Printable Sales Tax Exempt Form Georgia Georgia Tax Center Help Tax FAQs Due Dates and Other Resources Sales and Use Tax Assessment Related Certificates of Exemption Contractors Miscellaneous Refunds Returns Tax Credits Withholding Forms Complete save and print the form online using your browser 500 NOL Application for Net Operating Loss Adjustment for

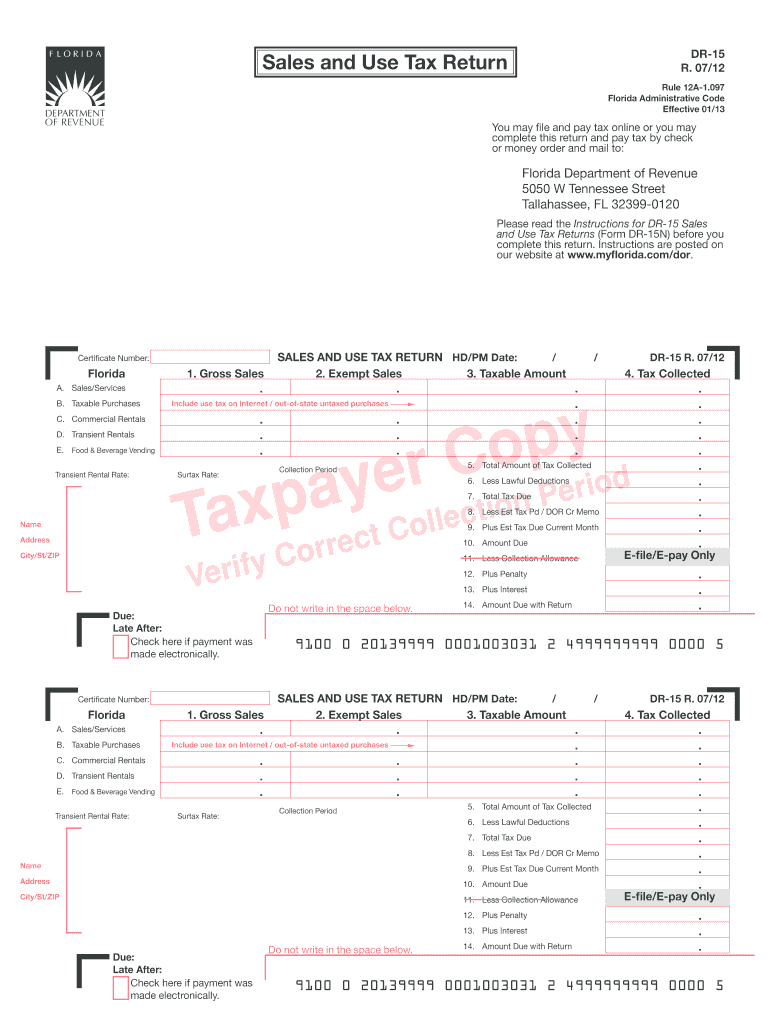

Print Blank Tax Forms These forms are available to complete online You can complete save and print the form online using your browser Or print a blank form to complete by hand If you would like to complete the forms by hand find Part A Tax Summary Record total state sales all sales sourced to the State of Georgia including leases and rentals Record total exempt state sales including leases and rentals Include all sales that are exempt from state sales tax even if such sales are subject to local sales tax

Printable Sales Tax Exempt Form Georgia

Printable Sales Tax Exempt Form Georgia

Printable Sales Tax Exempt Form Georgia

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-5-sales-and-use-tax-certificate-of-exemption-georgia-10.png

Georgia Tax Exempt Certificate Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor Get everything done in minutes

Templates are pre-designed files or files that can be used for different purposes. They can save time and effort by offering a ready-made format and design for developing various sort of content. Templates can be utilized for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Printable Sales Tax Exempt Form Georgia

