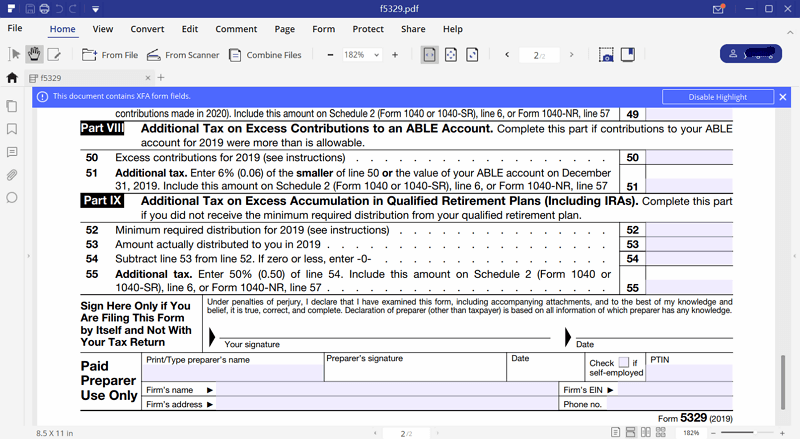

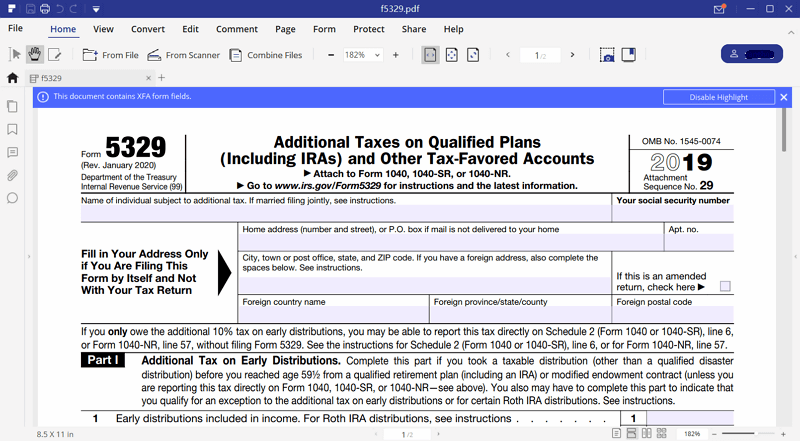

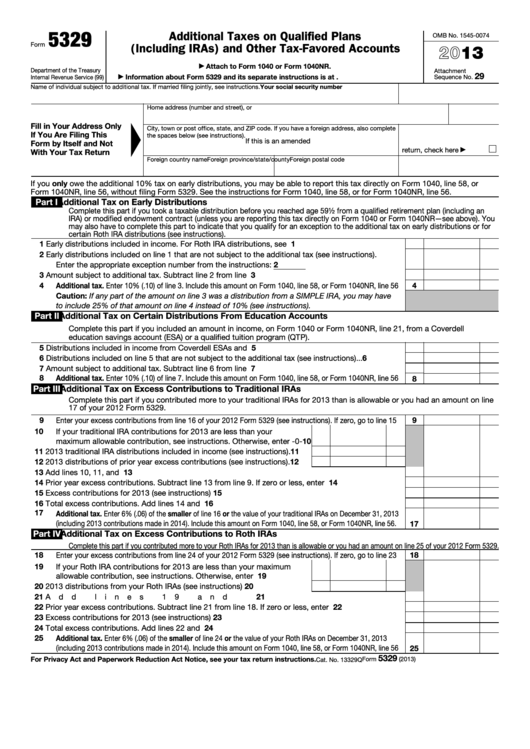

Printable Tax Form 5329 Form 5329 must be filed by taxpayers with retirement plans or education savings accounts who owe an early distribution or another penalty The form must be submitted with a taxpayer s annual

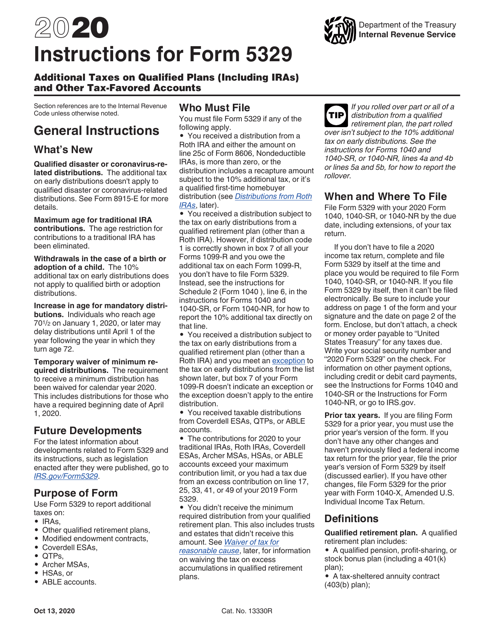

8 30 18 Feb 2021 The type and rule above prints on all proofs including departmental reproduction proofs MUST be removed before printing 2020 Instructions for Form 5329 Additional Taxes on Qualified Plans Including IRAs and Other Tax Favored Accounts Rev February 2021 Department of the Treasury Internal Revenue Service For the 2022 tax year which you ll file in 2023 the form must filed by the standard deadline of April 18 2023 If you don t file by the deadline the IRS applies a failure to file penalty of 5 of the unpaid taxes due for each month or part of a

