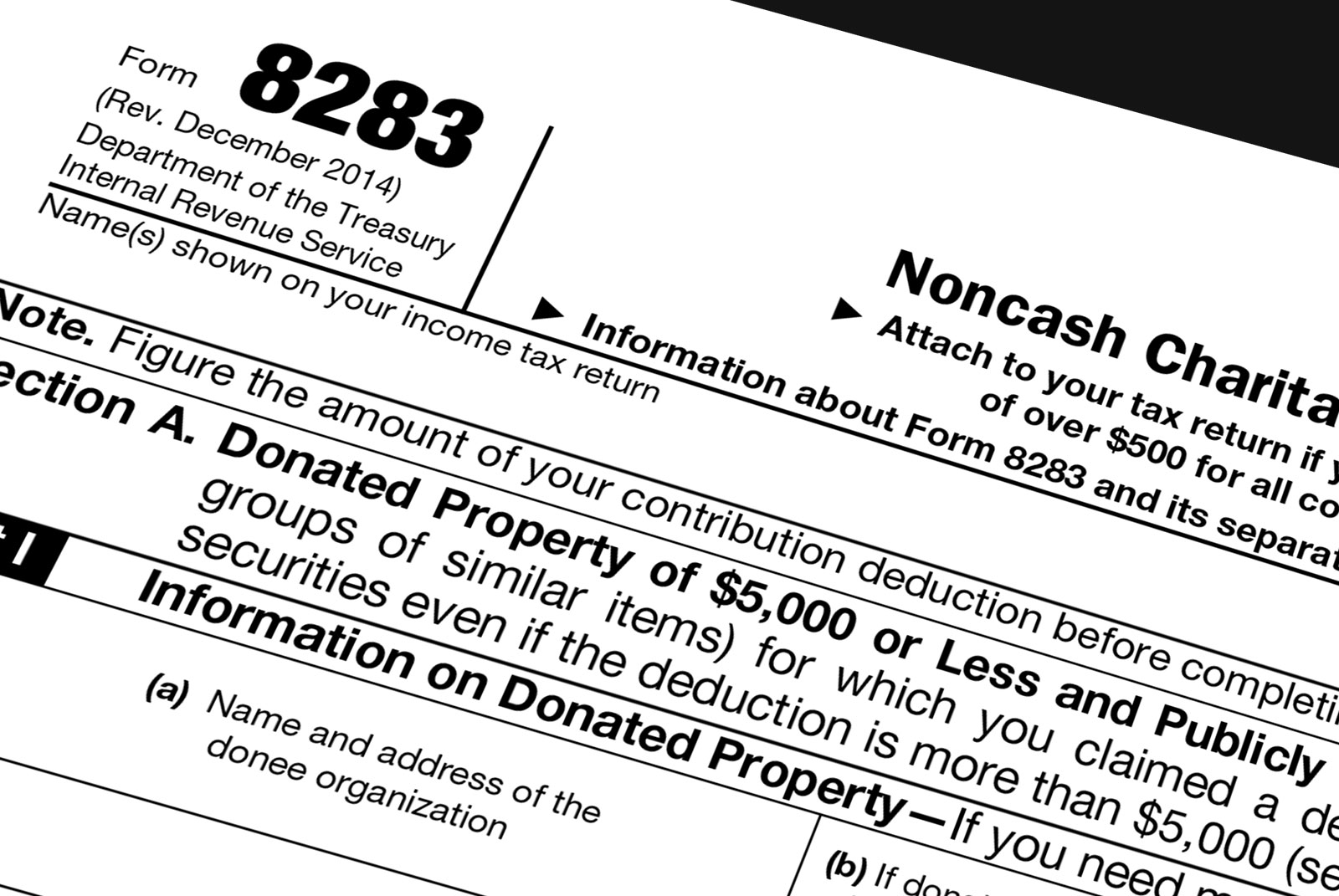

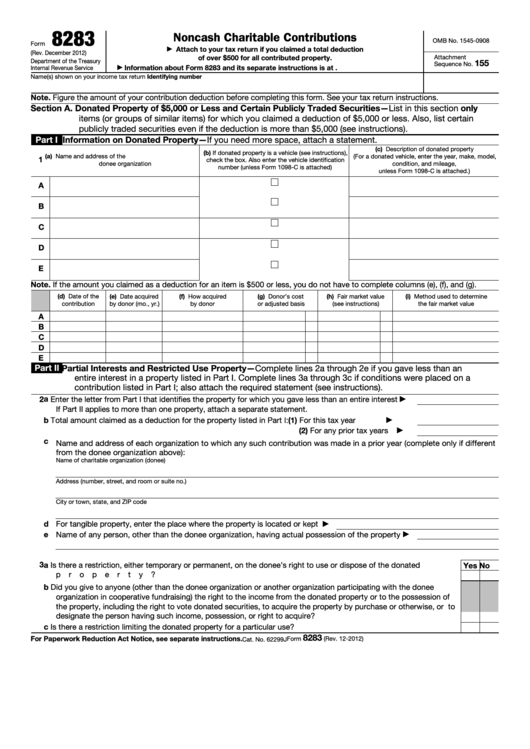

Printable Irs Form 8283 What is Form 8283 used for Form 8283 is used to report noncash donations exceeding 500 If you are claiming a charitable contribution deduction and have a significant amount of noncash donations you may be required to file Form 8283 as well as the Schedule A Donations made by check credit or debit card or cash do not need to be