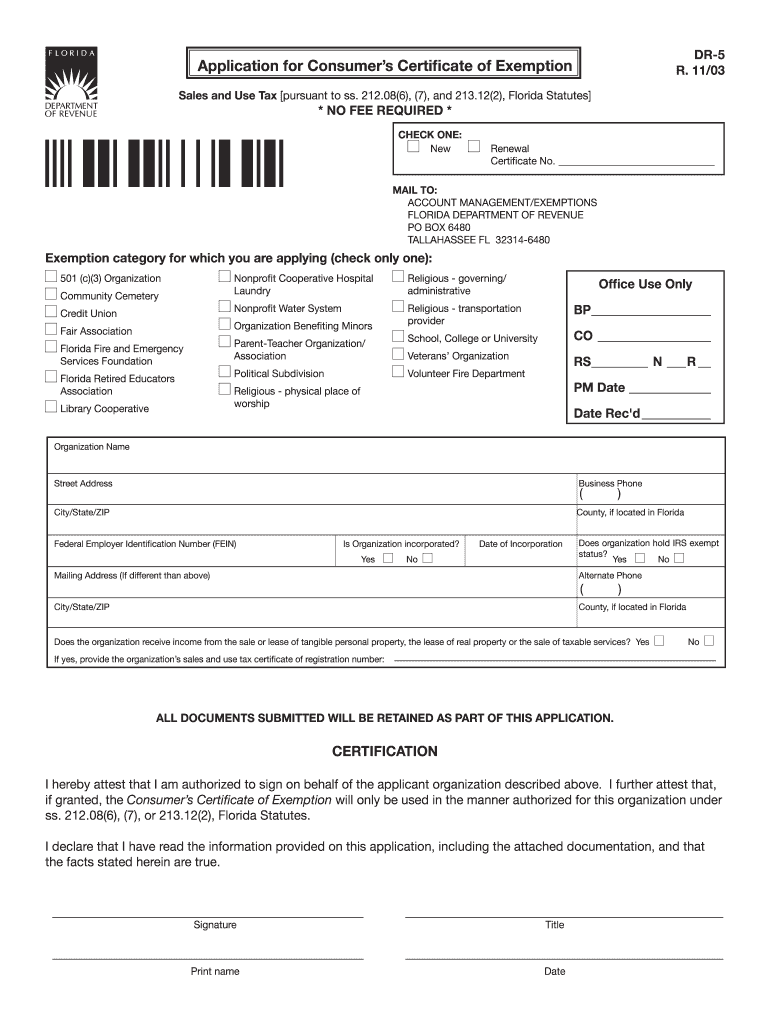

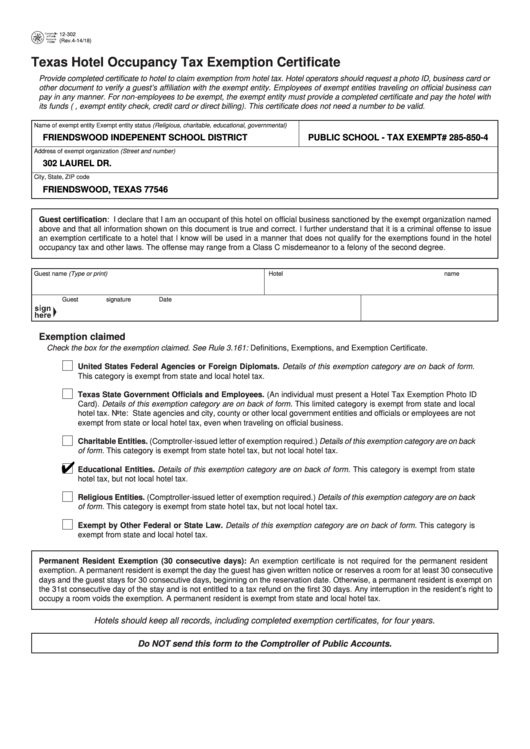

Hotel Tax Exempt Form

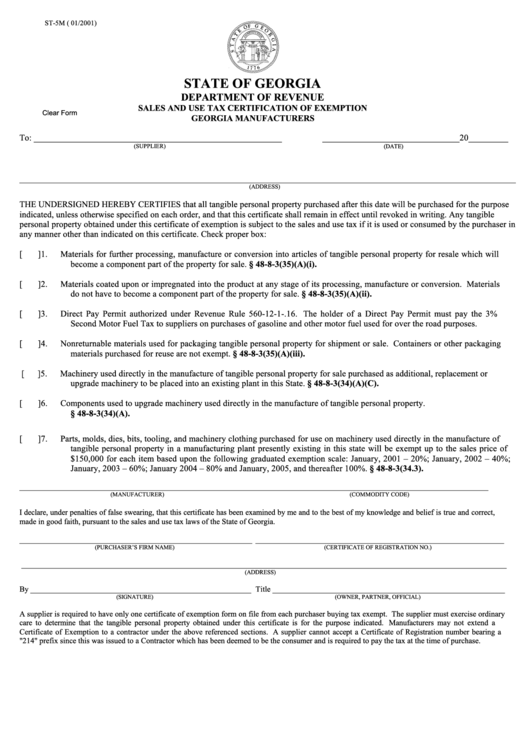

Fillable Form St 5m Sales And Use Tax Certification Of Exemption

Agriculture Tax Exempt Form Florida ExemptForm

Florida State Sales Tax Exemption Form Example ExemptForm

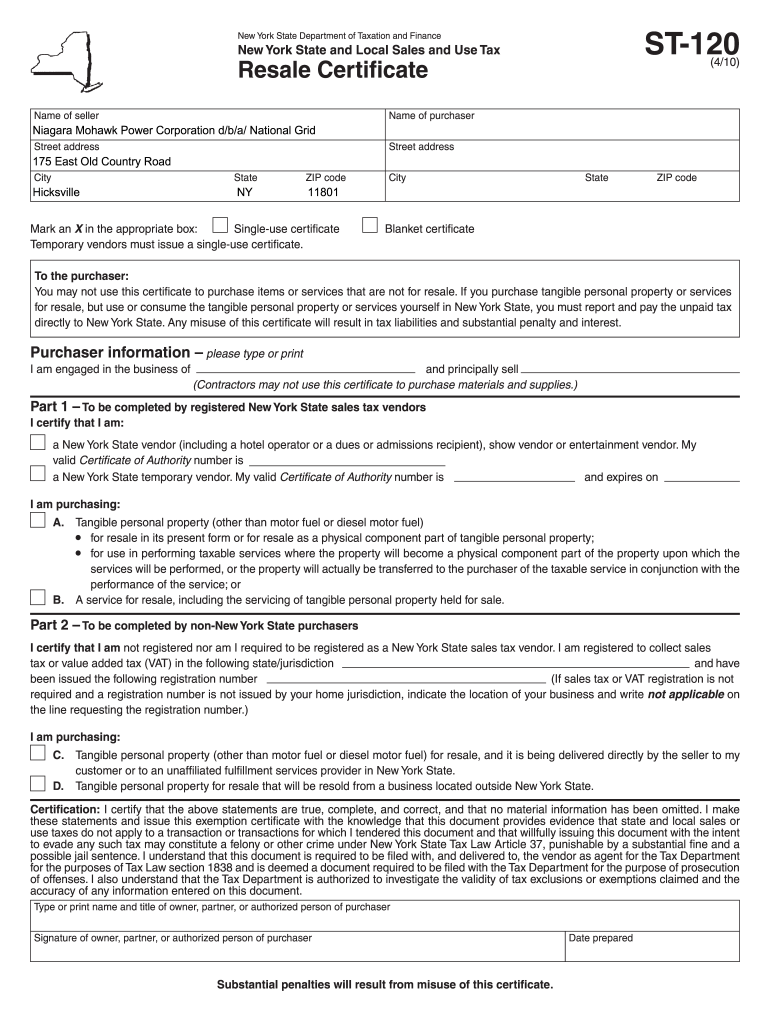

Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller

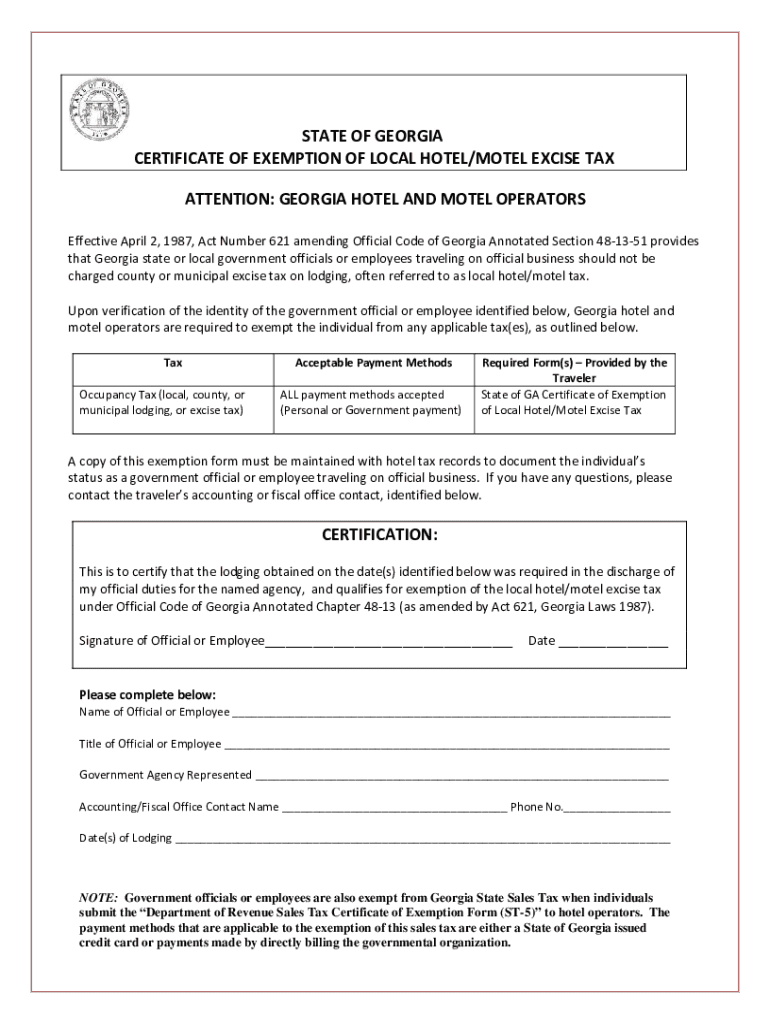

2013 Form GA Certificate Of Exemption Of Local Hotel Motel Excise Tax

https://dor.georgia.gov/document/form/formst-4pdf/download

Form ST 4 is a sales tax certificate of exemption for non resident purchasers or lessees of tangible personal property in Georgia It allows them to avoid paying sales tax if they remove the property from the state immediately after purchase or lease Learn more about the eligibility and requirements of this form here

