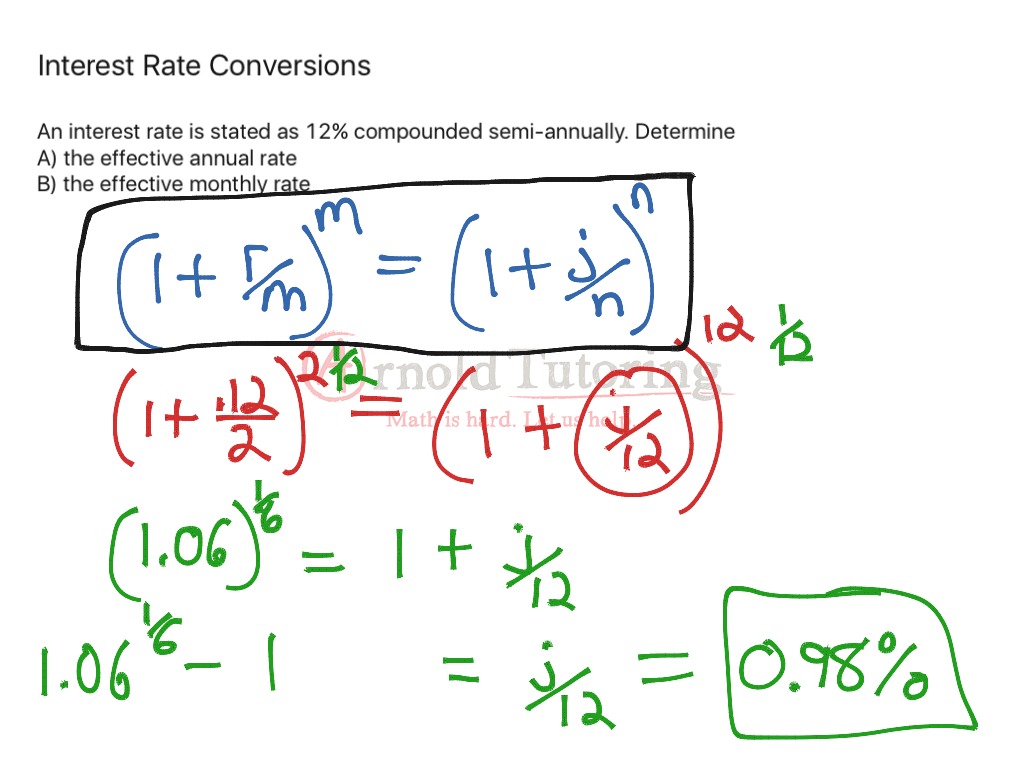

Printable Interest Rate Conversion Formula Table The original interest rate and compounding are known IY 7 7 CY Old quarterly 4 CY New semi annually 2 How You Will Get There Step 2 Apply Formula 9 1 to the original interest rate Step 3 Convert the original interest rate to its new periodic rate using Formula 9 4 Step 4

Values of Interest Factors When N Equals Infinity Single Payment Uniform Payment Series F Pi A F i 0 P Fi 0 A P i i Arithmetic Gradient Series F A i A G i 1 i P A i 1 i 2 P G i 1 i Compound Interest tables Calculator Use Convert a nominal interest rate from one compounding frequency to another while keeping the effective interest rate constant Given the periodic nominal rate r compounded m times per per period the equivalent periodic nominal rate i compounded q times per period is i q 1 r m m q 1 i q 1 r m m q 1

Printable Interest Rate Conversion Formula Table

Printable Interest Rate Conversion Formula Table

Printable Interest Rate Conversion Formula Table

https://showme0-9071.kxcdn.com/files/465607/pictures/thumbs/2706219/last_thumb1504740804.jpg

Some definitions effective interest rate per unit period normally one year number of interest periods a present sum of money a future sum of money equivalent to but interest periods from the present at interest rate an end of period cash receipt or disbursement in a uniform series continuing for periods with the entire series

Templates are pre-designed documents or files that can be used for various purposes. They can conserve time and effort by providing a ready-made format and layout for producing different kinds of content. Templates can be utilized for individual or professional jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Printable Interest Rate Conversion Formula Table

