Printable Irs 2029 W7 IRS gov DraftForms and remain there after the final release is posted at IRS gov LatestForms Also see IRS gov Forms Most forms and publications have a page on IRS gov IRS gov Form1040 for Form 1040 IRS gov Pub501 for Pub 501 IRS gov W4 for Form W 4 and IRS gov ScheduleA for Schedule A Form 1040 for example and

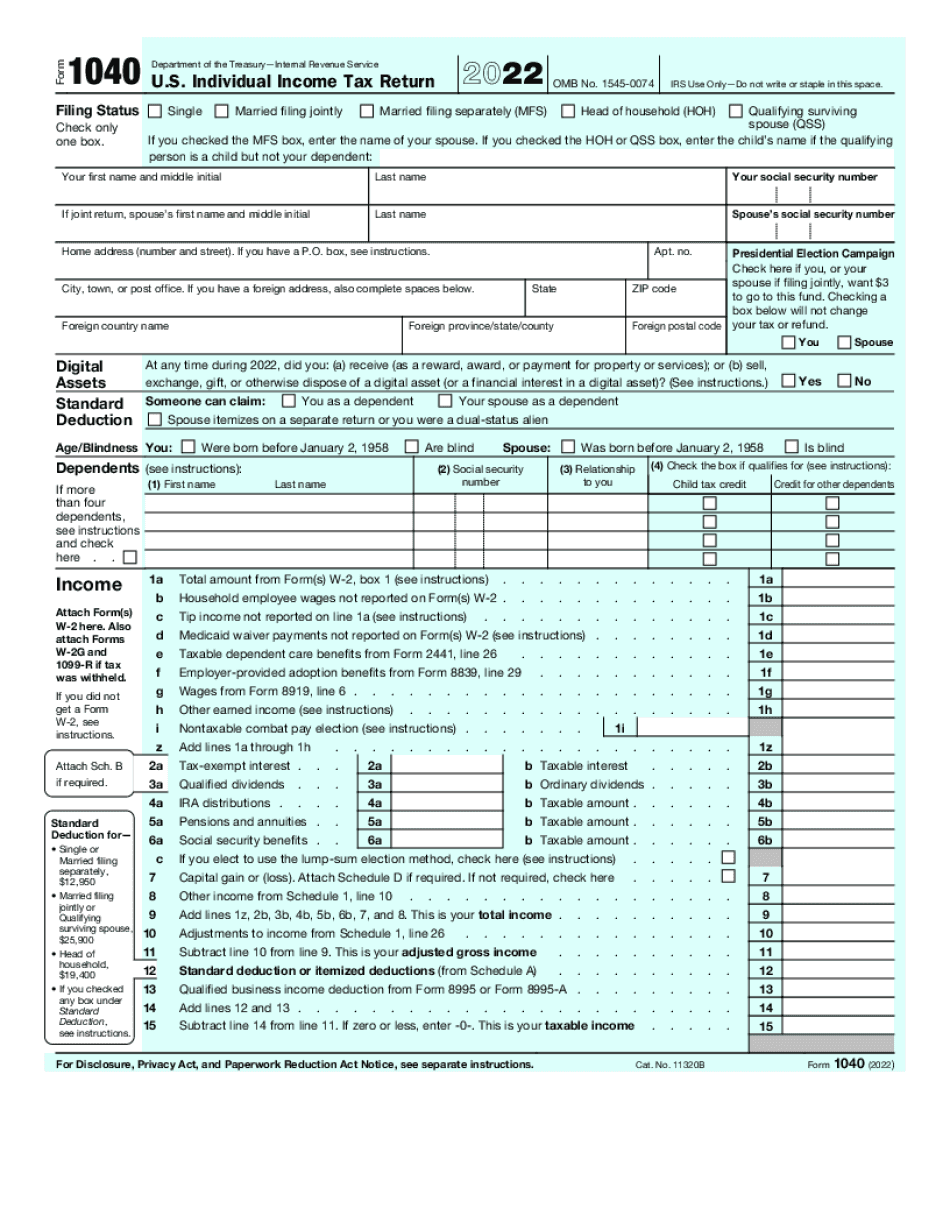

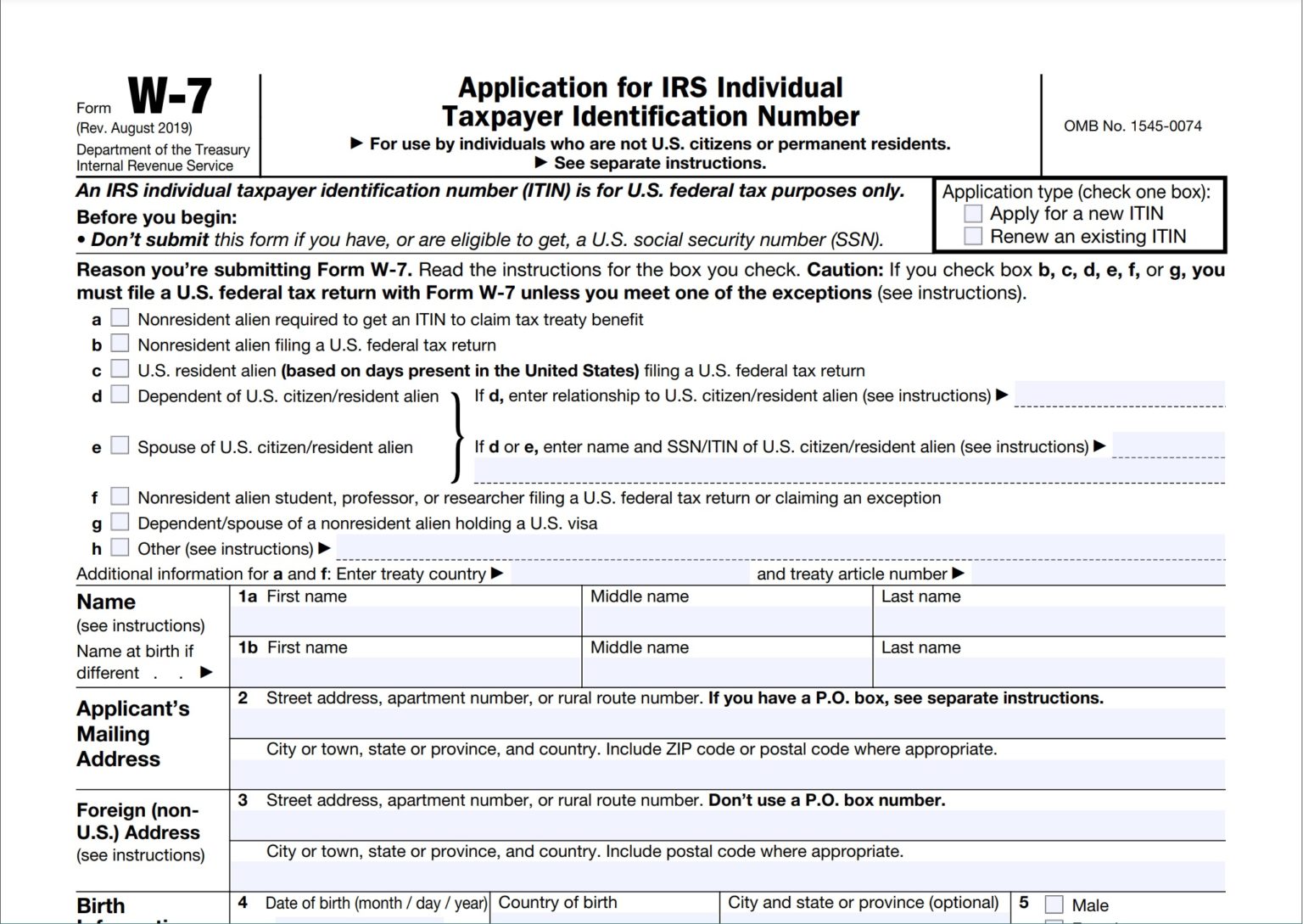

POPULAR FOR TAX PROS Form 1040 X Amend Fix Return Form 2848 Apply for Power of Attorney Form W 7 Apply for an ITIN Circular 230 Rules Governing Practice before IRS Complete IRS W 