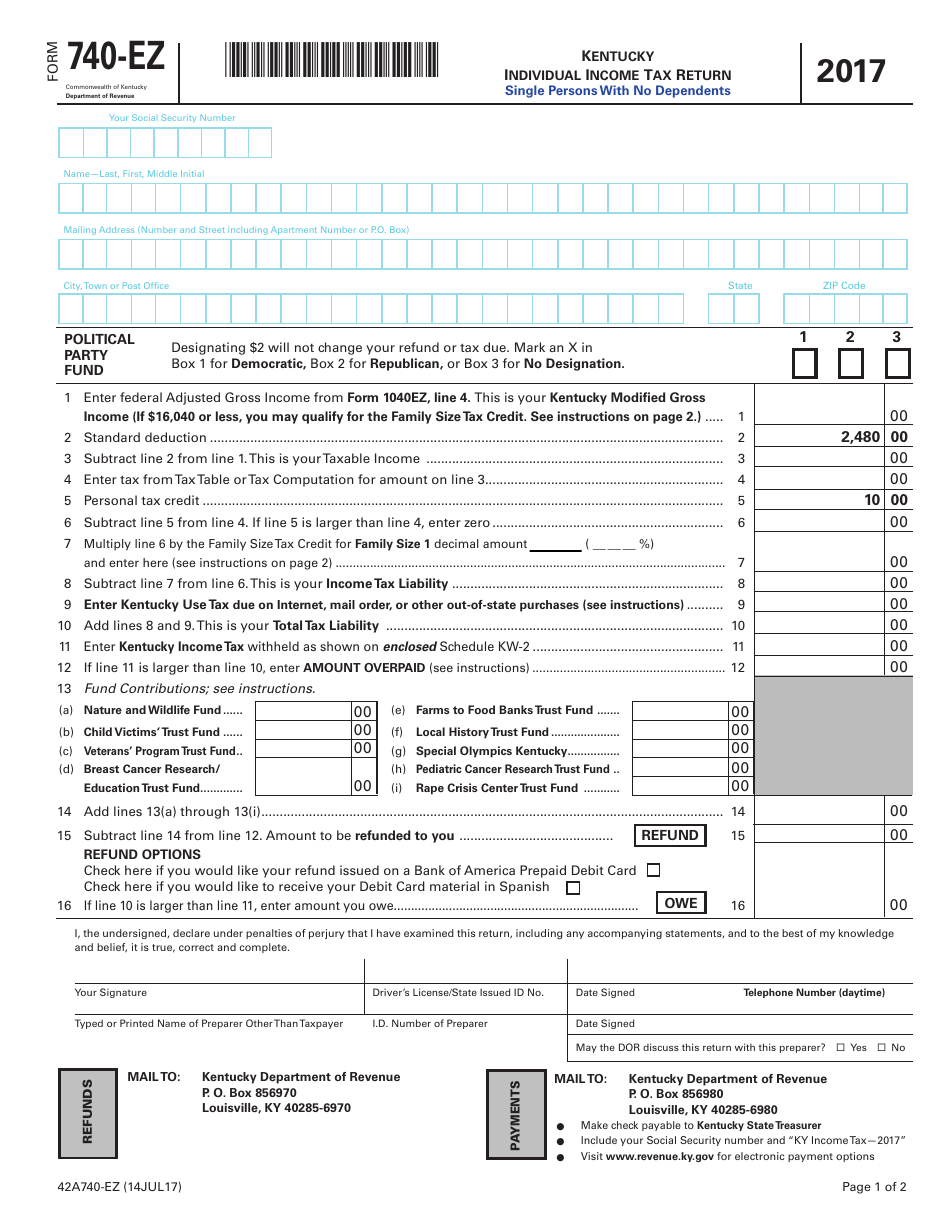

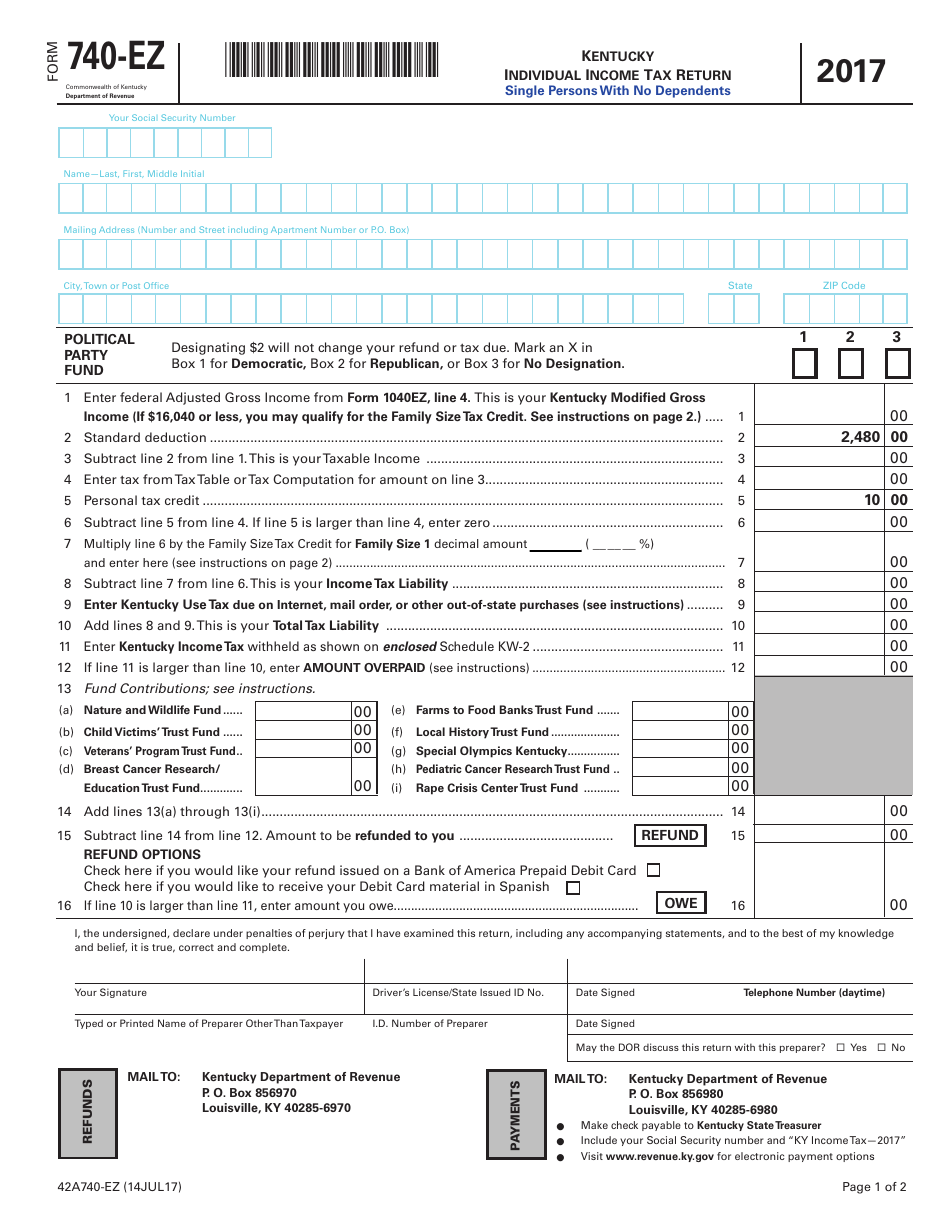

Printable Kentucky Tax Withholding Annuity Form Income Tax Liability Thresholds The 2020 filing threshold amount based upon federal poverty level is expected to be 12 760 for a family size of one singe or married living apart from your spouse for the entire year 17 240 for a family of two single with one dependent child or a married couple 21 720 for a family of three single with t

