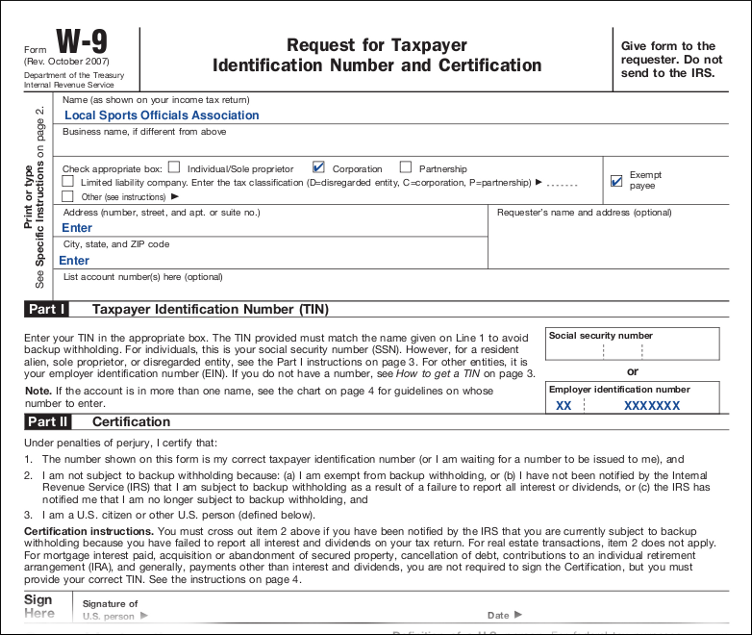

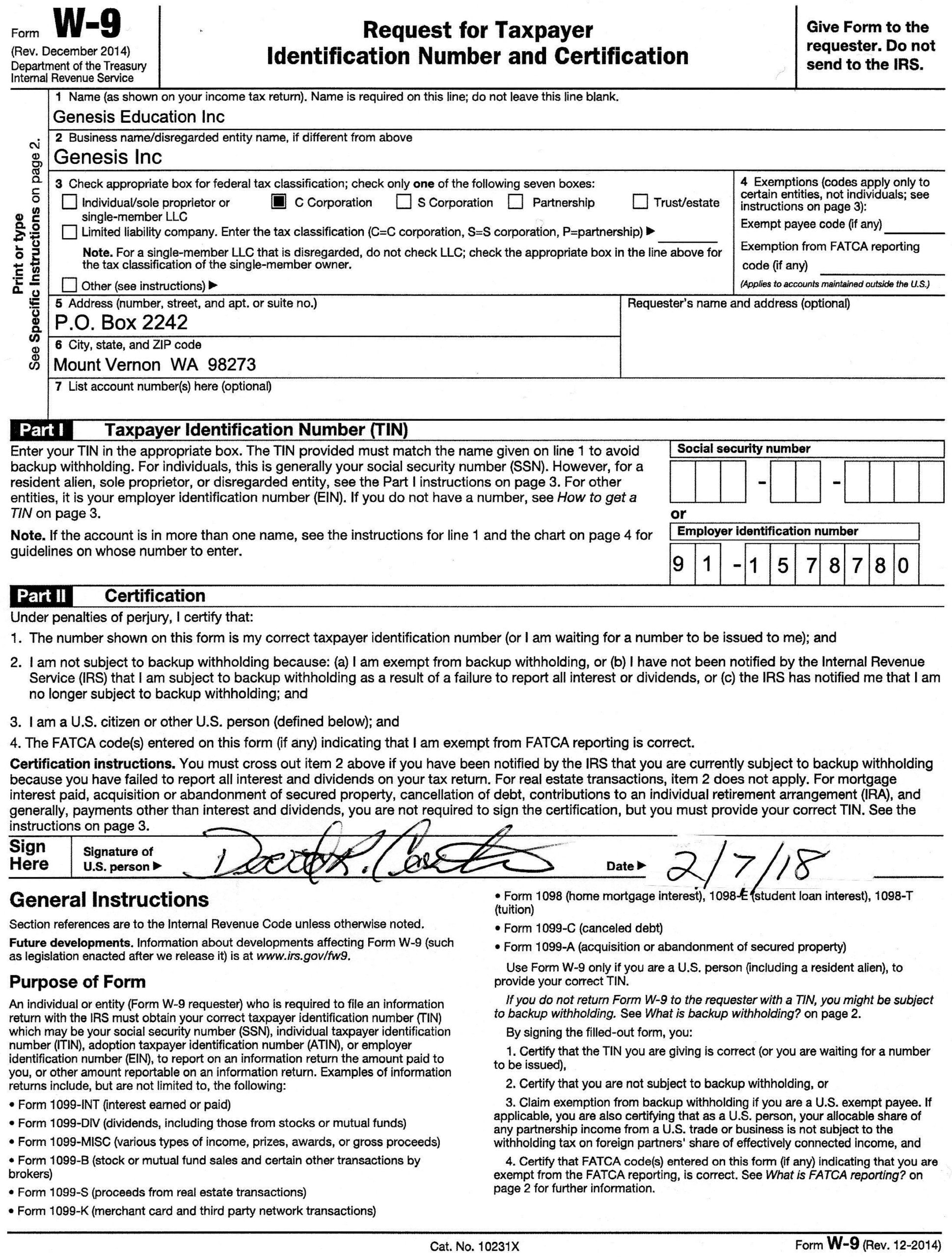

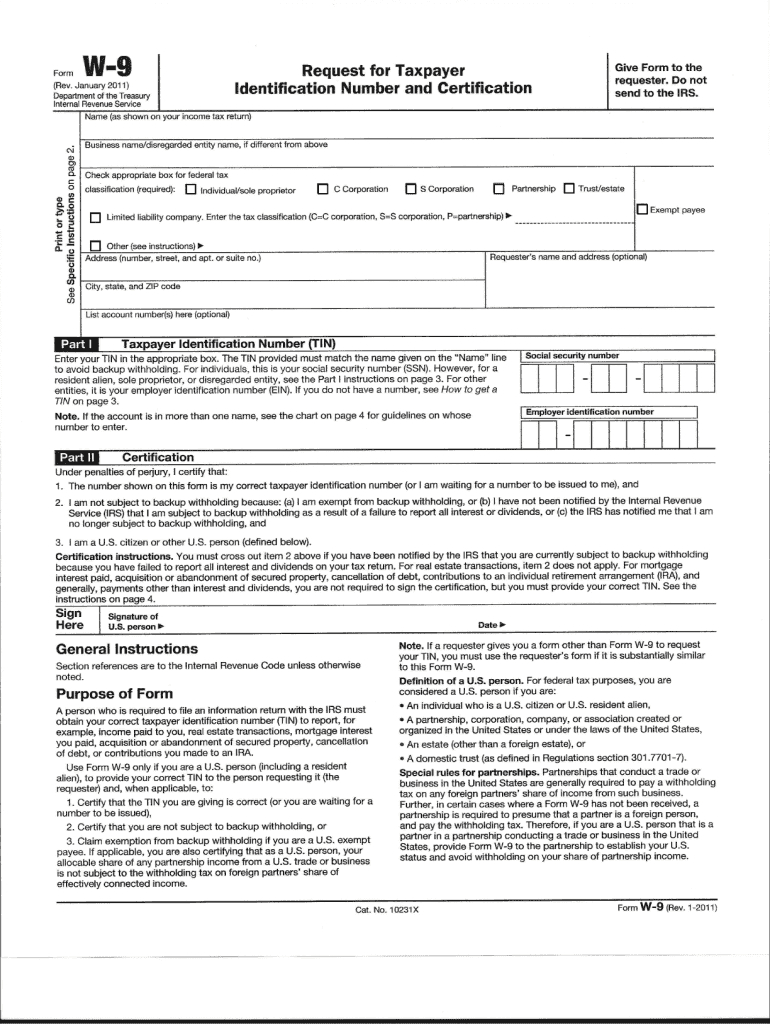

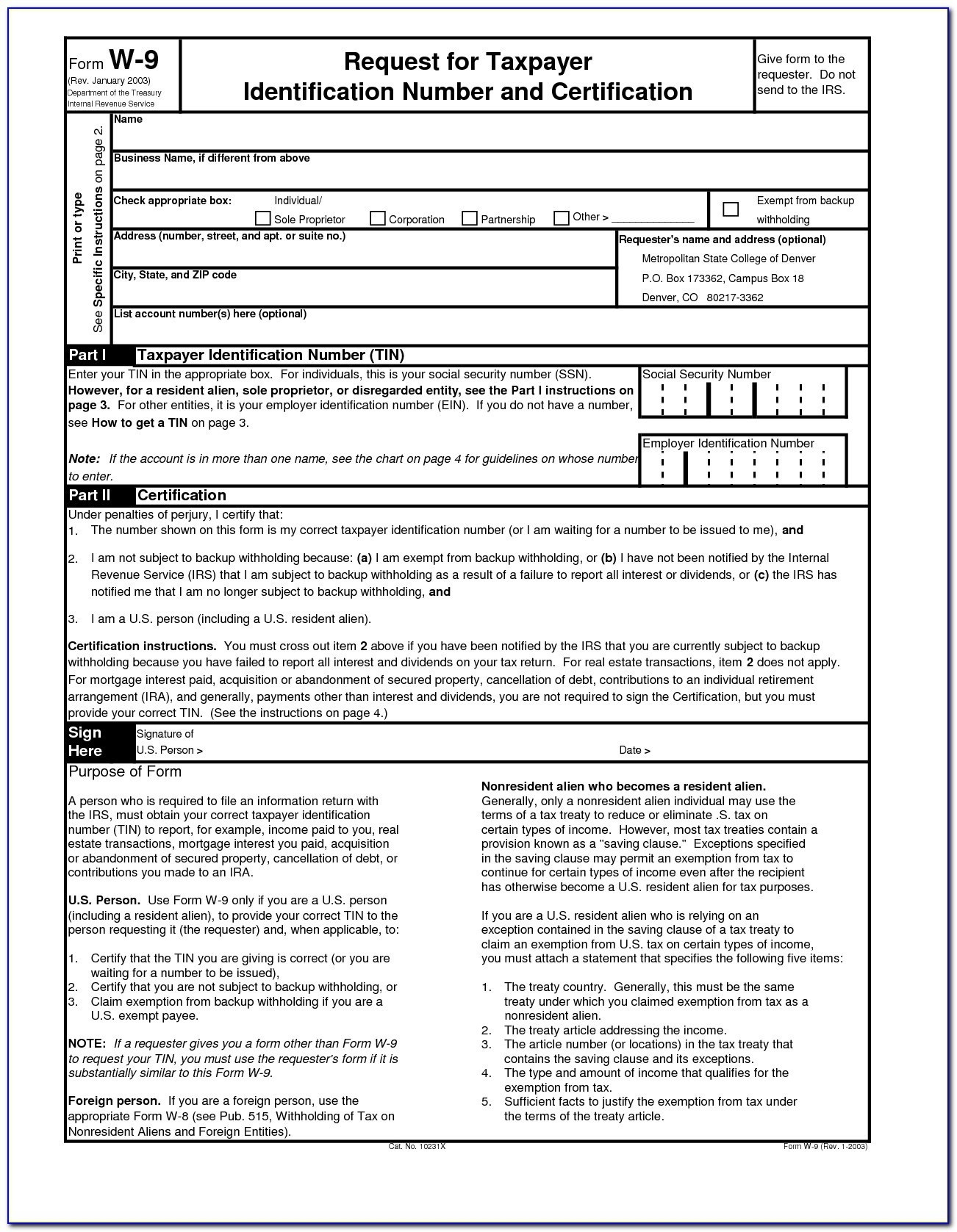

Printable Copy Of A W9 Be able to supply a hard copy of the electronic Form W 9 if the Internal Revenue Service requests it and Require as the final entry in the submission an electronic signature by the payee whose name is on Form W 9

Be able to supply a hard copy of the electronic Form W 9 if the Internal Revenue Service requests it and Require as the final entry in the submission an electronic signature by the payee whose name is on Form W 9 that authenticates and verifies the submission The electronic signature must be under penalties of perjury and the perjury W 9 forms are for self employed workers like freelancers independent contractors and consultants You need to use it if you have earned over 600 in that year without being hired as an employee If your employer sends you a W 9 instead of a W 4 the company has likely classified you as an independent contractor

