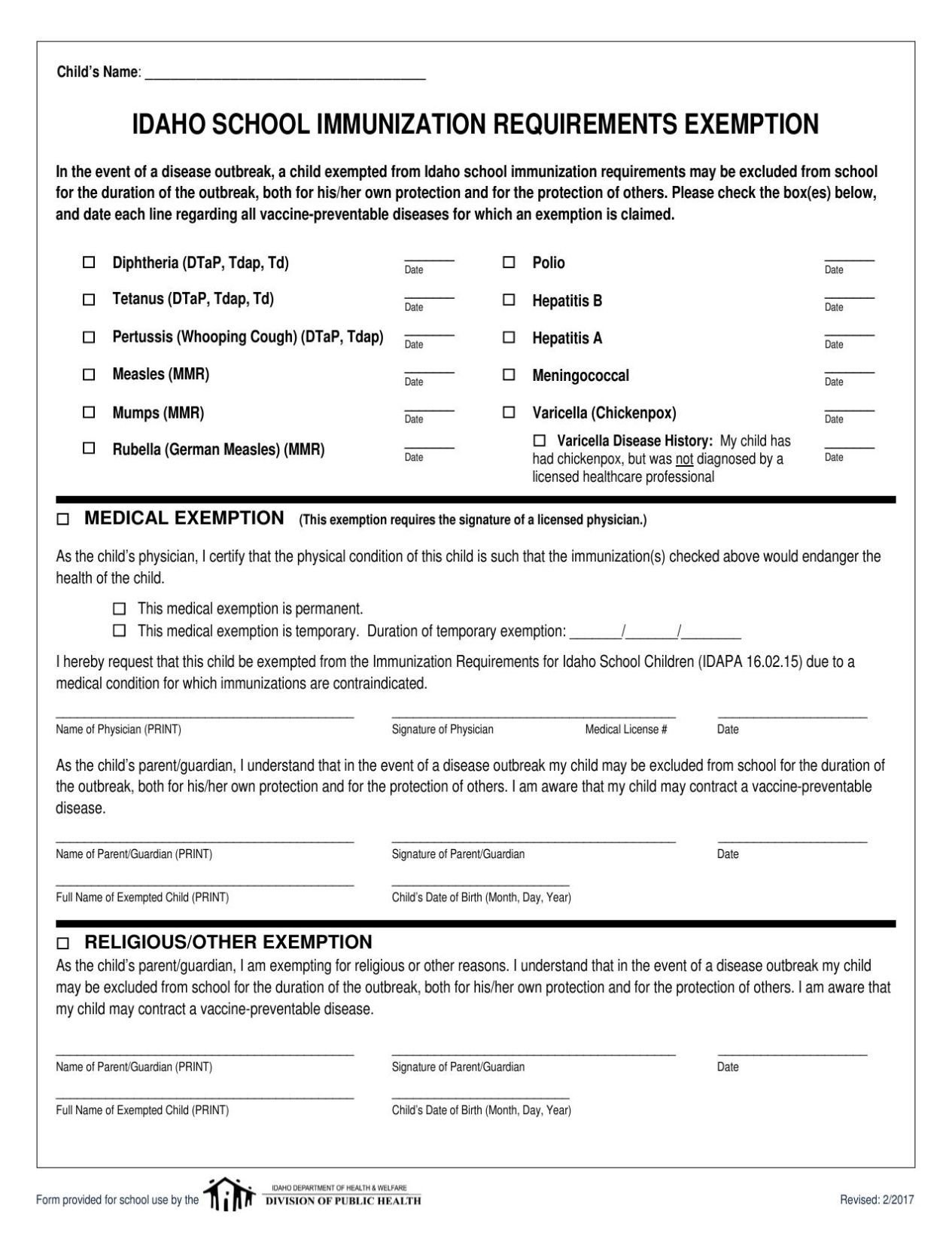

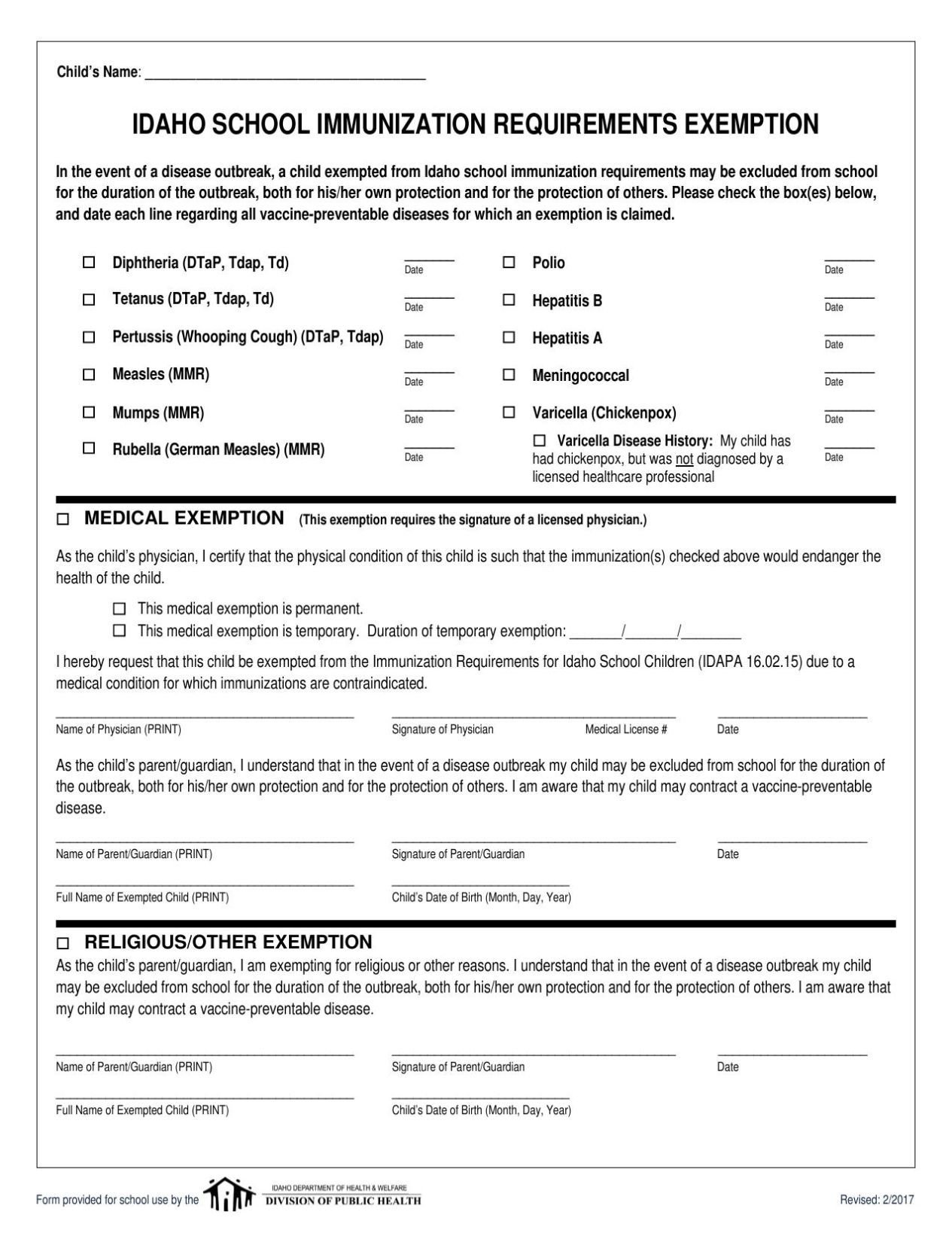

Printable Form Of Exemptions For Employee The person requesting a medical exemption is in possession of a provincial or territorial government issued credential e g QR code confirming that the person cannot be vaccinated The employer must verify the credential prior to granting a medical exemption

Exempt vs non exempt employees Below is a list of differences between exempt and non exempt employees Overtime pay If you re an exempt employee the CLC does not entitle you to receive overtime pay for working more than the standardized number of hours 40 hours per week Exempt employees are usually Paid on a salary rather than an hourly basis and their work is either executive or professional Distinguished from non exempt employees who are required to be paid at least the minimum wage and overtime when working more than the standard 40 hour workweek

