Printable Employer Quarterly Unemployment Insurance Tax Report Form Prepare to apply Complete and submit your online application right away If you apply more than 4 weeks after your last day of work you may lose benefits When you apply you ll need your social insurance number SIN if your SIN begins with a 9 you need to supply proof of your immigration status and work permit

The indexing factor for January 1 2023 is 6 5 The tax credits corresponding to the claim codes in the tables have been indexed accordingly Employees will automatically receive the indexing increase whether or not they file Form TD1ON 2023 Ontario Personal Tax Credits Return Use this worksheet to calculate some of the amounts for your Ontario credits Form ON BEN Application for the 2023 Ontario Trillium Benefit and Ontario Senior Homeowners Property Tax Grant Schedule ON428 A Low income Individuals and Families Tax LIFT Credit Schedule ON479 A Ontario Childcare Access and Relief from Expenses CARE

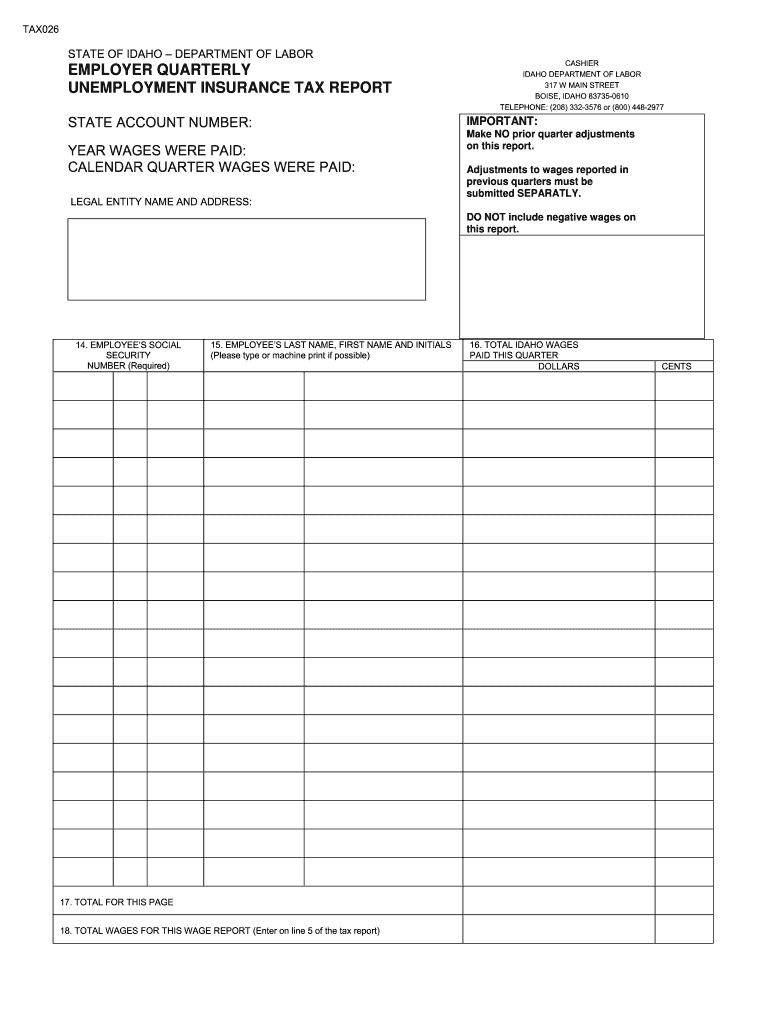

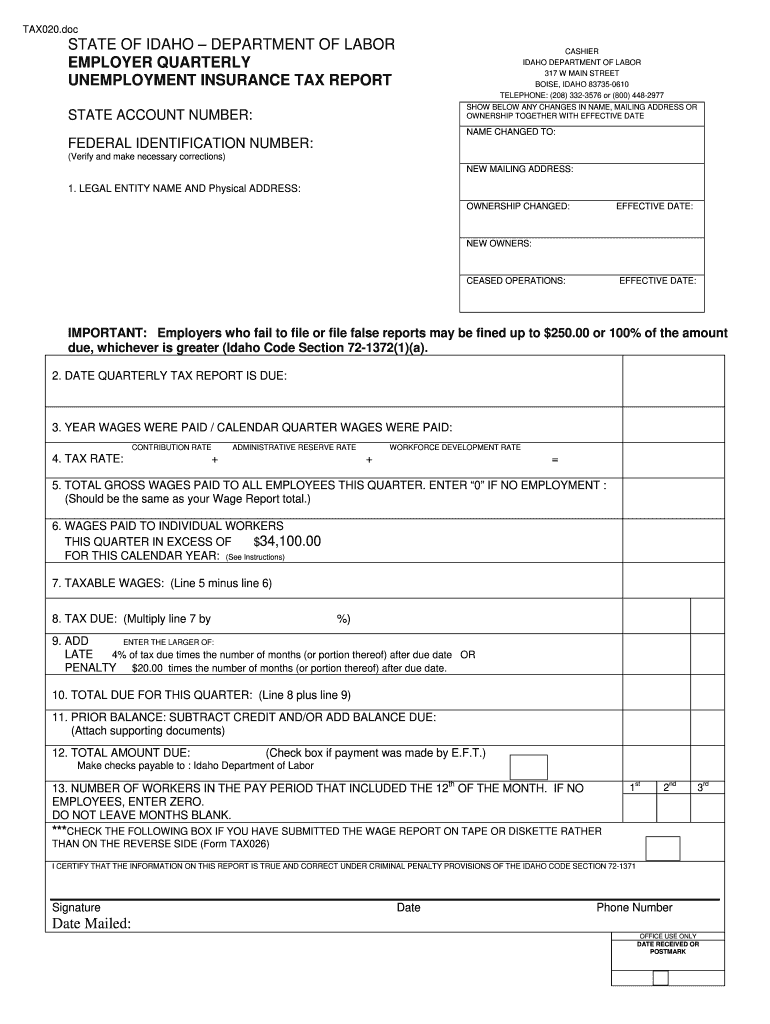

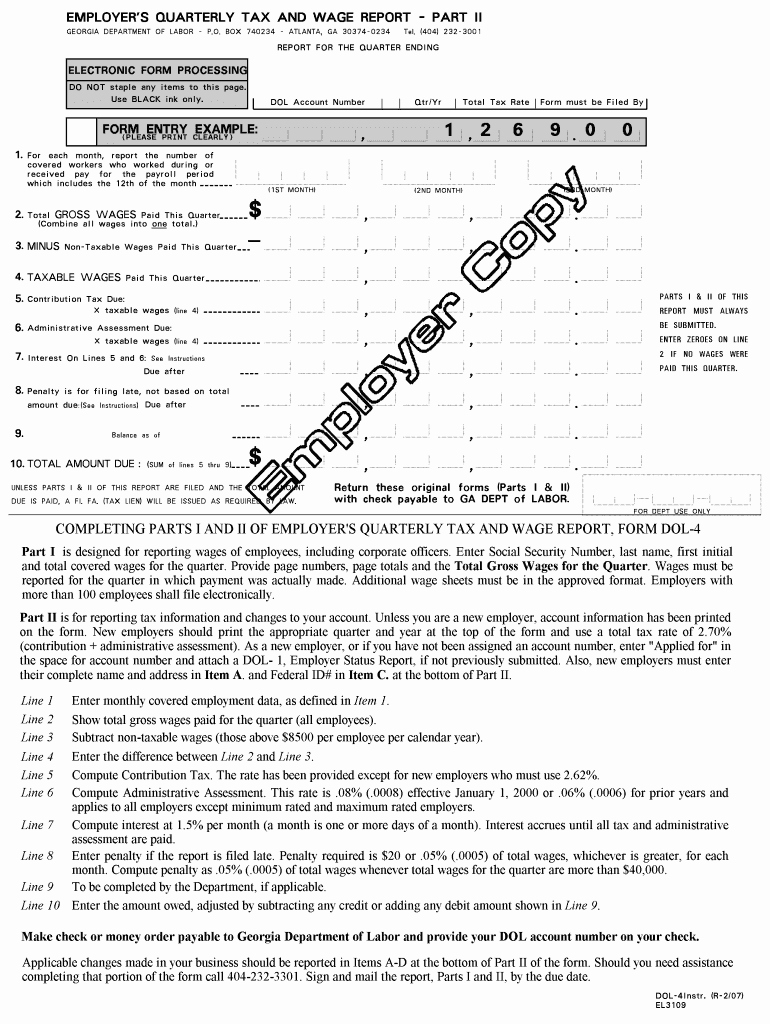

