Printable 8962 Tax Form Learn how to maximize health care tax credit get highest return

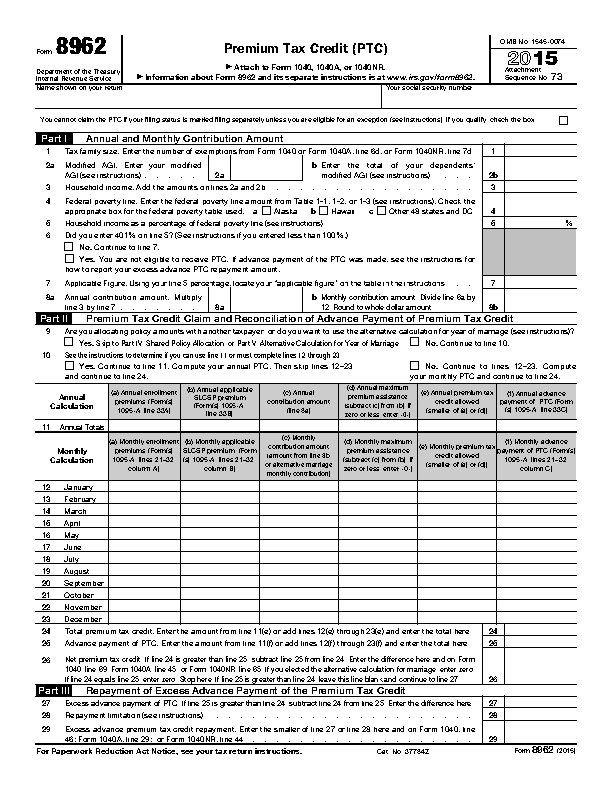

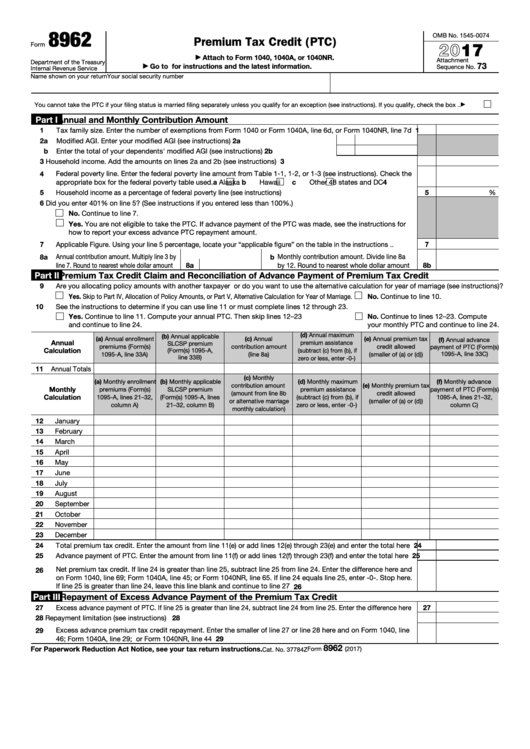

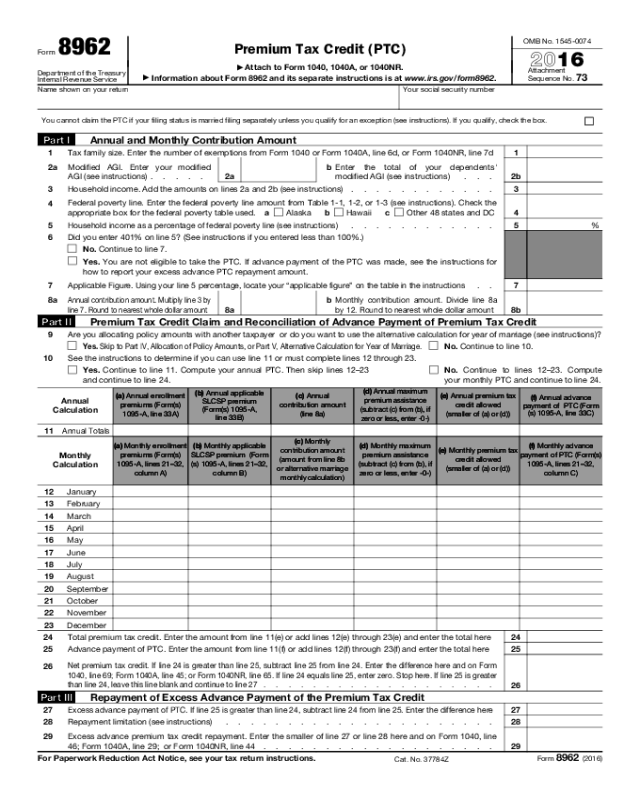

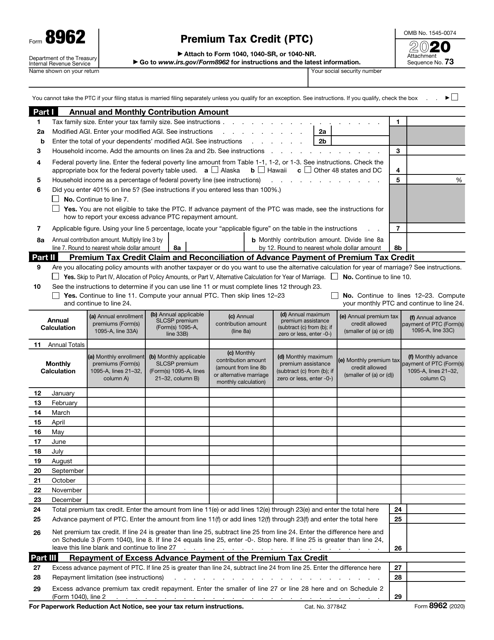

Form 8962 is used to figure the amount of Premium Tax Credit and reconcile it with any advanced premium tax credit paid This form is only used by taxpayers who purchased a health plan through the Health View all of the current year s forms and publications by popularity or program area Select a heading to view its forms then u se the Search feature to locate a form or publication by its Name Form Number Year or Type

Printable 8962 Tax Form

Printable 8962 Tax Form

Printable 8962 Tax Form

https://handypdf.com/resources/formfile/images/10000/form-8962-page1.png

We last updated Federal Form 8962 in December 2022 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023 We will update this page with a new version of the form for 2024 as soon as it is made available by the Federal government

Templates are pre-designed documents or files that can be utilized for numerous purposes. They can save time and effort by supplying a ready-made format and layout for producing various sort of content. Templates can be used for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Printable 8962 Tax Form

Irs Form 8962 For 2016 Printable TUTORE ORG Master Of Documents

Form 8962 2014 Diy Menu Cards Menu Card Template Wedding Menu

8962 Form 2021 Printable Martin Printable Calendars

Fillable Form 8962 Premium Tax Credit 2017 Printable Pdf Download

:max_bytes(150000):strip_icc()/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)

