Printable Tax K 41 Kansas The Form 2021 K 41 KANSAS FIDUCIARY INCOME TAX form is 4 pages long and contains 0 signatures 11 check boxes 200 other fields Country of origin US File type PDF BROWSE OTHERS US FORMS Fill has a huge library of thousands of forms all set up to be filled in easily and signed Fill in your chosen form Sign the form using our

K 41 Rev 7 16 DO NOT STAPLE 2016 KANSAS FIDUCIARY INCOME TAX 140016 For the taxable year beginning 2 0 1 6 ending Name of Estate or Trust Name of Fiduciary Employer ID Number EIN Mailing Address Number and Street including Rural Route Telephone How to fill out and sign kansas k 41 instructions 2021 online Get your online template and fill it in using progressive features Enjoy smart fillable fields and interactivity Follow the simple instructions below

Printable Tax K 41 Kansas

Printable Tax K 41 Kansas

Printable Tax K 41 Kansas

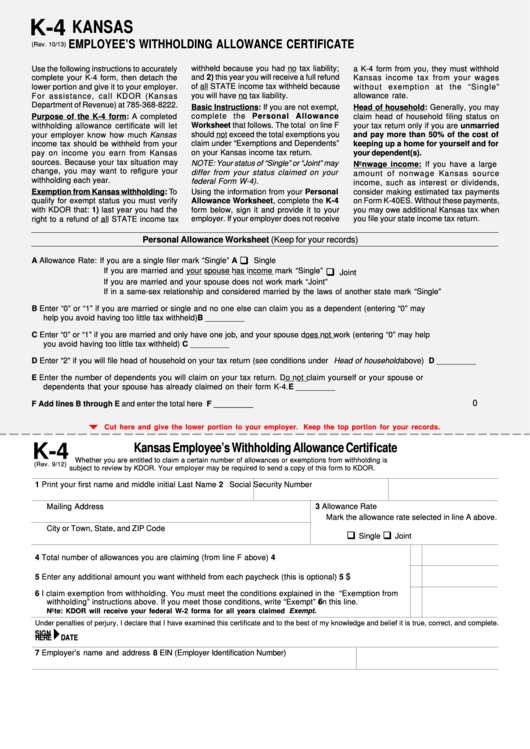

https://w4formsprintable.com/wp-content/uploads/2021/07/fillable-form-k-4-kansas-employee-s-withholding.png

Please use the link below to download 2022 kansas form k 41 pdf and you can print it directly from your computer More about the Kansas Form K 41 Tax Return We last updated Kansas Form K 41 in January 2023 from the Kansas Department of Revenue This form is for income earned in tax year 2022 with tax returns due in April 2023

Pre-crafted templates use a time-saving solution for creating a varied series of files and files. These pre-designed formats and designs can be made use of for various individual and expert jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the material production process.

