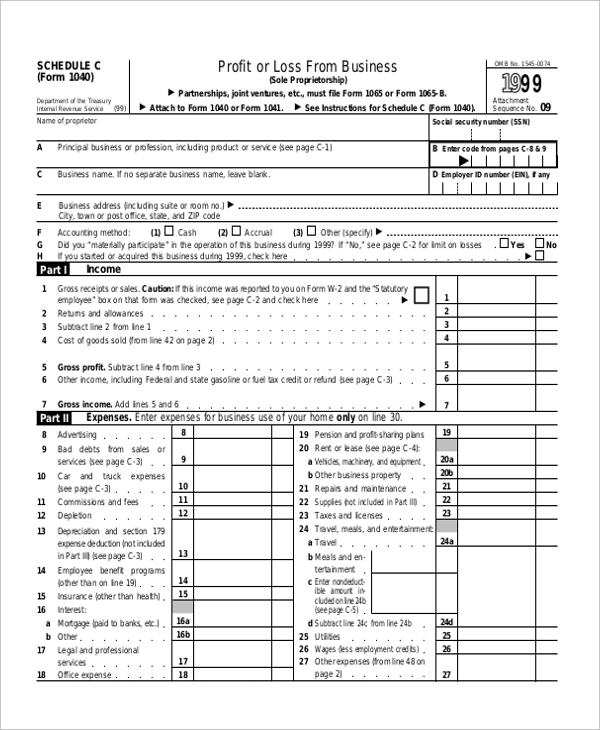

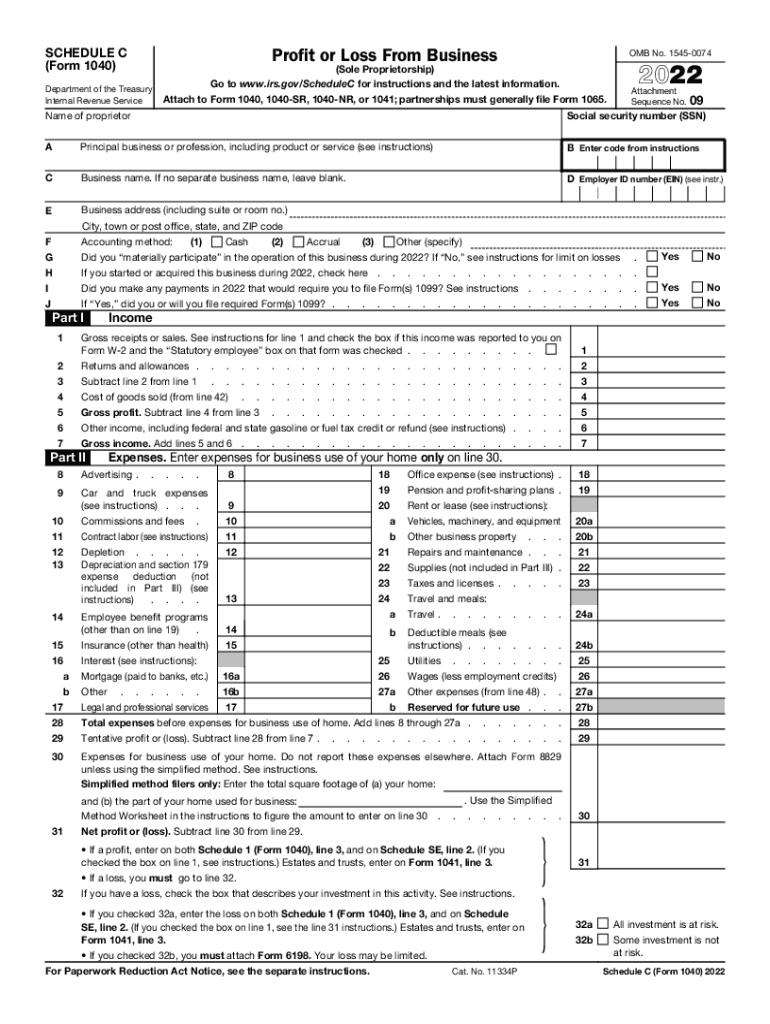

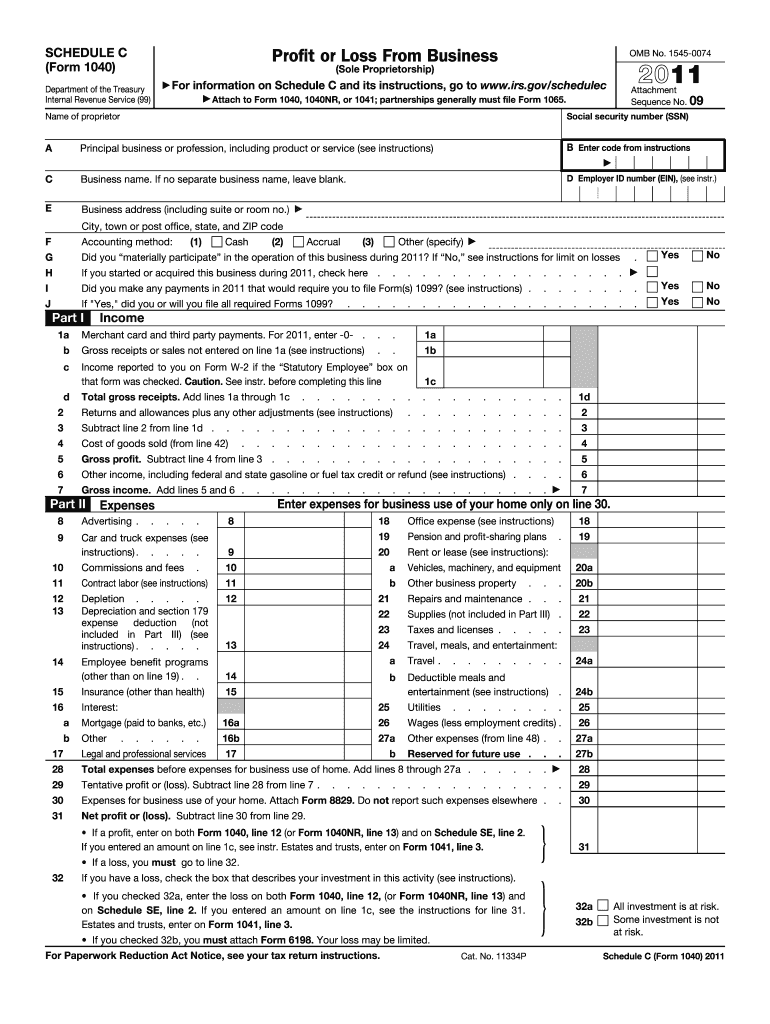

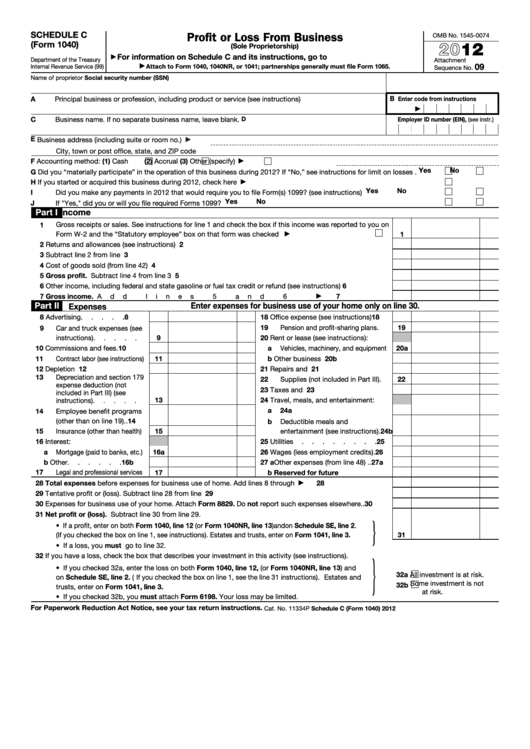

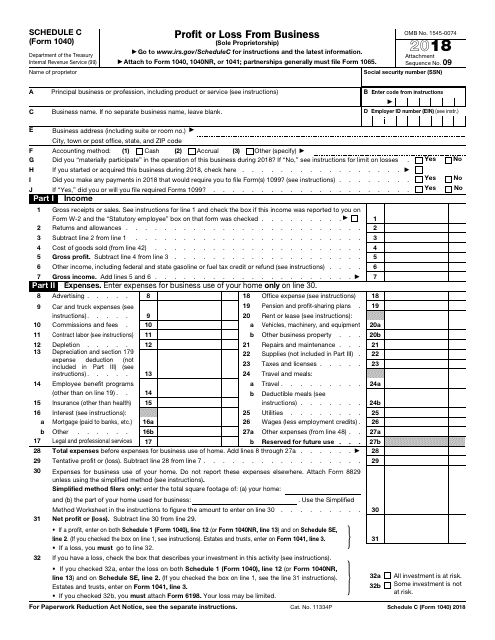

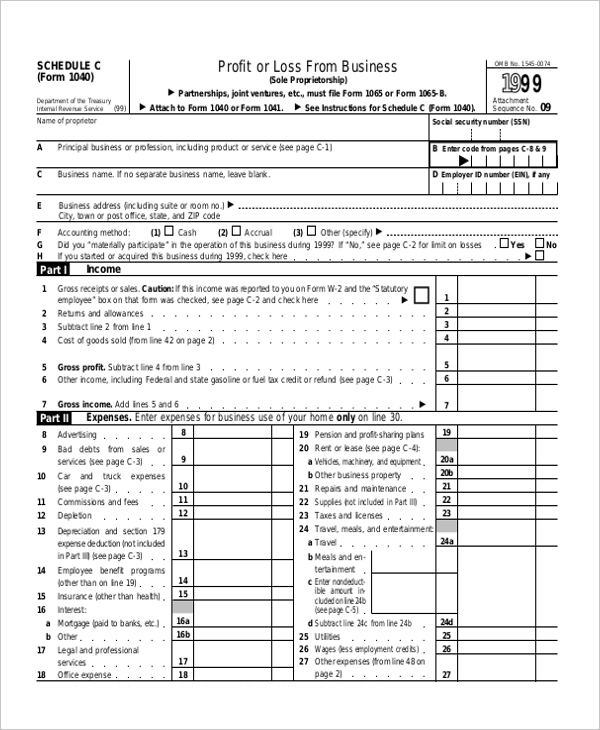

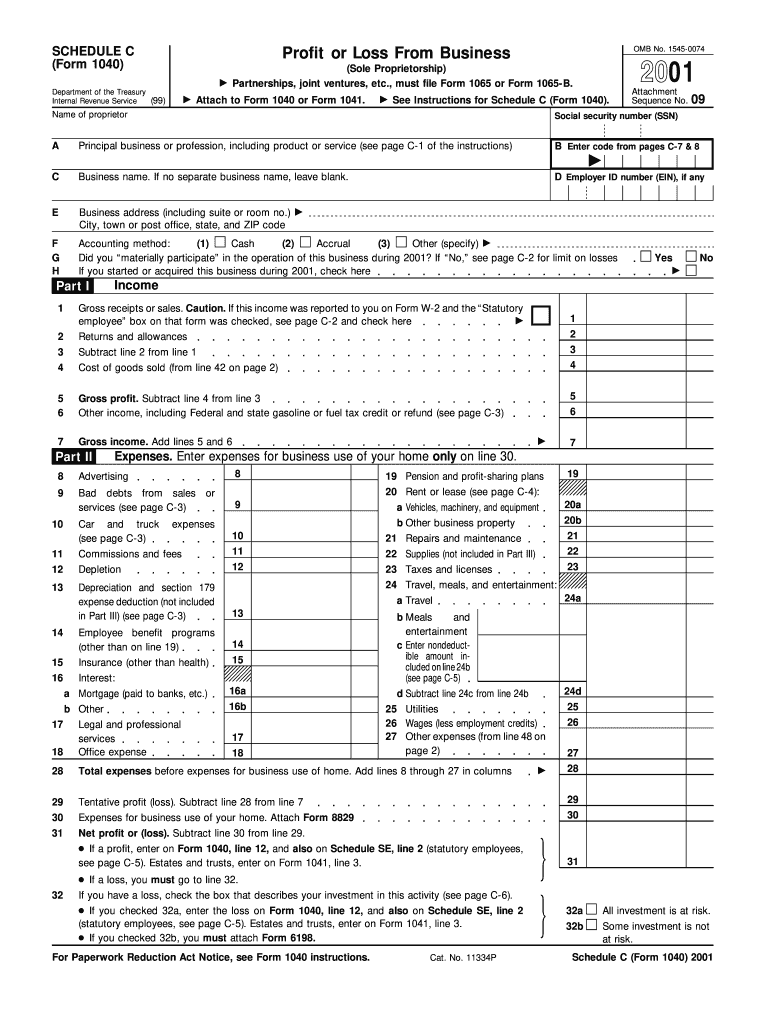

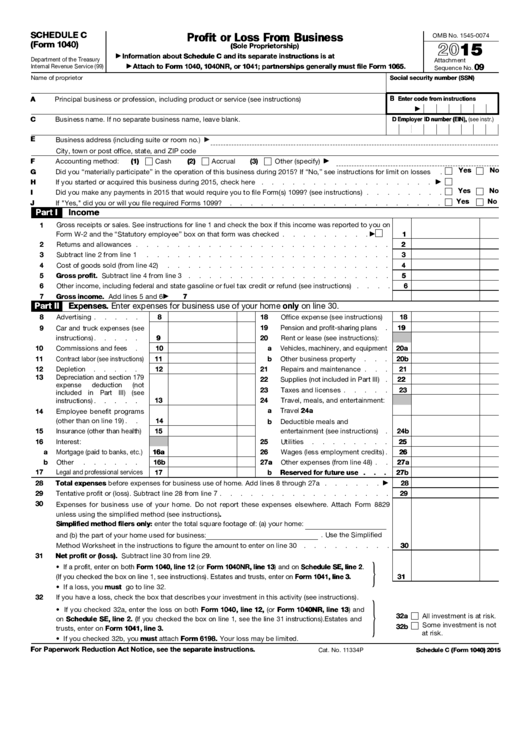

Printable Schedule C Form 1040 A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor Known as a Profit or Loss From Business form it is used to provide information about both the profit and the loss sustained in business by the sole proprietor

Printable Form 1040 Schedule C Click any of the IRS Schedule C form links below to download save view and print the file for the corresponding year These free PDF files are unaltered and are sourced directly from the publisher The Schedule C form is generally published in October of each year by the IRS Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity