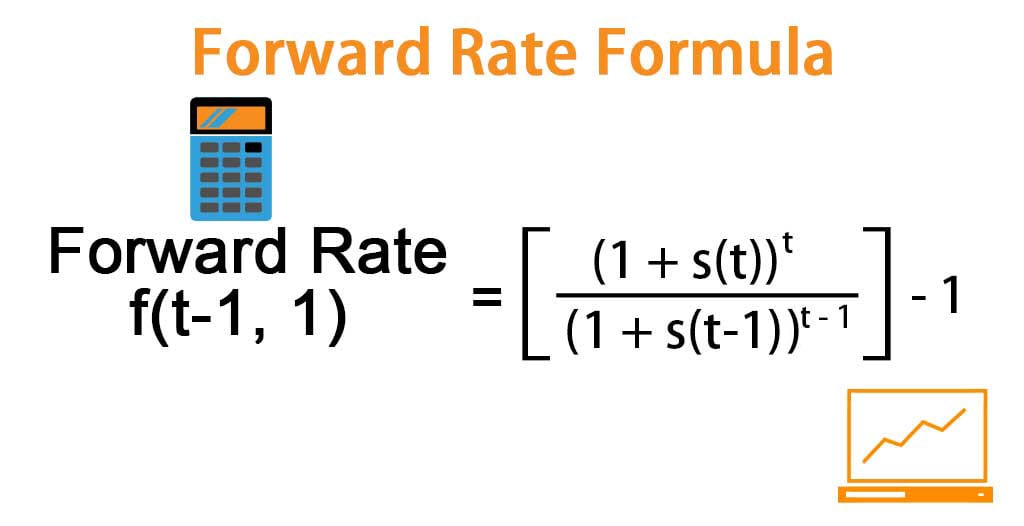

Forward Rate Formula Formula Examples With Excel Template

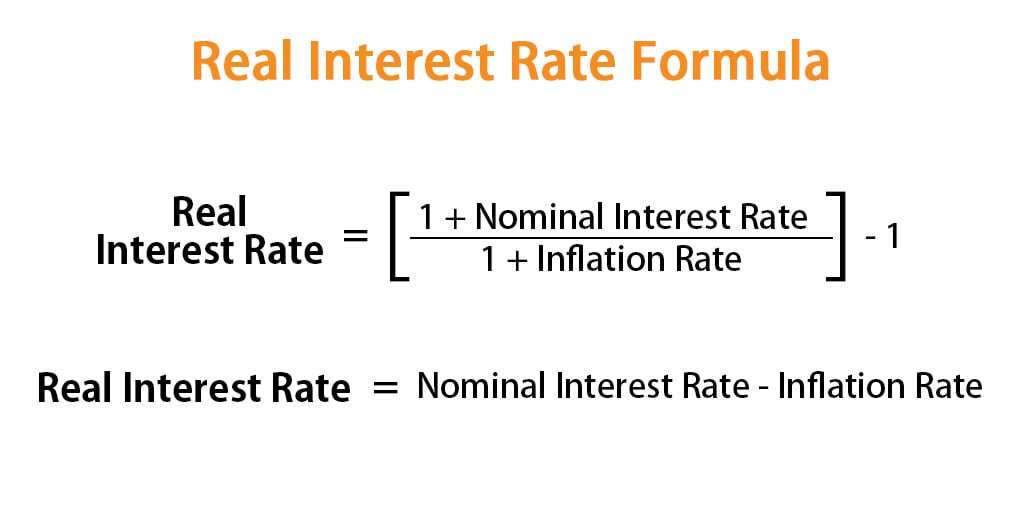

Real Interest Rate Formula Calculator Examples With Excel Template

Explaining Interest Rates And Points Emily Caryl Ingram

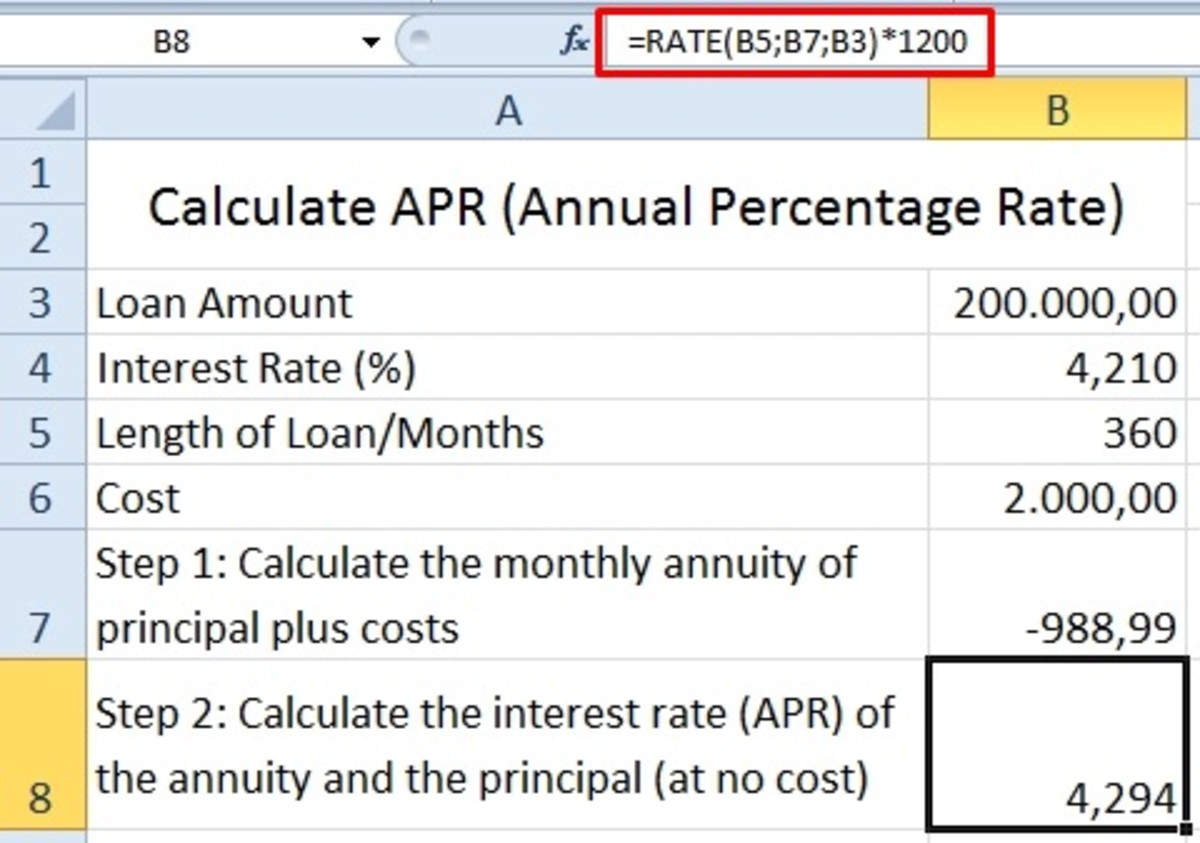

40 Excel Interest Formula Latest Formulas

Interesse Composto Come Sfruttarlo Al Meglio Investendo

Understanding Interest Rates Your Mortgage 2020 Guide

https://www.georgebrown.ca//formula_sheet_for_financial_…

P 1 rt S is the future value or maturity value It is equal to the principal plus the interest earned COMPOUND INTEREST FV PV 1 i n nominal annual rate of interest number of compounding periods periodic rate of interest PV FV 1 i n ANNUITIES OR PV Tutoring and Learning Centre George Brown College 2014

https://www.atb.com/siteassets/legacy/Form_3676.pdf

Table of Interest Rate Equivalents ANNUAL INTEREST RATES CALCULATED MONTHLY NOT IN ADVANCE CONVERTED TO EQUIVALENT INTEREST RATE CALCULATED HALF YEARLY NOT IN ADVANCE The interest rate payable under the mortgage is calculated monthly not in advance

https://vindeep.com/Corporate/InterestRateConversion.aspx

It can be computed in Excel by this function EXP R 1 Interest rate conversion formulas for comparing and converting interest rates with different interest payment periodicities

