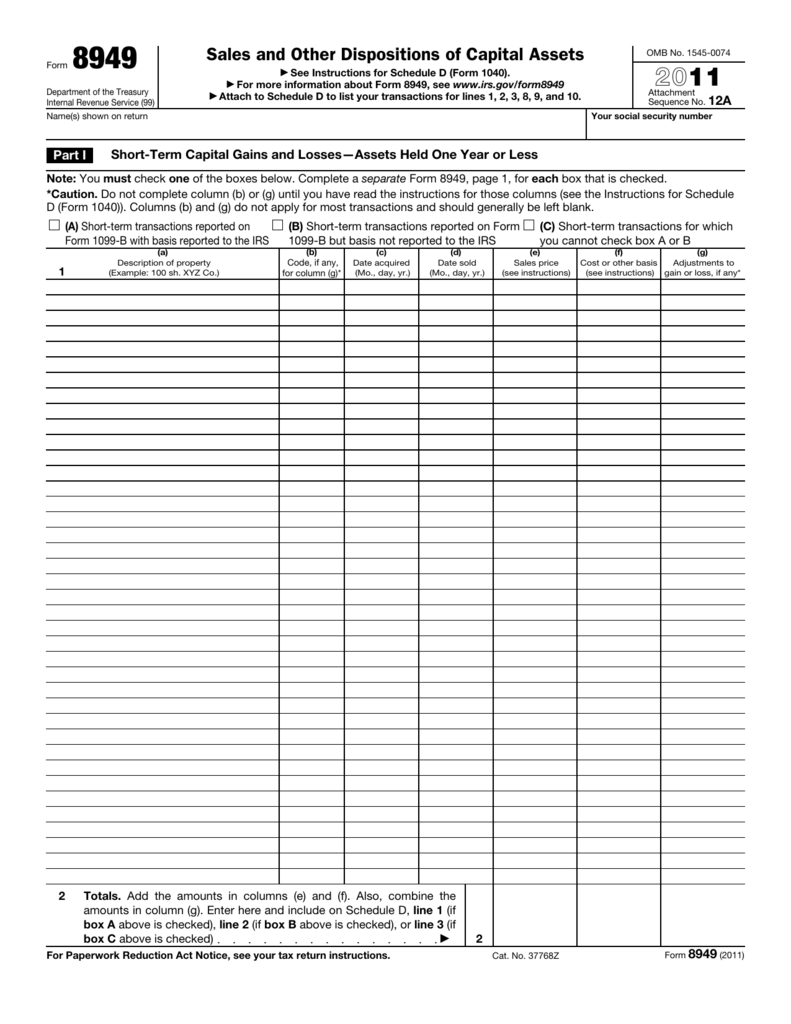

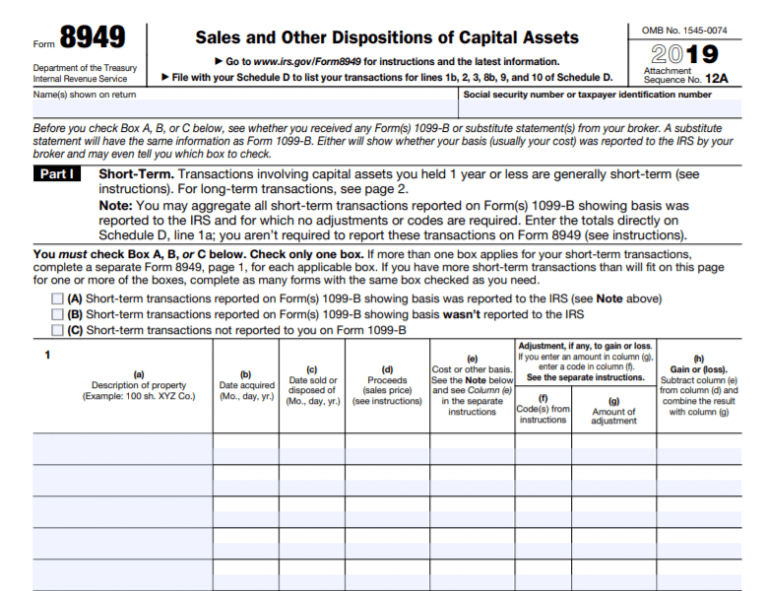

Printable Irs Tax Form 8949 Form 8949 Sales and Other Dispositions of Capital Assets is a tax form used to report capital gains and losses from investments