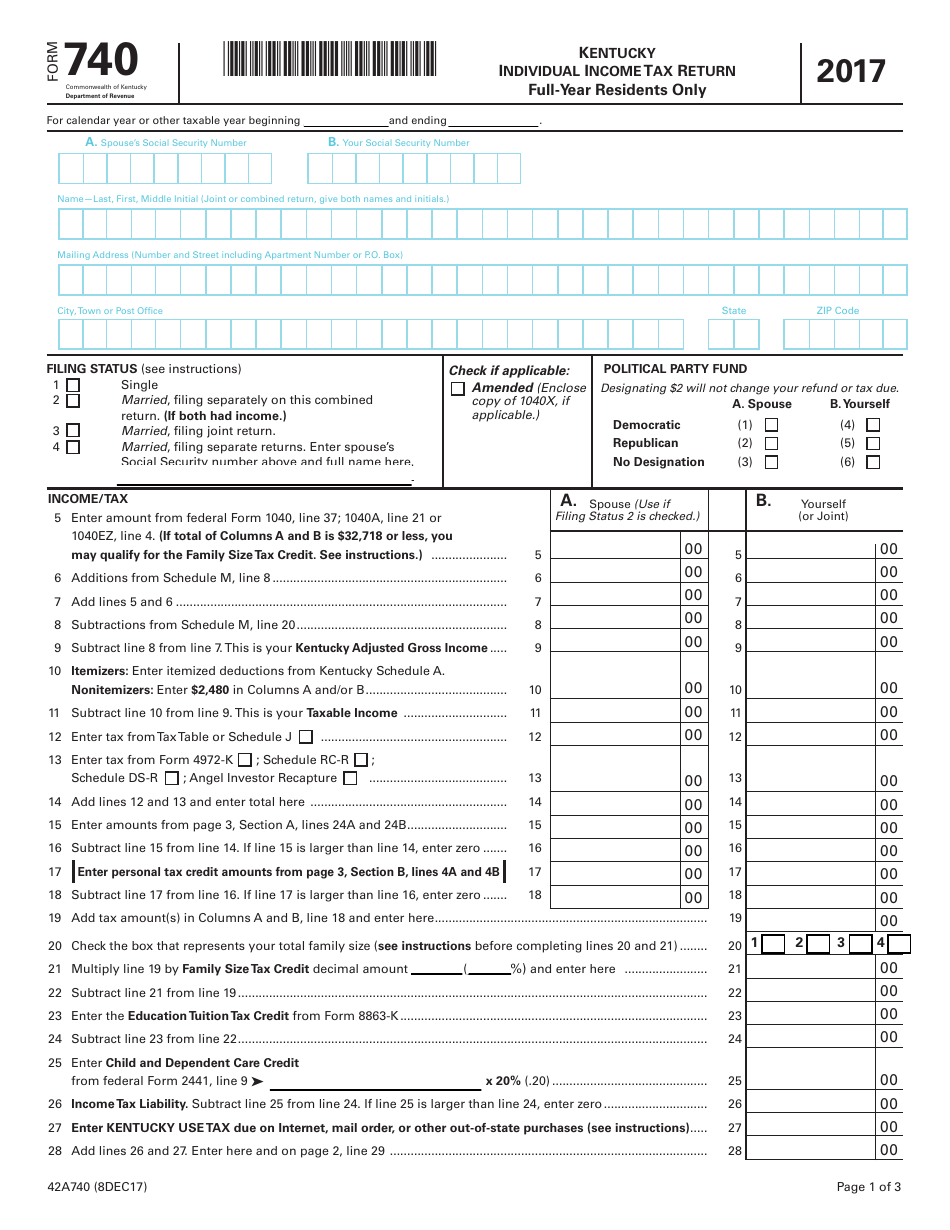

Who must file Form 740 NP Full year nonresidents with income from Kentucky sources Persons moving into Kentucky Persons moving out of Kentucky 2021 Kentucky Income Tax Return Nonresident or Part Year Resident Electronic Filing It s to your advantage Choose one of these easy methods If you elect for withholding the flat Kentucky state tax rate it will be calculated based on the taxable amount after the standard personal deduction and state pension income exclusion If you elect a fixed amount or percentage it will be calculated based on the gross annuity amount

