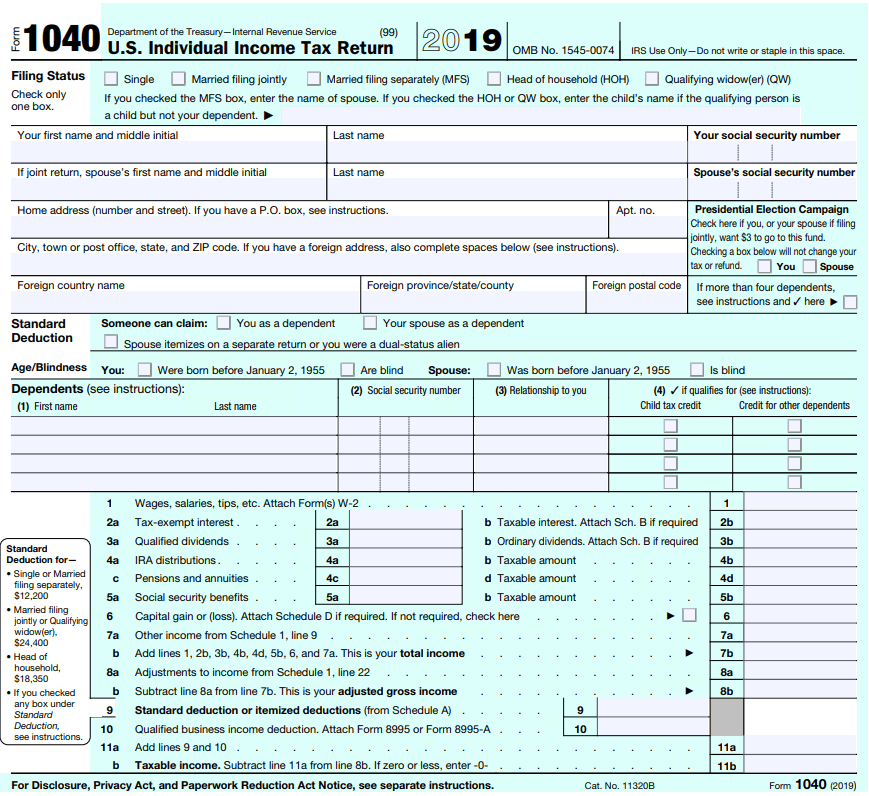

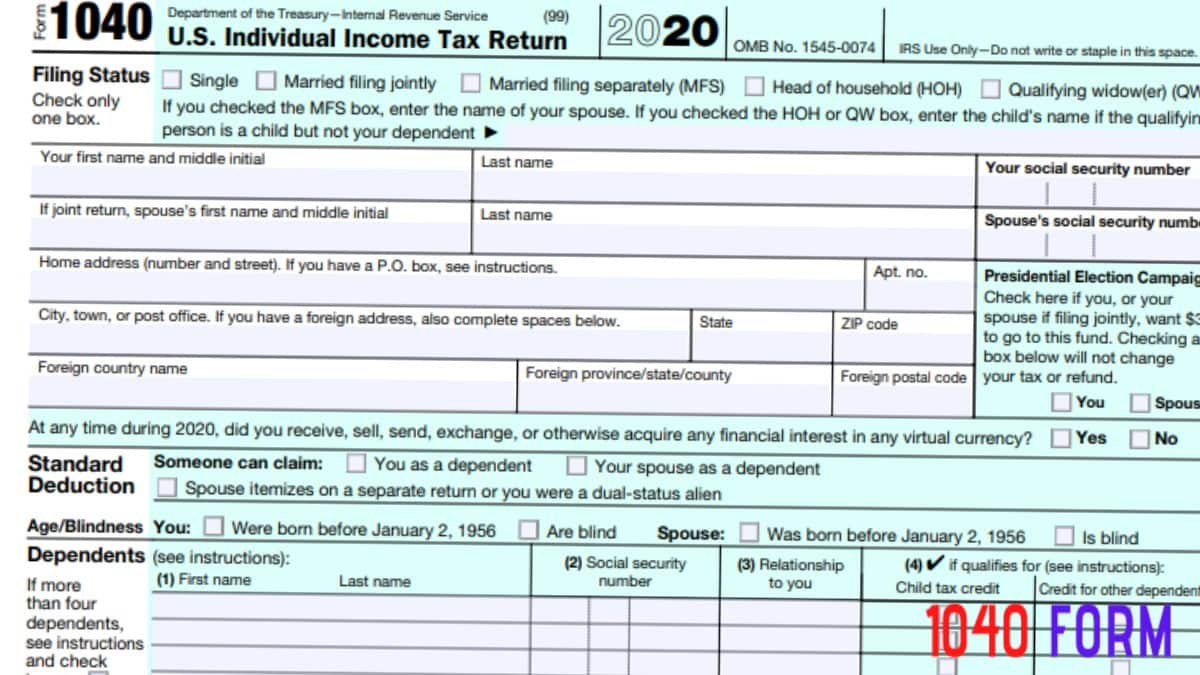

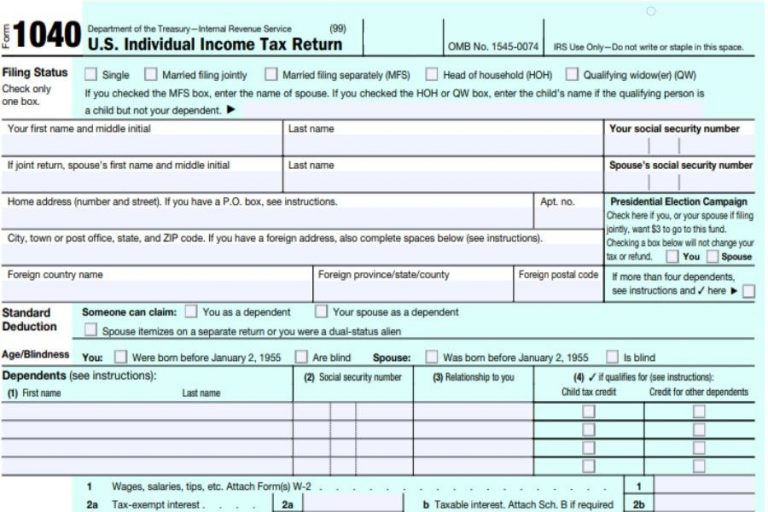

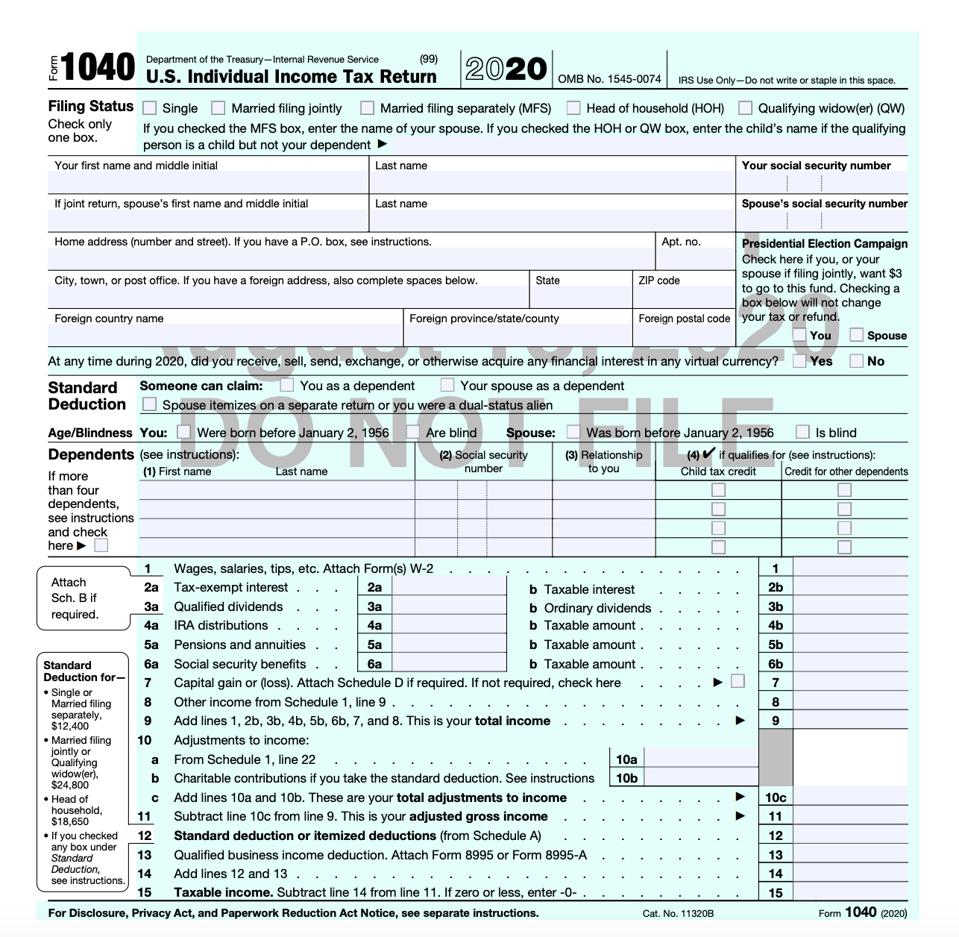

Printable Copy Of Schedule 5 1040 Form Form 1040 U S Individual Income Tax Return 2021 Department of the Treasury Internal Revenue Service 99 OMB No 1545 0074 IRS Use Only Do not write or staple in this space Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH

