Printable Exemption Form For Debt Relief IRS Forms and Instructions Savings Bonds and Treasury Securities Forms Bank Secrecy Act Forms Treasury International Capital TIC Forms and Instructions Alcohol and Tobacco Tax and Trade Bureau TTB Forms Office of the Comptroller of the Currency Forms usa gov forms

No Do not file this Form 8857 but go to line 2 to see if you can file a different form 2 Did the IRS take your share of a joint refund from any tax year to pay any of the following past due debt s owed ONLY by the person listed on line 6 Child support Spousal support Student loan or other federal nontax debt Federal or Here are the criteria you need to meet You re a current federal student loan holder You earn less than 125 000 a year or your household earns less than 250 000 a year You re a Pell Grant

Printable Exemption Form For Debt Relief

Printable Exemption Form For Debt Relief

Printable Exemption Form For Debt Relief

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/pa-exemption-certificate-fill-out-and-sign-printable-pdf-template-4.png

Complete an application package Form 433 A OIC individuals or 433 B OIC businesses and all required documentation as specified on the forms Form 656 s you must submit individual and business tax debt Corporation LLC Partnership on separate Forms 656 205 application fee non refundable

Templates are pre-designed files or files that can be used for numerous purposes. They can save effort and time by supplying a ready-made format and design for producing different type of material. Templates can be utilized for individual or expert projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Printable Exemption Form For Debt Relief