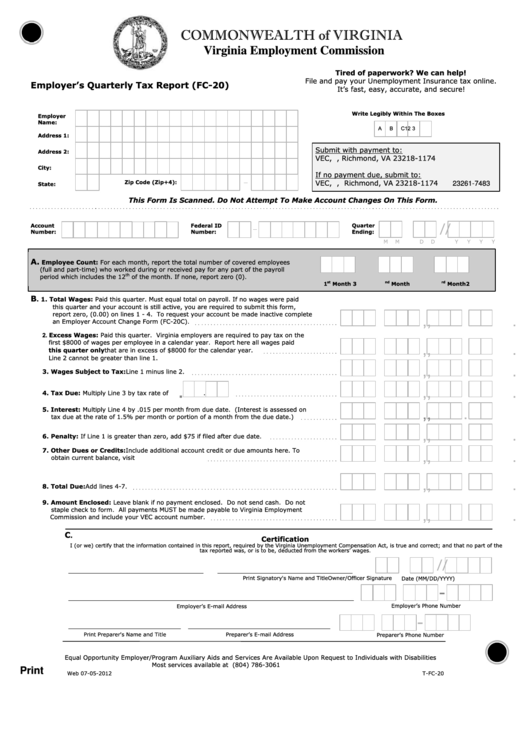

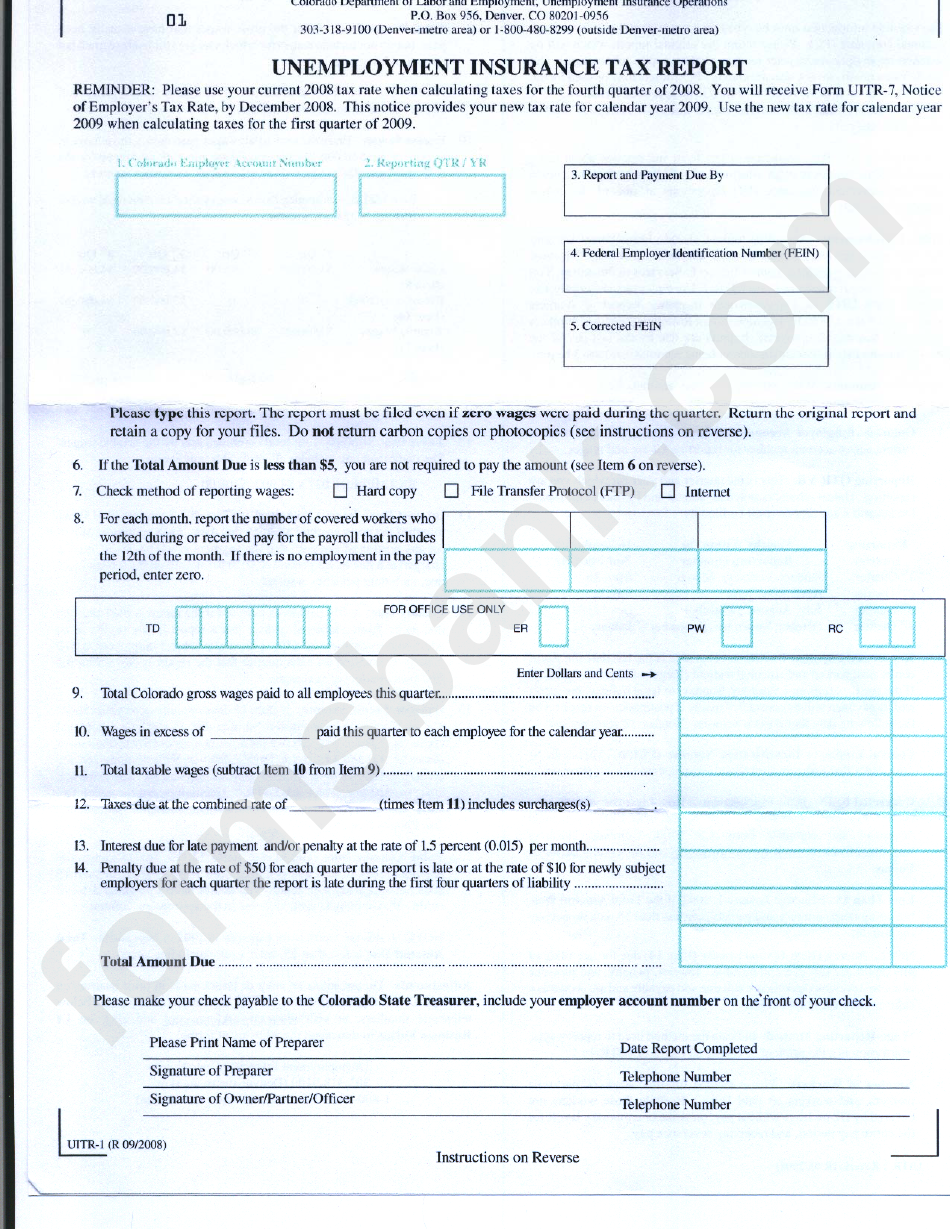

Printable Employer Quarterly Unemployment Insurance Tax Report Form

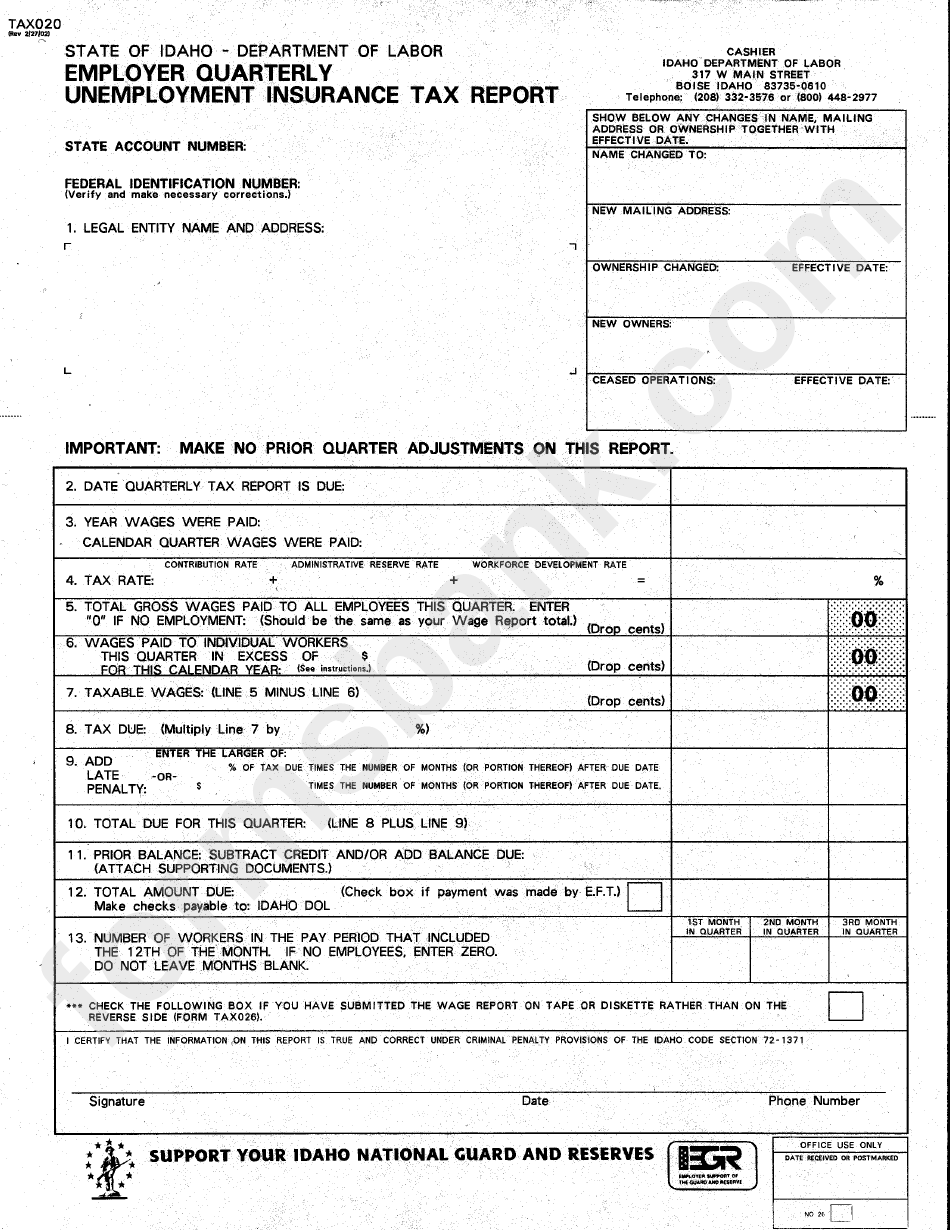

Printable Employer Quarterly Unemployment Insurance Tax Report Form

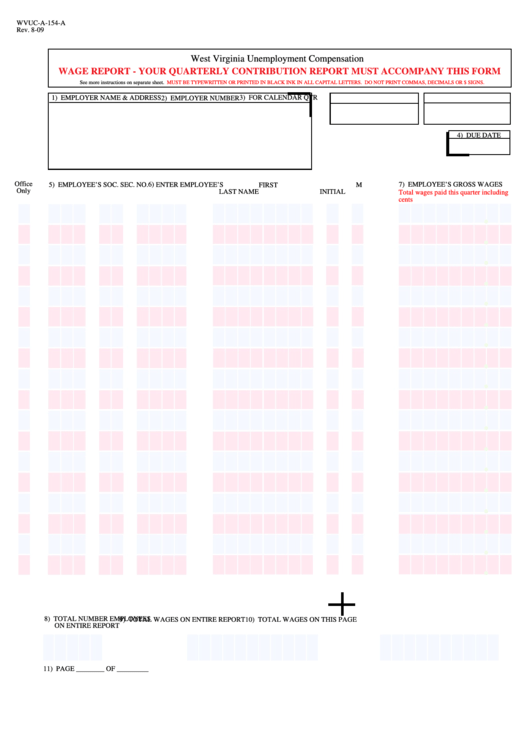

Printable Employer Quarterly Unemployment Insurance Tax Report Form

https://www.pdffiller.com/preview/100/266/100266084/large.png

Find all Canadian federal and provincial 2022 tax forms Based on your tax situation TurboTax provides the tax forms you need Employment income related to multi employer insurance plans RL 24 Child care expenses RL 25 Income from a profit sharing plan TurboTax Online prices are determined at the time of print or electronic

