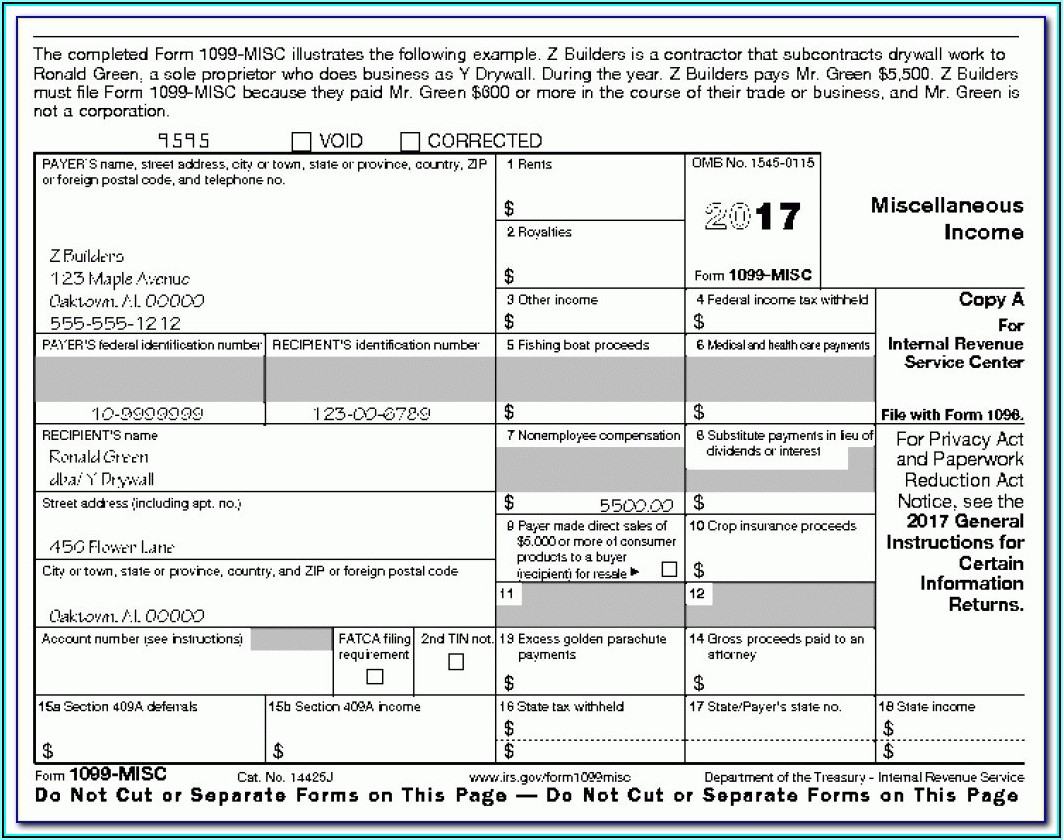

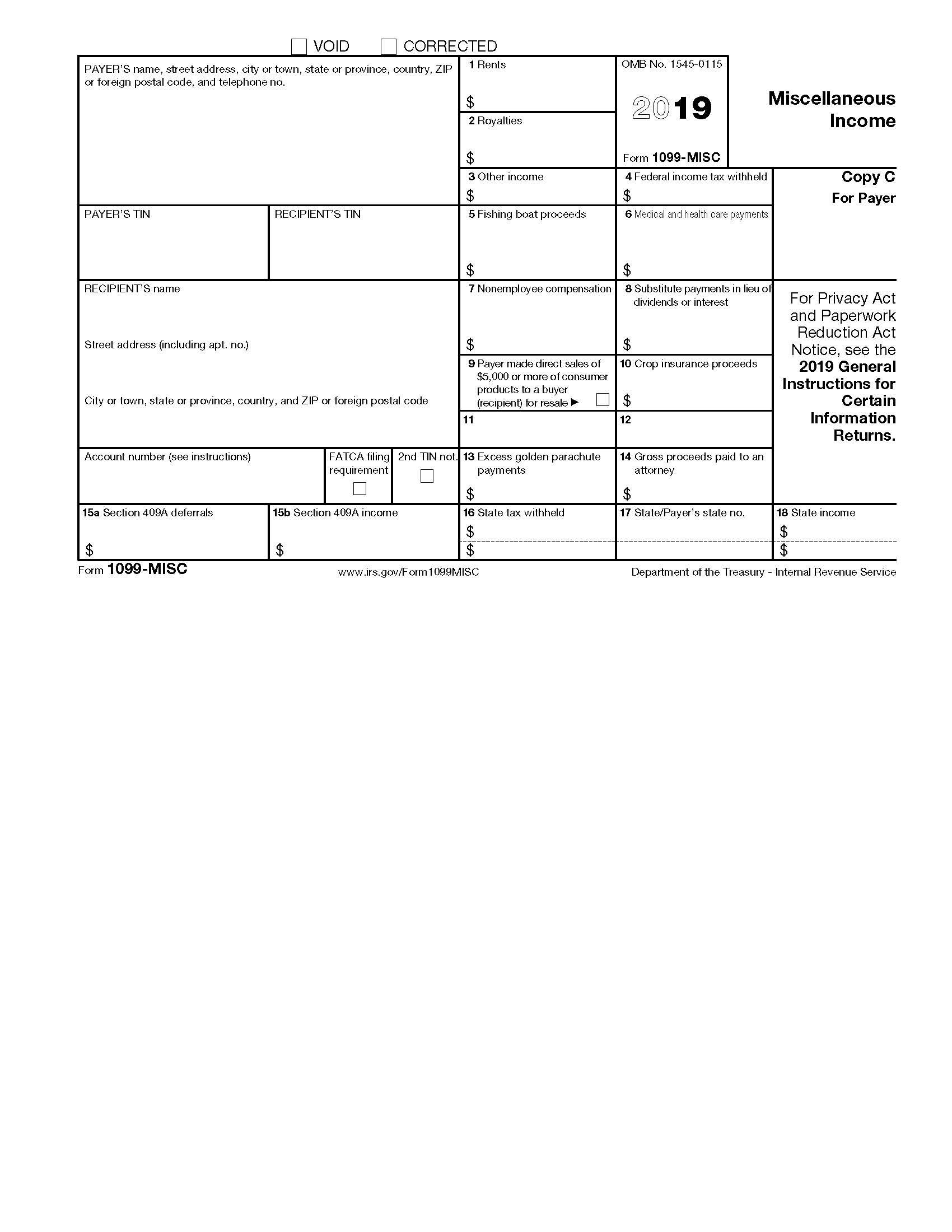

Printable 1099 Tax Form Page Last Reviewed or Updated 04 Oct 2023 Information about Form 1099 MISC Miscellaneous Information including recent updates related forms and instructions on how to file Form 1099 MISC is used to report rents royalties prizes and awards and other fixed determinable income

What Is a Form 1099 MISC A Form 1099 MISC is an IRS form that reports non employee compensation In addition to reporting compensation to freelancers and contractors this form covers received income that spans the gamut from rents and crop insurance proceeds to prizes and awards medical and health care payments and any Attention Attention Copy A of this form is provided for informational purposes only Copy A appears in red similar to the official IRS form The official printed version of Copy A of this IRS form is scannable but the online version of it printed from this website is not Do not print and file copy A downloaded from this website a

Printable 1099 Tax Form

Printable 1099 Tax Form

Printable 1099 Tax Form

https://secureservercdn.net/104.238.68.196/793.969.myftpupload.com/wp-content/uploads/2021/01/1099.png

A 1099 is an information filing form used to report non salary income to the IRS for federal tax purposes There are 20 variants of 1099s but the most popular is the 1099 NEC If you paid an independent contractor more than 600 in

Templates are pre-designed documents or files that can be utilized for different purposes. They can save time and effort by providing a ready-made format and design for creating various type of material. Templates can be utilized for individual or expert jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Printable 1099 Tax Form

Printable 1099 R Form Printable Forms Free Online

Printable Form 1099 Misc Irs Printable Forms Free Online

Glory 1099 Template Excel 2018 Leave Tracker 2019

1099 Printable Form Word Template Printable Forms Free Online

Printable 1099 Misc Tax Form Template Printable Templates

Federal 1099 Printable Form Printable Forms Free Online

