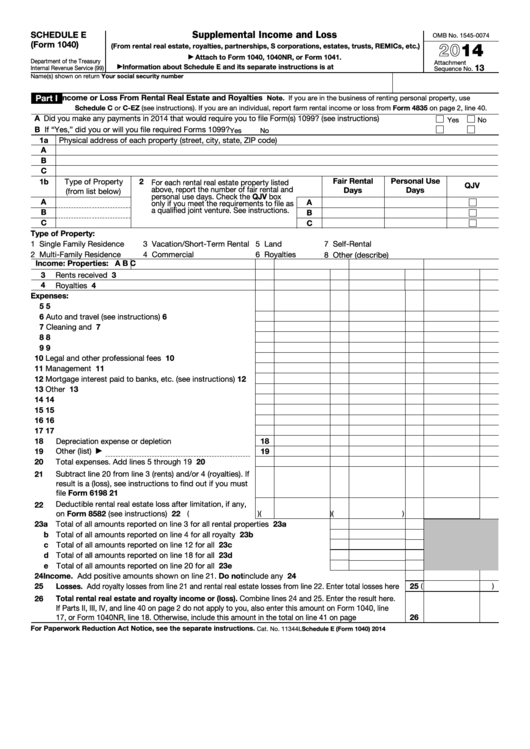

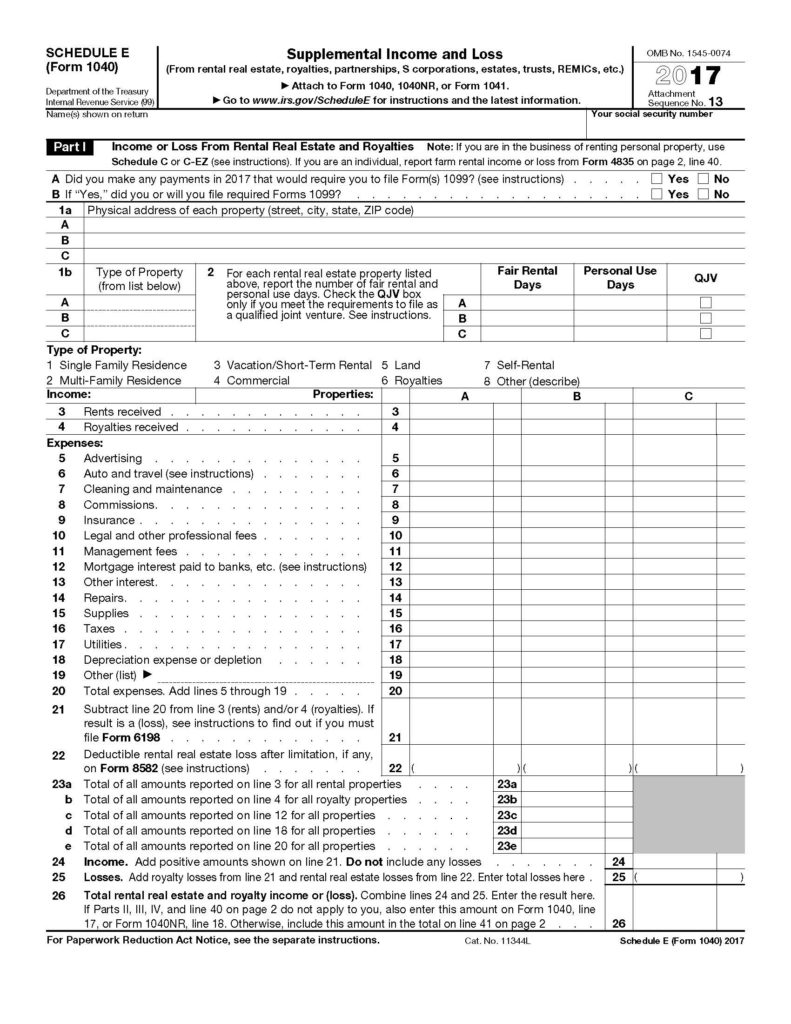

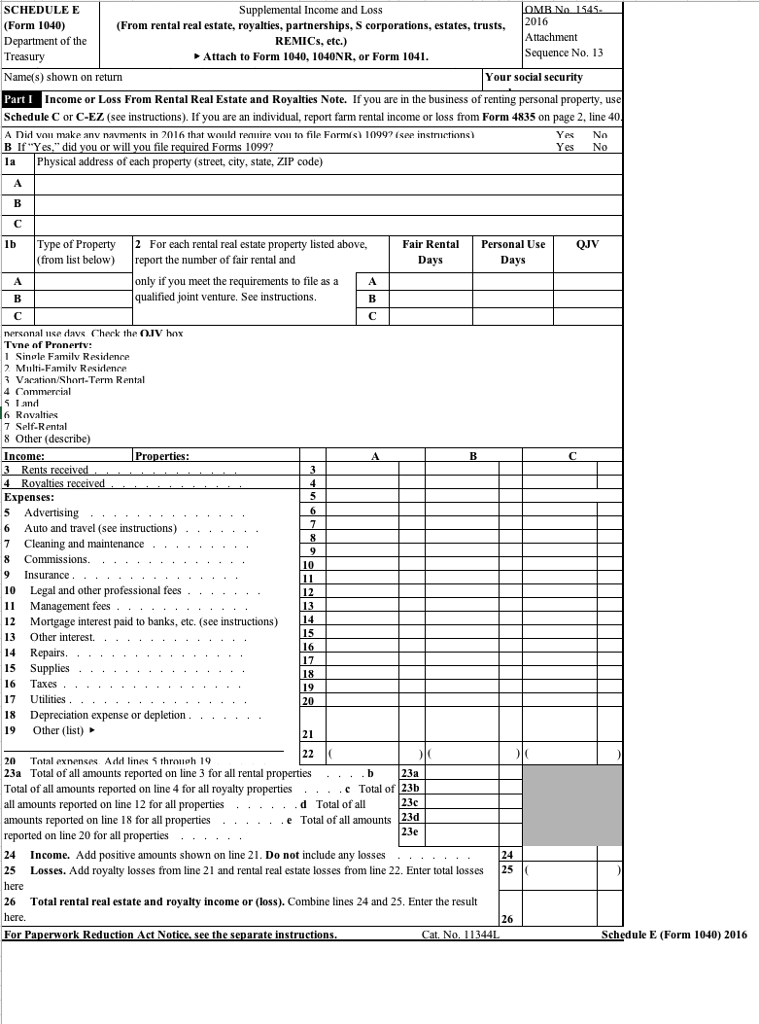

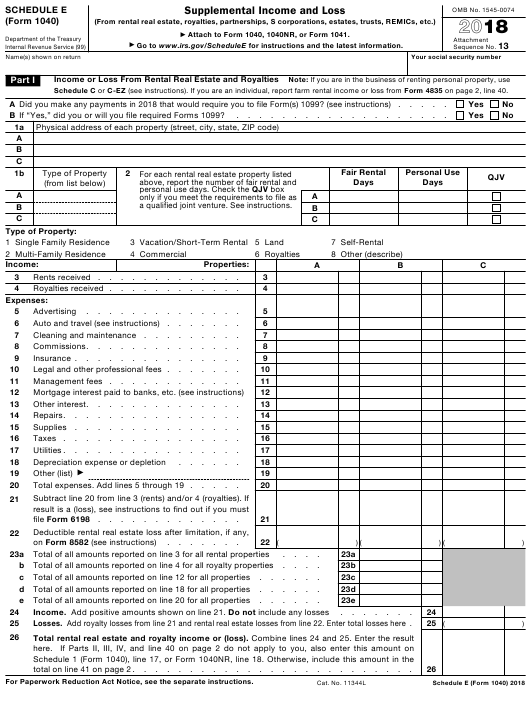

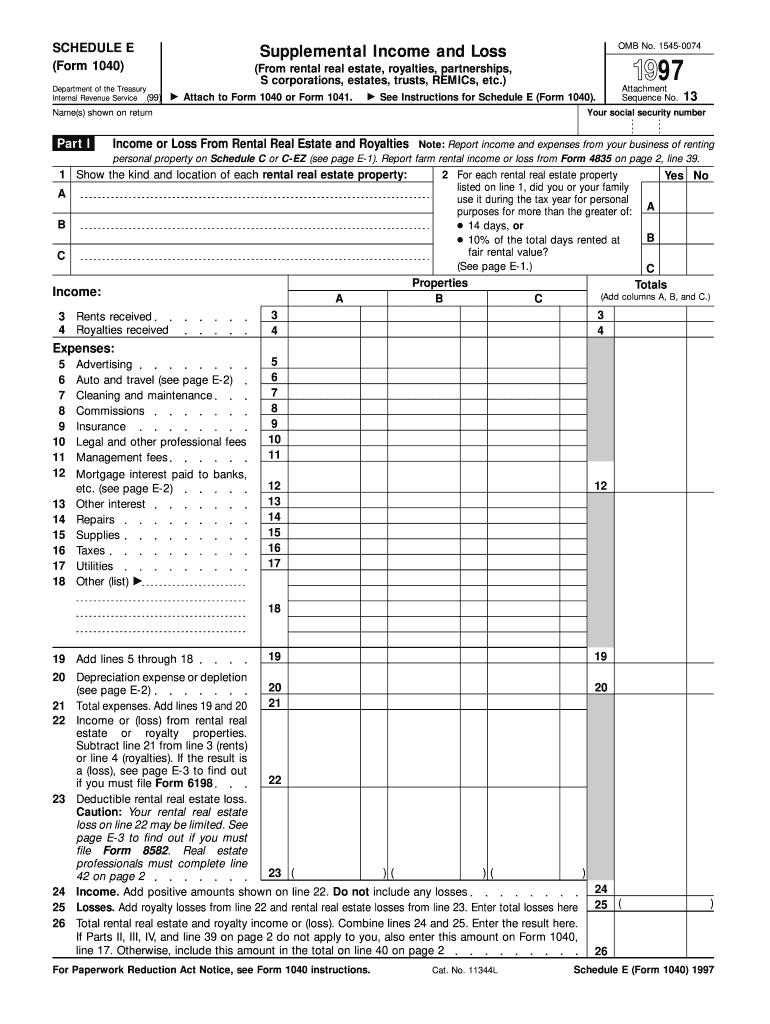

Printable Schedule E Tax Form For those who prefer to submit a hard copy rather than report their taxes electronically a printable tax form 1040 Schedule is preferable The form consists of two pages Enter your name and social security number in the top parts of both In Part I report any income or loss from rental real estate and royalties

Use Schedule E Form 1040 to report income or loss from rental real estate royalties partnerships S corporations estates trusts and residual interests in REMICs You can attach your own schedule s to report income or loss from any of these sources Use the same format as on Schedule E Printable Schedule E Tax Form Among the most significant advantages of using free printable templates such as Printable Schedule E Tax Form is that they eliminate the need for developing a document from scratch Rather you can pick from a large range of pre designed templates that have already been formatted and styled to look excellent

Printable Schedule E Tax Form

Printable Schedule E Tax Form

Printable Schedule E Tax Form

https://1044form.com/wp-content/uploads/2020/08/fillable-schedule-e-form-1040-supplemental-income-and-6.png

Access IRS forms instructions and publications in electronic and print media

