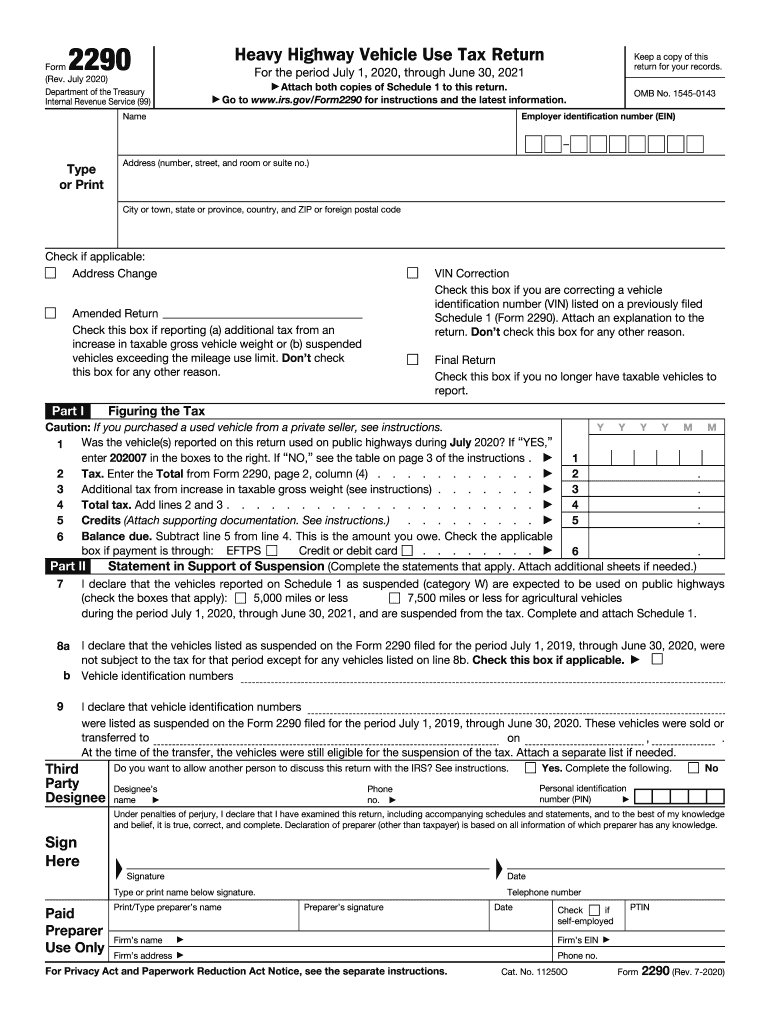

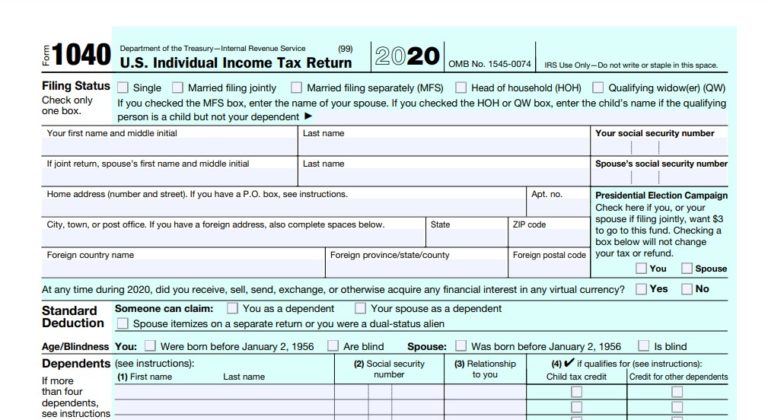

Printable V4 Tax Papers Get federal tax return forms and file by mail Get paper copies of federal and state tax forms their instructions and the address for mailing them Find easier to read tax forms for seniors and people with different needs

What is Form W 4V Form W 4V is the form used to voluntarily request federal income tax withholding on government paid income such as Social Security benefits or unemployment compensation Find IRS tax forms instructions and publications There are a number of excellent sources available for taxpayers to obtain tax forms instructions and publications They include

Printable V4 Tax Papers

Printable V4 Tax Papers

Printable V4 Tax Papers

https://oyungurup.com/wp-content/uploads/2021/01/2020-form-irs-2290-fill-online-printable-fillable-blank-irs-tax-forms-for-2021-printable.png

A W 4 form formally titled Employee s Withholding Certificate is an IRS tax document that employees fill out and submit to their employers Employers use the information provided on a W 4 to

Templates are pre-designed files or files that can be used for various purposes. They can conserve time and effort by providing a ready-made format and layout for producing different sort of material. Templates can be utilized for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Printable V4 Tax Papers