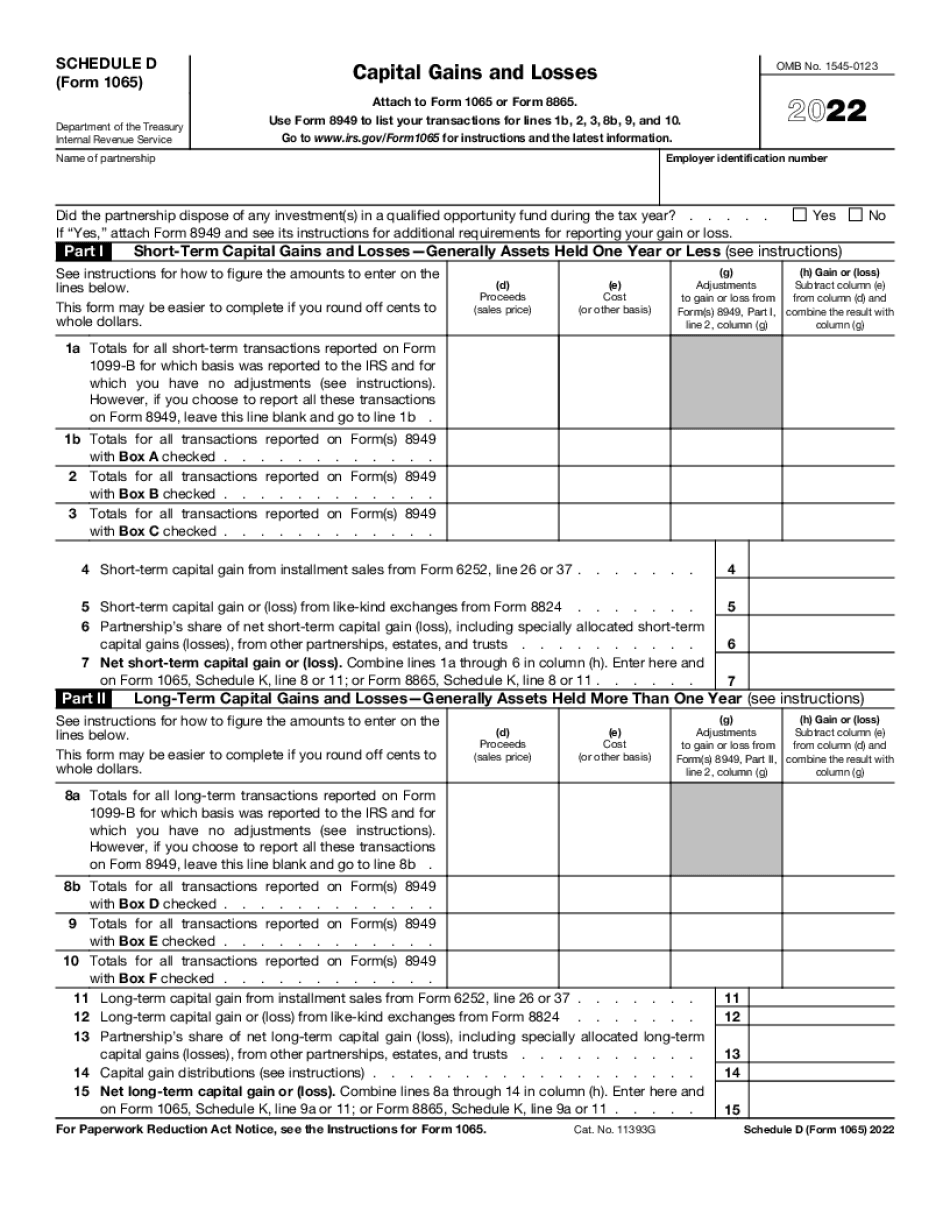

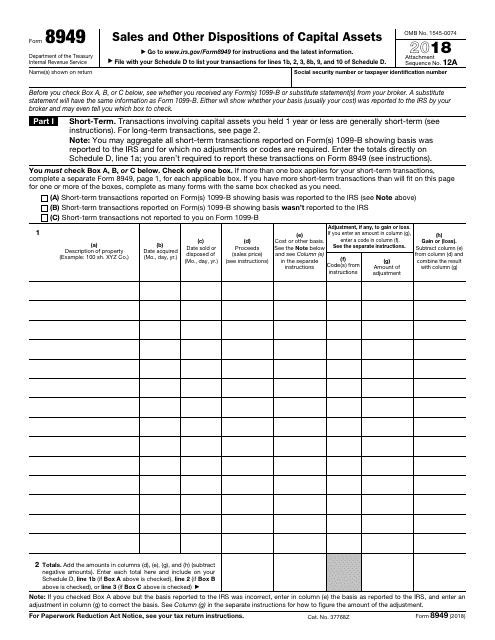

Use Form 8949 to report sales and exchanges of capital assets Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099 B or 1099 S or substitute statements with the amounts you report on your return IRS Form 8949 is a tax document you typically use to account for the difference in figures reported on Forms 1099 B and 1099 S and your tax return Form 8949 is filed along with Schedule D Key Takeaways The primary purpose of IRS Form 8949 is to report sales and exchanges of capital assets

Printable Irs Tax Form 8949

Printable Irs Tax Form 8949

Printable Irs Tax Form 8949

https://www.pdffiller.com/preview/626/995/626995041/big.png

Use Adobe Reader to print those two pages That s all you have to mail to the IRS given that those wash sales are not on your e Filed form 8949 already you might enter them manually if they are few in number If you were wise enough to avoid wash sales you won t have to list or mail anything

Pre-crafted templates use a time-saving option for developing a varied variety of documents and files. These pre-designed formats and layouts can be utilized for numerous individual and professional projects, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, enhancing the content creation process.

Printable Irs Tax Form 8949

Form 8949 Sales And Other Dispositions Of Capital Assets 2014 Free

Form 8949 Pillsbury Tax Page

Printable Form 8949 Printable Forms Free Online

File IRS Form 8949 To Report Your Capital Gains Or Losses

Fillable Irs Form 8949 Printable Forms Free Online

Fillable IRS Form 8949 Printable PDF Sample FormSwift

https://8949taxform.com

Tax Form 8949 Instructions Get 2022 IRS Form 8949 Printable PDF Example to Fill Out in 2023 Tax Form 8949 for 2022 Get Now IRS Form 8949 A Comprehensive Guide for Accurate Reporting IRS tax form 8949 for 2022 is essential for taxpayers who have sold or exchanged capital assets such as stocks bonds or real estate

