Printable List Business Expenses Taxes Business expenses A business expense is a cost you incur for the sole purpose of earning business income You have to support business expense claims with a sales invoice an agreement of purchase and sale a receipt or some other voucher that supports the expenditure If you pay cash for any business expenses be sure to get

1 Using an app or software With business expense tracking software like QuickBooks you can build a habit of taking a photo of your receipt from your phone the moment you buy something and uploading it directly into an accounting software program When you make expense tracking something you do without thinking like brewing T4002 Self employed Business Professional Commission Farming and Fishing Income Canada ca The T4002 contains information for self employed business persons commission sales persons and for professionals on how to calculate the income to report on your income tax return

Printable List Business Expenses Taxes

Printable List Business Expenses Taxes

Printable List Business Expenses Taxes

https://www.housview.com/wp-content/uploads/2018/08/business_expense_template_for_taxes_spreadsheet_small_sheet_home_8.jpg

Operating Expenses When you own a small business you can deduct your operating expenses from your income including but not limited to advertising startup costs delivery expenses maintenance and repairs

Templates are pre-designed files or files that can be used for numerous purposes. They can save time and effort by supplying a ready-made format and layout for creating different type of content. Templates can be utilized for personal or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Printable List Business Expenses Taxes

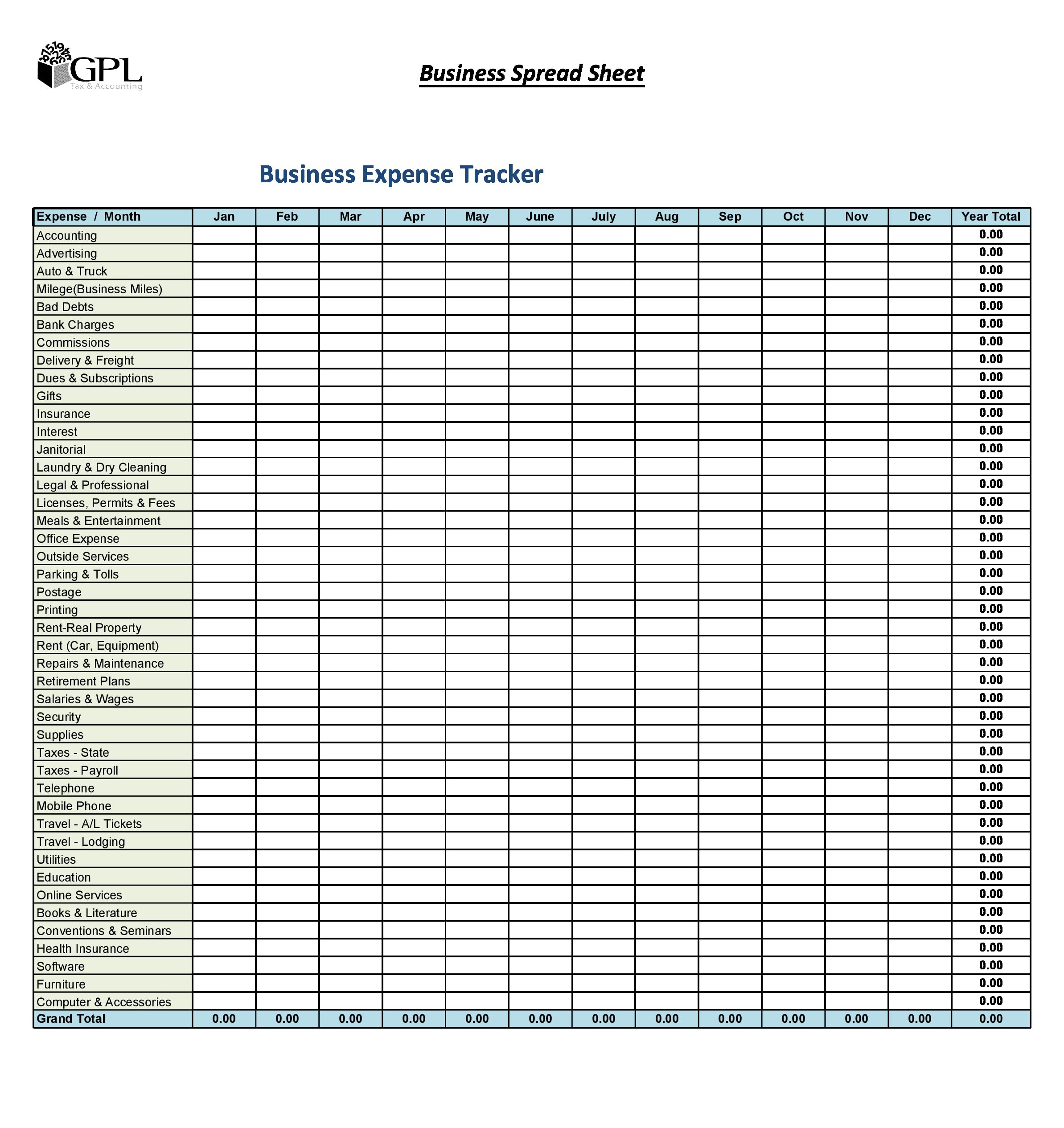

30 Best Business Expense Spreadsheets 100 Free TemplateArchive

Business Expenses Template For Taxes Excelxo

Business Expenses Template Spreadsheet Templates For Business Expense

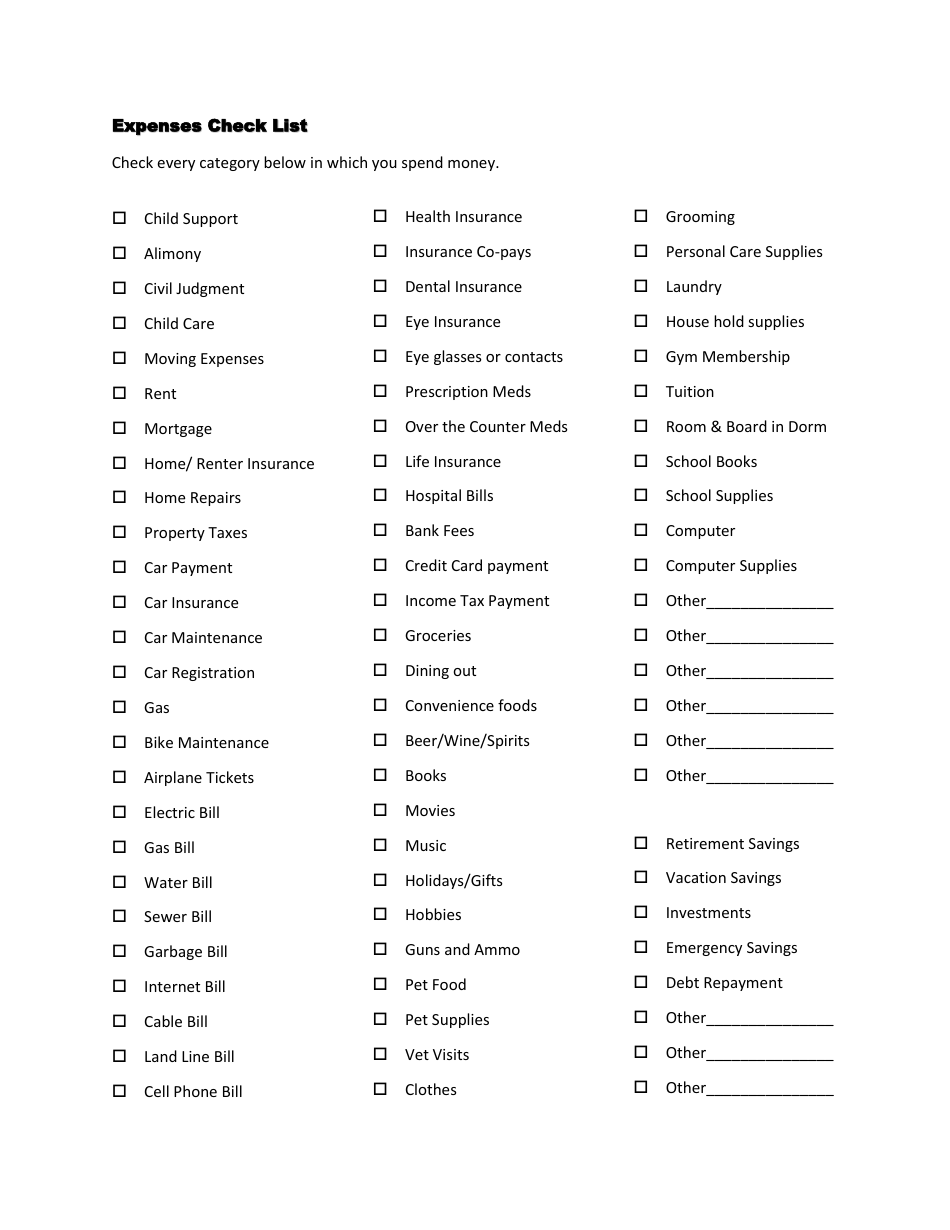

Expenses Check List Template Download Printable PDF Templateroller

Business Expense And Income Spreadsheet DocTemplates

Business Expenses What You Can And Can t Claim The Independent Girls

https://turbotax.intuit.ca/tips/the-big-list-of-small-business-tax

Key Takeaways Make sure to keep track of and claim every business expense even the small ones Every receipt adds up and together they may even knock you into a lower tax bracket Claim as many business expenses as you can to reduce the amount of taxes you have to pay for the year

https://fbc.ca/blog/small-business-tax-preparation-checklists

