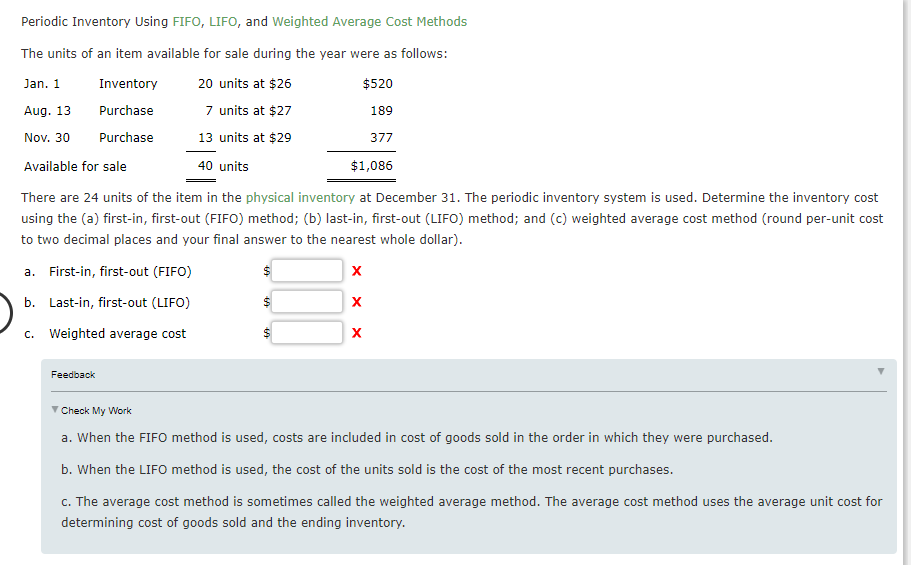

Printable Lifo And Fifo Inventory Methods Expert Answer Periodic inventory using FIFO LIFO and weighted average cost methods The units of an item available for sale during the year were as follows method round per unit cost to two decimal places and your final answer to the nearest whole dollar

Using LIFO Method The value of inventory calculated using the FIFO method was 2750 while that calculated using the LIFO method was 1750 Now look at the differences between the values of total assets and shareholders equity total assets total liabilities All of that is due to the difference in inventory values which in turn is Question Periodic inventory using FIFO LIFO and weighted average cost methodsThe units of an item available for sale during the year were as follows DateLine Item DescriptionUnitsCost per UnitAmountJan 1Inventory40 unitsat 165 6 600Aug 13Purchase200 unitsat 18036 000Nov 30Purchase60

Printable Lifo And Fifo Inventory Methods

Printable Lifo And Fifo Inventory Methods

Printable Lifo And Fifo Inventory Methods

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/06165518/FIFO-vs-LIFO-e1664086122696.jpg

Inventory cost per unit Total cost of goods available for sale Total units available for sale Inventory cost per unit 117 300 43 units Inventory cost per unit 2 727 91 Ending inventory cost 16 units x 2 727 91 Ending inventory cost 43 647 Should you have any question please let me know in the comments Thank you

Templates are pre-designed files or files that can be used for different functions. They can conserve time and effort by supplying a ready-made format and layout for creating different type of content. Templates can be used for personal or professional tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Printable Lifo And Fifo Inventory Methods

Solved Periodic Inventory Using FIFO LIFO And Weighted Chegg

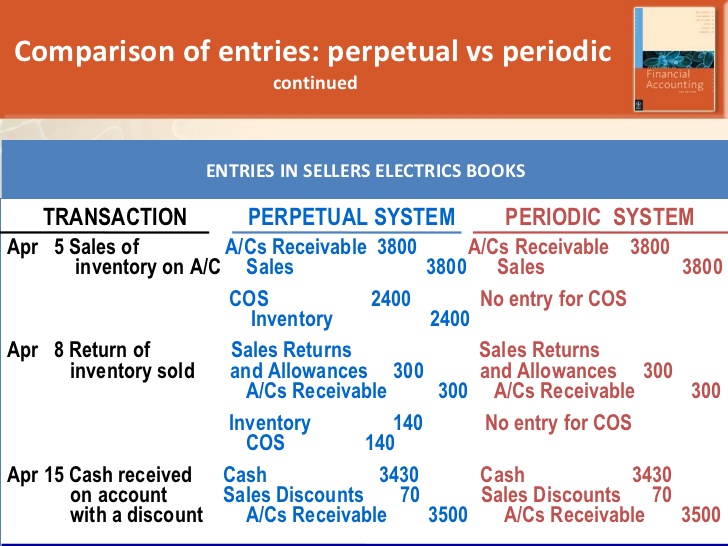

FIFO Or LIFO Inventory Methods Online Accounting

Difference Between FIFO And LIFO Methods Of Inventory Valuation

LIFO FIFO Inventory Methods Ppt Powerpoint Presentation Professional

Periodic Inventory Using FIFO LIFO And Weighted Average Cost Methods

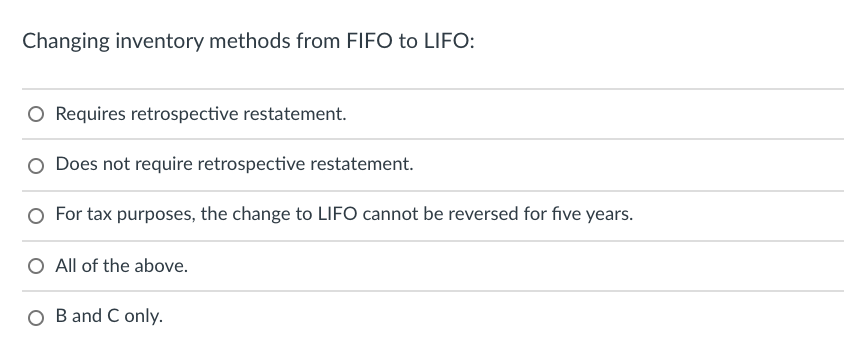

Solved Changing Inventory Methods From FIFO To LIFO Chegg

FIFO and LIFO are the two most common inventory valuation methods FIFO stands for first in first out and assumes the first items entered into your inventory are the first ones you

The U S generally accepted accounting principles GAAP allow businesses to use one of several inventory accounting methods first in first out FIFO last in first out LIFO and

7 Inventory Management Techniques Exploring FIFO FEFO and LIFO Methods July 03 2023 Originating from the French word Inventaire inventory means a listicle of things discovered It simply refers to raw materials products in the manufacturing process goods packaging and all sorts of ph ysical inventory

LIFO method short for Last In First Out is a method of inventory valuation where the last items added to inventory are assumed to be the first sold This means that the cost of the most recent inventory purchases is used to calculate the cost of goods sold before any older inventory costs are used

While all three methods FIFO FEFO and LIFO aim to manage inventory effectively they differ in their priorities and suitability for various industries Here s a brief comparison of their key

First in first out FIFO and last in first out LIFO are two standard methods of valuing a business s inventory Your chosen system can profoundly affect your taxes income logistics LIFO last in first out and FIFO first in first out are the two most common inventory cost methods that companies use to account for the costs of purchased inventory on the balance sheet What Is First In First Out FIFO FIFO is the standard or default inventory accounting method for business firms Note

Cost of ending inventory is computed using the equation given below Cost of ending inventory Total cost Cost of goods sold 3 856 000 2 732 019 1 123 981 Step 4 As per the requirement of the question the cost of ending inventory of the company using FIFO method is equal to 1 147 296 and the cost of ending inventory of the