https://www.southeastag.com/pdf/Georgia.pdf

A Georgia Sales and Use tax number is not required for this exemption O C G A 48 8 3 15 39 41 56 59 71 4 Materials used forpackaging tangible personal property shipment or sale Such materials must be solely packaging and must not be purchased for reuse by the shipper or seller A Georgia Sales and Use tax number is not

https://www.salestaxhandbook.com/georgia/sales-tax-exemption-certifi…

We have six Georgia sales tax exemption forms available for you to print or save as a PDF file If any of these links are broken or you can t find the form you need please let us know You can find resale certificates for other states here Agricultural Certificate of Sales Tax Exemption Download Now

https://dor.georgia.gov/document/document/2020-list-sales-an…

The exemption begins July 1 2023 and ends the earlier of i midnight of December 31 2026 or ii the time at which the aggregate state and local sales tax refunded pursuant to O C G A 48 8 3 87 exceeds 800 000 The exemption is administered by refund only

https://startingyourbusiness.com/georgia-sales-tax-certificate-of

A Georgia Sales Tax Exemption Certificate is a document that allows a business to purchase goods and services tax free from suppliers for the purpose of reselling those goods and services The certificate is also sometimes referred to as a seller s permit resale permit or a reseller permit

Georgia Department of Revenue Sales Tax Exempt Fillable Form Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor Get everything done in minutes Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases 1 New signed into law May 2018 Co located data centers and single user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which

Ga Sales Tax Exemption Form Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor Get everything done in minutes