Download a printable checklist for your 2022 tax return here Tax preparation documents for business owners Here are the documents you ll need to file your tax return if you re self employed or a small business owner along with a list of business deductions you can use to lower your tax bill What Documents Do You Need to File Your Tax

https://www.bdc.ca//manage-finances/tax-deductible-expenses

What can I deduct for my business taxes Generally all businesses can deduct from their income expenses that are incurred not only to make the business operational but also to maintain that business once it is up and running The CRA has a list of the common business expenses that you can deduct

https://www.canada.ca/en/revenue-agency/services/tax/businesses/small

A business expense is a cost you incur for the sole purpose of earning business income You have to support business expense claims with a sales invoice an agreement of purchase and sale a receipt or some other voucher that supports the expenditure If you pay cash for any business expenses be sure to get receipts or other vouchers

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topic…

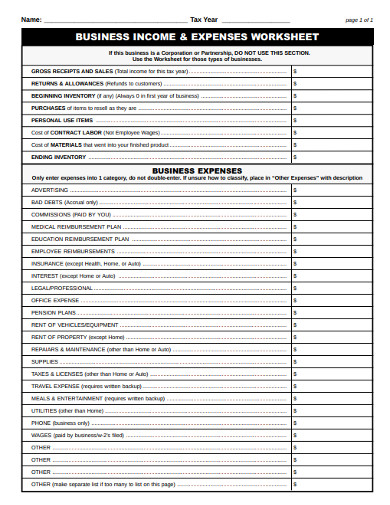

This is a list of deductible expenses under Part 4 of form T2125 Line 8521 Advertising Line 8523 Meals and entertainment Line 8590 Bad debts Line 8690 Insurance Line 8710 Interest and bank charges Line 8760 Business taxes licences and memberships Line 8810 Office expenses