Tax Papers Lang Allan Company CPA PC

Edge ReadCube Papers V4 33 0 0 PDF EDGE

My Tax Papers Researchabout web fc2

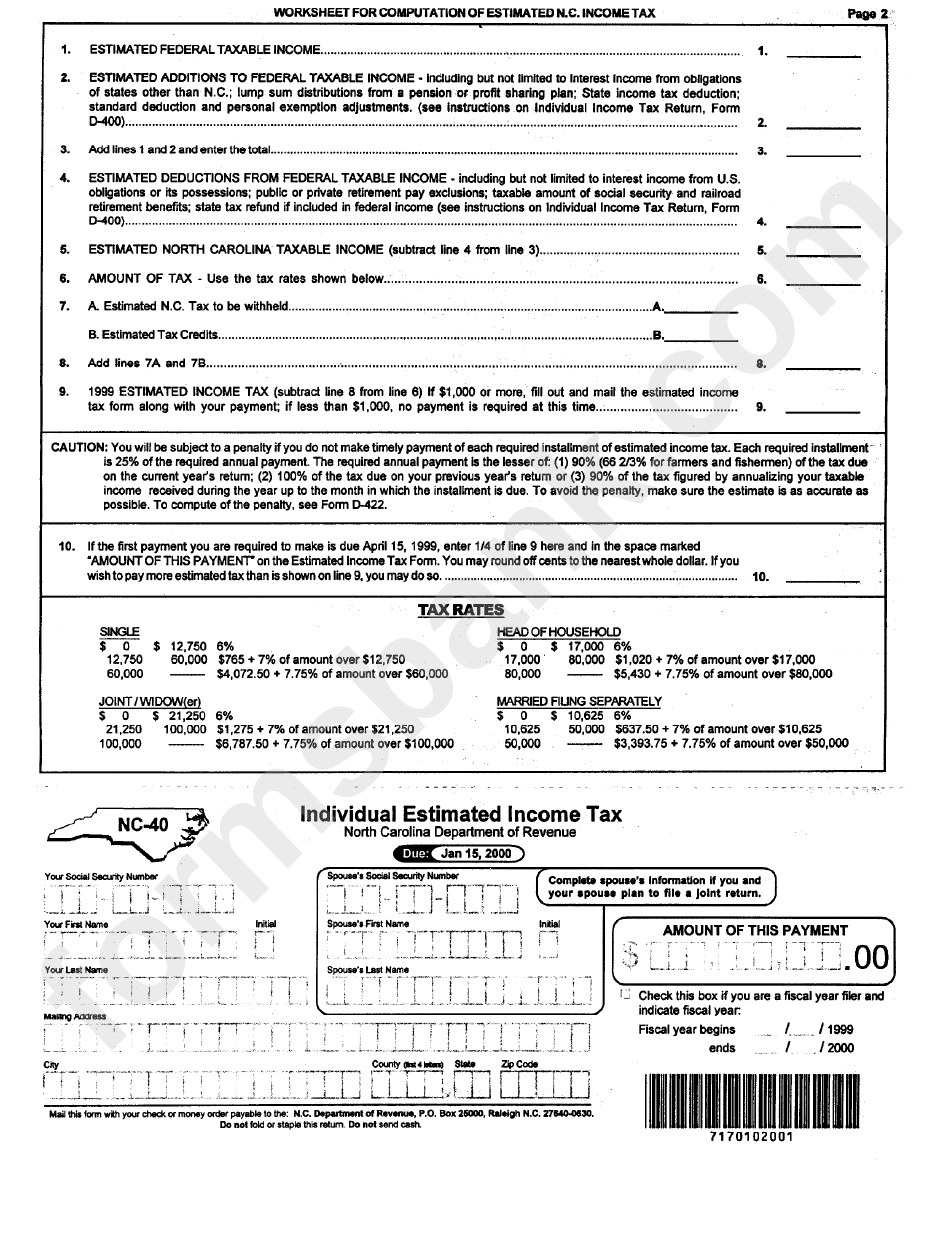

Printable Forms For Nc Tax Returns Printable Forms Free Online

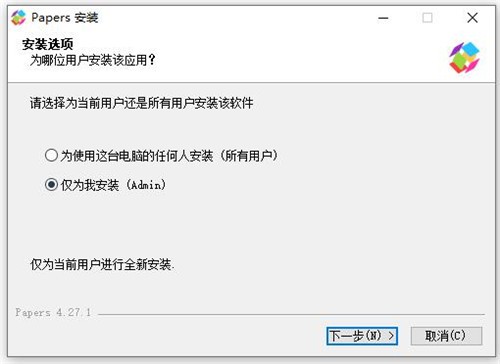

Papers Papers For Windows v4 27 1 0 PC

Printable Forms For Filing City Tax Printable Forms Free Online

https://www.taxformfinder.org/federal/form-w-4v

We last updated the Voluntary Withholding Request in January 2023 so this is the latest version of Form W 4V fully updated for tax year 2022 You can download or print current or past year PDFs of Form W 4V directly from TaxFormFinder You can

https://www.irs.gov/pub/irs-pdf/fw4v.pdf

Purpose of Form If you receive any government payment shown below you may use Form W 4V to ask the payer to withhold federal income tax Unemployment compensation including Railroad Unemployment Insurance Act RUIA payments Social security benefits Social security equivalent Tier 1 railroad retirement benefits

https://www.irs.gov/forms-pubs/about-form-w-4-v

Information about Form W 4V Voluntary Withholding Request including recent updates related forms and instructions on how to file Use this form to ask payers to withhold federal income tax from certain government payments

https://www.tax-brackets.org/federaltaxforms/w-4v

Please use the link below to download 2022 federal w 4v pdf and you can print it directly from your computer More about the Federal W 4V Estimated We last updated Federal W 4V in January 2023 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023

https://www.irs.gov/pub/irs-prior/fw4--2021.pdf

W 4 Rev December 2020 Department of the Treasury Internal Revenue Service Employee s Withholding Certificate Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay Give Form W 4 to your employer Your withholding is subject to review by the IRS

The latest versions of IRS forms instructions and publications View more information about Using IRS Forms Instructions Publications and Other Item Files Click on a column heading to sort the list by the contents of that column Follow the simple instructions below Reporting your earnings and filing all the essential taxation documents including IRS W 4V is a US citizen s sole responsibility US Legal Forms tends to make your taxes managing more accessible and efficient You can find any lawful blanks you want and complete them digitally

Find employment tax forms a small business or self employed person needs to file their taxes Below are forms commonly associated with employment taxes however this list is not exhaustive Form instructions are either included with the form itself or are included in a separate publication