Printable Form Of Exemptions For Employee

Printable Form Of Exemptions For Employee

Printable Form Of Exemptions For Employee

https://bloximages.chicago2.vip.townnews.com/idahopress.com/content/tncms/assets/v3/editorial/0/eb/0eb7d401-cd9d-5767-866c-d3b6403968d1/59a0ae638cdd6.preview.jpg

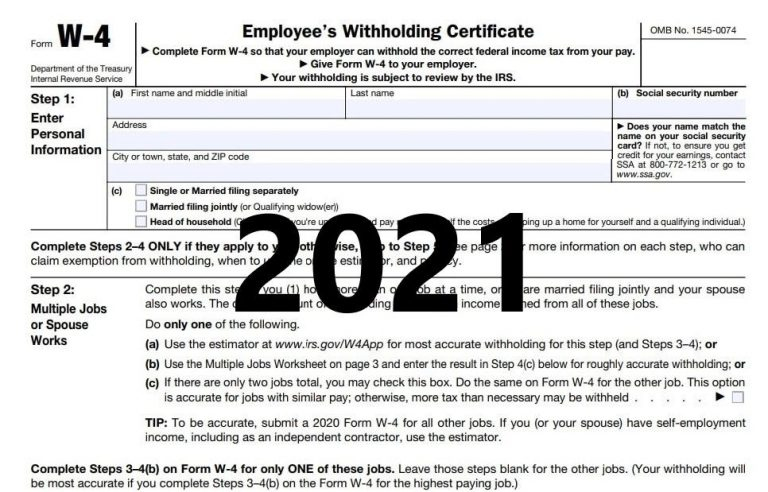

An employee who submits a false Form W 4 may be subject to a 500 penalty When an employer gets an invalid Form W 4 the employer does not use it to figure federal income tax withholding The employer should inform the employee that it is invalid and ask the employee for a corrected form

Templates are pre-designed documents or files that can be used for different purposes. They can save effort and time by providing a ready-made format and layout for developing different kinds of content. Templates can be used for individual or professional tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Printable Form Of Exemptions For Employee