Printable Copy Of A W9

Printable Copy Of A W9

Printable Copy Of A W9

https://paperspanda.com/wp-content/uploads/2021/07/download-w9-tax-form.png

View Details Request a review Learn more

Templates are pre-designed files or files that can be used for different functions. They can conserve effort and time by supplying a ready-made format and layout for developing various type of material. Templates can be utilized for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Printable Copy Of A W9

Printable W9 Form 2022 Free Customize And Print

Fillable W 9 Tax Form Printable Forms Free Online

2021 W 9 Form Blank Calendar Template Printable

W9 Printable Form 2021 PapersPanda

Free Fillable W9 Form W9 Invoice Template Attending W11 Pertaining To

Free Printable W9 Forms

https://www.irs.gov/forms-pubs/about-form-w-9

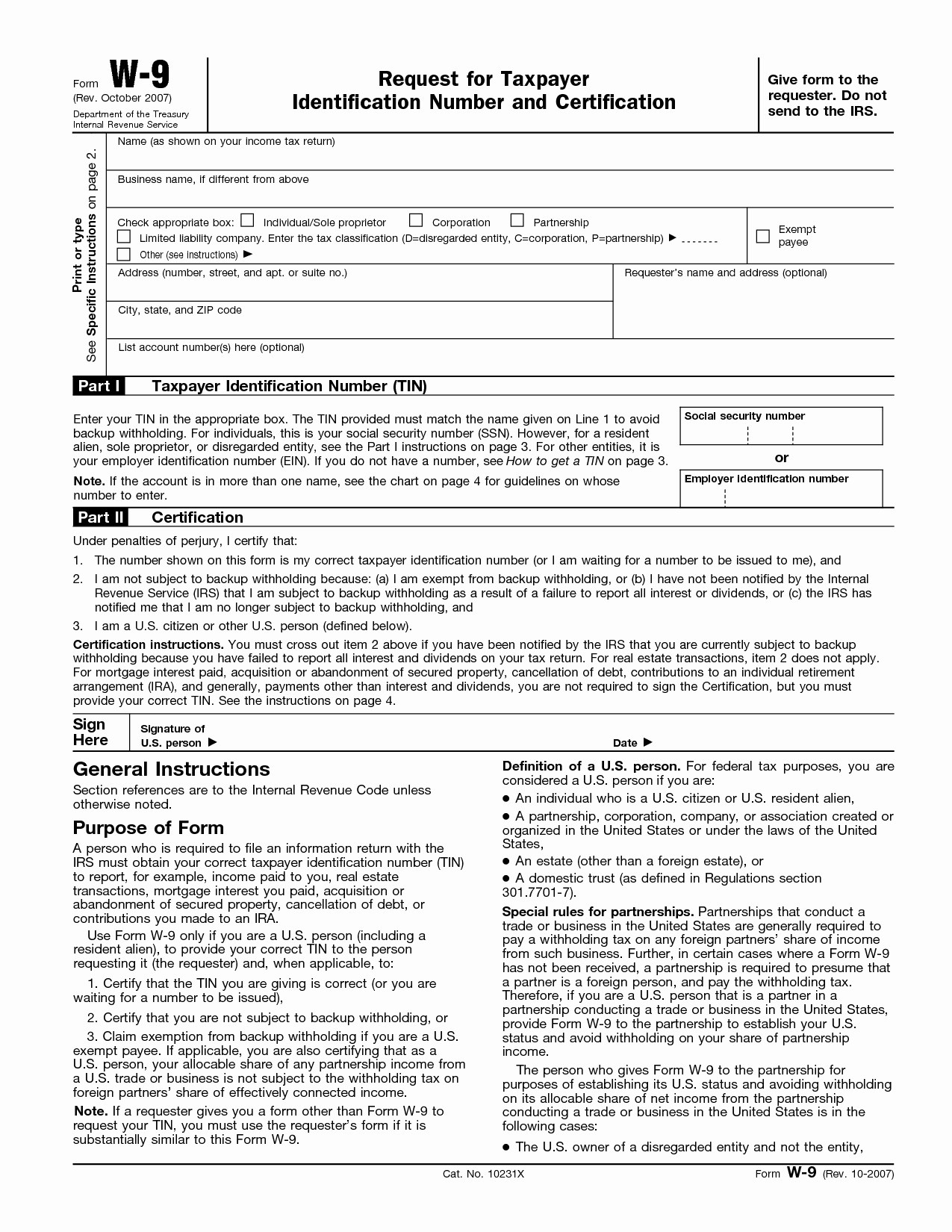

Use Form W 9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example Income paid to you Real estate transactions Mortgage interest you paid Acquisition or abandonment of secured property Cancellation of debt Contributions you made to an IRA

