Printable Forms Free Online

Office Paper Products Business Forms Forms Record Keeping Supplies W

W2 Form For Walmart Employees Form Resume Examples q78QERN8g9

Printable W2 Form For Employees DuscountschoolsupplyCom

Ds 82 Form Printable Form Resume Examples N8VZ78n2we

Irs gov Form W 9 2020 Form Resume Examples ojYqX4Z9zl

https://www.irs.gov/forms-pubs/about-form-w-2

Information about Form W 2 Wage and Tax Statement including recent updates related forms and instructions on how to file Form W 2 is filed by employers to report wages tips and other compensation paid to employees as well as FICA and withheld income taxes

https://www.canada.ca//payroll/set-up-new-employee/filing-form-td1.html

Provincial and territorial form TD1 To be filled out by all individuals that are claiming more than the basic personal amount Form TD1X To be filled out by employees that are paid by commission TD1 IN To be filled out by employees who are Indians

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg?w=186)

https://www.irs.gov/pub/irs-prior/fw2--2021.pdf

Forms W 2 and W 3 for filing with SSA You may also print out copies for filing with state or local governments distribution to your employees and for your records The maximum amount of dependent care assistance benefits excludable from

https://www.irs.gov/pub/irs-pdf/fw4.pdf

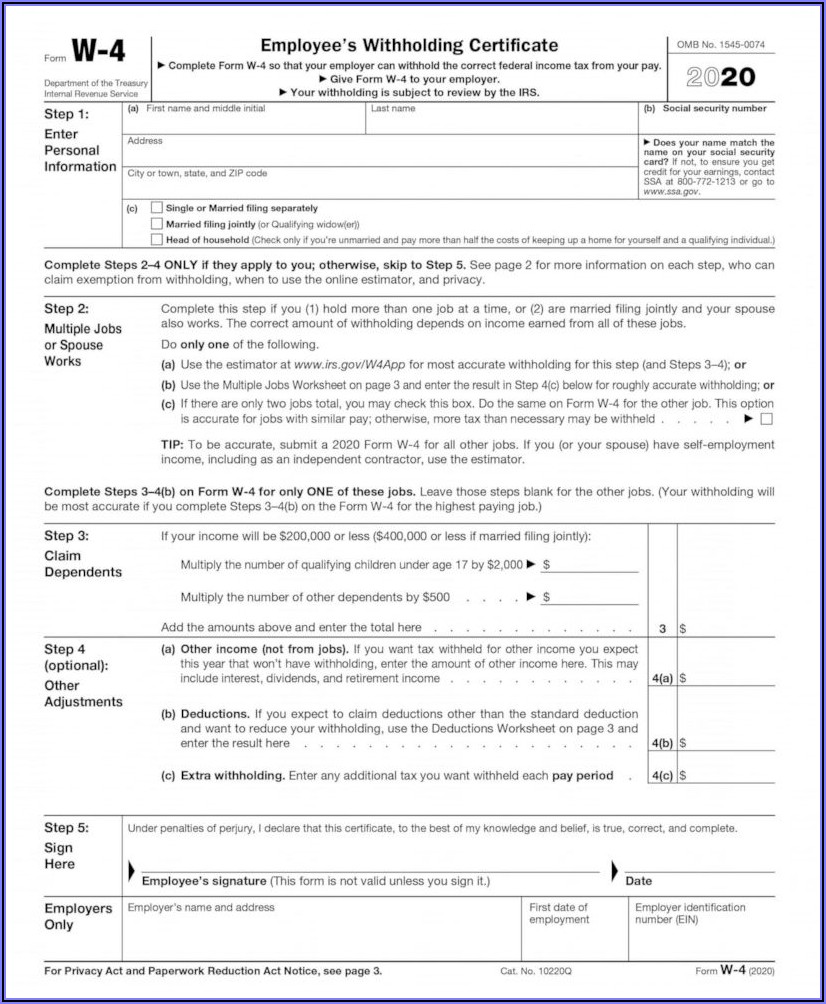

Claim Dependent and Other Credits If your total income will be 200 000 or less 400 000 or less if married filing jointly Multiply the number of qualifying children under age 17 by 2 000 Multiply the number of other dependents by 500 Add the amounts above for qualifying children and other dependents You may add to

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png?w=186)

https://www.irs.gov/pub/irs-pdf/fw2.pdf

W 2 Filing Instructions and Information web page which is also accessible at www socialsecurity gov employer You can create fill in versions of Forms W 2 and W 3 for filing with SSA You may also print out copies for filing with state or local governments distribution to your employees and for your records

How do I add a dependent s W 2 to my return You don t your dependent s W 2 isn t reported on your return If your unmarried dependent s W 2 earnings exceed their Standard Deduction 12 950 in 2022 they You need to enable JavaScript to run this app Open TurboTax Sign In Why sign in to Support Get personalized help You can t claim dependents or exemptions on a W 2 that form is your year end review of your paycheck withholding You used to be able to claim allowances on your W 4 at the beginning of the year but that changed in 2020 explains Patriot Software You can still claim dependents however

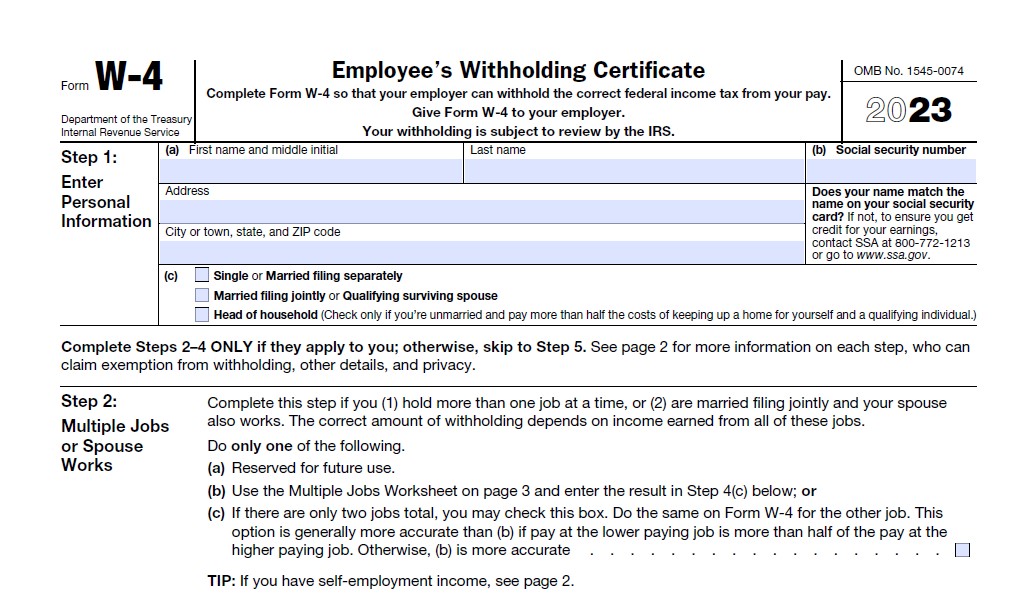

A Form W 4 is a tax document that employees fill out when they begin a new job It tells the employer how much to withhold from an employee s paycheck for taxes How a W 4 form is filled