Templates are pre-designed files or files that can be utilized for numerous purposes. They can conserve time and effort by supplying a ready-made format and layout for producing different sort of content. Templates can be used for individual or professional jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

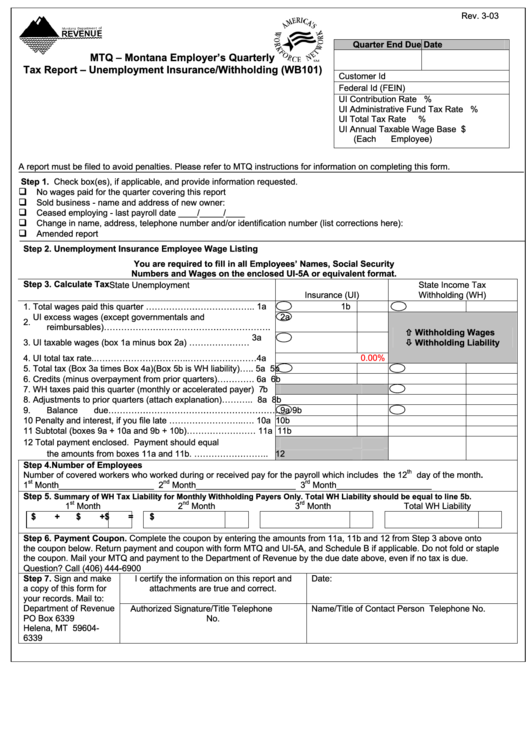

Printable Employer Quarterly Unemployment Insurance Tax Report Form

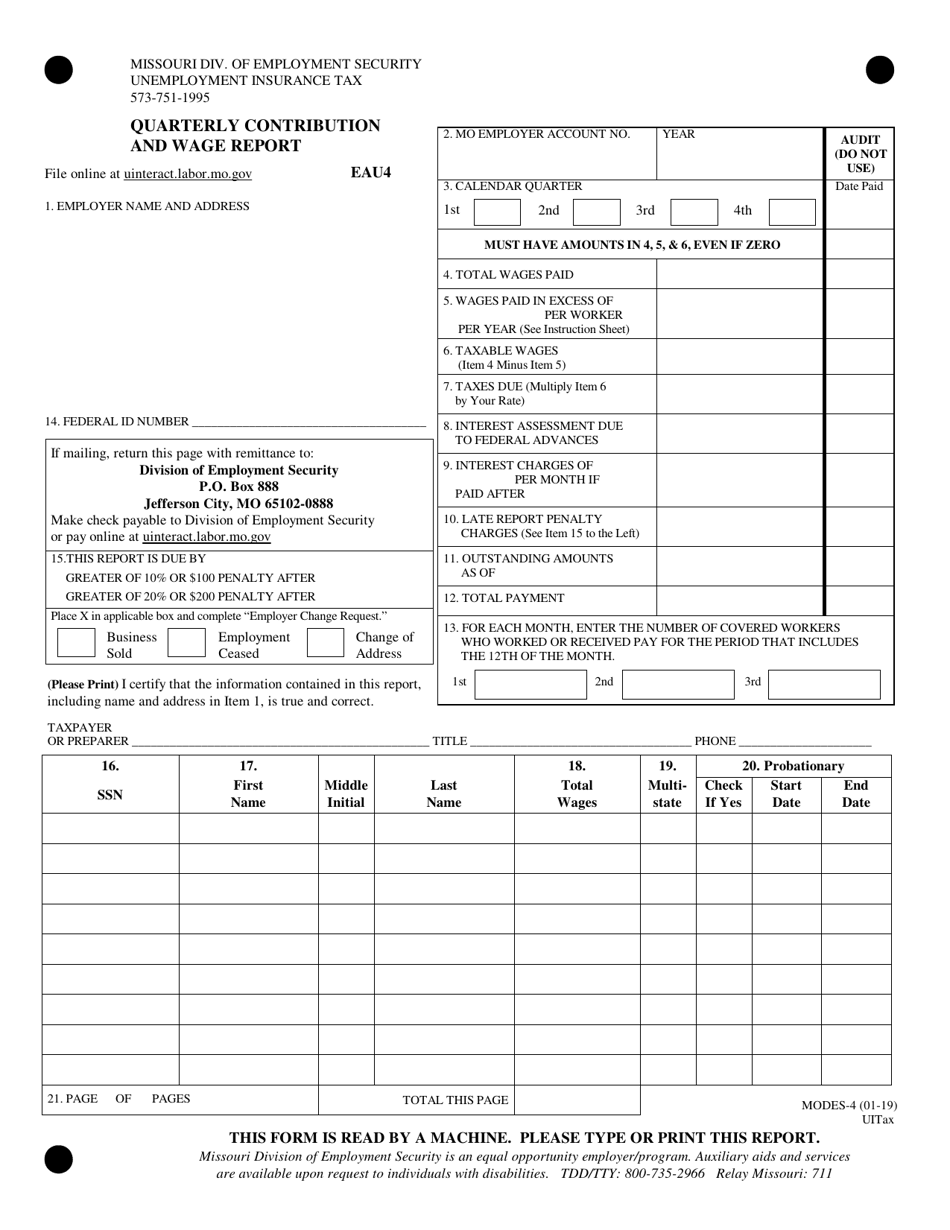

Form MODES 4 Fill Out Sign Online And Download Fillable PDF

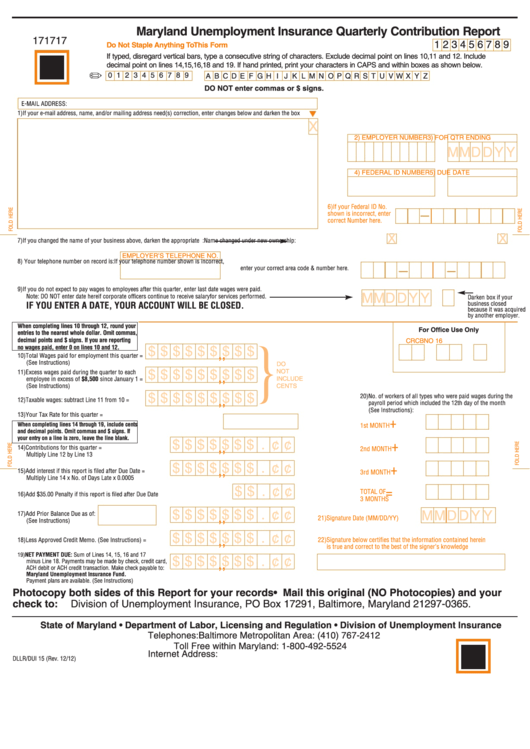

Form Dllr oui 15 Maryland Unemployment Insurance Quarterly

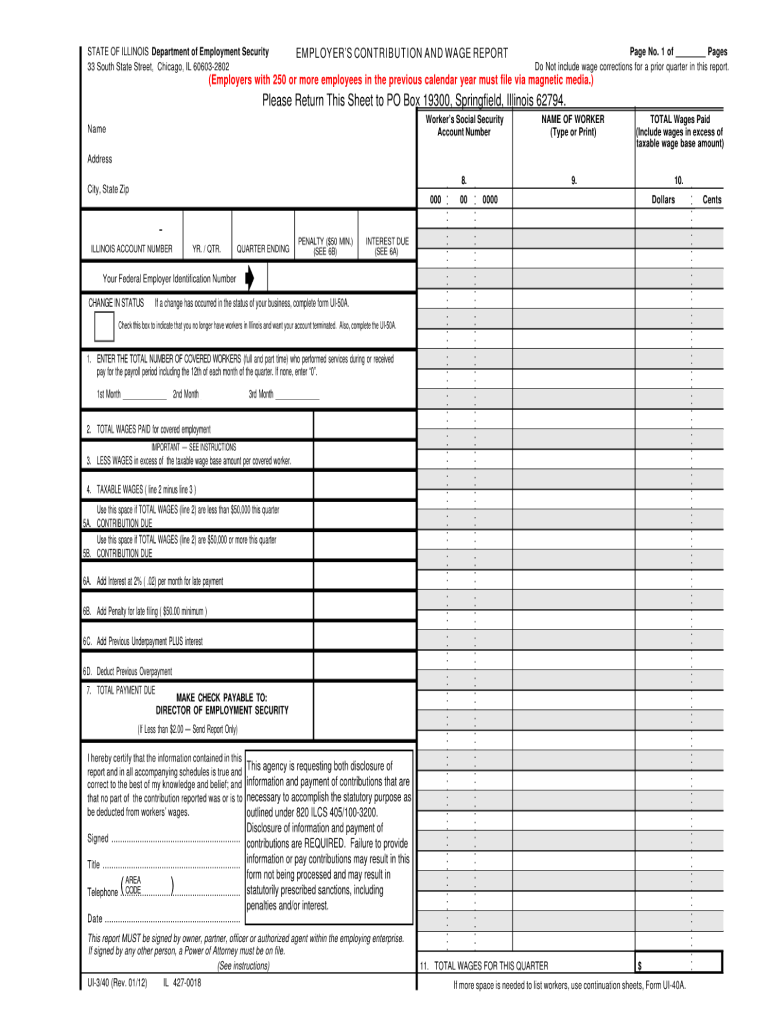

Employer Contribution And Wage Report Illinois Pdf 2012 Form Fill Out

Tax020 Form Fill Out Sign Online DocHub

Form Tax020 Employer Quarterly Unemployment Insurance Tax Report

Wv Unemployment Compensation Contribution Report UNEMPLOYMENT KLO

https://www.canada.ca//corporate/online-services-forms.html

Employment Insurance claim information Status of immigration and or citizenship application s Tax information slips for the Canada Pension Plan Old Age Security and Employment Insurance View or update your Canada Revenue Agency information Your personal information for the Canada Pension Plan and or Old Age Security