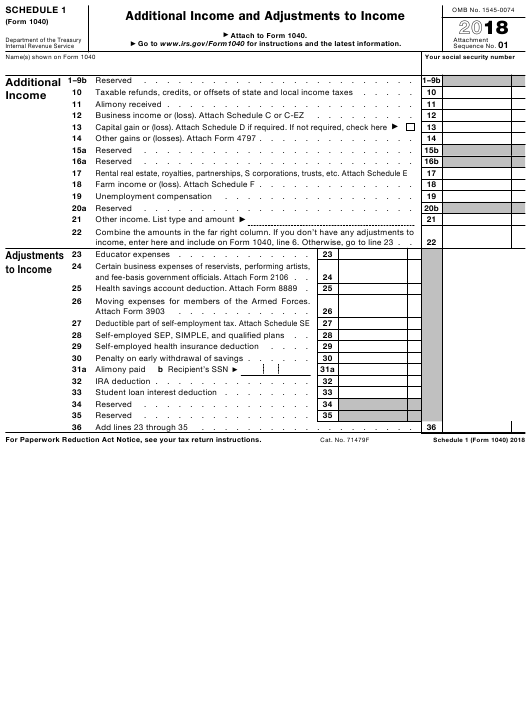

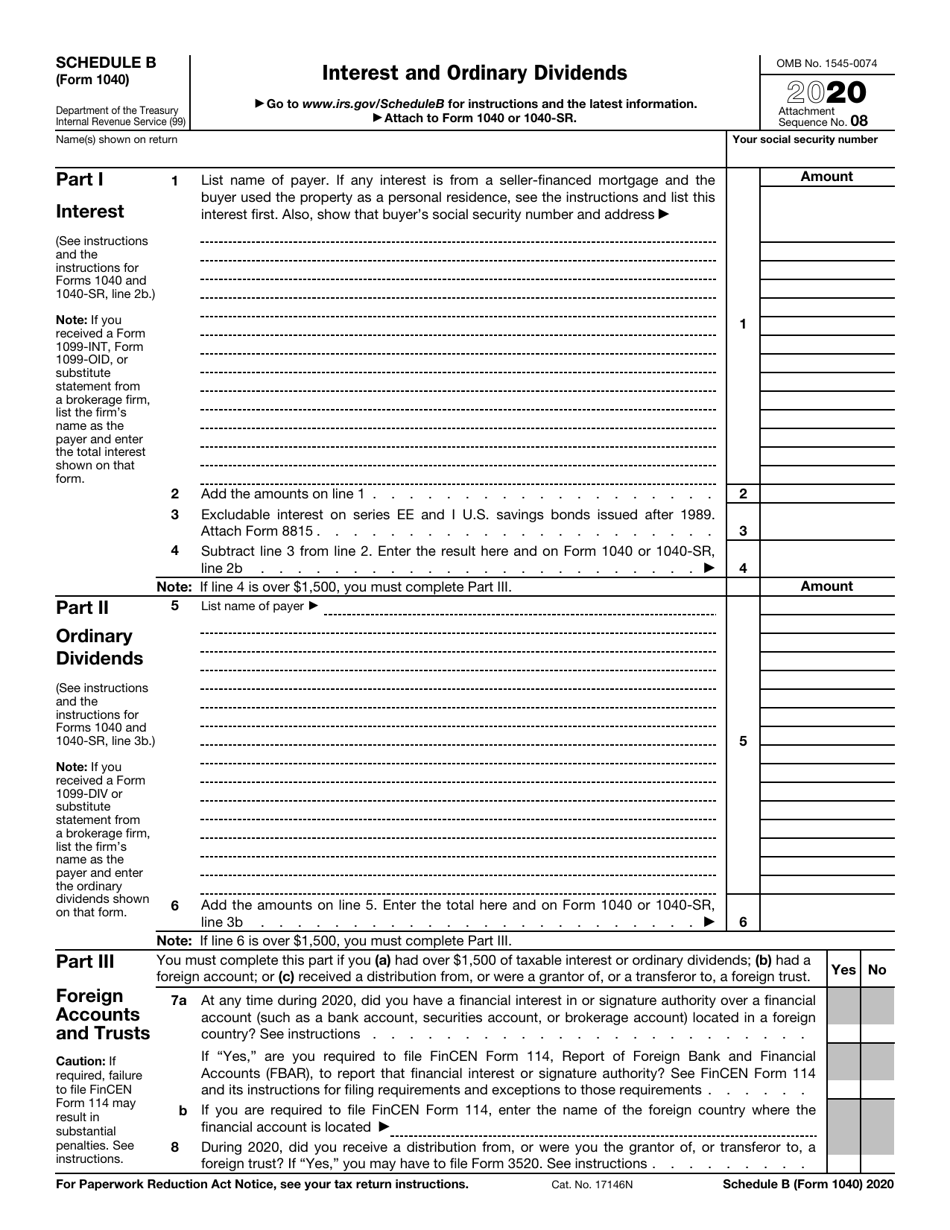

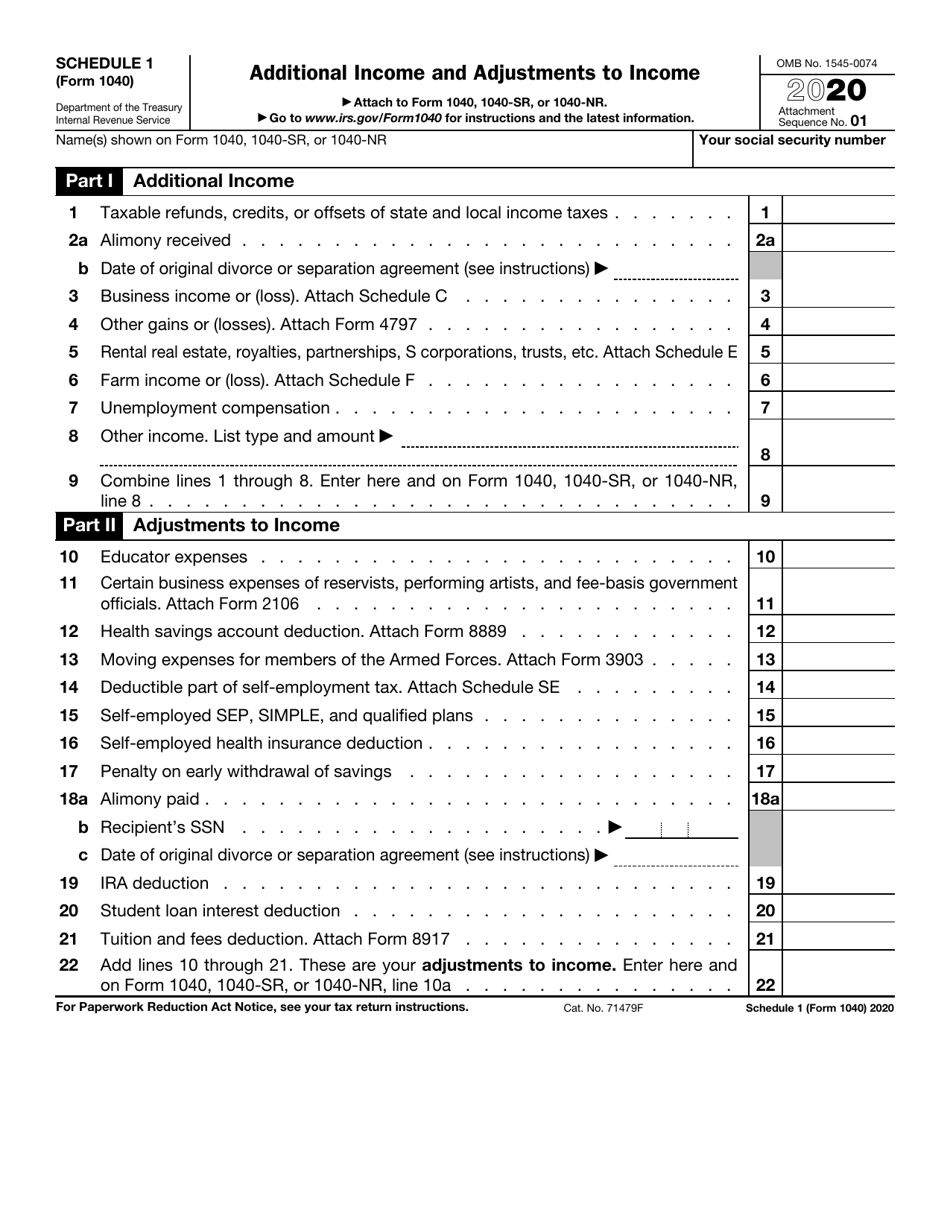

Information about Schedule A Form 1040 Itemized Deductions including recent updates related forms and instructions on how to file This schedule is used by filers to report itemized deductions What was Form 1040 Schedule 5 For tax years prior to 2018 you would use Form 1040 Schedule 5 Form 8849 if you had paid and reported a tax on gasoline diesel fuel and or kerosene under section 4081 of the Internal Revenue Code

Printable Copy Of Schedule 5 1040 Form

Printable Copy Of Schedule 5 1040 Form

Printable Copy Of Schedule 5 1040 Form

https://upload.wikimedia.org/wikipedia/commons/thumb/b/ba/Form_1040%2C_2015.pdf/page1-1200px-Form_1040%2C_2015.pdf.jpg

Free printable 2022 Schedule 5 form and 2022 Schedule 5 instructions booklet sourced from the IRS Download and print the PDF file Then calculate your Other Payments and Refundable Credits and attach to Form 1040

Templates are pre-designed files or files that can be utilized for different purposes. They can conserve effort and time by supplying a ready-made format and layout for producing various type of material. Templates can be used for personal or expert projects, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Printable Copy Of Schedule 5 1040 Form

