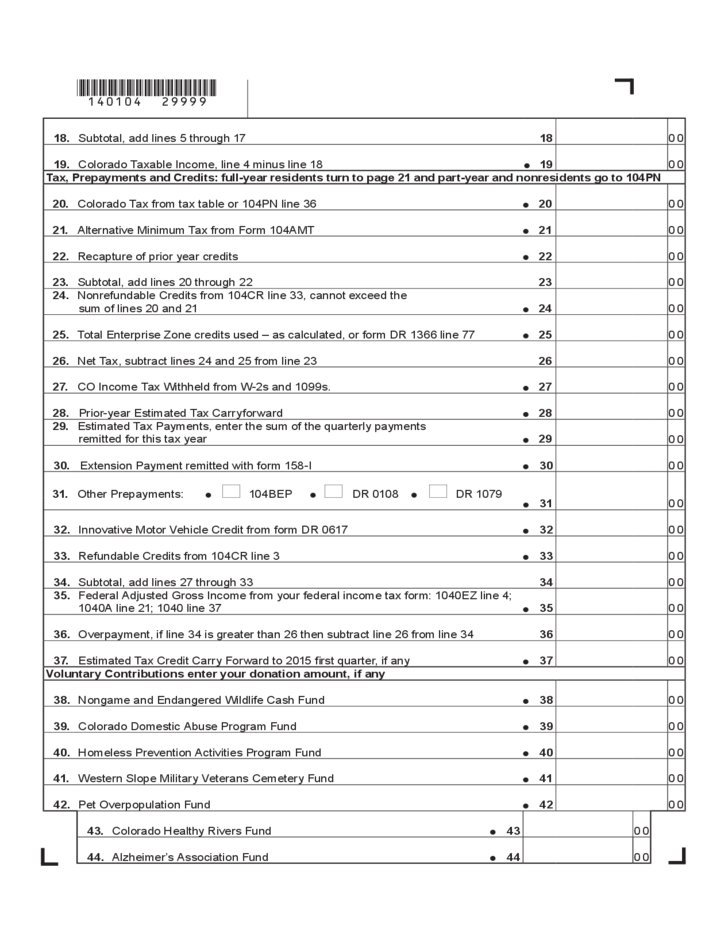

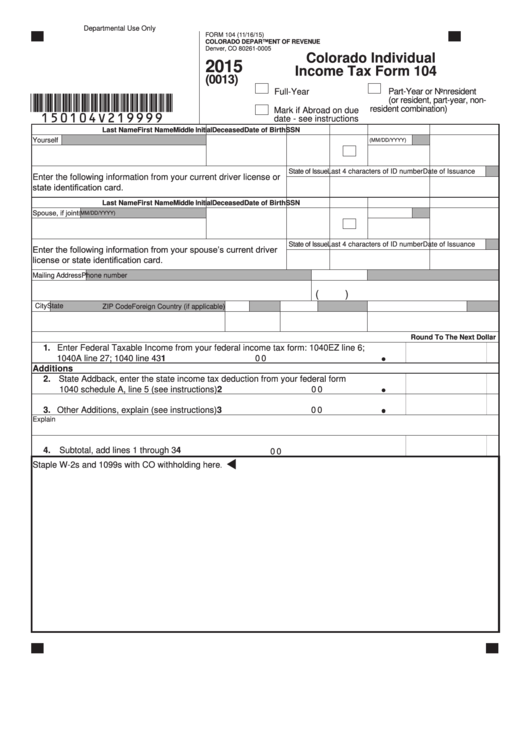

Printable Colorado Income Tax Form 104 Cr Tax Prepayments and Credits see 104 Book for full year tax table and part year DR 0104PN Schedule 10 Colorado Tax from tax table or the DR 0104PN line 36 you must submit the DR 0104PN with your return if applicable 10 00 11 Alternative Minimum Tax from the DR 0104AMT line 8 you must submit the DR 0104AMT with your return 11 00 12