https://eforms.com/irs/w9

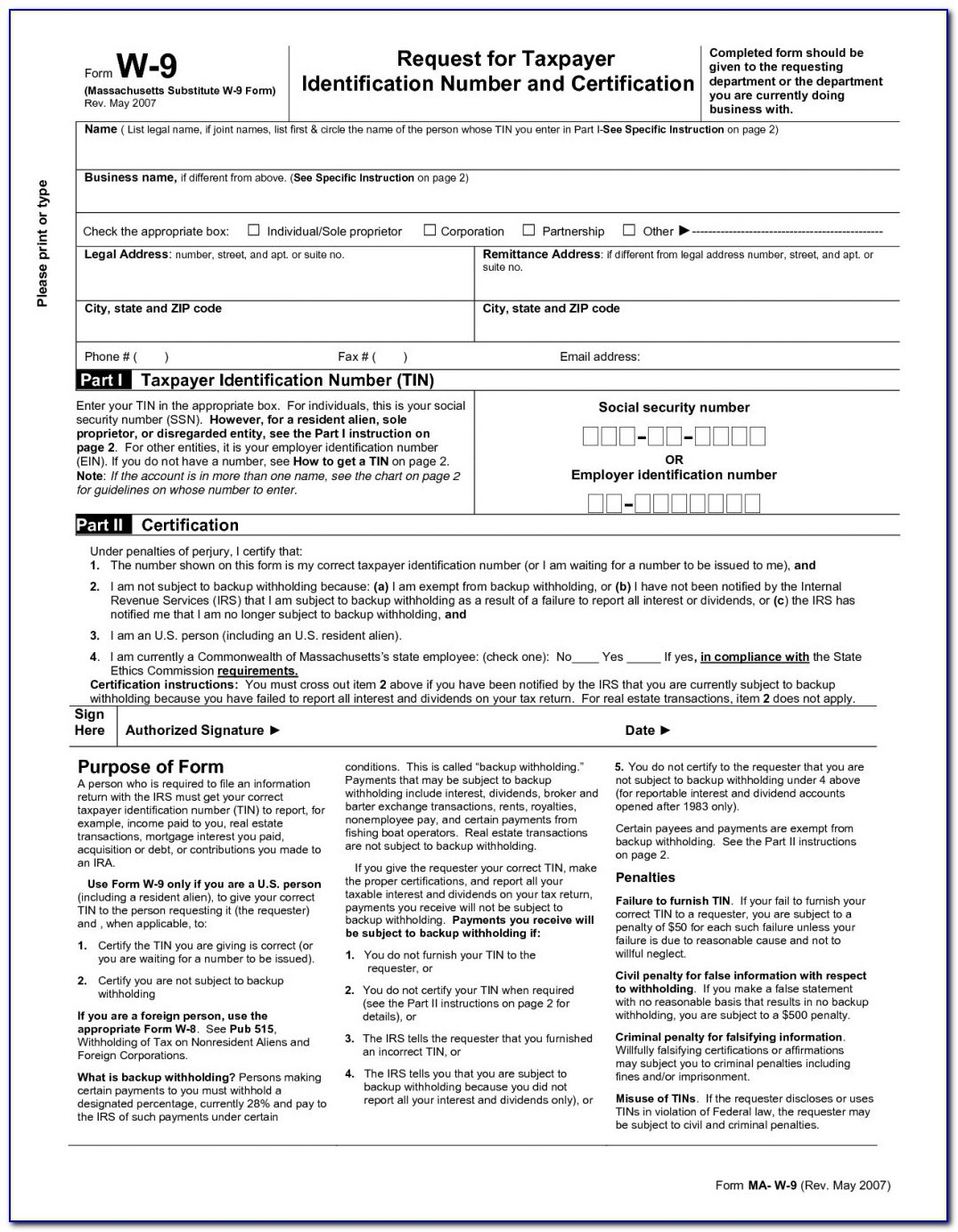

Create Document Updated October 17 2023 An IRS form W 9 or Request for Taxpayer Identification Number and Certification is a document used to obtain the legal name and tax identification number TIN of an individual or business entity It is commonly required when making a payment and withholding taxes are not being deducted