Printable Kentucky Tax Withholding Annuity Form

Printable Kentucky Tax Withholding Annuity Form

Printable Kentucky Tax Withholding Annuity Form

https://data.templateroller.com/pdf_docs_html/1728/17286/1728632/form-740-ez-2017-kentucky-individual-income-tax-return-kentucky_print_big.png

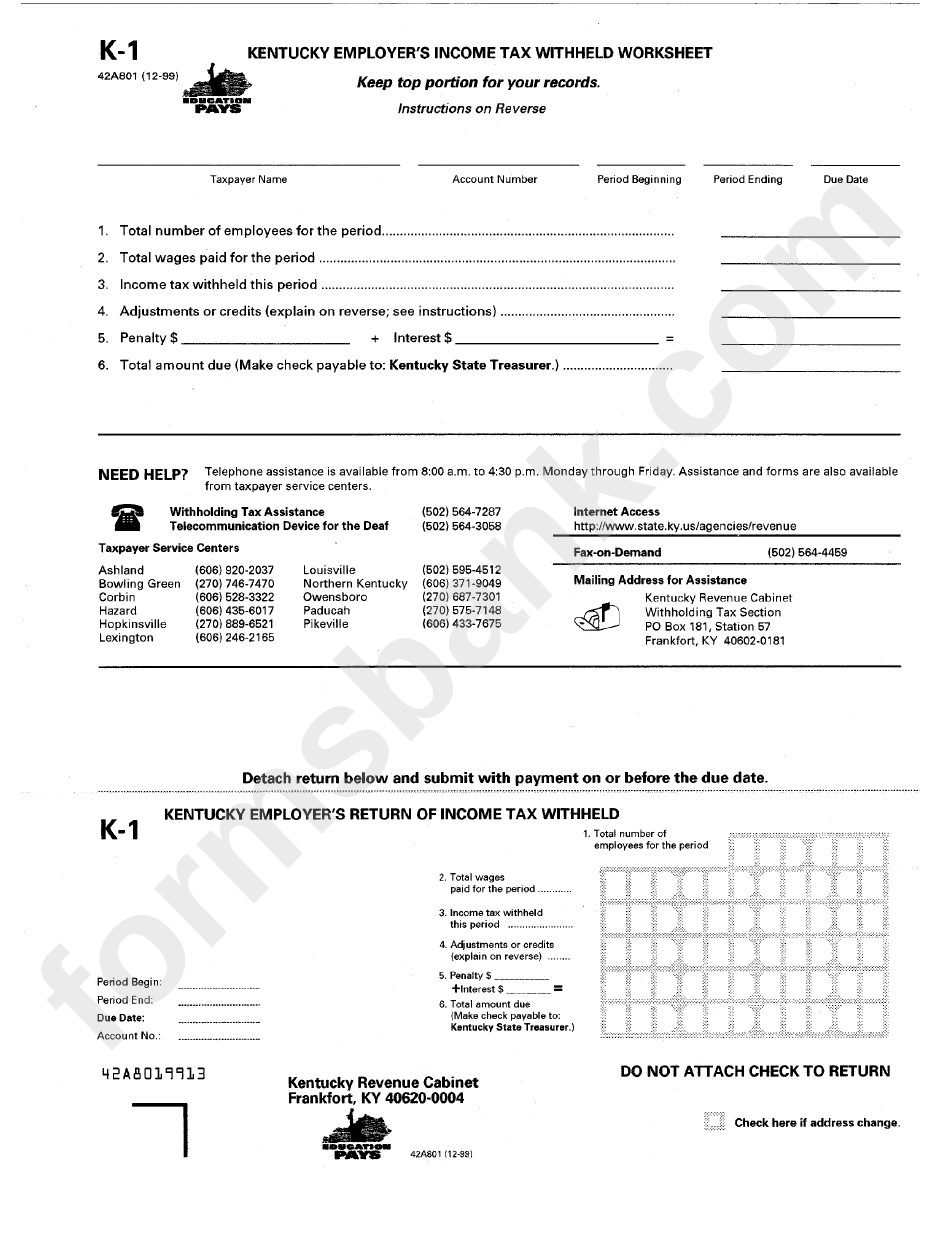

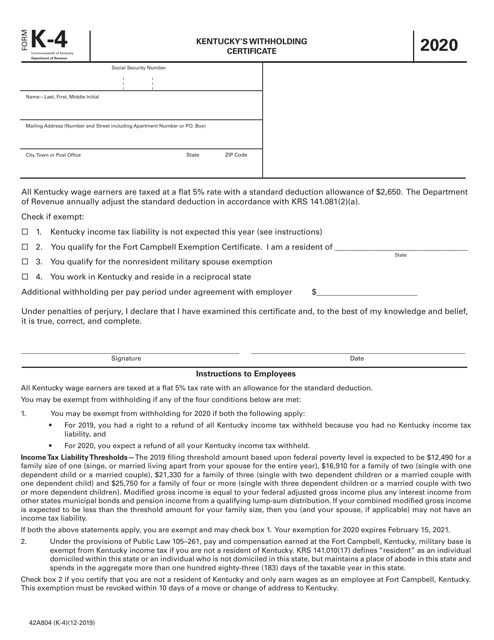

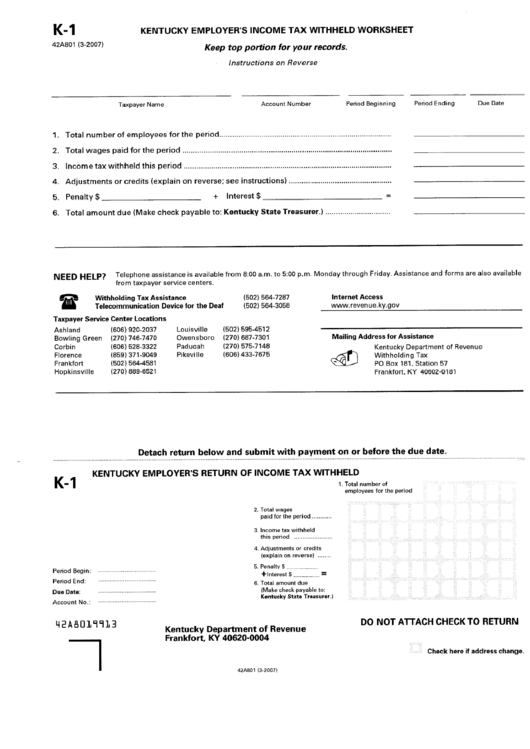

42A804 Form K 4 Kentucky s Withholding Certificate 42A805 Form K 5 Kentucky Employer s Report of Withholding Tax Statements 42A806 Transmitter Report for CD Submission Employers report and pay Kentucky withholding tax annually quarterly monthly or twice monthly Employers who accumulate

Pre-crafted templates offer a time-saving service for creating a varied variety of files and files. These pre-designed formats and layouts can be used for various personal and expert jobs, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the content development process.

