Printable Federal Tax Withholding Form For best results download and open this form in Adobe Reader See General information for details You can view this form in PDF td1 23e pdf PDF fillable saveable td1 fill 23e pdf For people with visual impairments the following alternate formats are also available Large print td1 lp 23e pdf Last update 2022 12 20

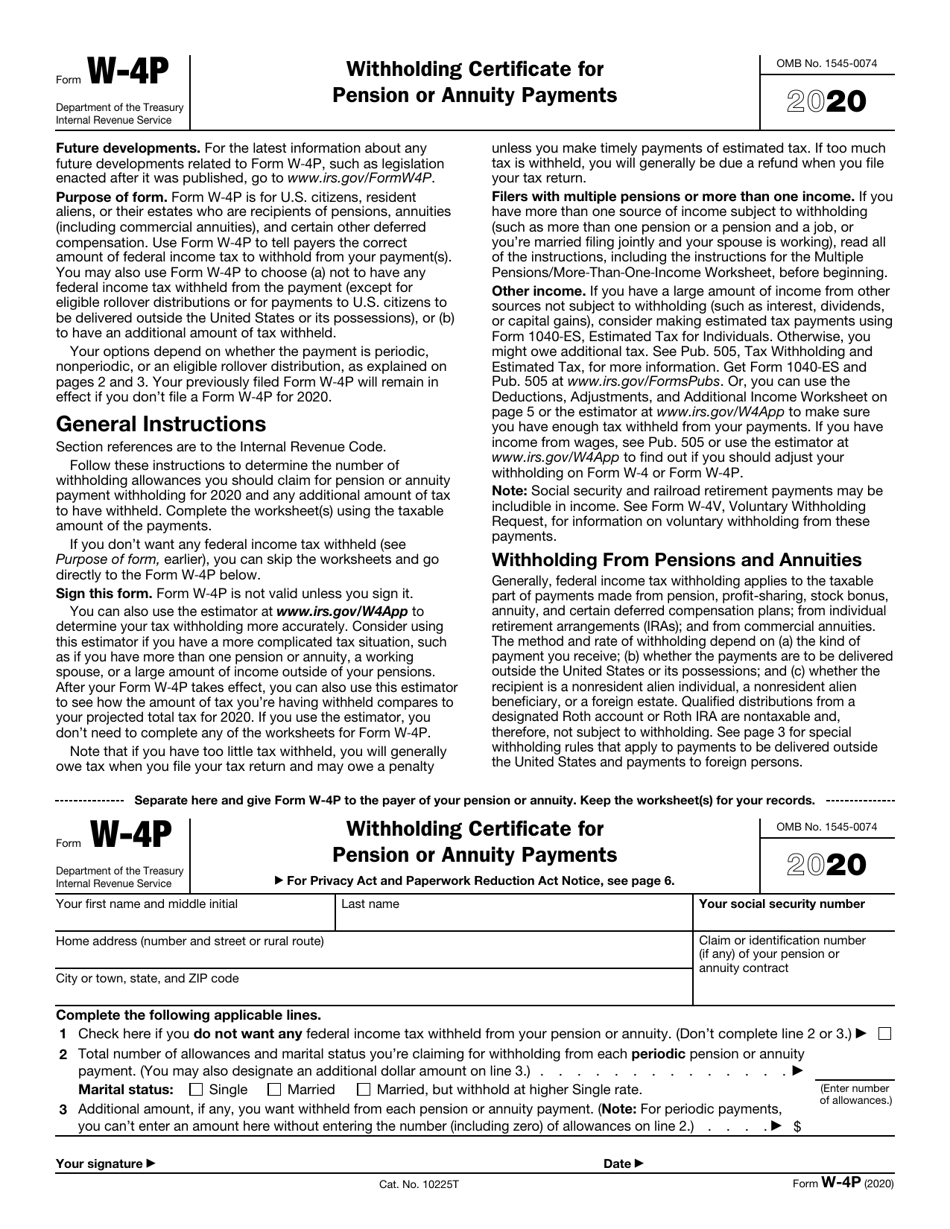

Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks or who must pay the employer s portion of social security or Medicare tax Form 941 PDF Related Instructions for Form 941 PDF Complete Form W 4R to have payers withhold the correct amount of federal income tax from your nonperiodic payment or eligible rollover distribution from an employer retirement plan annuity including a commercial annuity or individual retirement arrangement IRA See page 2 for the rules and options that are available for each type of payment

Printable Federal Tax Withholding Form

Printable Federal Tax Withholding Form

Printable Federal Tax Withholding Form

https://images.sampletemplates.com/wp-content/uploads/2016/10/20145251/Federal-Tax-Withholding-Form.jpg