Printable Schedule C Form 1040

Printable Schedule C Form 1040

Printable Schedule C Form 1040

https://1044form.com/wp-content/uploads/2020/08/free-8-sample-schedule-c-forms-pdf-9.jpg

Fill Online Printable Fillable Blank 2019 Schedule C Form 1040 Or 1040 SR Form Use Fill to complete blank online OTHERS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable

Templates are pre-designed documents or files that can be utilized for different purposes. They can save effort and time by supplying a ready-made format and design for creating different type of material. Templates can be utilized for personal or expert projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Printable Schedule C Form 1040

Schedule C Form 1040 Free Fillable Form PDF Sample FormSwift Fill

A Sole Proprietor Reports The Sole Proprietorship Income And or Losses

Schedule C Form Fill Out And Sign Printable PDF Template SignNow

Schedule C Form 1040 How To Complete It The Usual Stuff

Fillable Schedule C Form 1040 Profit Or Loss From Business 2012

Printable Schedule C TUTORE ORG Master Of Documents

https://www.irs.gov/forms-pubs/about-schedule-c-form-1040

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor includes recent updates related forms and instructions on how to file

https://www.irs.gov/instructions/i1040sc

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity

https://1040-schedule1.com

File IRS Form 1040 Schedule 1 for 2022 Get IRS Form 1040 Schedule 1 to file in 2023 Print blank Schedule 1 Form 1040 or fill in file it online for free Line by line instructions to report adjustments to income error free Become tax forms pro with our guidelines

https://www.uslegalforms.com//tax/469368-irs-1040-schedule-c-2020

Editable IRS 1040 Schedule C 2020 2023 Download blank or fill out online in PDF format Complete sign print and send your tax documents easily with US Legal Forms

https://www.irs.gov/form

Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return

Download and print Once you ve found Form 1040 Schedule C click on it to open the PDF file Review the form to ensure it s the correct version for the current tax year After verifying you can download and save it to your computer Download a blank fillable Schedule C Irs Form 1040 in PDF format just by clicking the DOWNLOAD PDF button Open the file in any PDF viewing software Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content

You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040 Schedule C is typically for people who operate sole proprietorships or single member LLCs A Schedule