Printable Kentucky Tax Withholding Annuity Form

City Of Toledo Employer Withholding Tax Form WithholdingForm

Ca 2023 Withholding Form Printable Forms Free Online

Maryland Withholding Tax Form WithholdingForm

Kentucky Employee Withholding Form 2023 Printable Forms Free Online

Nebraska Personal Allowances Worksheet For Kids Printable Tripmart

W4 2022 Tax Form W4 Form 2022 Printable

https://revenue.ky.gov/Forms/42A804(K-4).pdf

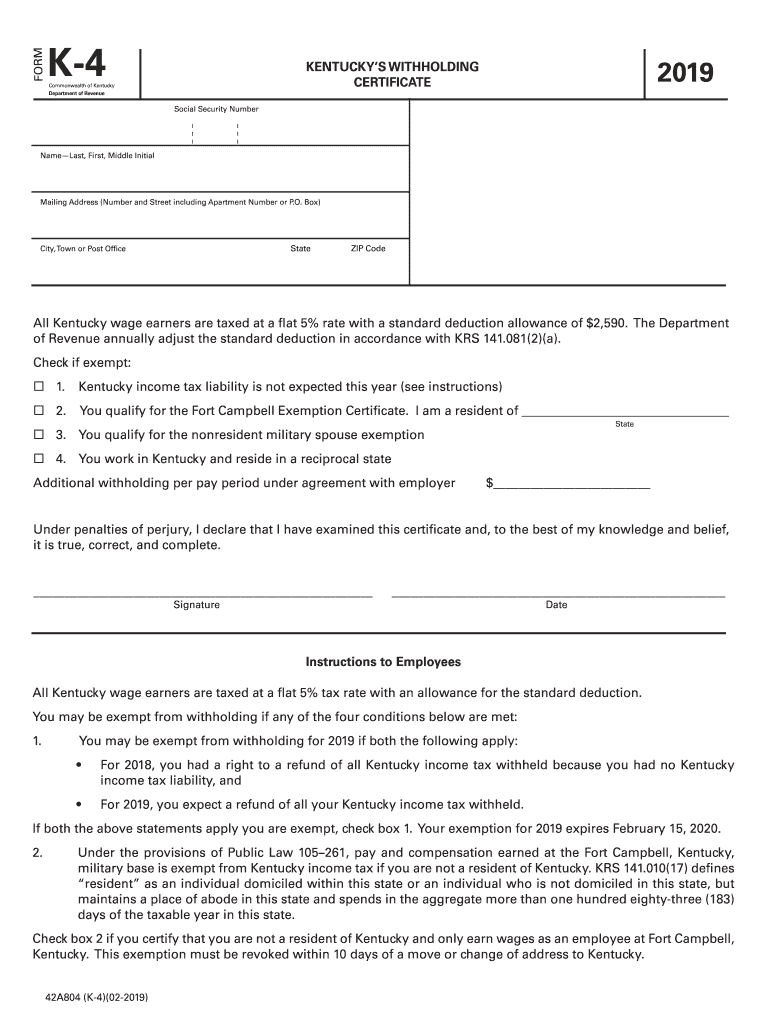

KENTUCKY S WITHHOLDING CERTIFICATE 2023 Social Security Number Name Last First Middle Initial Mailing Address Number and Street including Apartment Number or P O Box City Town or Post Ofice State ZIP Code All Kentucky wage earners are taxed at a flat 4 5 rate with a standard deduction allowance of 2 980