Printable Form Of Exemptions For Employee Printable Forms Free Online

M1 Fillable Form Printable Forms Free Online

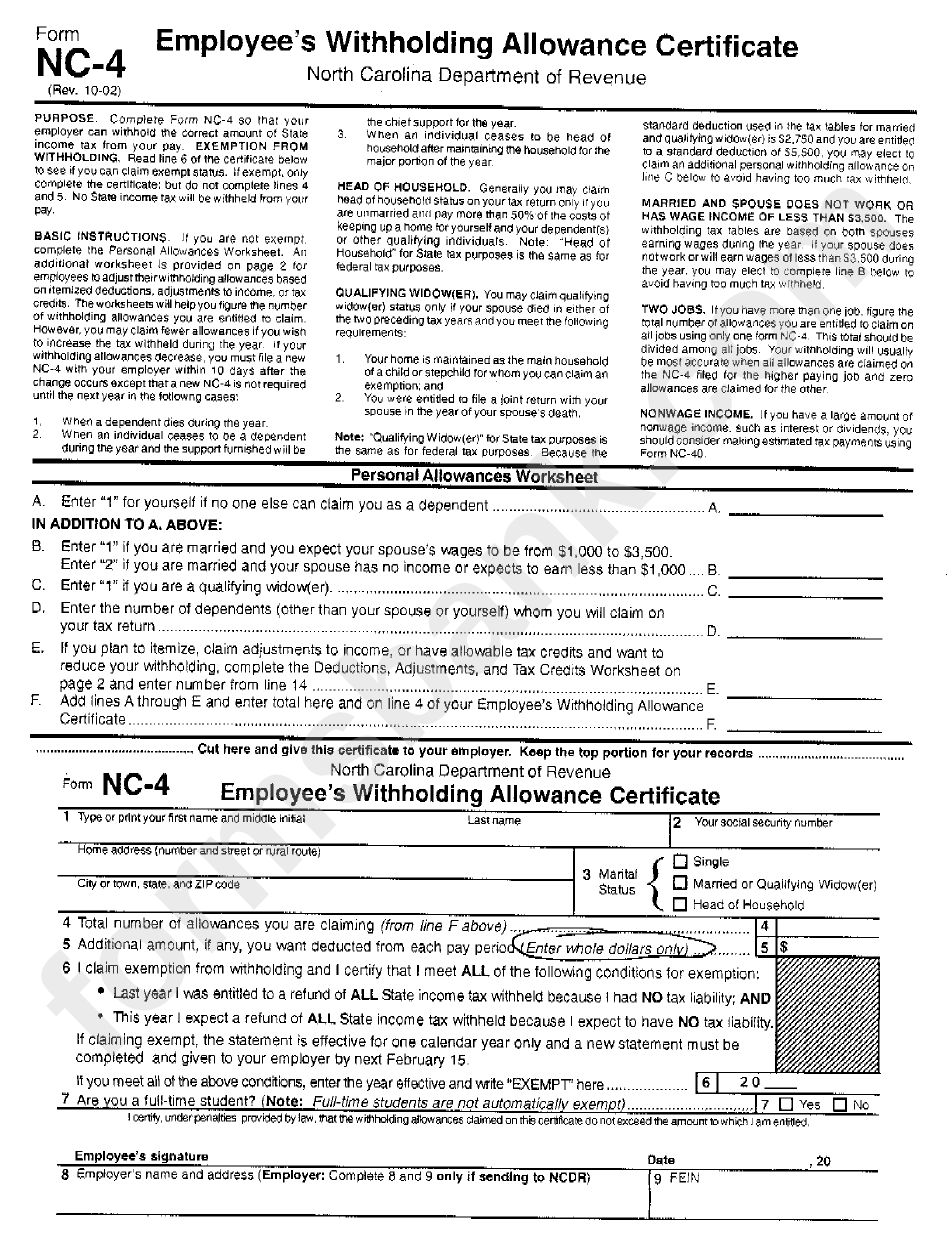

Nc 4 Printable Form Printable Forms Free Online

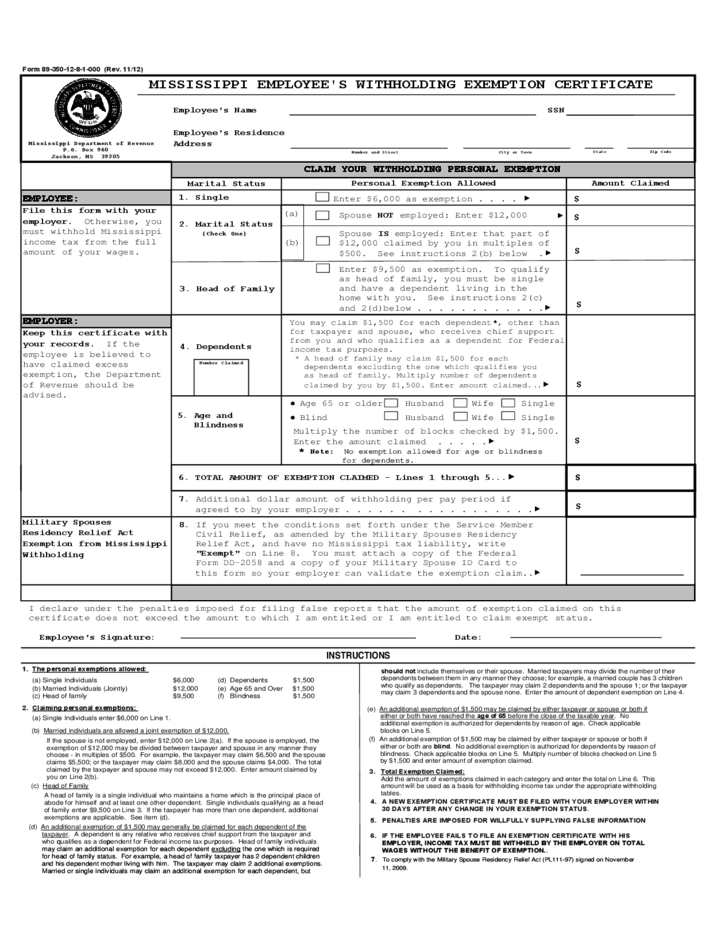

Mississippi Employee Withholding Form 2021 2022 W4 Form

Ohio Vaccine Exemption Sample Letter The Basics

Enter On Line 1 Below The Number Of Personal Exemptions Fill Out And

https://www.canada.ca/en/revenue-agency/services/forms-publications/td1

Date modified 2022 12 20 As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the amount of tax deducted at source

https://www.canada.ca/en/revenue-agency/services/forms-publications/

2023 09 01 You use this form if you are an employee who works at a special work site It will allow your employer to determine if the certain benefits can be excluded from income

https://www.canada.ca/en/revenue-agency/services/forms-publications/fo…

2023 10 19 This site provides a list of Canada Revenue Agency CRA tax forms listed by form number