7 2019 2023 online with US Legal Forms Easily fill out PDF blank edit and sign them Save or instantly send your ready documents

Printable Irs 2029 W7

Printable Irs 2029 W7

Printable Irs 2029 W7

https://www.pdffiller.com/preview/624/654/624654310/big.png

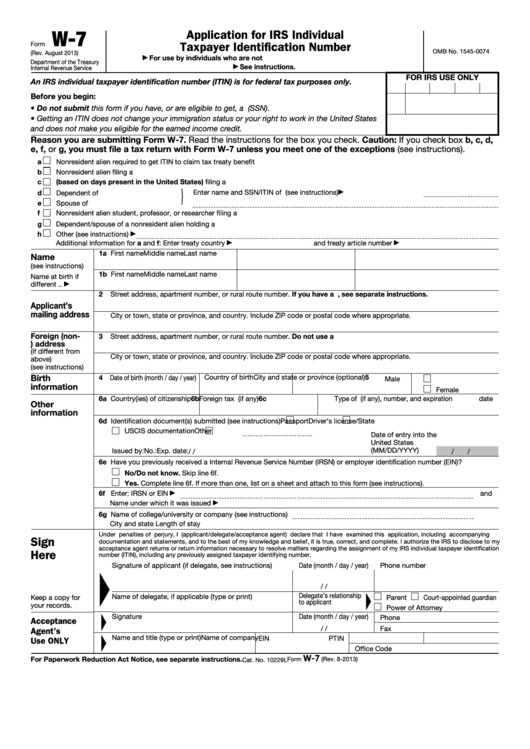

Form W 7 is used to apply for an IRS Individual Taxpayer Identification Number ITIN This IRS form can also be used for an ITIN renewal or for an ITIN that has already expired An ITIN is a nine digit number that always begins with the number 9 and has a 7 or 8 in the fourth digit ex 9XX 8X XXXX