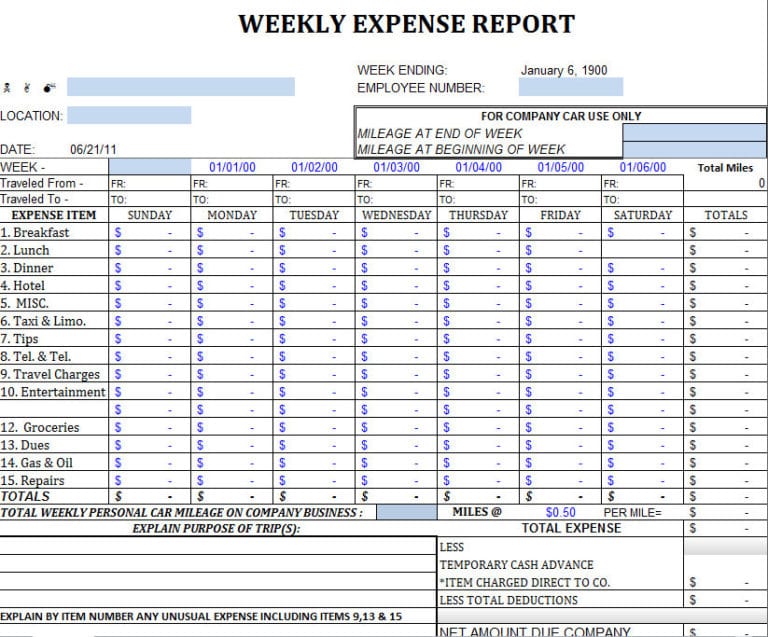

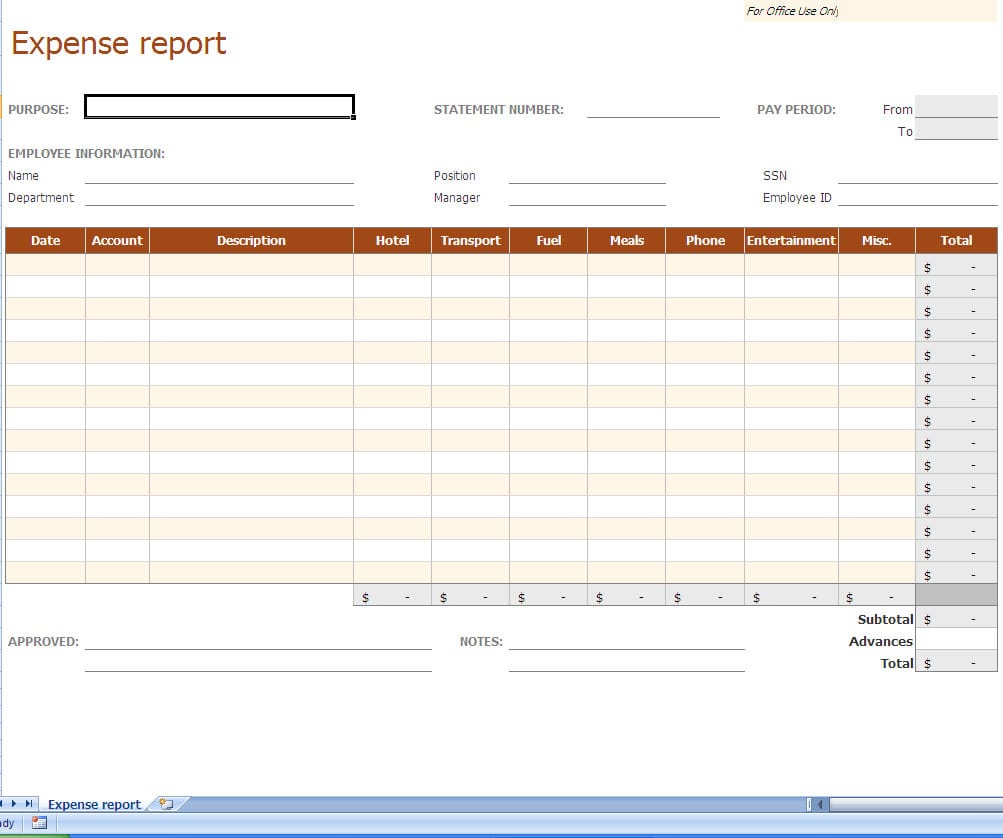

There are also a number of provincial or territorial tax credits available for Canadian based operations To claim back a part of these advertising costs look to line 8521 on form T2125 where it says Advertising fill in the amount on the right hand side and add it to the total expenses at the bottom of the list This printable small business expense report template offers an easy way to track company expenses Use the existing category names or enter your own column headings to best track business expenses Use this spreadsheet to track payments itemize expenses and more

Small business tax deductions will help you save money for your business Refer to our complete list of tax deductions to find ways to save more money