https://8949taxform.com/forms/2022-irs-form-8949-instructions

Get Printable IRS Form 8949 Guide to Reporting Capital Gains and Losses Get printable 8949 form worksheet in PDF Step by step fill out instructions completed example Fill online and send to IRS in minutes

https://www.irs.gov/forms-pubs/about-form-8949

Form 8949 is used to list all capital gain and loss transactions Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099 B or 1099 S or substitute statement with the amounts you report on your return

https://8949irsform.com

Here s what you ll need to fill out IRS Form 8949 fillable or printable Your name address and Social Security number or taxpayer identification number The date you acquired the asset and the date you sold it The sales price of the asset and the cost or other basis of the asset Any adjustments to the basis such as commissions or fees

https://8949form.org

Federal Tax Form 8949 Versions Guides Get IRS Form 8949 printable fillable templates Download the blank 8949 tax form or fill it out online Line by line filling instructions for corporations trusts etc File the form error free with our tips

Forms Instructions and Publications Search Access IRS forms instructions and publications in electronic and print media Find and fill out the correct irs 8949 form signNow helps you fill in and sign documents in minutes error free Choose the correct version of the editable PDF form from the list and get started filling it out

The printable IRS tax form 8949 also known as Sales and Other Dispositions of Capital Assets is used to report gains and losses from the sale or exchange of financial estates Follow this bullet list guide to ensure accuracy and