Tax Form 8962 Printable

Form 8692 Printable Printable Forms Free Online

Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit

You must file Form 8962 with your income tax return Form 1040 1040 SR or 1040 NR if any of the following apply to you

Form 8962 is used to estimate the amount of premium tax credit for which you re eligible if you re insured through the Health Insurance Marketplace You need to complete Form 8962 if you

You must reconcile your premium tax credit when you file your tax return if you were enrolled in Health Insurance Marketplace plan

We last updated the Premium Tax Credit in December 2022 so this is the latest version of Form 8962 fully updated for tax year 2022 You can download or print current or past year PDFs of Form 8962 directly from TaxFormFinder You can print other Federal tax

Contact Us Oregon Department of Revenue 955 Center St NE Salem OR 97301 2555 Agency Directory Mailing Addresses Media Contacts Regional Offices Phone 503 378 4988 or 800 356 4222 TTY We accept all relay calls Fax 503 945 8738 Email Questions dor dor oregon gov Print Report Inappropriate Content TurboTax 2022 form 8962 Premium Tax Credit Using Turbo Tax 2022 for estimating Taxes seems pretty good except that form 8962 the Premium Tax Credit I think is very wrong If you go above the 400 poverty line it seems TurboTax 2022 wants to tell you you have to pay back all the subsidies from the

This document is required to reconcile your income with the credit you received Steps to Fill Out the 8962 Form Template Start by visiting our website to access the relevant template Here you have the option to download a blank Form 8962 which you can then fill out either on paper or online