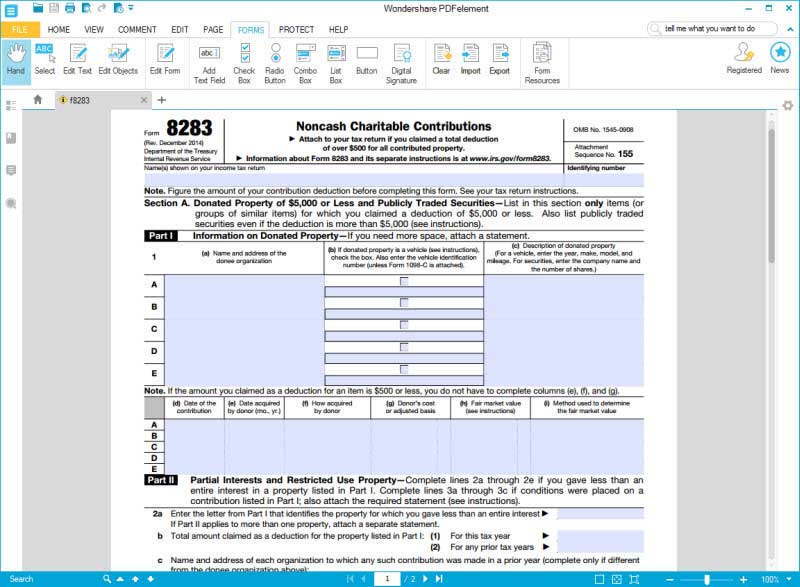

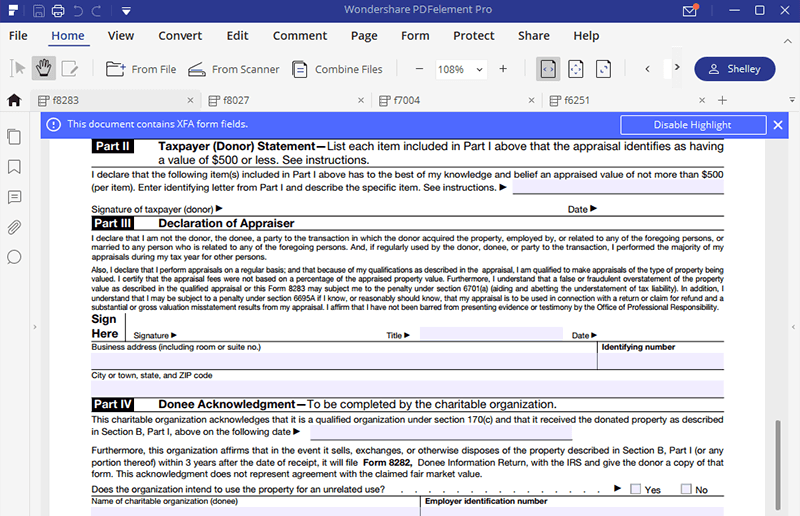

IRS Form 8283 is a tax form that reports certain noncash charitable contributions to the IRS Definition and Example of Form 8283 Form 8283 is a two part tax form you use to report certain noncash charitable contributions to claim Form 8283 Noncash Charitable Contributions is a tax form distributed by the Internal Revenue Service IRS and used by filers who wish to deduct non cash contributions made to a qualifying

Printable Irs Form 8283

Printable Irs Form 8283

Printable Irs Form 8283

https://www.printableform.net/wp-content/uploads/2021/06/download-irs-form-8283-noncash-charitable-contributions-768x986.jpg

What Is IRS Form 8283 If you make qualified noncash donations to IRS accepted charitable organizations during the year these donations may allow you to claim a tax deduction A qualified charitable tax deduction could reduce the amount of taxable income on your tax return

Templates are pre-designed documents or files that can be used for numerous functions. They can save effort and time by providing a ready-made format and layout for creating different kinds of content. Templates can be used for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Printable Irs Form 8283