Pre-crafted templates offer a time-saving option for developing a diverse variety of documents and files. These pre-designed formats and layouts can be made use of for various individual and expert projects, consisting of resumes, invites, flyers, newsletters, reports, discussions, and more, improving the content development procedure.

Printable Irs 2029 W7

W7 Form 2023 Application For IRS ITIN IRS Tax Forms 2023

Form W7 Application Irs Individual Taxpayer Stock Photo 1651968322

W9 Form 2023 Fillable Pdf Free Printable Forms Free Online

Irs Form W 4V Printable

Crayfish Dissection Lab Companion Classical Conversations Homeschool

W7 Form Printable Form Printable Forms Free Online

https://www.irs.gov/forms-pubs/about-form-w-7

Page Last Reviewed or Updated 13 Jul 2023 Information about Form W 7 Application for IRS Individual Taxpayer Identification Number ITIN including recent updates related forms and instructions on how to file Form W 7 is used to

https://www.irs.gov/instructions/iw7

For your convenience you can access fillable Form W 7 at IRS gov pub irs pdf fw7 pdf complete print then sign the Form W 7 Note Keep a copy of your application for your records

https://eforms.com/irs/w-7

Updated September 15 2023 An IRS Form W 7 also called an Application for IRS Individual Taxpayer Identification Number is a form used by individuals who are ineligible for a Social Security Number but still need to file taxes in the United States If the applicant is approved a 9 digit Individual Taxpayer Identification Number ITIN

https://www.taxformfinder.org/federal/form-w-7

We last updated the Application for IRS Individual Taxpayer Identification Number in February 2023 so this is the latest version of Form W 7 fully updated for tax year 2022 You can download or print current or past year PDFs of Form W 7 directly from TaxFormFinder

https://www.irs.gov/forms-instructions-and-publications

The latest versions of IRS forms instructions and publications View more information about Using IRS Forms Instructions Publications and Other Item Files Click on a column heading to sort the list by the contents of that column