Templates are pre-designed files or files that can be used for various functions. They can save time and effort by supplying a ready-made format and design for creating various kinds of content. Templates can be used for individual or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Printable Schedule E Tax Form

Tikloable Blog

Printable Irs Form Schedule E Form 1040 Printable Forms Free Online

What Is E Form

Irs Fillable Form 1040 Blank Tax Forms Printable Example Calendar

Irs Printable Form Schedule E Printable Forms Free Online

Form 2290 Printable Printable World Holiday

https://www.irs.gov/pub/irs-pdf/f1040se.pdf

Supplemental Income and Loss From rental real estate royalties partnerships S corporations estates trusts REMICs etc Attach to Form 1040 1040 SR 1040 NR or 1041 Go to www irs gov ScheduleE for instructions and the latest information OMB No 1545 0074 SCHEDULE E Form 1040

https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax

Free tax help for small business owners and self employed individuals If you own a small business or are self employed the CRA offers free liaison officer services by phone or videoconference Liaison officers can make it easier to file by helping you understand your tax obligations answering your questions and making sure you are

https://www.canada.ca/en/revenue-agency/services/forms-publications

View and download forms All Canada Revenue Agency forms listed by number and title

https://www.canada.ca/en/revenue-agency/services/forms-publications/ta…

You can get an income tax package guide return forms and schedules online or by mail Certain tax situations may require a specific return or form For tax filing information go to Get ready to do your taxes On this page Get a 2022 income tax package Get a previous year s income tax package Tax situations requiring a specific return or form

https://www.canada.ca/en/revenue-agency/services/forms-publications/

Printing PDF forms Before you print set the page size in the Adobe Reader print properties to legal or letter based on the size of the document Need a signature If a signature is required completed forms must be printed and signed by hand If you experience problems printing a PDF

Quick steps to complete and e sign Schedule e tax form online Use Get Form or simply click on the template preview to open it in the editor Start completing the fillable fields and carefully type in required information Fillable Schedule E Form 1040 Supplemental Income And Loss 2014 Printable Pdf Download There are many websites that offer free printable templates and the types of templates available are virtually endless

1040SR Free printable 2022 Schedule E form and 2022 Schedule E instructions booklet sourced from the IRS Download and print the PDF file Then calculate your Supplemental Income and Loss and attach to Form 1040