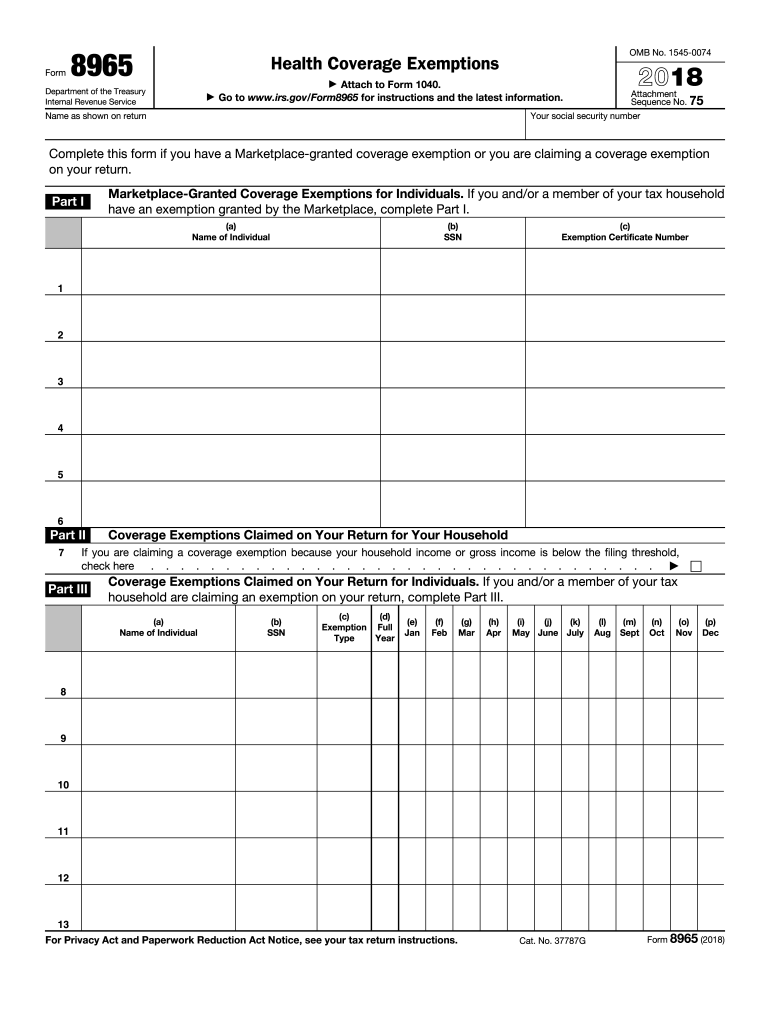

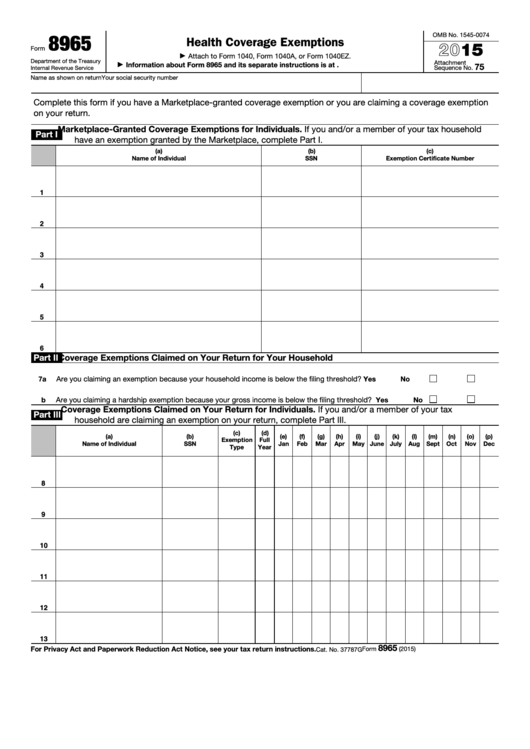

Printable Irs Form 8965 Self or another member of your tax household Attach Form 8965 to your tax return Form 1040 Form 1040A or Form 1040EZ Form 8965 is used only to claim and report coverage exemptions If you are unable to check the Full year coverage box on your tax return you don t need to re port the months when you and other members of your tax house