https://formswift.com/w9

The W 9 Form is an essential tool for employers to gather information about contractors for income tax purposes Verifying the information on this form and keeping it up to date ensures you collected accurate personal information Form W 9 should be reviewed and updated yearly

https://www.td.com/ca/document/PDF/apply/forms/tdw-apply-for…

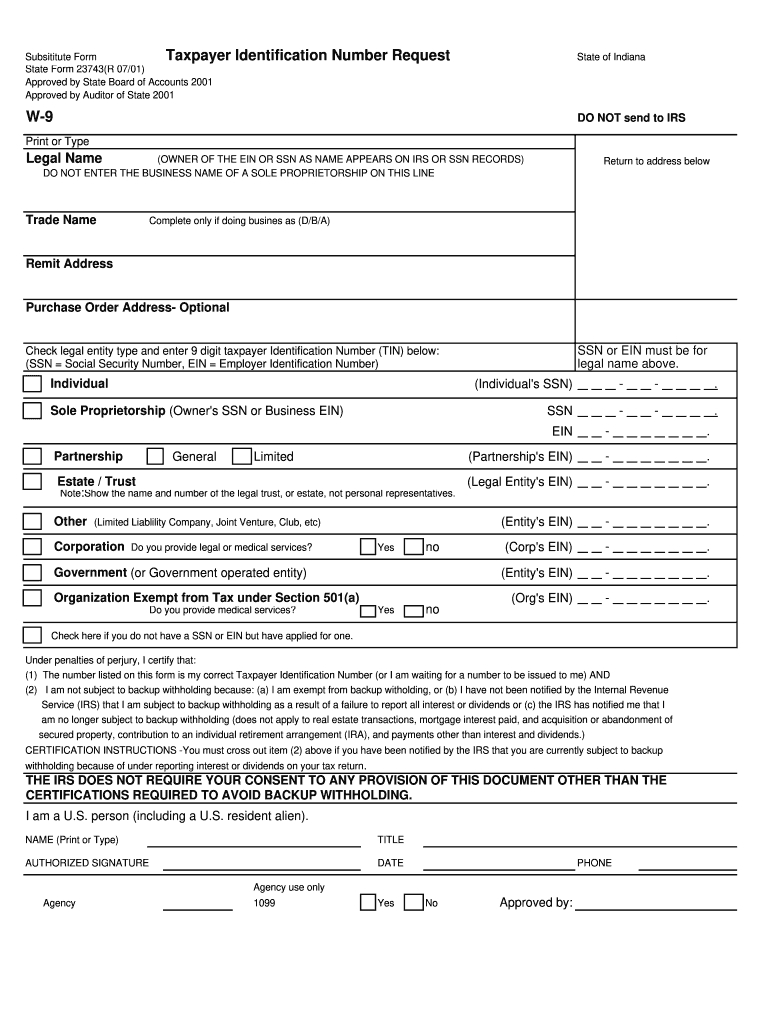

Print or type See Specific Instructions on page 2 Taxpayer Identification Number TIN Enter your TIN in the appropriate box The TIN provided must match the name given on Line 1 to avoid backup withholding For individuals this is your social security number SSN However for a resident

https://www.canada.ca/en/revenue-agency/services/forms-publications/

Payer or agent s copy Keep an electronic or printed copy of the slip you give to each non resident recipient for your records Make sure your account number is in the box called Non resident account number on those copies For printed copies it is good to cross out the second slip completely

Give Form to the requester Do not send to the IRS Business name disregarded entity name if different from above Check appropriate box for federal tax classification required Individual sole proprietor C Corporation Corporation Updated for Tax Year 2023 October 19 2023 8 39 AM OVERVIEW Form W 9 is a commonly used IRS form for providing necessary information to a person or company that will be making payments to another person or company One of the most common situations is when someone works as an independent contractor for a business

Print your full legal name as it appears on your income tax return here 2 If you operate under a business name or disregarded entity name write that here 3 Federal tax classification is a fancy way of saying