K 1 Fillable Form 1040 Printable Forms Free Online

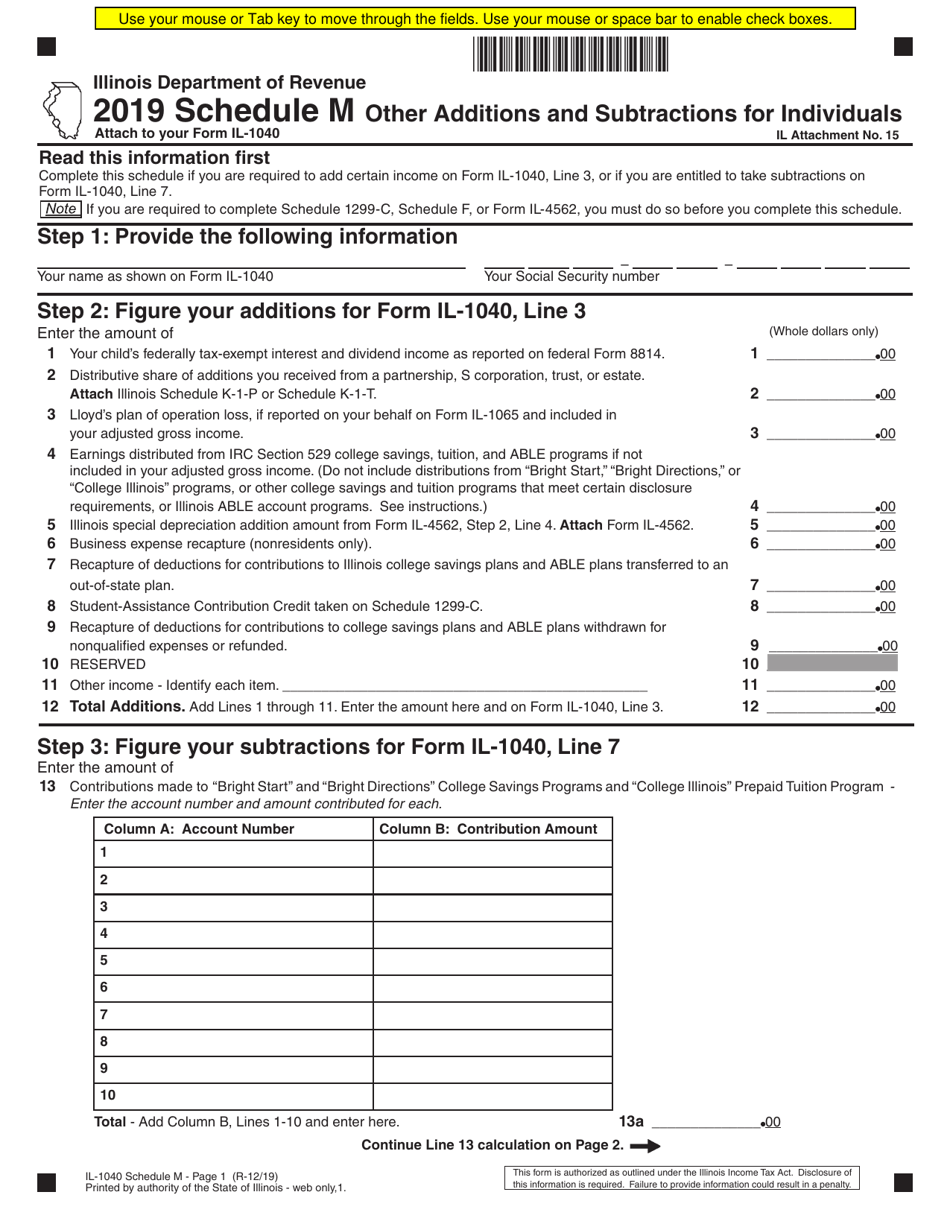

Form IL 1040 Schedule M 2019 Fill Out Sign Online And Download

1040 Form 2020 PDF 1040 Form Printable

Schedule C Tax Form Printable Printable Form Templates And Letter

Tax Return Printable Form

Irs Form 1040 Printable

https://www.canada.ca/en/revenue-agency/services/forms-publications/

PDF 5000 s5 21e pdf PDF fillable saveable 5000 s5 fill 21e pdf For people with visual impairments the following alternate formats are also available E text 5000 s5 21e txt Large print 5000 s5 lp 21e pdf Last update 2022 01 18 Previous year versions are also available Report a problem on this page Date modified 2023 01 24

https://turbotax.intuit.ca/tips/schedule-5-tax-form-details-of

What is the Schedule 5 tax form used for You use the Canada Revenue Agency s CRA Schedule 5 when you want to claim the amounts for spouse or common Law partner as well as amounts for your dependants If you are claiming amounts for your dependants you ll need to enter some information about them on the schedule as well

https://www.canada.ca/en/revenue-agency/services/forms-publications/

Canada Revenue Agency s copy The Canada Revenue Agency only accepts T4E or T4E Q forms that are filed electronically For more information see Filing Information Returns Electronically T4 T5 and other types of returns

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Form 1040 U S Individual Income Tax Return 2022 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying surviving spouse QSS

https://www.irs.gov/help/downloading-and-printing

Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return

The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040 Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable Form 1040 schedule 5 Other Payments and Refundable Credits On average this form takes 7 minutes to complete The Form 1040 schedule 5 Other Payments and

Part 1 of Schedule 5 Allocation of taxable income Complete Part 1 of Schedule 5 if you or your partnerships had a permanent establishment in more than one province or territory Complete columns A to F for each province or territory in which you had a permanent establishment in the tax year