Fillable Form 8282 Printable Forms Free Online

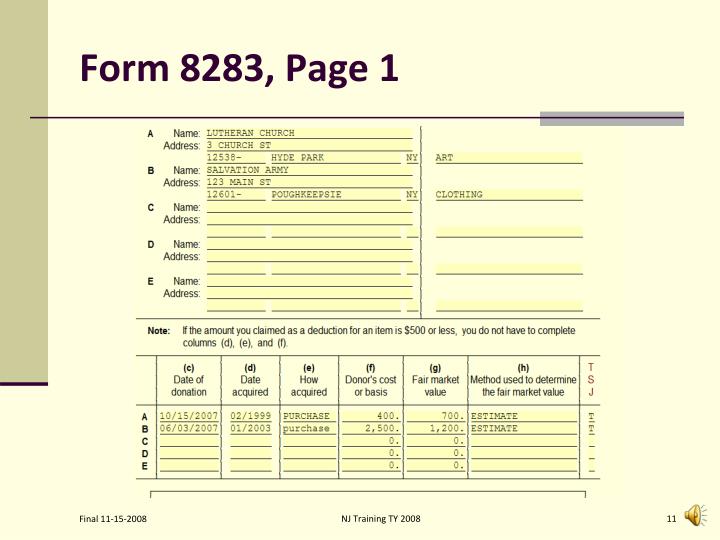

PPT Itemized Deductions PowerPoint Presentation ID 3396847

Irs Form 8283 Instructions 2021 2023 Fill Online Printable Fillable

Instructions For How To Fill In IRS Form 8283

For How To Fill In IRS Form 8283

Instructions For Form 8283 Printable Pdf Download

https://www.irs.gov/forms-pubs/about-form-8283

Information about Form 8283 Noncash Charitable Contributions including recent updates related forms and instructions on how to file Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property the claimed value of which exceeds 500

https://www.irs.gov/pub/irs-pdf/i8283.pdf

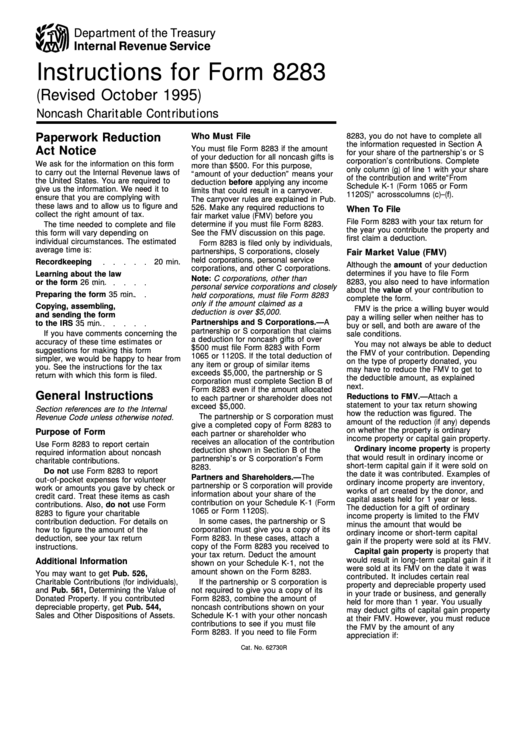

Use Form 8283 to report information about noncash charitable contributions Do not use Form 8283 to report out of pocket expenses for volunteer work or amounts you gave by check or credit card Treat these items as cash contributions Also do not use Form 8283 to figure your charitable contribution deduction

https://www.taxformfinder.org/federal/form-8283

We last updated the Noncash Charitable Contributions in December 2022 so this is the latest version of Form 8283 fully updated for tax year 2022 You can download or print current or past year PDFs of Form 8283 directly from TaxFormFinder You can print other Federal tax forms here

https://turbotax.intuit.com//what-is-the-irs-form-8283/L4cLHP3s0

Stock sales Rental property income Credits deductions and income reported on other forms or schedules for example income related to crypto investments If the combined value of all property you donate is

https://www.schwabcharitable.org/public/file/P-11957049

Completing IRS Form 8283 For Donations of Publicly Traded Securities to Schwab Charitable Accounts For taxpayers who itemize deductions donations of publicly traded securities to charity including donor advised funds must be reported on Part I of Form 8283 Noncash Charitable Contributions

Partnerships S corporations and individuals can use IRS Form 8283 to declare the value of their charitable contributions if their donations exceed the 500 limit C corporations don t have to file this form if their charitable contributions in a tax year are below the 5 000 mark What Is IRS Form 8283 Individuals and organizations who donated non cash contributions to a certain group must declare said gifts to the IRS if the value of the donated items exceeds 500 In this case the individual or organization must file Form 8283

What is Form 8283 In brief IRS Form 8283 helps to ensure that taxpayers accurately report the value of their noncash charitable contributions and that they have donated these assets to eligible charities According to the IRS Form 8283 is filed by individuals partnerships and corporations