Form 8965 health coverage exemptions health insurance healthcare coverage marketplace Tax Penalty Tax Return Taxes IRS Form 8965 is the form you file to claim an exemption to waive the penalty for not having minimum health insurance coverage Learn more about Form 8965 If you are required to file a tax return you do not have minimum essential coverage for yourself and everyone else in your tax household and you want to report or claim a coverage exemption for yourself or another member of your tax household file Form 8965 to report or claim coverage exemptions Attach Form 8965 to your tax return Form

Printable Irs Form 8965

Printable Irs Form 8965

Printable Irs Form 8965

https://www.signnow.com/preview/459/708/459708004/large.png

We last updated Federal Form 8965 in April 2022 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023 We will update this page with a new version of the form for 2024 as soon as it is made available by the Federal government

Templates are pre-designed files or files that can be used for various purposes. They can conserve time and effort by offering a ready-made format and layout for producing different sort of content. Templates can be utilized for personal or professional jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Printable Irs Form 8965

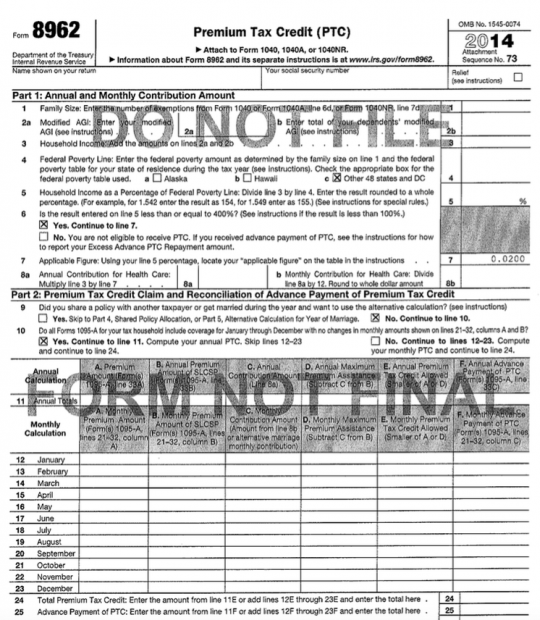

1040ez 2014 Form 8965 Form Resume Examples AjYdrqO2l0

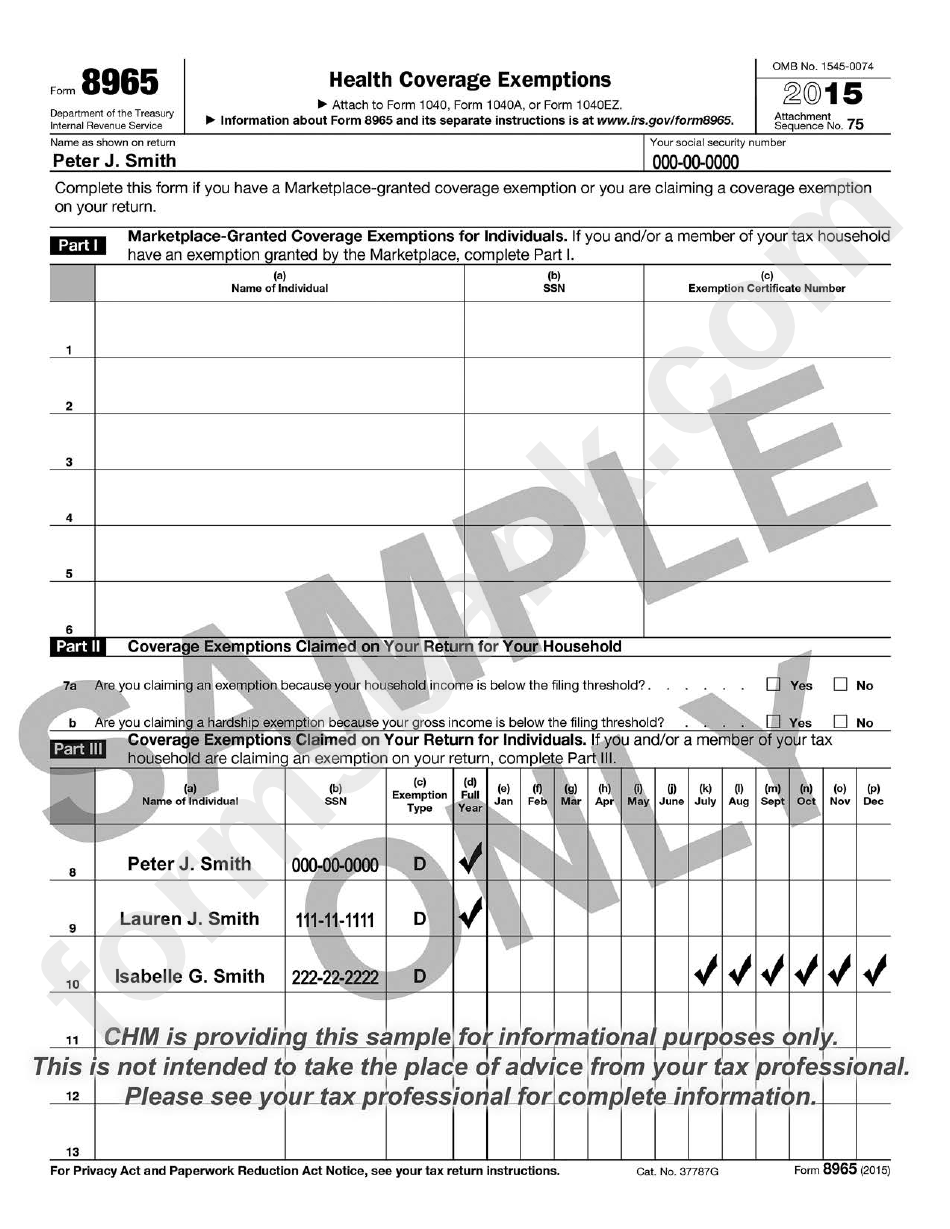

