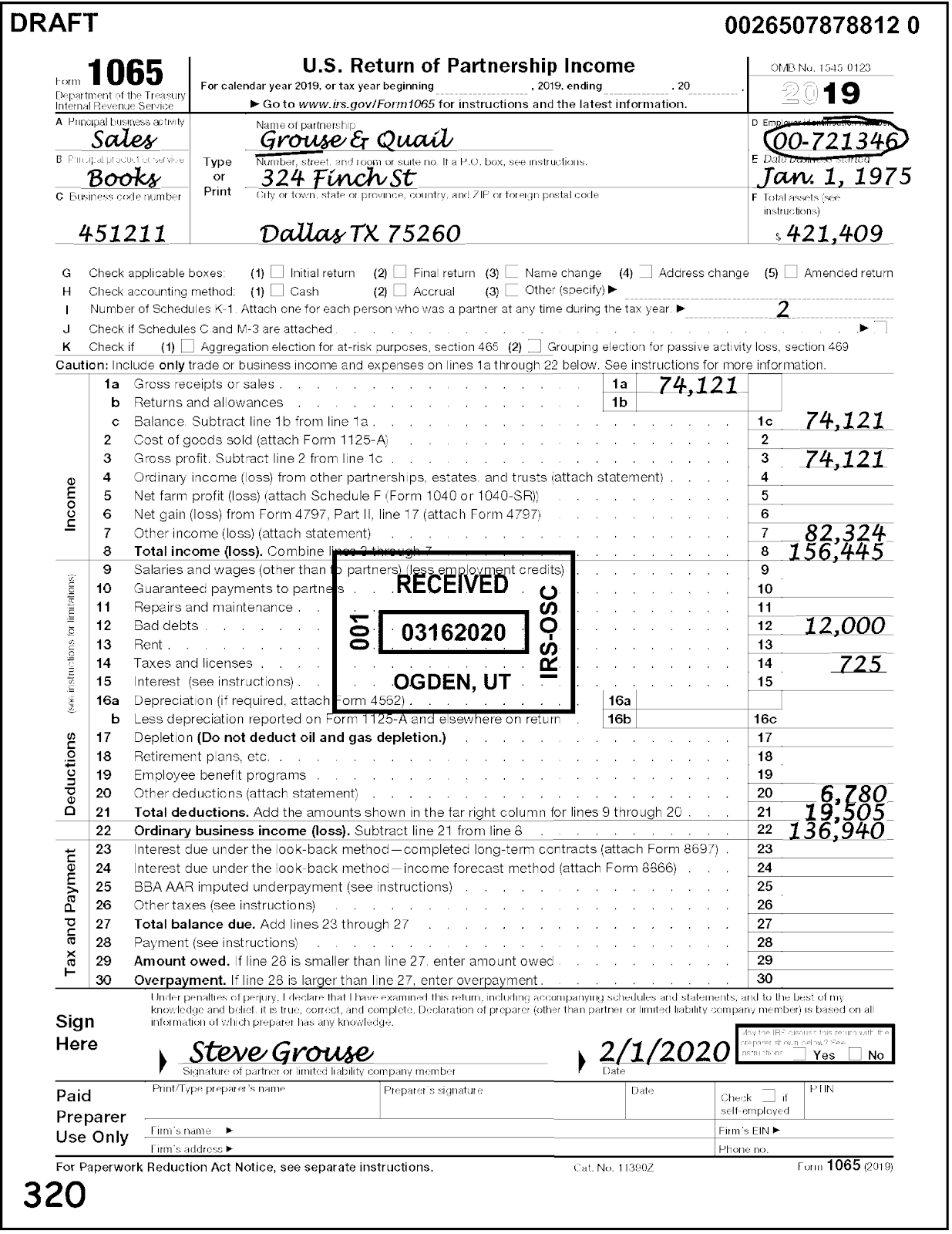

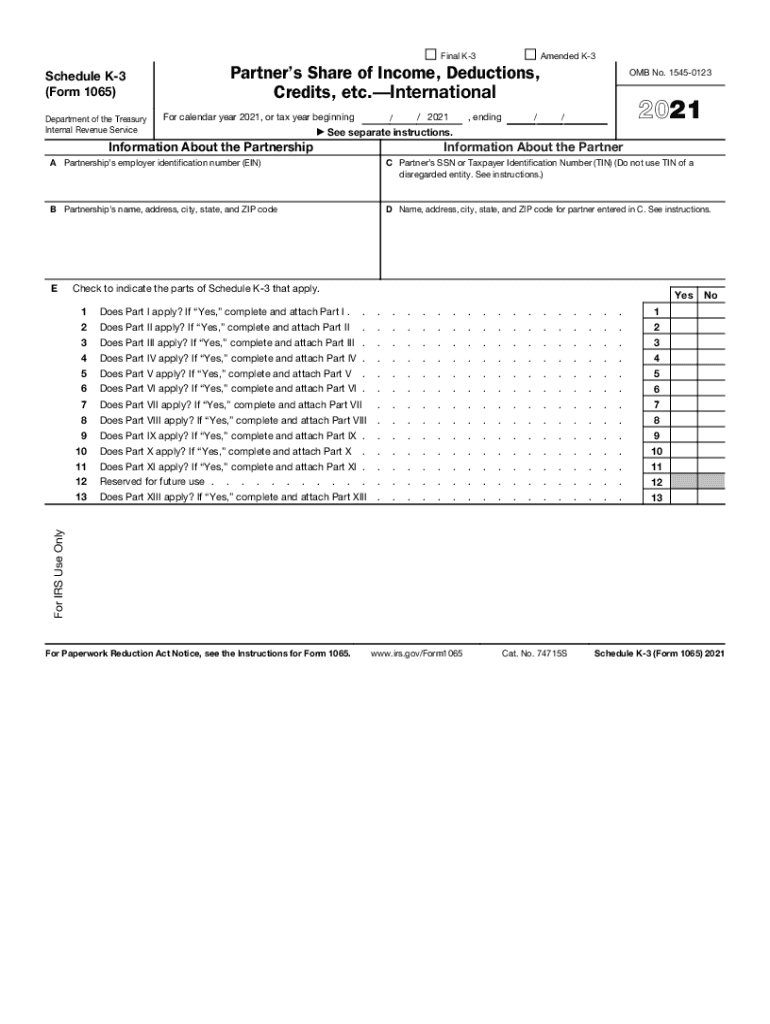

