Printable Driving Log Taxes A mileage log sometimes known as a logbook serves as a record of the journeys you make in your car Your log must include a record of both if you use the same vehicle for work and personal use You must be able to show that you travelled the distance you claim only for business purposes which is why you must document both

Free Mileage Log Templates Try Smartsheet for Free By Kate Eby April 13 2018 A well maintained mileage log can make a huge difference for salespeople service workers or anyone who spends a significant time on the road for their job especially if you are self employed Keep a Trip Log to Identify the Business Use of Your Vehicle A separate log should be kept for each vehicle which is driven for both business and personal use For the self employed only the business portion of vehicle expenses can be deducted from income and GST HST input tax credits are only allowed related to the business use of a vehicle

Printable Driving Log Taxes

Printable Driving Log Taxes

Printable Driving Log Taxes

http://templatelab.com/wp-content/uploads/2019/02/drivers-daily-log-20.jpg

Last updated Nov 20 2022 A big perk of using your personal vehicle for business when you re self employed is writing off your motor vehicle expenses But if you re doing this without keeping a mileage log the CRA could reject your claims for these expenses

Templates are pre-designed files or files that can be used for various functions. They can conserve time and effort by offering a ready-made format and layout for creating various type of content. Templates can be used for individual or expert tasks, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Printable Driving Log Taxes

Peerless Google Sheets Mileage Template Best Powerpoint Templates 2018 Free

Example 60 Hour Driving Log Filled Out 339415 How To Fill Out

Free Printable Mileage Log Form Printable Forms Free Online

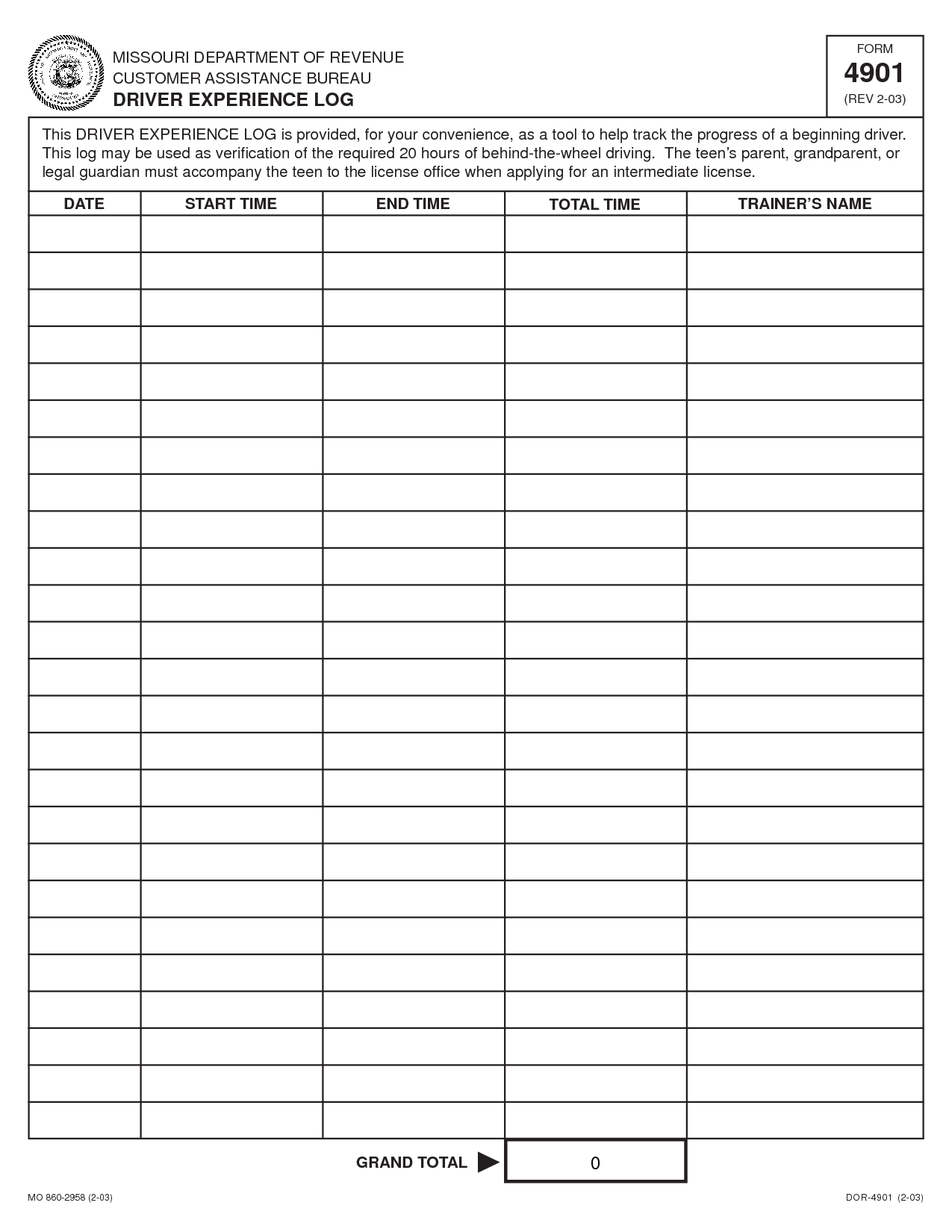

Printable Teen Driving Log Varsity Driving Academy

Free Printable Mileage Tracker Printable World Holiday

Irs Approved Mileage Log Printable

20 Printable Mileage Log Templates Free The IRS has strict rules about the types of driving that can be deducted from your taxes Many business owners are able to deduct the costs associated with their vehicle expenses for repairs and the miles it s driven

Free Download Requirements of a proper mileage log Here are the guidelines for creating and maintaining a proper mileage log A separate logbook must be kept for each vehicle If the vehicle is used by more than one person the driver s name must be recorded for each journey

Keep reading to find out more about CRA mileage log requirements along with how to claim them on next year s taxes What s required when tracking mileage for taxes The Canada Revenue Agency lets taxpayers claim the expenses associated with using their vehicle for work including business mileage

If you use your vehicle to earn income the Canada Revenue Agency CRA lets you claim a business tax deduction based on your mileage To ensure you claim the correct amount you need to track the number of kilometres you drive for both personal and business purposes

Full logbook The best evidence to support the use of a vehicle is an accurate logbook of business travel maintained for the entire year showing for each business trip the destination the reason for the trip and the distance covered

19 Free Printable Mileage Log Templates DocFormats Business 20 Mileage Log Templates If driving is part of your job you qualify to get federal income tax reductions However the qualification to get the federal income tax reductions is largely pegged on a crucial document called the mileage log 50 Printable Driver s Daily Log Books Templates Examples A drivers daily log is a type of document used to monitor and document the daily trips and activities that drivers do The types of drivers who use this document are bus drivers train

This free mileage log template tracks your trips and automatically calculates your mileage deduction on each one It s user friendly compliant with IRS standards and quite pretty to look at All in all it s a perfect solution for your own taxes or for requesting a mileage reimbursement from a customer or employer Entering your trip details