Form 8965 Sample Health Coverage Exemptions 2015 Printable Pdf Download

Obamacare Tax Forms What You Need To Know Bankrate

17 Best Images Of IRS Federal Worksheets Tax Deduction Worksheet IRS

Form 8965 Instructions Information On IRS Form 8965

Fillable Form 8965 Health Coverage Exemptions Printable Pdf Download

https://www.irs.gov/pub/irs-prior/f8965--2018.pdf

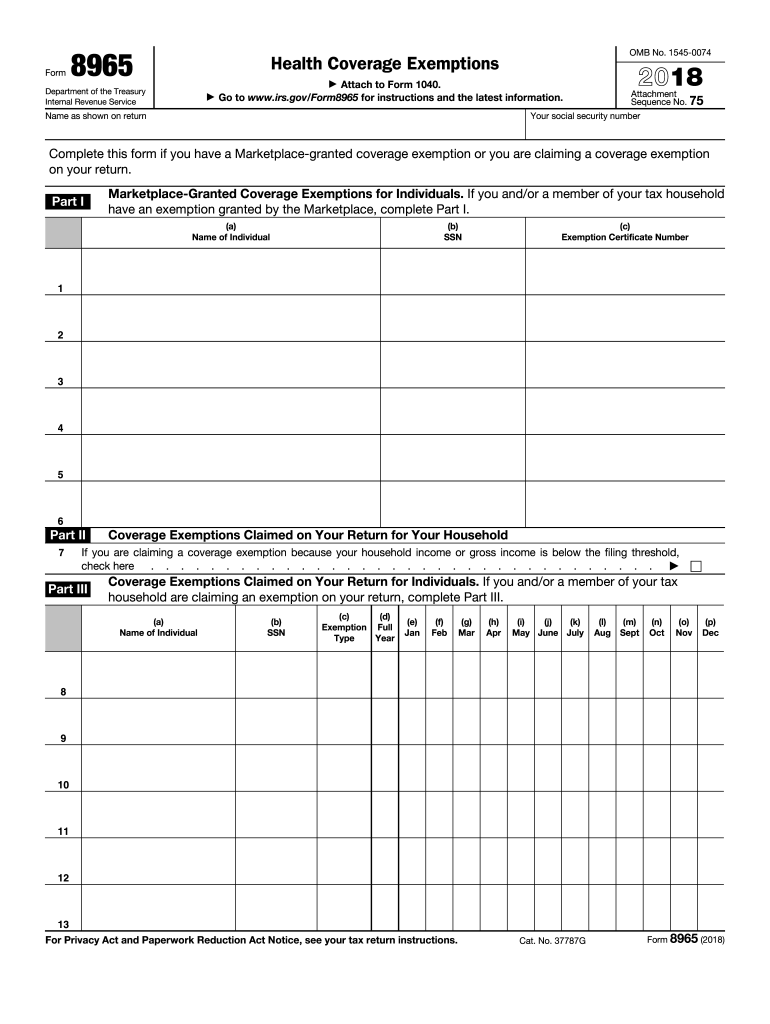

Form 8965 Health Coverage Exemptions 2018 Department of the Treasury Internal Revenue Service Attach to Form 1040 Go to www irs gov Form8965 for instructions and the latest information OMB No 1545 0074 Attachment Sequence No 75 Name as shown on return Your social security number

https://www.irs.gov/pub/irs-prior/i8965--2018.pdf

Attach Form 8965 to Form 1040 Form 8965 is used only to claim and report coverage exemptions If you are unable to check the Full year health care coverage or exempt box on Form 1040 you don t need to report the months when you and other mem bers of your tax household had minimum essential coverage on

https://www.irs.gov/affordable-care-act/

Under the Tax Cuts and Jobs Act the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31 2018 Beginning in Tax Year 2019 Forms 1040 and 1040 SR will not have the full year health care coverage or exempt box and Form 8965 Health Coverage Exemptions will no longer be used

https://www.taxformfinder.org/forms/2021/2021-federal-inst-8965.pdf

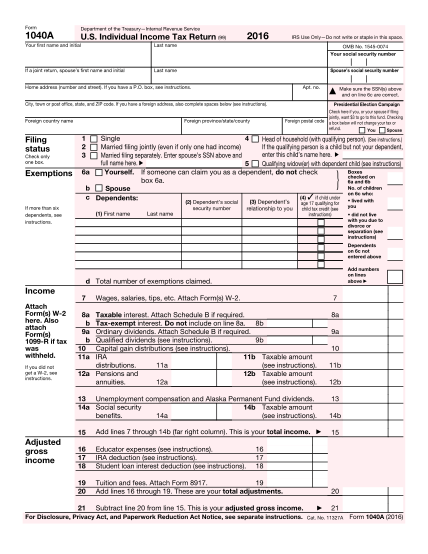

Use this form if your taxable income before your qualified business income deduction is at or below 164 900 164 925 if married filing separately 329 800 if married filing jointly and you aren t a patron of an agricultural or horticultural cooperative

https://smartasset.com/taxes/all-about-irs-form-8965

If you re claiming an exemption from healthcare coverage you ll need to fill out IRS form 8965 when you do your federal income taxes This form helps you comply with Affordable Care Act rules that require health insurance coverage for just about everyone in

You will use IRS Form 8965 to claim a health care coverage exemption on your tax return for tax years before 2019 The Affordable Care Act ACA made it mandatory for all Americans to have health insurance and those without it had to pay a penalty The IRS designed Form 8965 for taxpayers to claim an exemption to waive this penalty if they Application for Enrollment to Practice Before the Internal Revenue Service as an Enrolled Retirement Plan Agent ERPA Download Print Form 2441 2022 Child and Dependent Care Expenses Download Print Form 4506 A 2022 Request for Public Inspection or Copy of Exempt or Political Organization IRS Form Download Print Form 4810

In most cases you can claim a coverage exemption by submitting IRS Form 8965 alongside your federal tax return However in a few circumstances you need to fill out an application print it and mail it to the Health Insurance Marketplace for review