Printable 1st Page Form 1040 See IRS gov and IRS gov Forms and for the latest information about developments related to Forms 1040 and 1040 SR and their instructions such as legislation enacted after they were published go to IRS gov Form1040 Free File is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online

Order by phone at 1 800 TAX FORM 1 800 829 3676 You can also find printed versions of many forms instructions and publications in your community for free at Libraries IRS Taxpayer Assistance Centers New 1040 form for older adults The IRS has released a new tax filing form for people 65 and older It is an easier to read version of Form 1040 formally known as the U S Individual Income Tax Return is the standard federal income tax form people use to report income to the IRS claim tax deductions and credits and

Printable 1st Page Form 1040

Printable 1st Page Form 1040

Printable 1st Page Form 1040

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

Form 1040 2022 Additional Income and Adjustments to Income Department of the Treasury Internal Revenue Service Attach to Form 1040 1040 SR or 1040 NR Go to www irs gov Form1040 for instructions and the latest information OMB No 1545 0074 Attachment Sequence No 01 Name s shown on Form 1040 1040 SR or 1040 NR

Pre-crafted templates offer a time-saving service for developing a diverse series of documents and files. These pre-designed formats and designs can be used for various individual and expert jobs, including resumes, invitations, flyers, newsletters, reports, discussions, and more, improving the material production process.