Tax Exemption Form Printable Ohio Non Profit Printable Forms Free Online

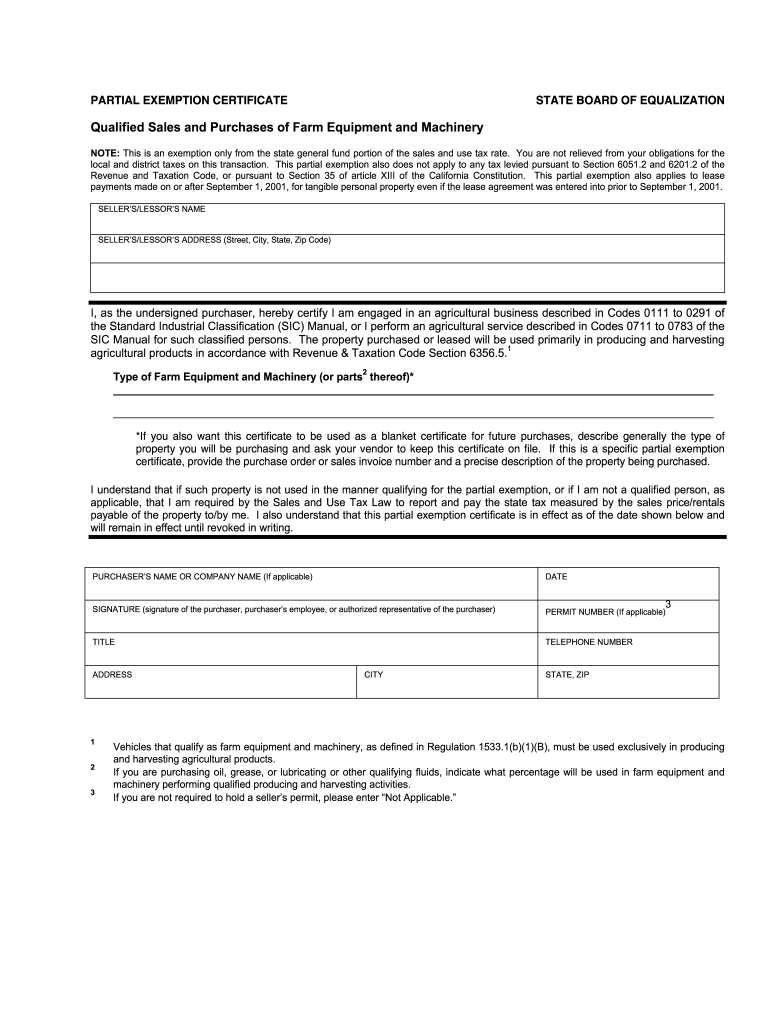

California Ag Tax Exemption Form Fill Out And Sign Printable PDF

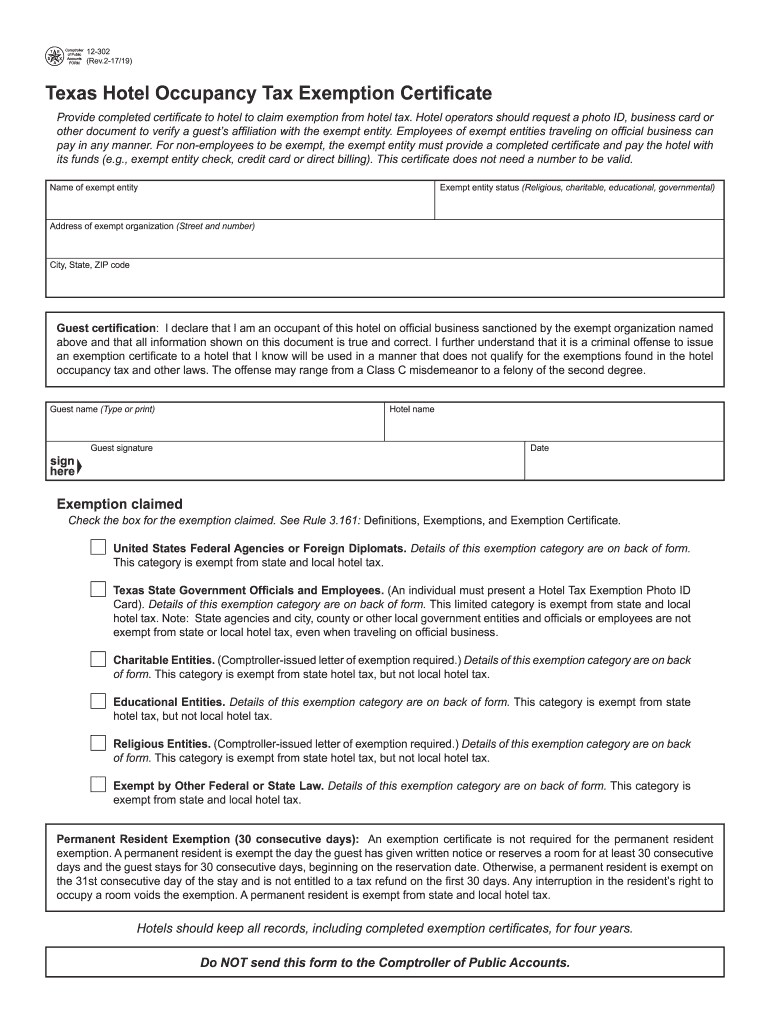

Exemption Waiver Form Fill Online Printable Fillable Blank PdfFiller

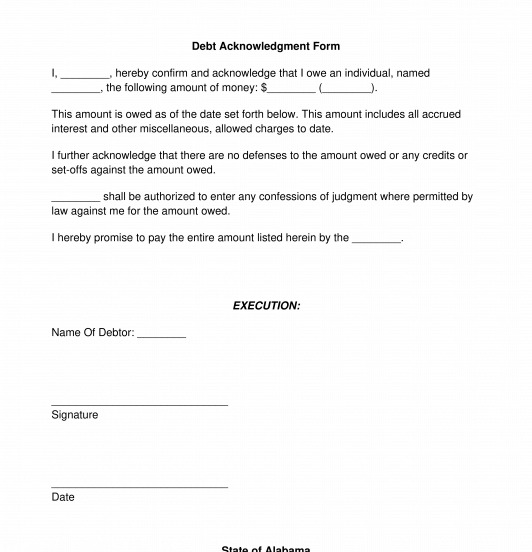

Debt Snowball Form Charlotte Clergy Coalition

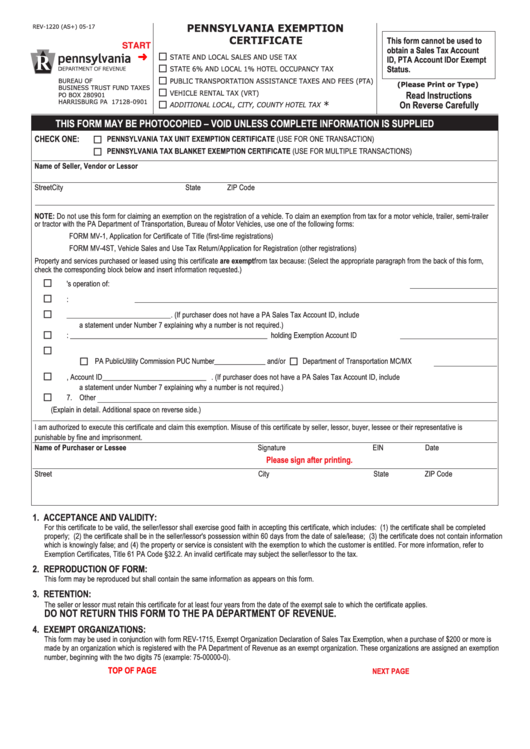

Pa Fillable Tax Forms Printable Forms Free Online

Vaccine Exemption Letter Pa VACCINESA

https://www.irs.gov/pub/irs-pdf/f8944.pdf

Specified tax return preparers use Form 8944 to request an undue hardship waiver from the section 6011 e 3 requirement to electronically file returns of income tax imposed by subtitle A on individuals estates and trusts Unless the

https://studentaid.gov/debt-relief/application

Student Loan Debt Relief The Supreme Court issued a decision blocking us from moving forward with our one time student debt relief plan Visit StudentAid gov debtrelief to learn more about the actions President Biden announced following the decision and find out how this decision impacts you Learn More About Student Loan Debt Relief

https://www.irs.gov/instructions/i982

Qualified principal residence indebtedness can be excluded from income for discharges before January 1 2026 or discharges subject to an arrangement that was entered into and evidenced in writing before January 1 2026 Amount eligible for the exclusion

https://www.irs.gov/forms-pubs/about-form-1099-c

Page Last Reviewed or Updated 07 Mar 2023 Information about Form 1099 C Cancellation of Debt Info Copy Only including recent updates related forms and instructions on how to file File 1099 C for canceled debt of 600 or more if you are an applicable financial entity and an identifiable event has occurred

https://www.irs.gov/pub/irs-pdf/f982.pdf

Form 982 Rev March 2018 Department of the Treasury Internal Revenue Service Reduction of Tax Attributes Due to Discharge of Indebtedness and Section 1082 Basis Adjustment Attach this form to your income tax return Go to www irs gov Form982 for instructions and the latest information

If one of your creditors canceled a debt you owe you ll likely receive a Form 1099 C this year A number of exceptions and exemptions can eliminate your obligations to pay tax on the canceled debt TABLE OF CONTENTS Canceled debt and your taxes Canceled debt exceptions Deductible debt exception Click to expand Canceled debt Option 1 Request help to get debt relief If you don t think you can pay your copay bills you can request help You can request one of these types of debt relief Request a waiver for all or part of your balance If we accept your request we ll stop collection and forgive your debt Make a compromise offer

A lender would issue the debtor a Form 1099 C which is a tax form showing the amount of the cancelled or forgiven debt The form is issued during tax season for the prior year when the