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png?w=186)

https://www.ontario.ca/document/industries-and-jobs-exemptions-or

With a few exceptions most employees and employers in Ontario are covered under the Employment Standards Act ESA There are also some employees who are not covered by certain parts of the act known as exemptions covered by special rules that change how certain parts of the act apply

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg?w=186)

https://www.ontario.ca/document/employer-health-tax-eht/forms-and

All eligible employers in an associated group must enter into an agreement to allocate the tax exemption for the year One of the employers in the group must complete this form Authorizing or Cancelling a Representative Authorization for the ministry to collect and disclose personal information

You can download and print a Form W 4 order multiple copies or call 800 TAX FORM 800 829 3676 You may also use a substitute Form W 4 you developed instead of the official Form W 4 if you also provide the tables instructions and worksheets contained in the Form W 4 in effect at that time Income tax would have been withheld if the employee had claimed no more than one withholding allowance or had not claimed exemption from withholding on Form W 4 Employee s Withholding Allowance Certificate Current Revision Form W 2 PDF Instructions for Forms W 2 and W 3 Print Version PDF

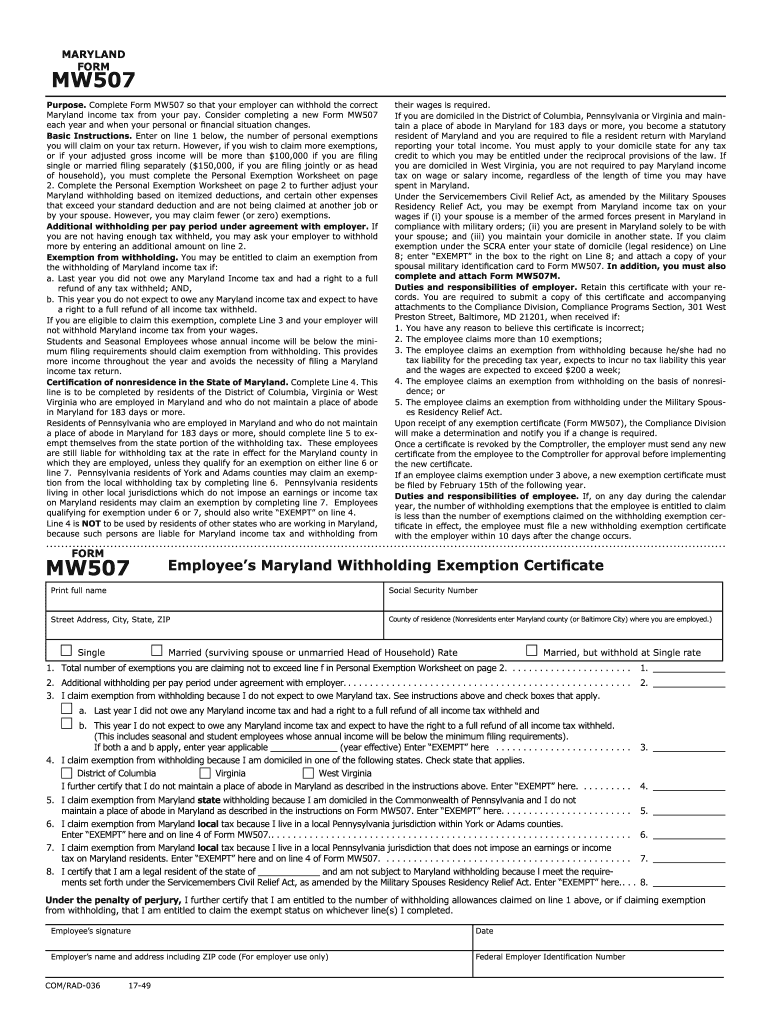

Purpose of Form Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty If too much is