Printable Irs Tax Form 8379 Please use the link below to download 2022 federal form 8379 pdf and you can print it directly from your computer More about the Federal Form 8379 We last updated Federal Form 8379 in February 2023 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023

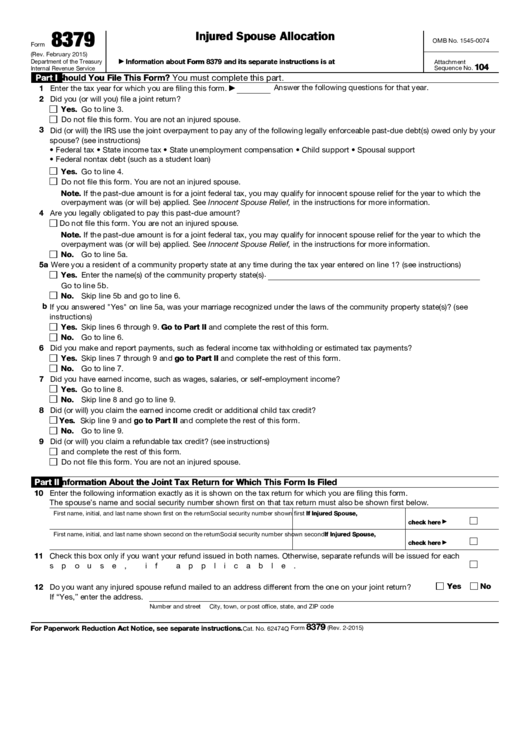

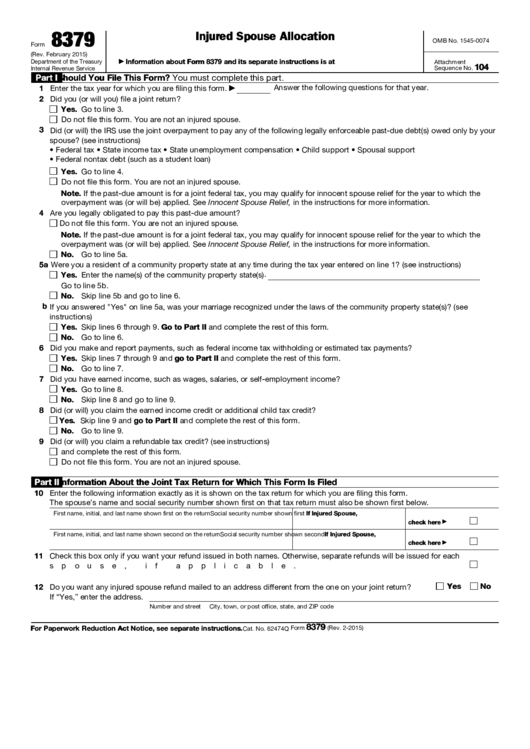

Form 8379 allows you to get back your share of a joint tax refund if it was garnished to pay a debt or obligation owed by your spouse These obligations might include child support payments past due student loan payments or overdue state tax payments This provision in the tax code is called injured spouse allocation where the injured We last updated the Injured Spouse Allocation in February 2023 so this is the latest version of Form 8379 fully updated for tax year 2022 You can download or print current or past year PDFs of Form 8379 directly from TaxFormFinder You can

Printable Irs Tax Form 8379

Printable Irs Tax Form 8379

Printable Irs Tax Form 8379

https://data.formsbank.com/pdf_docs_html/10/108/10836/page_1_thumb_big.png

IRS Form 8379 is a legal paper needed to be completed in the situation when one of the partners the one considered injured wants to claim for a tax refund filed together with the second partner The aggrieved partner can request it if there s a place for shared overpayment applied to the overdue commitment of another partner

Pre-crafted templates offer a time-saving solution for developing a varied series of files and files. These pre-designed formats and layouts can be used for various personal and expert jobs, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, enhancing the material creation procedure.