Printable Tax Form 5329

Printable Tax Form 5329

Printable Tax Form 5329

https://www.pdffiller.com/preview/100/394/100394555/large.png

Fill Online Printable Fillable Blank Form 5329 Additional Taxes on Qualified Plans Including IRS Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable

Templates are pre-designed documents or files that can be used for different purposes. They can conserve effort and time by supplying a ready-made format and design for creating various sort of content. Templates can be utilized for individual or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Printable Tax Form 5329

How To Fill In IRS Form 5329

Form 5329 Fillable Printable Forms Free Online

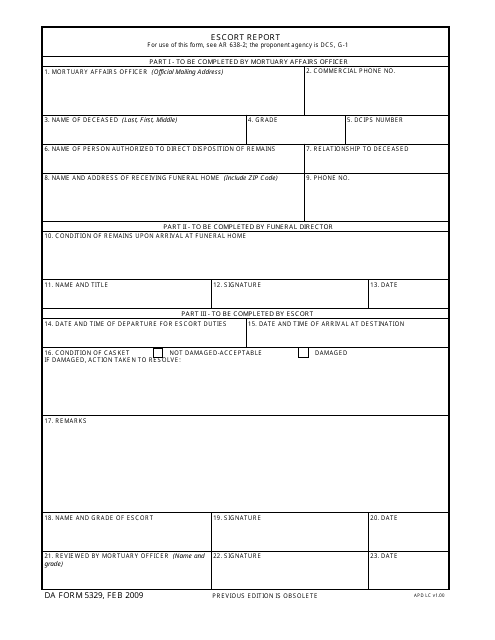

DA Form 5329 Download Fillable PDF Or Fill Online Escort Report

Instructions For How To Fill In IRS Form 5329

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at10.46.34AM-28b5a363d4434af7be07ebd3d2b1e6b0.png)

Form 5329 Additional Taxes On Qualified Plans Including IRAs And

What Is Tax Form 5329 Lively

https://www.irs.gov/pub/irs-prior/f5329--2021.pdf

5329 Department of the Treasury Internal Revenue Service 99 Additional Taxes on Qualified Plans Including IRAs and Other Tax Favored Accounts Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form5329 for instructions and the latest information OMB No 1545 0074 2021 Attachment Sequence No 29

https://www.irs.gov/pub/irs-pdf/i5329.pdf

File Form 5329 with your 2022 Form 1040 1040 SR or 1040 NR by the due date including extensions of your tax return If you don t have to file a 2022 income tax return complete and file Form 5329 by itself at the time and place you would be required to file Form 1040 1040 SR or 1040 NR

https://www.irs.gov/forms-pubs/about-form-5329

Form 5329 is used by any individual who has established a retirement account annuity or retirement bond Use Form 5329 to report additional taxes on IRAs other qualified retirement plans modified endowment contracts Coverdell ESAs QTPs Archer MSAs or

https://www.canada.ca/en/revenue-agency/services/forms-publications

Instructions for fillable slips Order forms and publications Paper copies of available forms and publications Technical tax information Technical publications related to the GST HST underused housing tax luxury tax income tax excise taxes and other levies excise duties and the fuel charge Order remittance vouchers and payment forms

https://turbotax.intuit.com/tax-tips/irs-tax-forms/what-is-form-5329

Form 5329 is the tax form used to calculate possibly IRS penalties from the situations listed above and possibly request a penalty waiver Form 5329 applies to each individual that might owe a penalty so for married couples filing jointly each spouse must complete their own form What is Form 5329 You may need this form in three situations

5329 form rating 4 8 Satisfied 54 votes How to fill out and sign irs form 5329 instructions online Get your online template and fill it in using progressive features Enjoy smart fillable fields and interactivity Follow the simple instructions below Quick steps to complete and e sign 5329 2016 tax online Use Get Form or simply click on the template preview to open it in the editor Start completing the fillable fields and carefully type in required information Use the Cross or Check marks in the top toolbar to select your answers in the list boxes

Quick steps to complete and e sign Example of completed form 5329 online Use Get Form or simply click on the template preview to open it in the editor