https://trs.ky.gov/wp-content/uploads/2021/05/kentucky-tax-wit…

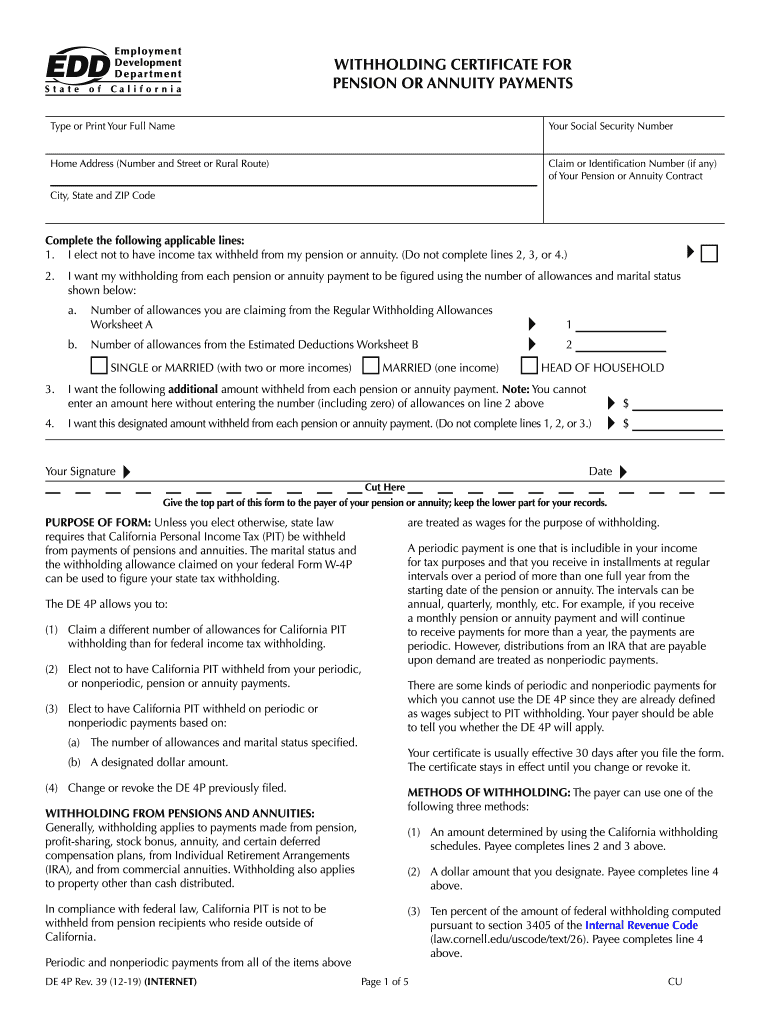

For federal taxes use the W 4P form Annuity payments to Kentucky residents are partially or completely exempt from Kentucky state tax depending on when the work that earned the annuity occurred For details see the tax information page on the TRS website at https trs ky gov retired members tax information

https://revenue.ky.gov/Get-Help/Pages/Forms.aspx

Bank Franchise Tax Business Registration Corporation Income and Limited Liability Entity Tax Electric Vehicle Power Excise Tax Employer Payroll Withholding Health Care Provider Tax Insurance Premiums Tax and Surcharge Inventory Tax Credit Motor Fuels Tax Motor Vehicle Rental Ride Share Excise Tax Motor Vehicle Tire Fee Nonresident

https://revenue.ky.gov/Forms/2021 42A003(T)(12-20).pdf

Compute annual wages 1 500 x 26 39 000 Compute Kentucky taxable wages 39 000 2 690 36 310 Compute gross annual Kentucky tax 36 310 x 5 flat tax rate 1 815 50 Compute Kentucky withholding tax for tax period 1 815 50 26 69 83 bi weekly withholding

https://trs.ky.gov/retired-members/resources/forms-pamphlets-retired

Federal W 4P for Pension or Annuity Payments 2023 Tables for W 4P Federal Tax Withholding Kentucky Resident State Tax Withholding Election The following forms must be completed by your physician Report of Physician Form D 3 This form is for disability applicants and disability retirees

Retiree Forms Download Form 6017 Federal Income Tax Withholding Preference Form 6025 Application for Direct Rollover of Direct Payment Form 6028 Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions Form 6030 Death Benefit Designation Tax for the year than will be withheld you may increase the withholding by claiming a smaller number of exemptions or you may enter into an agreement with your employer to have additional amounts withheld

The withholding methods use a tax rate of 4 instead of 4 5 and a standard deduction of 3 160 up from 2 980 The state also released the 2024 Form K 4 Kentucky s Withholding Certificate which is used to claim exemption from withholding