https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

On this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 8938 Box 14 Shows your total compensation of excess golden parachute payments subject to a 20 excise tax See your tax return instructions for where to report

https://eforms.com/irs/form-1099/misc

IRS Form 1099 MISC Updated October 19 2023 A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a specified dollar threshold for rents royalties prizes awards medical and legal exchanges and several other specific transactions must be reported to the IRS using this form

https://www.canada.ca/en/revenue-agency/services/forms-publications/fo…

2023 10 19 This site provides a list of Canada Revenue Agency CRA tax forms listed by form number

https://www.irs.gov/pub/irs-prior/f1099msc--2020.pdf

Www irs gov Form1099MISC Federal income tax withheld Nonqualified deferred compensation Copy B For Recipient This is important tax information and is being furnished to the IRS

https://www.canada.ca/en/revenue-agency/services/forms-publications/ta…

Canada Revenue Agency Forms and publications Tax packages for all years Personal income tax Get a T1 income tax package You may be looking for Certified tax software to file your taxes online You can get an income tax package guide return forms and schedules online or by mail Certain tax situations may require a

For the latest information about developments related to Forms 1099 MISC and 1099 NEC and their instructions such as legislation enacted after they were published go to IRS gov Form1099MISC or IRS gov Form1099NEC What s Contents Can you print 1099s on plain paper What to do before you print your 1099s When should you print and send your 1099s Where to order printable 1099 forms How to print 1099s from a PDF How to print 1099s from a spreadsheet How to print 1099s from QuickBooks Printing 1099s from Sage 50 Printing 1099s from Patriot

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn t your employer The payer fills out the form with the appropriate details and sends copies to you and the IRS reporting payments made during the tax year