T1213 Request to Reduce Tax Deductions at Source For best results download and open this form in Adobe Reader See General information for details You can view this form in PDF t1213 23e pdf PDF fillable saveable t1213 fill 23e pdf Last update 2023 09 13 Report a problem on this page

Templates are pre-designed files or files that can be used for numerous functions. They can save time and effort by offering a ready-made format and layout for creating various sort of material. Templates can be used for individual or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Printable Federal Tax Withholding Form

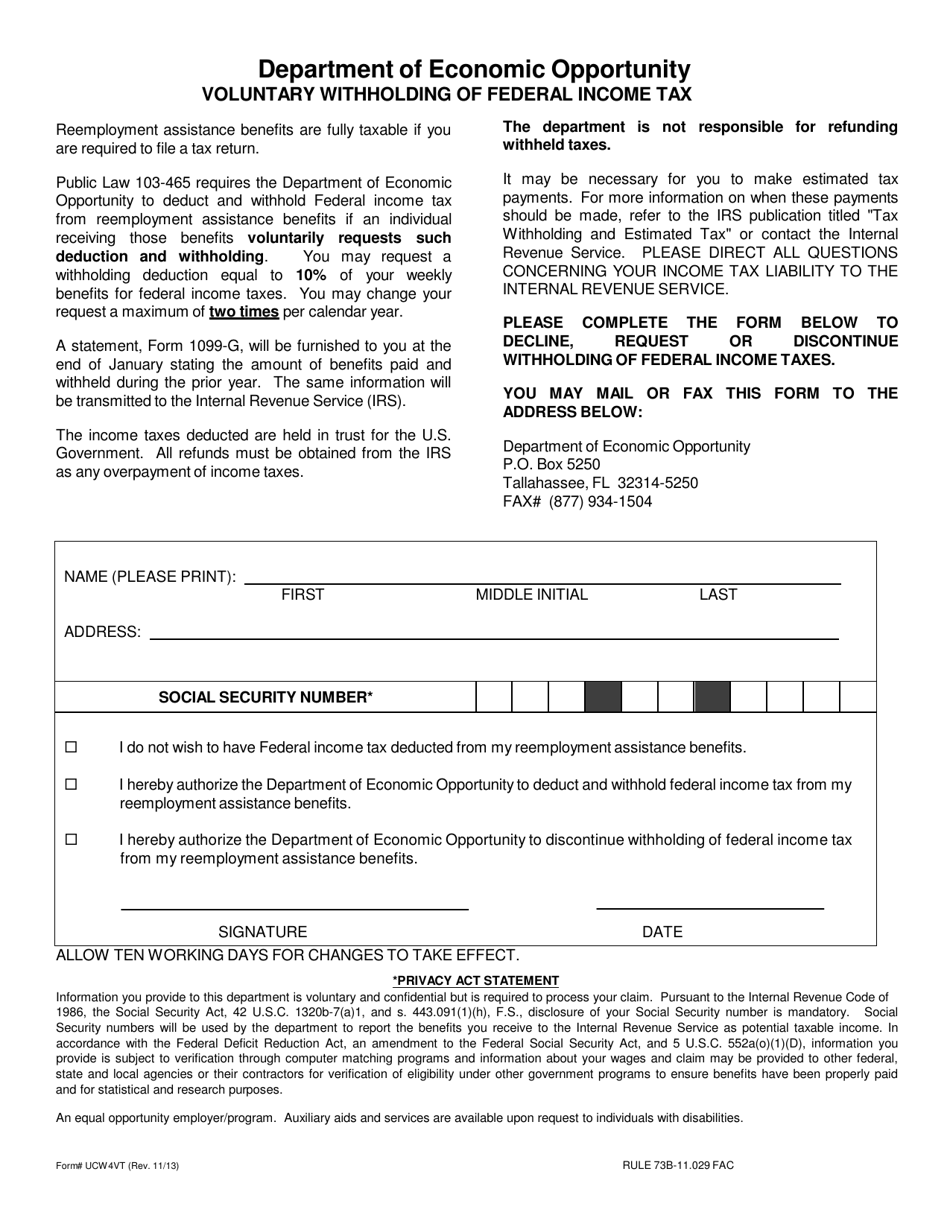

Form UCW4VT Fill Out Sign Online And Download Printable PDF Florida

IRS Urges Taxpayers To Review Their Withholding Status CALCULATOR WDET

IRS Form W 4P Download Fillable PDF Or Fill Online Withholding

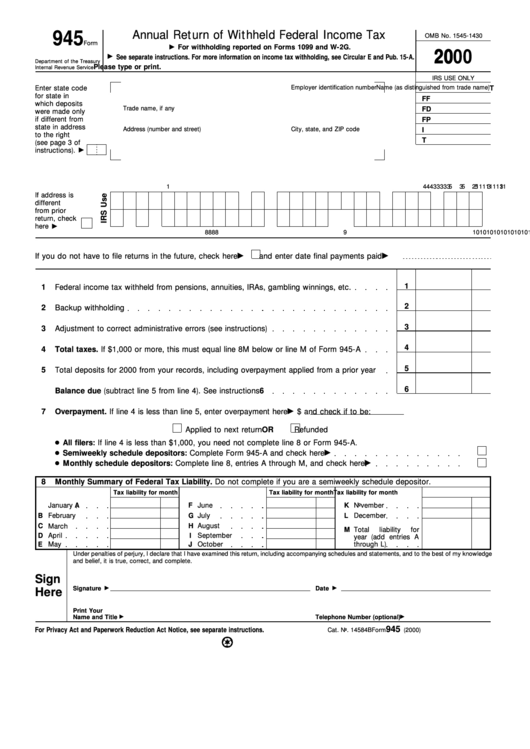

Form 945 Annual Return Of Withheld Federal Income Tax 2000

57 PDF PRINTABLE PDF ONLINE FREE PRINTABLE DOWNLOAD DOCX ZIP Printable

Tax Withholding Form Federal Withholding Tables 2021

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/

Employers and payers must get Form TD1 Personal Tax Credits Return when individuals start a new job or they want to increase income tax deductions This is used to calculate the amounts to withhold from their employment income or other income such as

