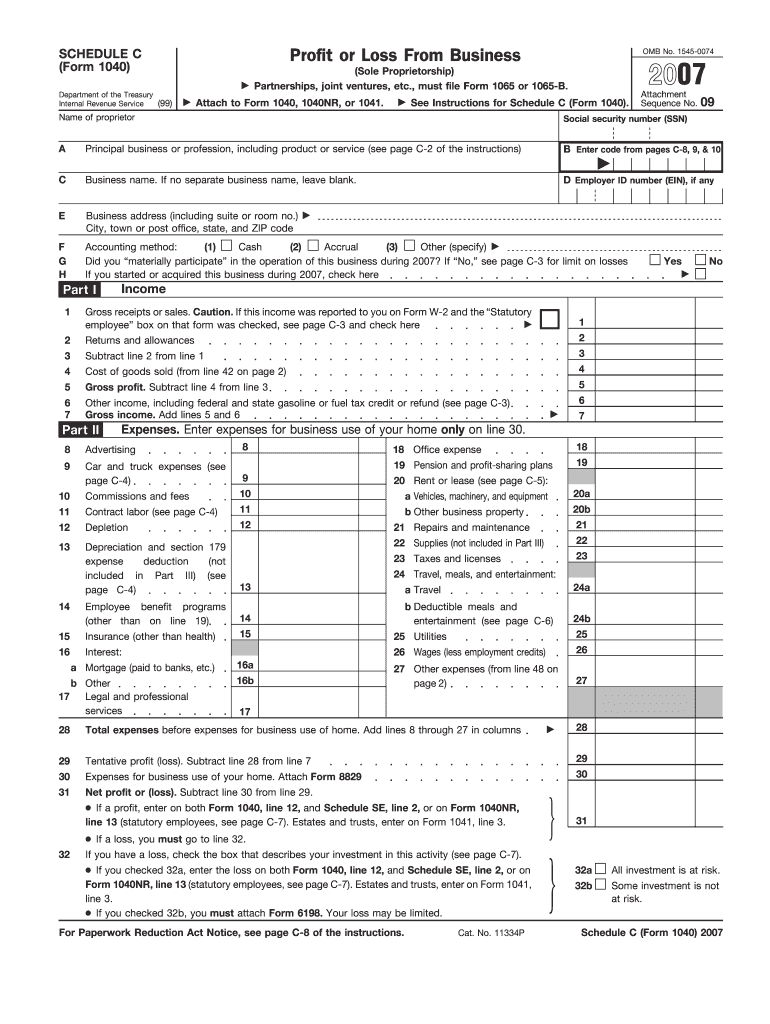

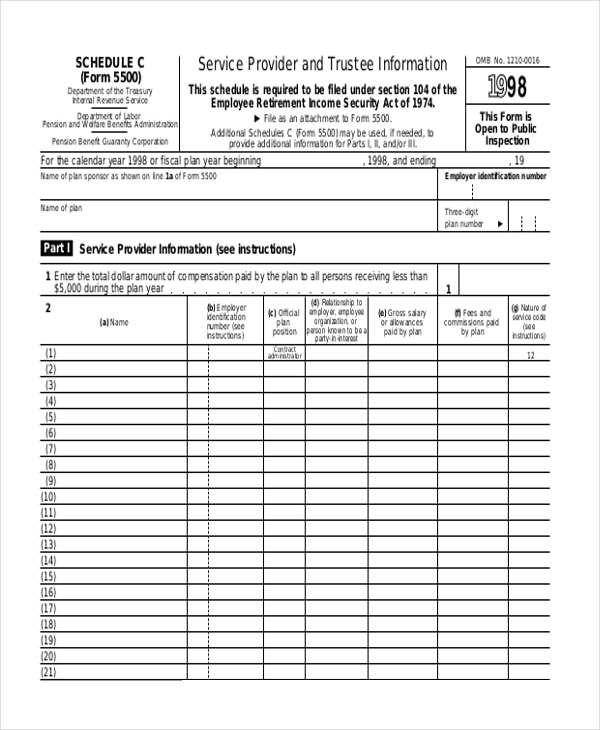

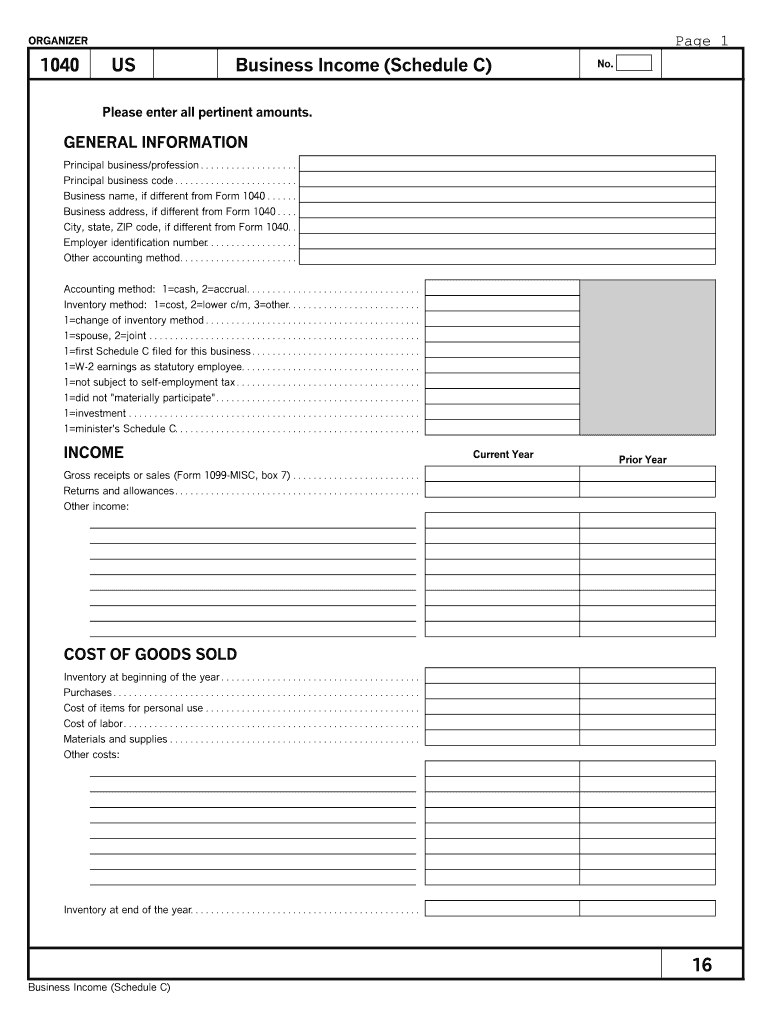

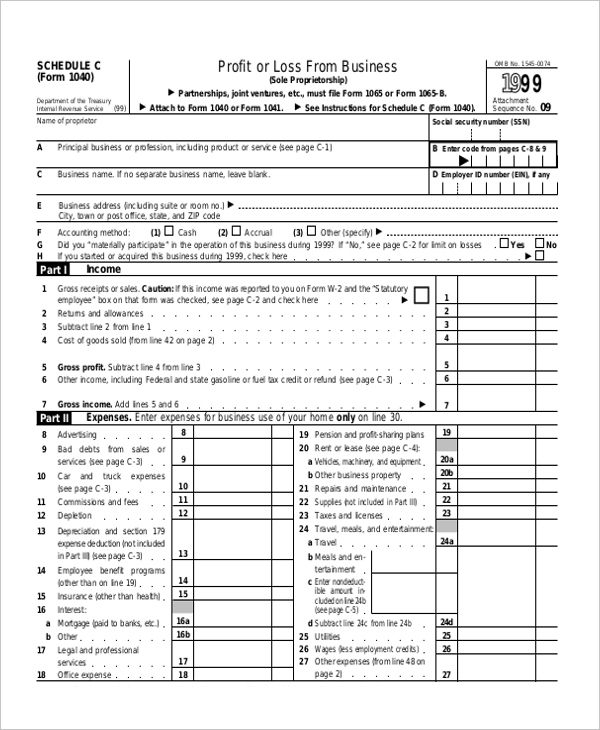

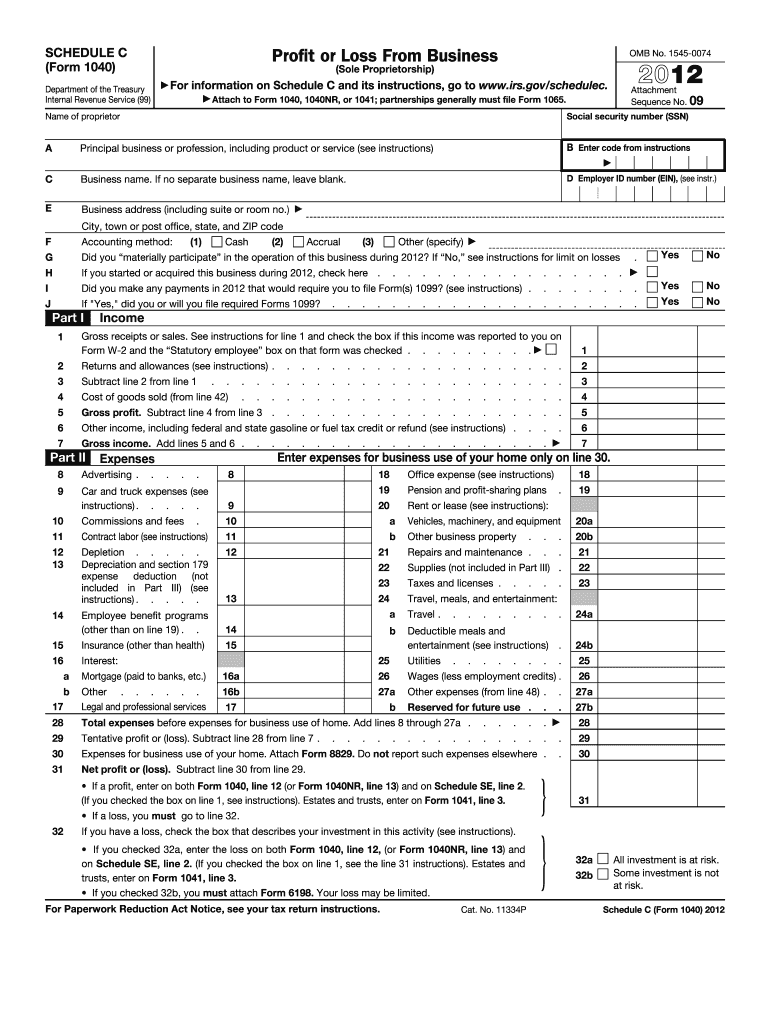

Printable Schedule C Tax Form 2021 Instructions for Schedule CProfit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor

Page Last Reviewed or Updated 02 Jun 2023 Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file Instructions 2022 Instructions for Schedule C 2022 Profit or Loss From Business Introduction Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor