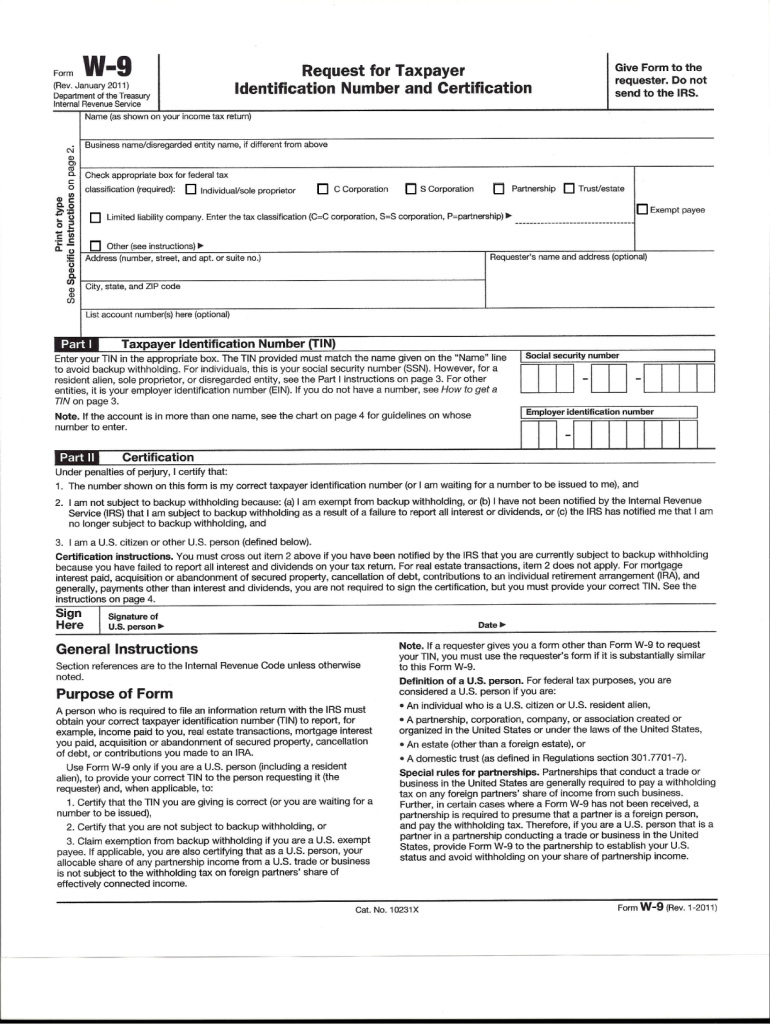

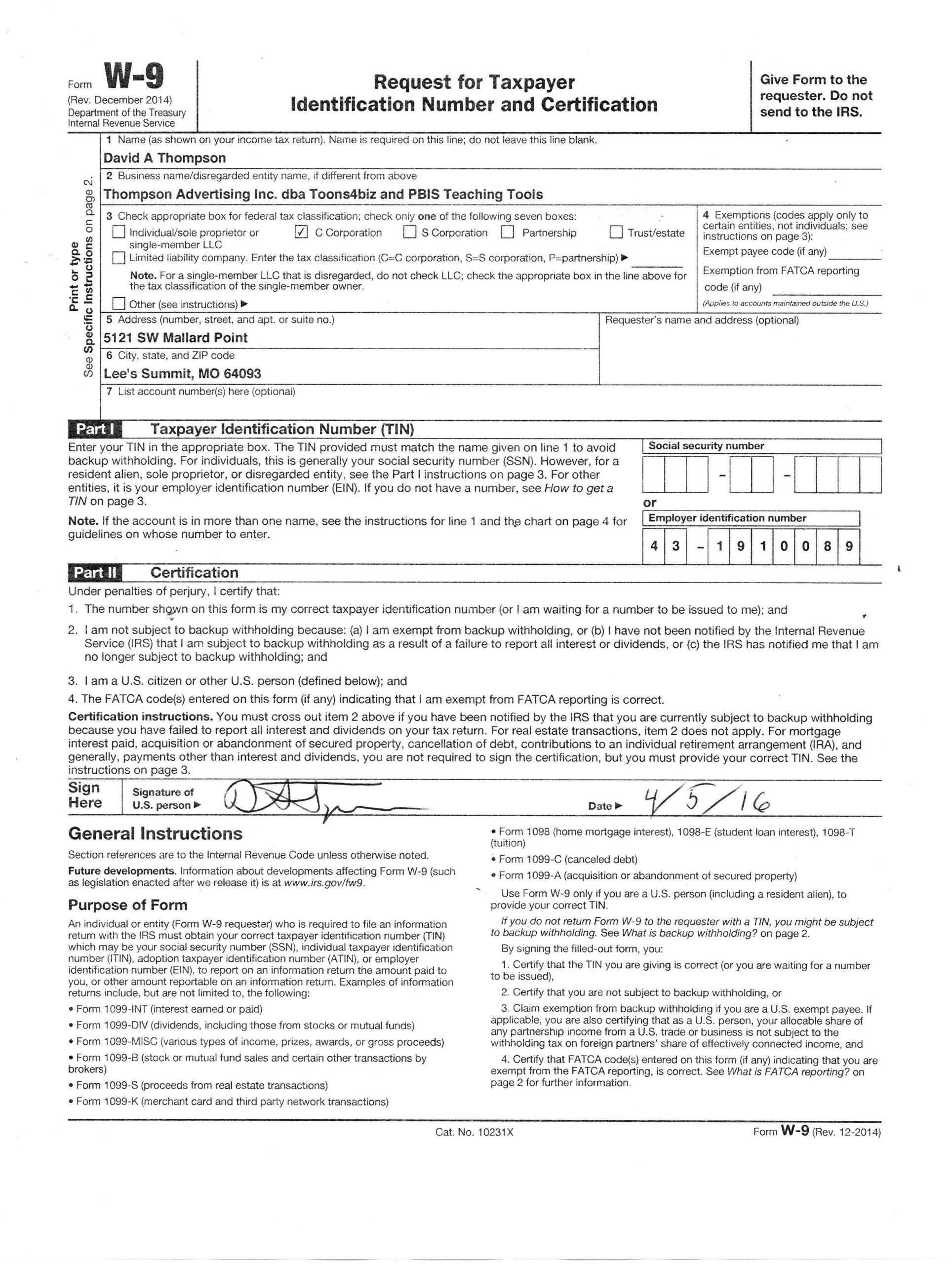

A W 7 Form is used to apply for an individual taxpayer identification number or ITIN for non citizens who aren t eligible to receive a Social Security number but need to file a federal tax return with the IRS for income from US sources TABLE OF CONTENTS ITINs Why ITINs are necessary About form W 7 Click to expand ITINs Information about Form W 9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file Form W 9 is used to provide a correct TIN to payers or brokers required to file information returns with IRS

A foreign student or employee of an educational institution permanently residing out of the US filing a federal tax return A non resident alien s possessing a valid visa dependent or spouse In case you fit into any of the categories above you must fill out Form W 7 and get or renew an ITIN Critical use this paper for federal tax