https://www.irs.gov/pub/irs-pdf/fw4.pdf

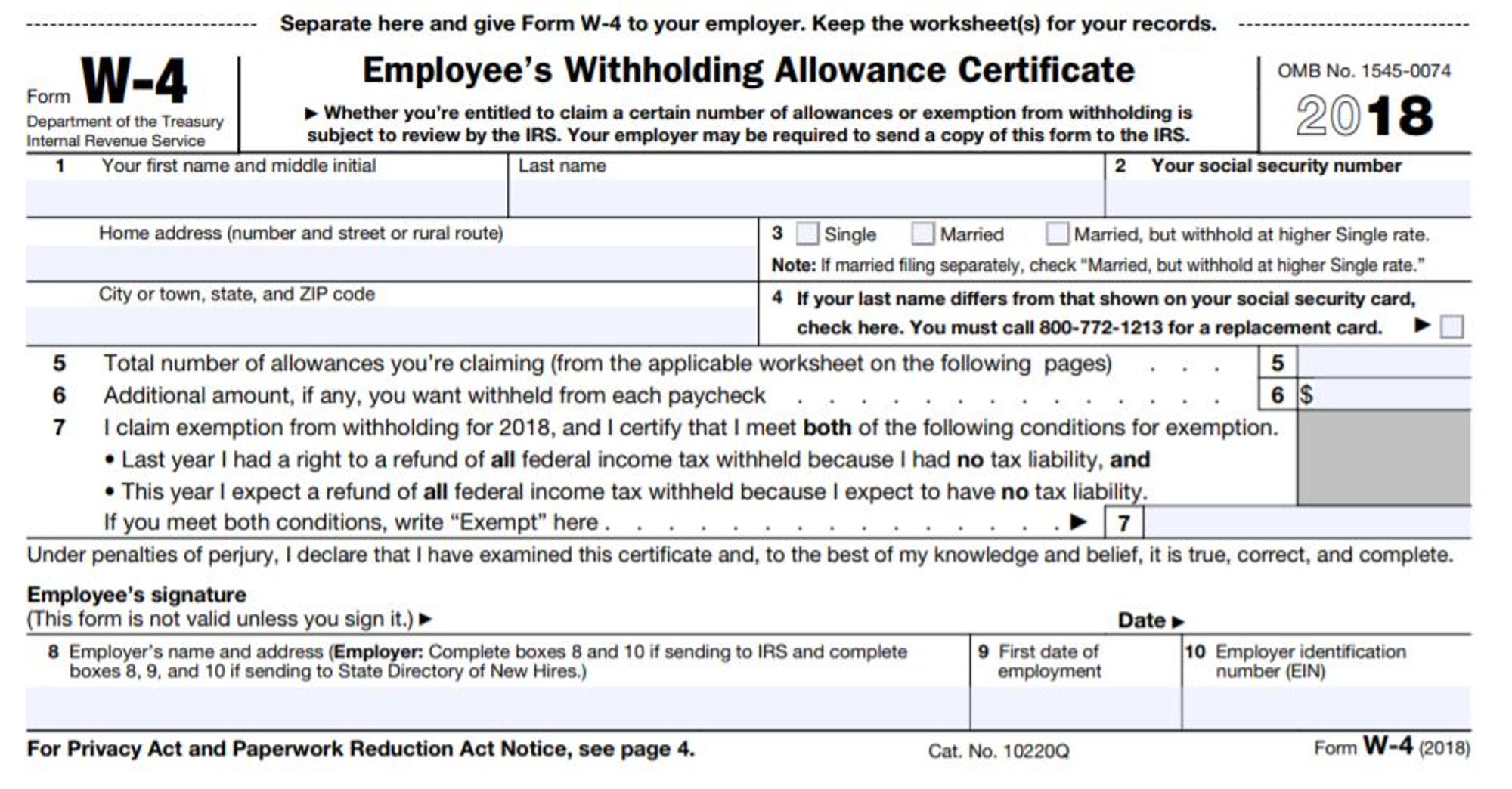

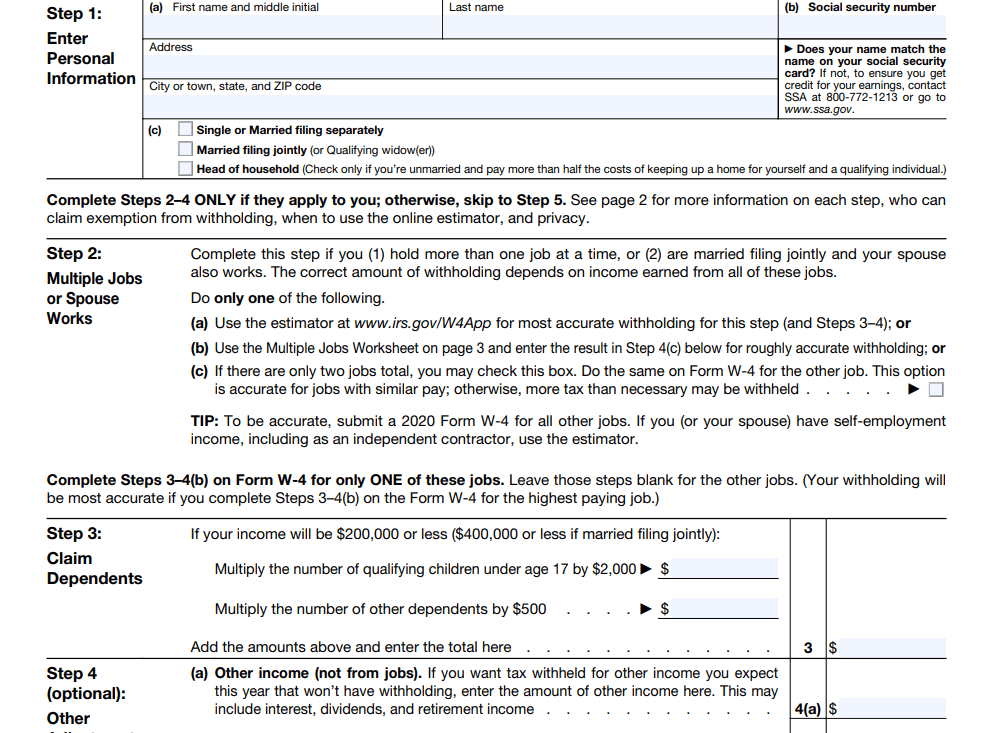

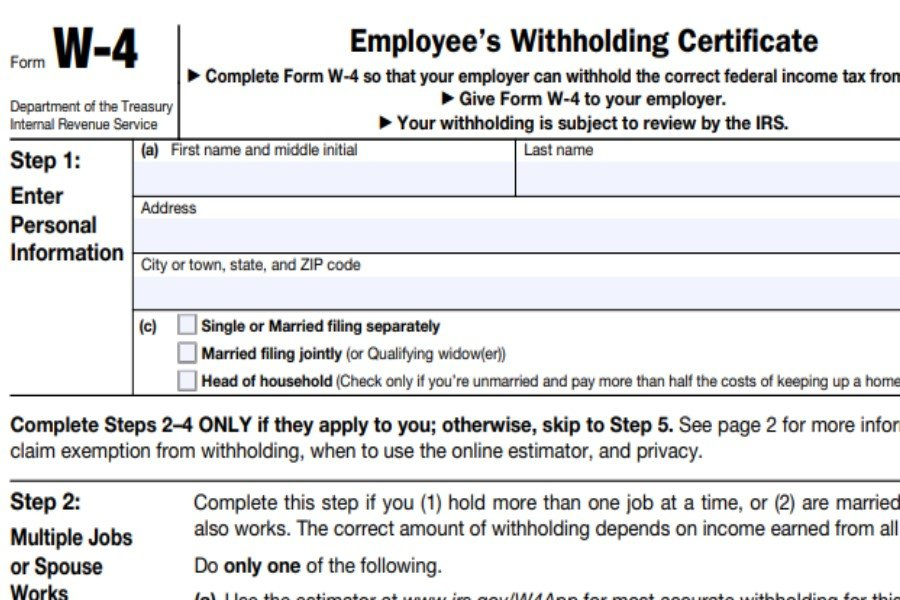

Complete Form W 4 so that your employer can withhold the correct federal income tax from

https://www.irs.gov/pub/irs-prior/fw4--2021.pdf

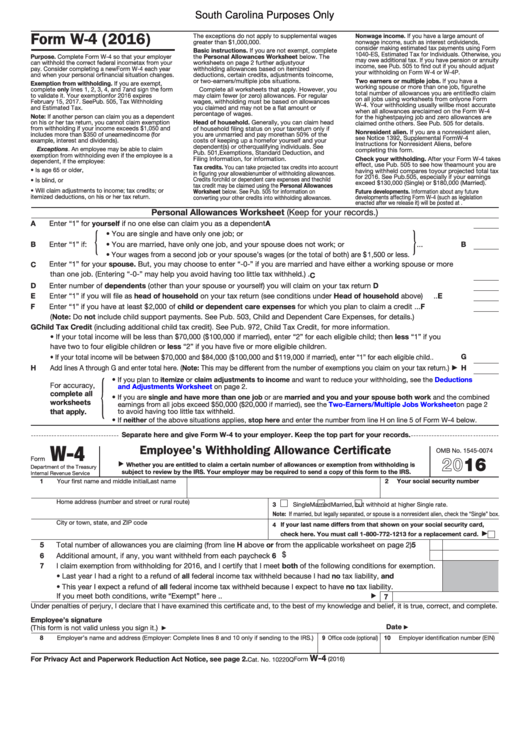

Purpose of Form Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty If too much is

https://www.irs.gov/pub/irs-prior/fw4--2020.pdf

Complete Form W 4 so that your employer can withhold the correct federal income tax from your