Printable Schedule C Tax Form

Printable Schedule C Tax Form

Printable Schedule C Tax Form

https://www.pdffiller.com/preview/100/639/100639784/large.png

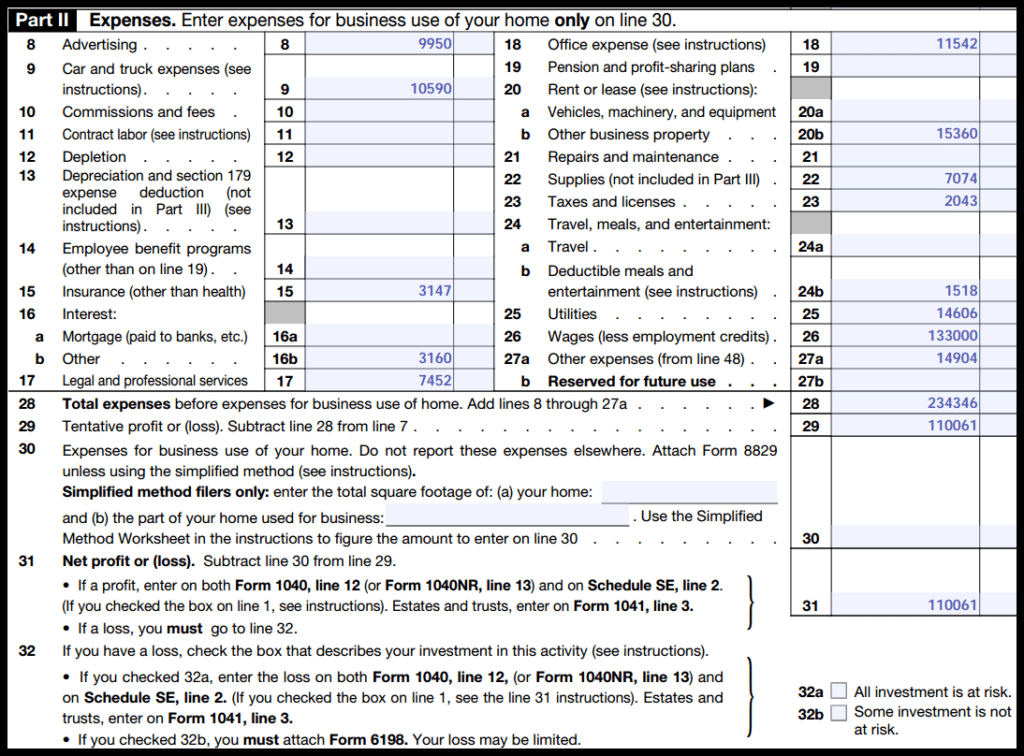

Key Takeaways Schedule C is for business owners to report their income for tax purposes Complete the form adding information and doing the calculations as you go This process will give you a net income or loss amount for your business Add this amount to your personal Form 1040 tax return along with other income you received

Pre-crafted templates use a time-saving option for creating a diverse series of files and files. These pre-designed formats and layouts can be made use of for various personal and professional projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the material creation process.

Printable Schedule C Tax Form

Schedule C Tax Form Schedule Form Blank Pdf Sample Nd Ward Forms

Schedule C Tax Form Fill Out And Sign Printable PDF Template SignNow

FREE 8 Sample Schedule C Forms PDF 1040 Form Printable

Schedule C Expenses Worksheet Fill Online Printable Fillable Blank

IRS 1040 Schedule C 2012 Fill And Sign Printable Template Online

IRS Schedule C Instructions Step by Step Including C EZ

https://www.irs.gov/pub/irs-pdf/f1040sc.pdf

SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Go to www irs gov ScheduleC for instructions and the latest information Attach to Form 1040 1040 SR 1040 NR or 1041 partnerships must generally file Form 1065 OMB No 1545 0074

https://www.canada.ca/en/revenue-agency/services/forms-publications/ta…

You can get an income tax package guide return forms and schedules online or by mail Certain tax situations may require a specific return or form For tax filing information go to Get ready to do your taxes

https://www.canada.ca/en/revenue-agency/services/forms-publications/fo…

Federal Worksheet for all except non residents 2023 01 24 Report a problem on this page Date modified 2023 10 19 This site provides a list of Canada Revenue Agency CRA tax forms listed by form number

https://www.canada.ca/en/revenue-agency/services/forms-publications/

General information The Canada Revenue Agency CRA produces forms and publications in Portable Document Format PDF which are fillable and savable for your convenience Filling and saving PDF forms To be able to fill in and save a PDF form download and then open the form using the free Adobe Reader

https://turbotax.intuit.ca/tax-resources/tax-forms.jsp

2022 Canadian Income Tax Return Forms from TurboTax There s no need to get copies of Canada Revenue Agency forms anymore when you file with TurboTax download Choose your TurboTax If you re used to the traditional format it s really easy to switch to the familiar paper based CRA income tax forms for 2022 using our TurboTax download software

Create My Document A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form it is used to provide information about both the profit and the loss sustained in IRS Schedule C is a tax form for reporting profit or loss from a business You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule

Sole proprietorships and single member LLCs file Schedule C to report business net profit or loss Follow these 9 steps to filling out and filing Schedule C If you ve ever downloaded a tax form