Printable 1st Page Form 1040

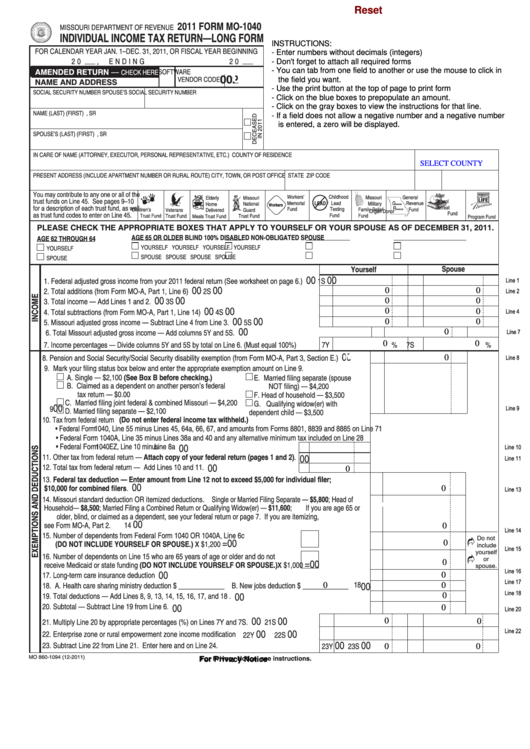

Missouri Form 1040 Printable Printable Forms Free Online

FREE 2022 Printable Tax Forms

Printable Irs Form 1040 Printable Form 2023

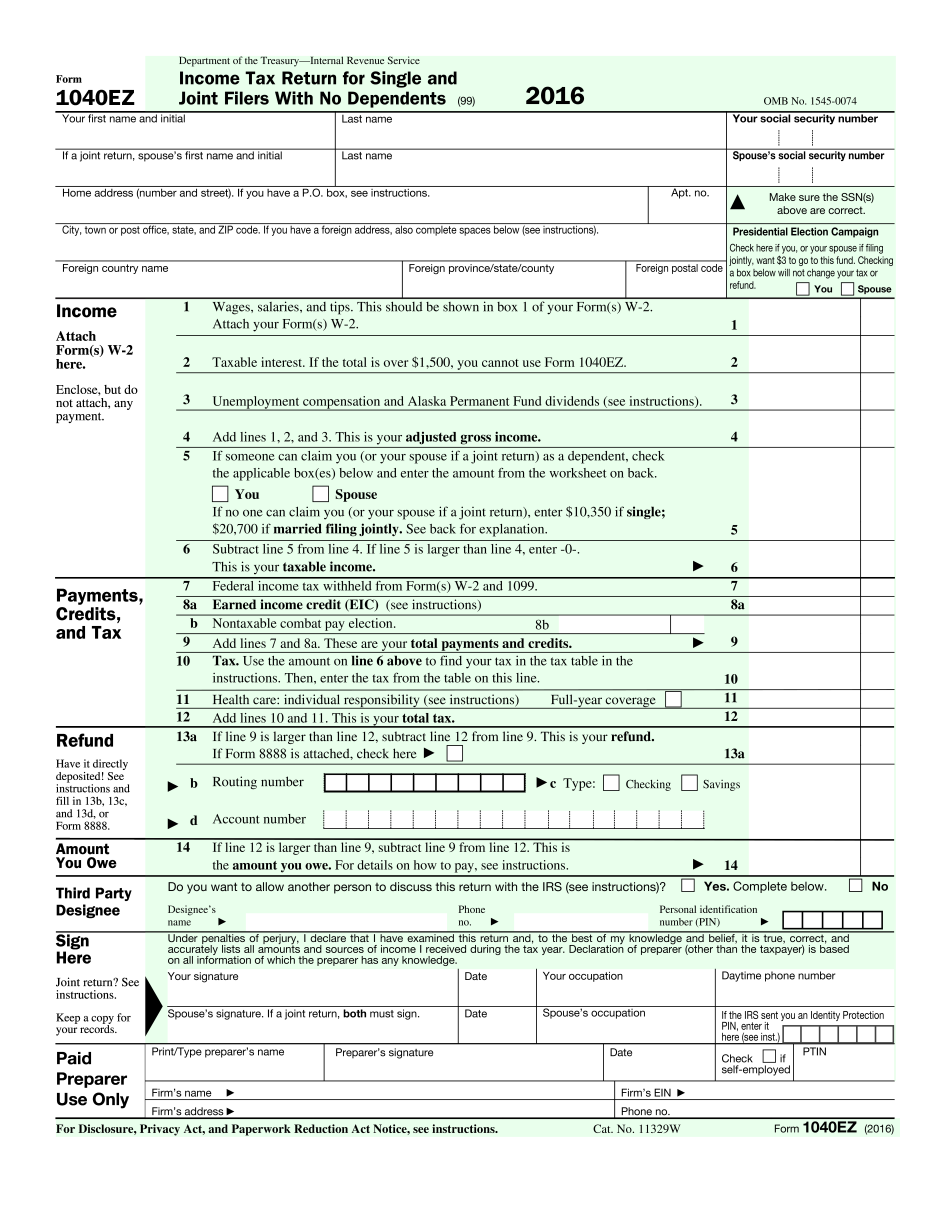

IRS 1040 EZ 2023 Form Printable Blank PDF Online

IRS Releases Drafts Of 2021 Form 1040 And Schedules Don t Mess With Taxes

2020 Irs 1040 Schedule Instructions Fill Out And Sign Printable PDF

https://www.irs.gov/pub/irs-prior/f1040--2021.pdf

Your first name and middle initial Last name Your social security number If joint return spouse s first name and middle initial Last name Spouse s social security number Home address number and street If you have a P O box see instructions Apt no City town or post office If you have a foreign address also complete