https://catalogue.servicecanada.gc.ca/apps/EForms/pdf/en/ISP …

Your CPP OAS Benefit is taxable income You should consider your personal tax situation before choosing an amount If you decide to have us withhold voluntary tax deductions you may request an amount or percentage now and have it changed at a later date

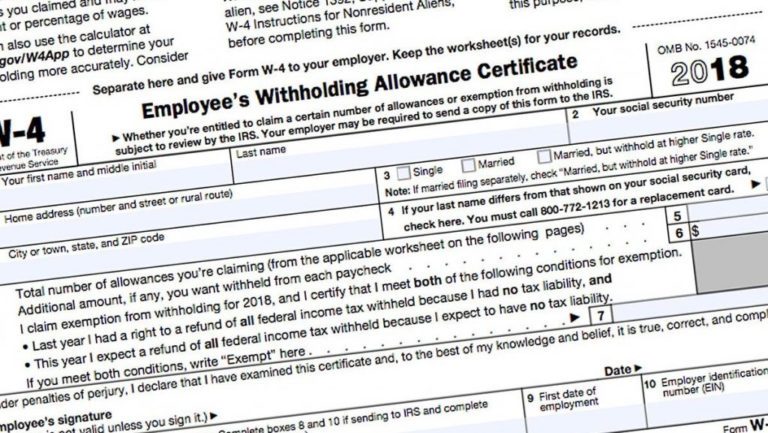

A W 4 form formally titled Employee s Withholding Certificate is an IRS tax document that employees fill out and submit to their employers Employers use the information provided on a W 4 REQUEST FOR VOLUNTARY FEDERAL INCOME TAX DEDUCTIONS Canada Pension Plan CPP and Old Age Security OAS 1 Social Insurance Number 2 Mr Mrs Ms MissGiven name initial and family name 3 Home address Need help completing the forms Canada or the United States 1 800 277 9914 All other countries 613 990 2244

In this video you ll learn 1 How Form W 4 has changed 2 Where to find instructions 3 Where to estimate withholding Now let s begin The IRS issued a new Form W 4 in 2020 The new design is simple accurate and gives employees privacy while minimizing the burden on employers and the payroll process