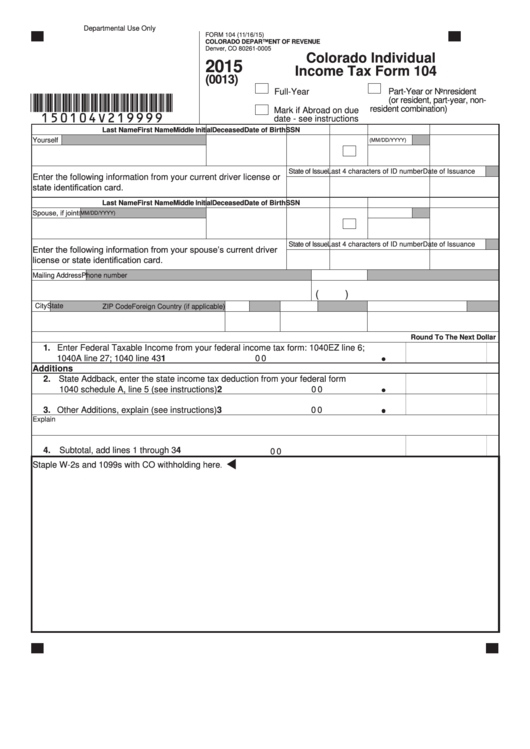

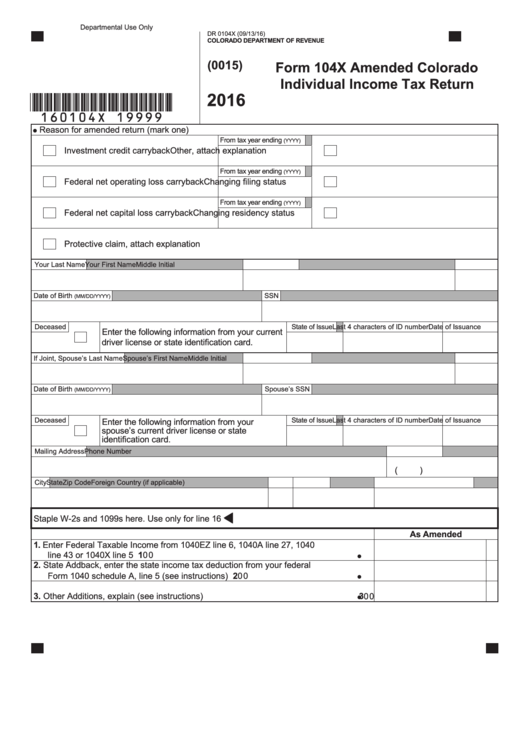

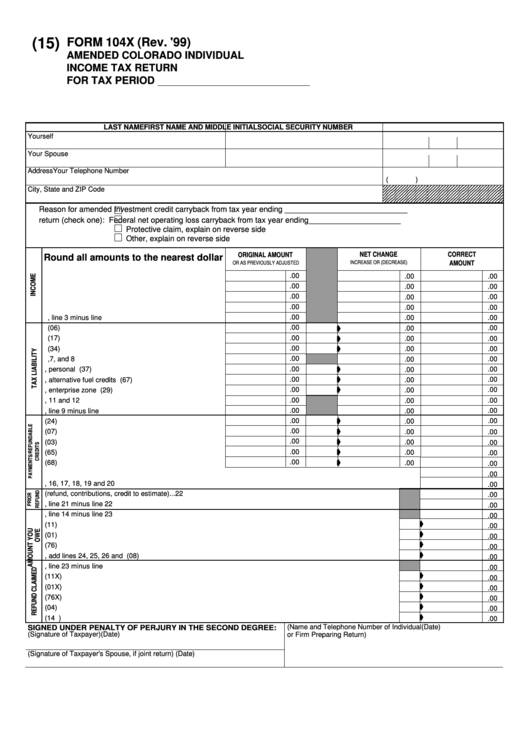

The Colorado Income Tax Filing Guide is available for full year part year and non resident individuals This book includes DR 0104 2022 Colorado Individual Income Tax Form DR 0104EE Colorado Easy Enrollment Information Form DR 0104CH 2022 Voluntary Contributions Schedule Form 104 is a Colorado Individual Income Tax form Like the Federal Form 1040 states each provide a core tax return form on which most high level income and tax calculations are performed

Printable Colorado Income Tax Form 104 Cr

Printable Colorado Income Tax Form 104 Cr

Printable Colorado Income Tax Form 104 Cr

https://data.formsbank.com/pdf_docs_html/328/3285/328587/page_1_thumb_big.png

210104 19999 DR 0104 10 19 21 COLORADO DEPARTMENT OF REVENUE Tax Colorado gov Page 1 of 4 0013 Full Year 2021 Colorado Individual Income Tax Return Part Year or Nonresident or resident part year Mark if Abroad on due date non resident combination Must include DR 0104PN see instructions Your Last Name Your

Pre-crafted templates provide a time-saving option for developing a diverse variety of documents and files. These pre-designed formats and designs can be made use of for various individual and expert jobs, including resumes, invitations, flyers, newsletters, reports, discussions, and more, enhancing the content production process.