https://onlinelibrary.wiley.com/doi/pdf/10.1002/9780470548813.…

276 COMPOUND INTEREST TABLES TABLE C 1 0 25 Compound Interest Factors 0 25 Single Payment Uniform Payment Series Compound Present Sinking Capital Compound Present Amount Worth Fund Recovery Amount Worth n Factor Factor Factor Factor Factor Factor n Find F Find P Find A Find A Find F Find P given P given F given F

https://ecampusontario.pressbooks.pub/businessmathtextbook/chapter/9-6

The Formula latex colorbox LightGray Formula 9 6 color BlueViolet text Interest Rate Conversion i text New 1 i text Old frac C Y text Old C Y text New 1 latex How It Works Follow these steps to

Interest Rate Table Future Value FV Columns Columns 20 max Starting Value Increments Periods n Rows Rows 50 max Starting Period Increments Answer Print Table Interest Rate to Grow 1 I F V 1 1 n 1 100 n FV 2 00 2 50 3 00 10 7 1773 9 5958 11 6123 11 6 5041 8 6867 10 5032 12 5 9463 7 9348 9 5873 There are five tables in this appendix that relate to the most common calculations used for interest rate analyses Each one uses a standard format that lists the interest rate from 1 to 13 across the top and the number of years from 1 to 30 down the left side

A compound interest table will help you understand the potential return of your investment Here we explain compound interest tables and how to use them Young Research Publishing Inc