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/

What is a T4A slip A T4A slip identifies amounts paid during the calendar year for certain types of income from many different sources including self employed commissions and RESP educational assistance payments You can get a Form T4A in a PDF or PDF fillable saveable format to file on paper

https://miercpa.com/pdfs/Form_1028.pdf

All liable employers are required by Section 13 of the Michigan Employment Security MES Act MCL 431 13 and Administrative Rule 421 121 of the Unemployment Insurance Agency UIA to disclose their tax liability by filing a quarterly tax report Check out how easy this report is to file online through

https://www.canada.ca/en/services/benefits/ei

2023 07 18 Includes information about Employment Insurance EI temporary benefits for workers sickness fishing and family related benefits as well as how to apply online and submit a report

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/

Establishing the number of insurable hours for Record of Employment ROE purposes Learn about the reasons for issuing a Record of Employment ROE and how and when to issue one

The online system may be used to file the Quarterly Tax and Wage Report You may access the online system by signing in For more information about using the online system click here NCUI 101e Note Once you receive confirmation the quarterly report is filed you will be given an option to print the report Printing the report after filing Employer s Quarterly Wage Report Filing Options Texas Workforce Commission TWC Rules 815 107 and 815 109 require all employers to report Unemployment Insurance UI wages and to pay their quarterly UI taxes electronically Employers that do not file and pay electronically may be subject to penalties as prescribed in Sections 213 023 and

UC 8 Quarterly Tax Report For tax reporting for CY2014 through CY2017 UC 8 Quarterly Tax Report For tax reporting for CY2008 through CY2013 UC 8 Quarterly Tax Report For tax reporting for quarters prior to CY2008 View forms for employers brought to you by the Division of Unemployment Insurance