https://www.irs.gov/form

Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return

https://omb.report/document/www.irs.gov/pub/irs-pdf/f1040.pdf

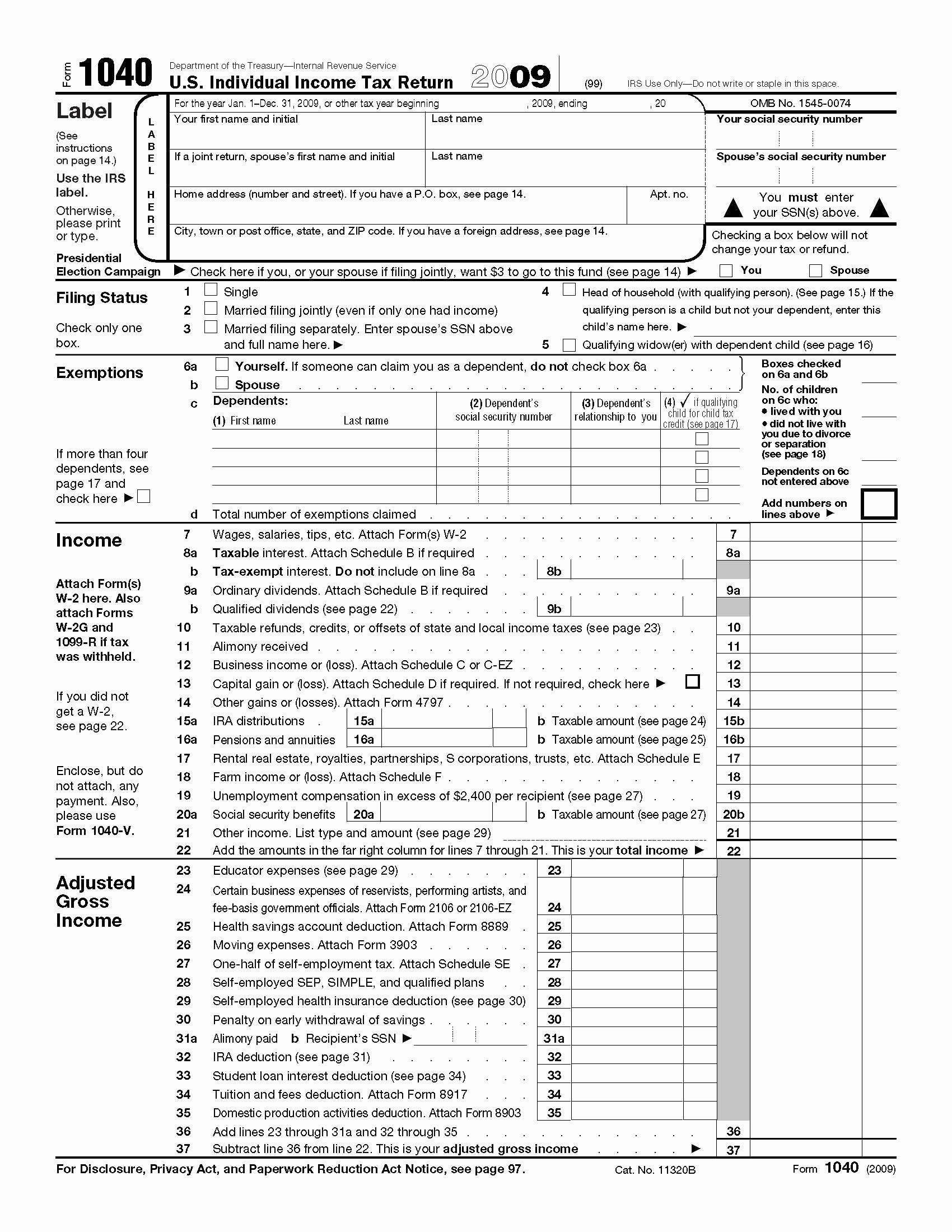

Department of The Treasury IRS OMB 1545 0074 Form 1040 U S Individual Income Tax Return 2020 Document pdf Download PDF pdf Form 1040 U S Individual Income Tax Return 2020 Filing Status Check only one box 99 Department of the Treasury Internal Revenue Service Single Married filing jointly OMB No 1545 0074 Married filing

https://www.irs.gov/forms-pubs/about-form-1040

Information about Form 1040 U S Individual Income Tax Return including recent updates related forms and instructions on how to file Form 1040 is used by citizens or residents of the United States to file an annual income tax return

https://www.irs.gov/instructions/i1040gi

Print or type the information in the spaces provided check the box under Dependents on page 1 of Form 1040 or 1040 SR and include a statement showing the information Dependent care benefits should be shown in box 10 of your Form s W 2 But first complete Form 2441 to see if you can exclude part or all of the benefits Line 1f

On the first page of the Form 1040 x you ll fill out information about yourself your dependents and your income On the second page you ll fill out information related to the tax deductions and credits that you qualify for 3 Include Form 8962 with your Form 1040 Form 1040 SR or Form 1040 NR Don t include Form 1095 A Health Coverage Reporting If you or someone in your family was an employee in 2020 the employer may be required to send you Form 1095 C Part II of Form 1095 C shows whether your employer offered you health insurance coverage and if so

2 Complete Form 8962 to claim the credit and to reconcile your advance credit payments 3 Include Form 8962 with your Form 1040 Form 1040 SR or Form 1040 NR Don t include Form 1095 A Health Coverage Reporting If you or someone in your family was an employee in 2022 the employer may be required to send you Form 1095 C Part II