Printable Irs Tax Form 8379

2010 Form IRS 8379Fill Online Printable Fillable Blank PdfFiller

Irs Form 8379 Line 20 Universal Network

Instructions For Form 8379 Injured Spouse Allocation 2010 Printable

Printable Irs Form 8379 Printable Forms Free Online

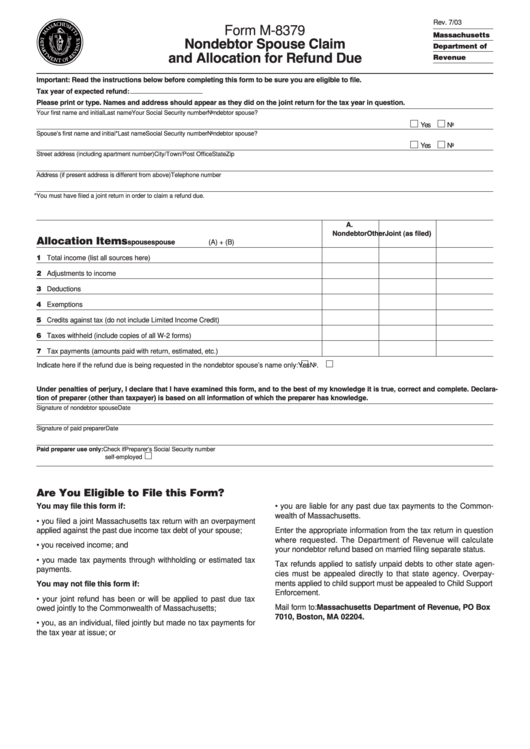

Fillable Form M 8379 Nondebtor Spouse Claim And Allocation For Refund

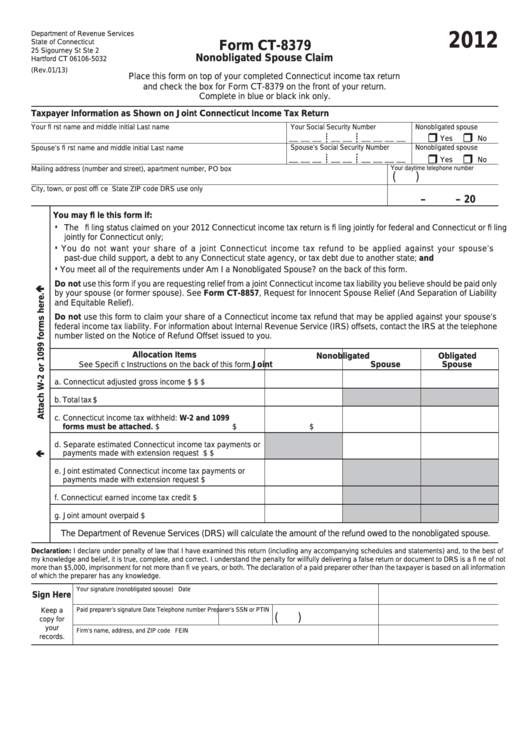

Form Ct 8379 Nonobligated Spouse Claim 2012 Printable Pdf Download

https://www.irs.gov/pub/irs-pdf/i8379.pdf

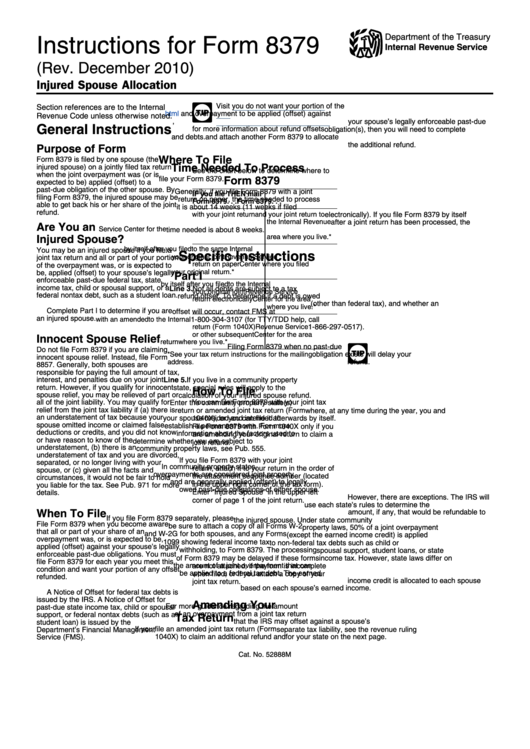

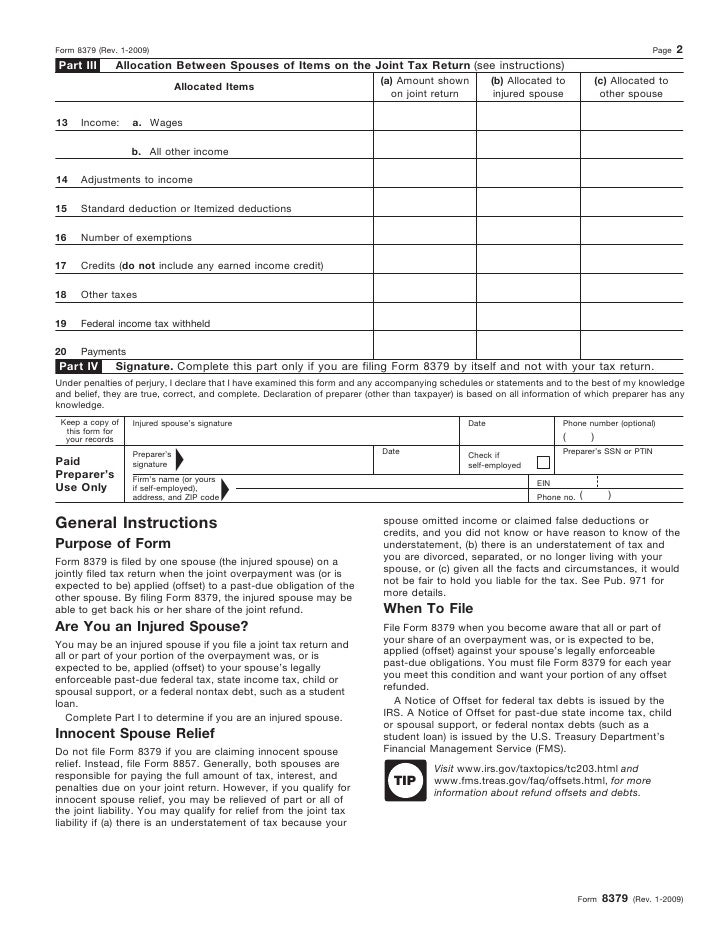

Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund Which Revision To Use

https://www.irs.gov/instructions/i8379

Purpose of Form Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund

https://www.irs.gov/forms-pubs/about-form-8379

Information about Form 8379 Injured Spouse Allocation including recent updates related forms and instructions on how to file Form 8379 is used by injured spouses to compute their share of a joint tax refund

https://www.irs.gov/pub/irs-prior/i8379--2020.pdf

Form 8379 is filed by one spouse the injured spouse on a jointly filed tax return when the joint overpayment was or is expected to be applied offset to a past due obligation of the other spouse By filing Form 8379 the injured spouse may be able to get back his or her share of the joint refund Are You an Injured Spouse

https://turbotax.intuit.com/tax-tips/marriage/what-is-irs-form-8379

Form 8379 essentially asks the IRS to release the injured spouse s portion of the refund Filling out the form A couple can file Form 8379 along with their joint tax return if they expect their refund to be seized Alternatively the injured spouse can file it separately from the return if they find out after they file that a refund was seized

Follow the simple instructions below Finding a authorized specialist making an appointment and going to the office for a personal conference makes finishing a Irs Form 8379 from start to finish tiring US Legal Forms helps you to quickly generate legally compliant documents according to pre created web based blanks Irs form 8379 rating 4 8 Satisfied 41 votes How to fill out and sign irs form 8379 printable online Get your online template and fill it in using progressive features Enjoy smart fillable fields and interactivity Follow the simple instructions below

IRS 8379 Instructions 2021 2023 Fill and Sign Printable Template Online US Legal Forms IRS 8379 Instructions 2021 Get IRS 8379 Instructions 2021 2023 Show details How It Works Open form follow the instructions Easily sign the form with your finger Send filled signed form or save 8379 instructions form rating