Printable Tax K 41 Kansas

Printable Kansas Income Tax Forms Printable Forms Free Online

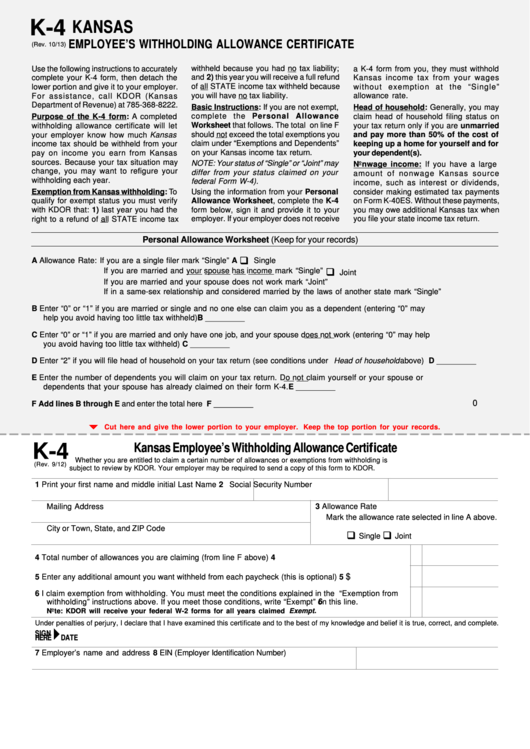

Kansas Fillable Tax Forms Printable Forms Free Online

Kansas Fillable Tax Forms Printable Forms Free Online

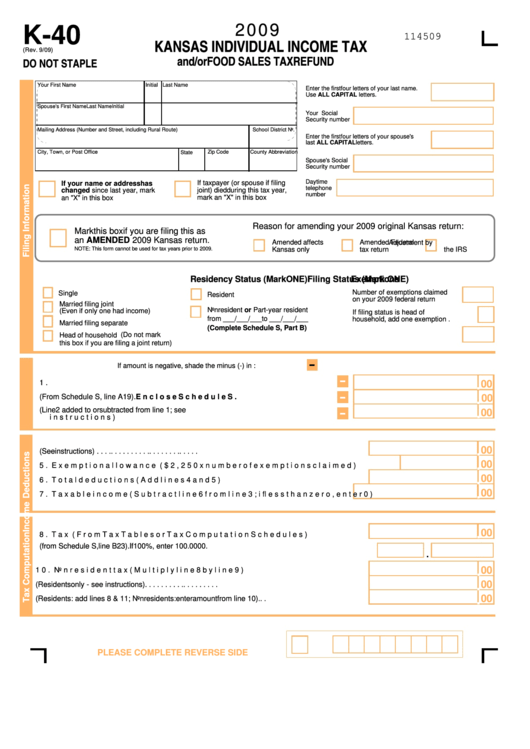

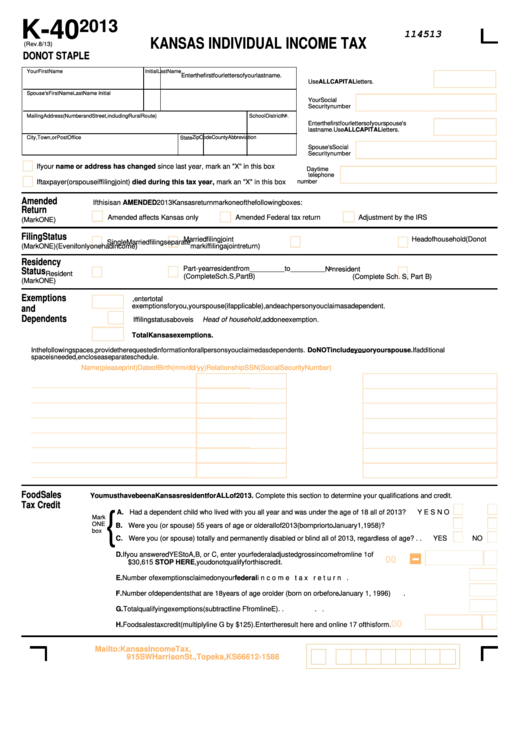

2020 Form KS DoR K 40 Fill Online Printable Fillable Blank PdfFiller

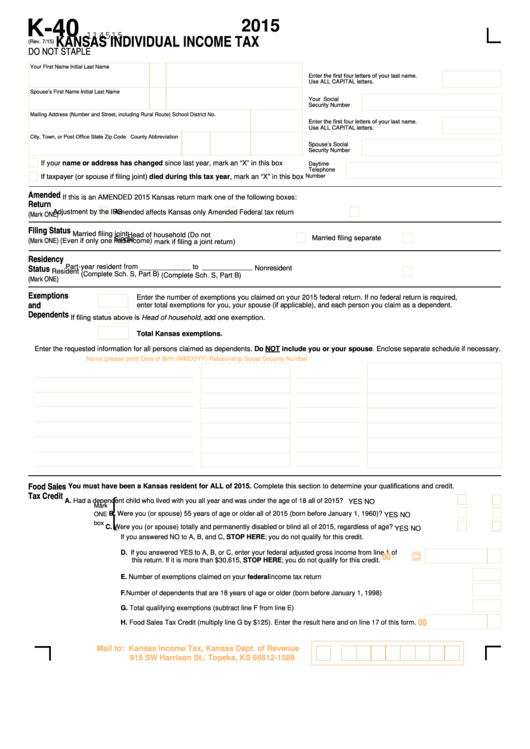

Kansas Fillable Tax Forms Printable Forms Free Online

Hayley Lewis KSHB 41 Kansas City Missouri Hot reporters

https://ksrevenue.gov/pdf/k-4122.pdf

The fiduciary of a nonresident estate or trust must file a Kansas Fiduciary Income Tax Return if the estate or trust had taxable income or gain derived from Kansas sources This includes income or gain from 1 real or tangible personal property lo cated within Kansas 2 a business profession or occupation carried on within Kansas or 3

https://ksrevenue.gov/pdf/k-41inst20.pdf

The filing status shown on Form K 41 will reflect the nature of the entity for which the return is being filed Residency Status Residents If you are filing for a resident estate or trust check the box for residents If all income is taxable to the fiduciary and no distributions are made or required to be made only Part I must be completed

https://ksrevenue.gov/pdf/k-41inst22.pdf

2022 Fiduciary Income Tax For a fast refund file electronically See back cover for details ksrevenue gov GENERAL INFORMATION If any due date falls on a Saturday Sunday or legal holiday substitute the next regular workday LINE INSTRUCTIONS FOR FORM K 41 PAGE 1 Heading Type or print your name and address in the spaces provided

https://www.taxformfinder.org/kansas/form-k-41

We last updated the Fiduciary Income Tax in January 2023 so this is the latest version of Form K 41 fully updated for tax year 2022 You can download or print current or past year PDFs of Form K 41 directly from TaxFormFinder

https://ksrevenue.gov/forms-fid.html

2022 Fiduciary Income Tax K 41 2022 Fiduciary Income Tax Voucher K 41V 2022 Fiduciary Income Tax instructions HTML 2022 Fiduciary Income Tax instructions PDF 2022 Fiduciary Estimated Voucher K 41ES 2022 Fiduciary Estimated Voucher K 41ES

Name please print Date of Birth MMDDYY Relationship Social Security Number 11 Kansas tax on lump sum distributions residents only see instructions 12 TOTALINCOMETAX residents add lines 8 11 nonresidents enter amount from line 10 41 KANSAS HOMETOWN HEROES FUND 42 KANSAS CREATIVE ARTS Pages 1 4 K 41 u0015u0013u0013u0016 KANSAS 140003 Rev 7 03 FIDUCIARY INCOME TAXDO NOT STAPLEFor the year January 1 to December 31 2003 or other taxable year beginning 20 ending 20 Name of Estate or Trust Name of Fiduciary Employer ID Number EIN Filing

ONE Filing Status Mark ONE Estate Resident Trust Nonresident See instructions Income Tax Computation Credits If this is an amended return mark an X in this box Date Established MONTH Federal taxable income Residents Federal Form 1041 Nonresidents Part III line 48 column D 2