Printable Colorado Income Tax Form 104 Cr

Colorado Tax Forms 2021 Printable State CO 104 Form And CO 104

State Income Tax Withholding Form Colorado WithholdingForm

Printable Colorado Income Tax Forms Printable Forms Free Online

Printable Colorado Income Tax Forms Printable Forms Free Online

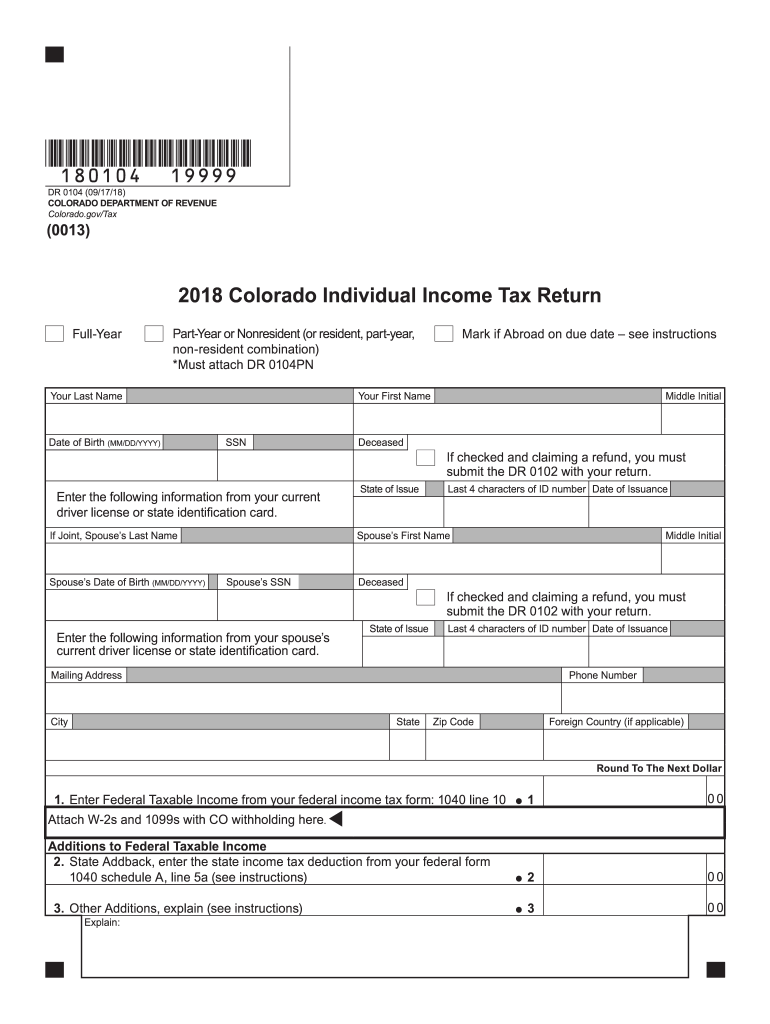

Colorado Income Tax Forms 2018 Fill Out Sign Online DocHub

Colorado Most Form Printable Printable Forms Free Online

https://tax.colorado.gov/sites/tax/files/documents/DR0104CR_…

Form 104CR Individual Credit Schedule 2021 Taxpayer s Last Name First Name Middle Initial SSN or ITIN Use this schedule to calculate your income tax credits For best results visit Tax Colorado gov to research eligibility requirements and other information about these credits before following the line by line instructions contained below

https://tax.colorado.gov/2022-individual-income-tax-forms

Filing Forms DR 0104 Book Individual Income Tax Booklet DR 0104 Individual Income Tax Return form only DR 0104AD Subtractions from Income Schedule DR 0104AMT Alternative Minimum Tax Schedule DR 0104BEP Colorado Nonresident Beneficiary Estimated Income Tax Payment

https://tax.colorado.gov/DR0104CR

Use this schedule to calculate your income tax credits For best results view the DR 0104 Booklet for line by line information about claiming these credits View Download Form DR 0104CR

https://www.taxformfinder.org/colorado/form-104cr

We last updated the Tax Credits for Individuals in January 2023 so this is the latest version of

https://tax.colorado.gov/sites/tax/files/documents/DR0104Book…

104 BOOK 2021 Booklet Includes Instructions DR 0104 Related Forms Tax Colorado gov This book includes yDR 01042021 Colorado Individual Income Tax Form yDR 0104EEColorado Easy Enrollment Information Form yDR 0104CH2021 Voluntary Contributions Schedule yDR 09002021 Individual Income Tax Payment Form

Free printable and fillable 2022 Colorado Form 104 and 2022 Colorado Form 104 Instructions booklet in PDF format to fill in print and mail your state income tax return due April 18 2023 Colorado state income tax Form 104 must be postmarked by April 18 2023 in order to avoid penalties and late fees Individual Income Tax Filing Guide Use this instructional booklet to guide you in filling out and filing your Form 104 individual income tax return 11 0001 Estimated Individual Income Tax Return You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding Estimated tax payments are due on a quarterly

Form 104PN has already eliminated the Colorado tax on this income A non resident cannot claim this credit The total credit for tax paid to other states may not exceed the Colorado tax attributable to the total non Colorado source income If taxes were paid to two or more other states or if income and or losses are incurred in two or more