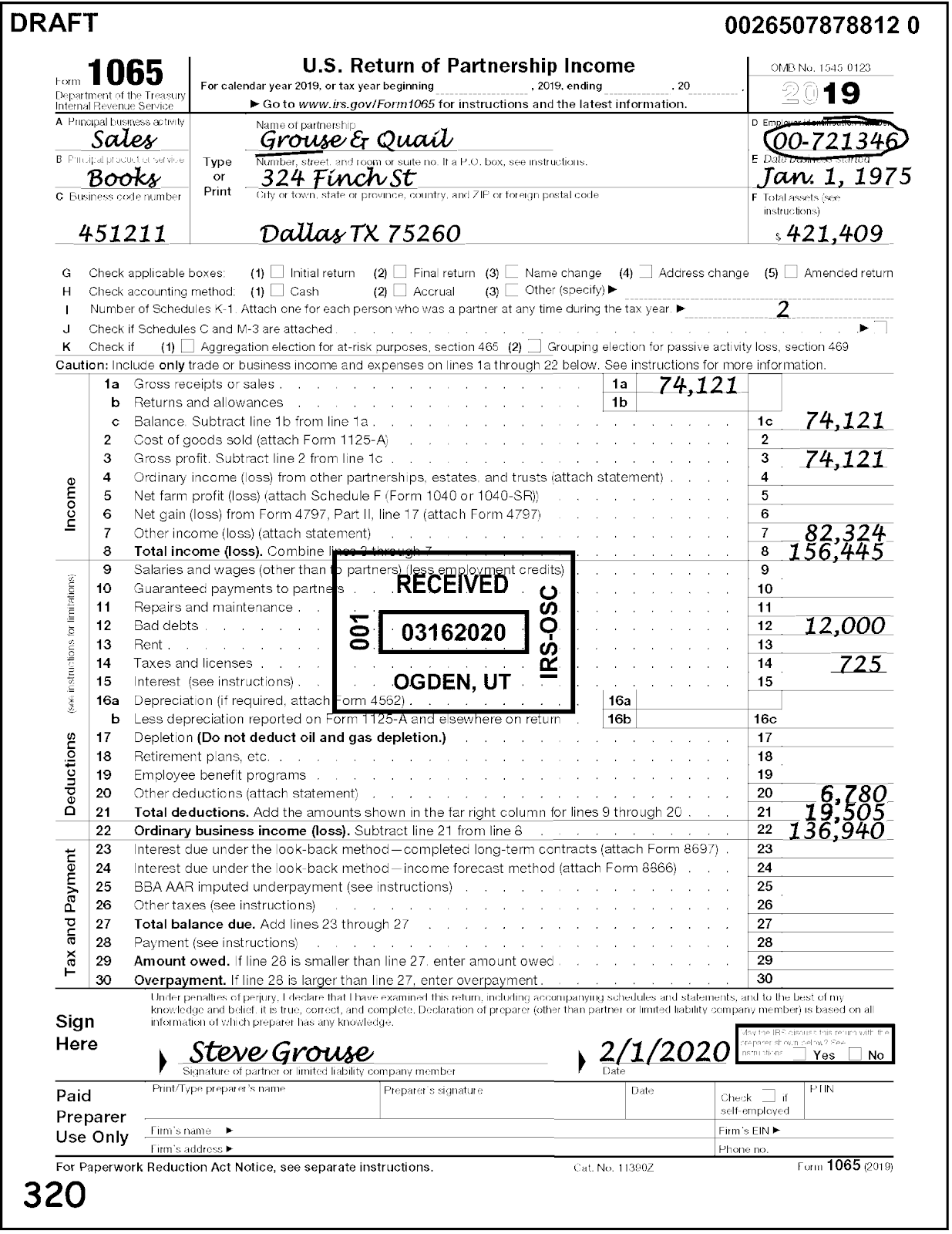

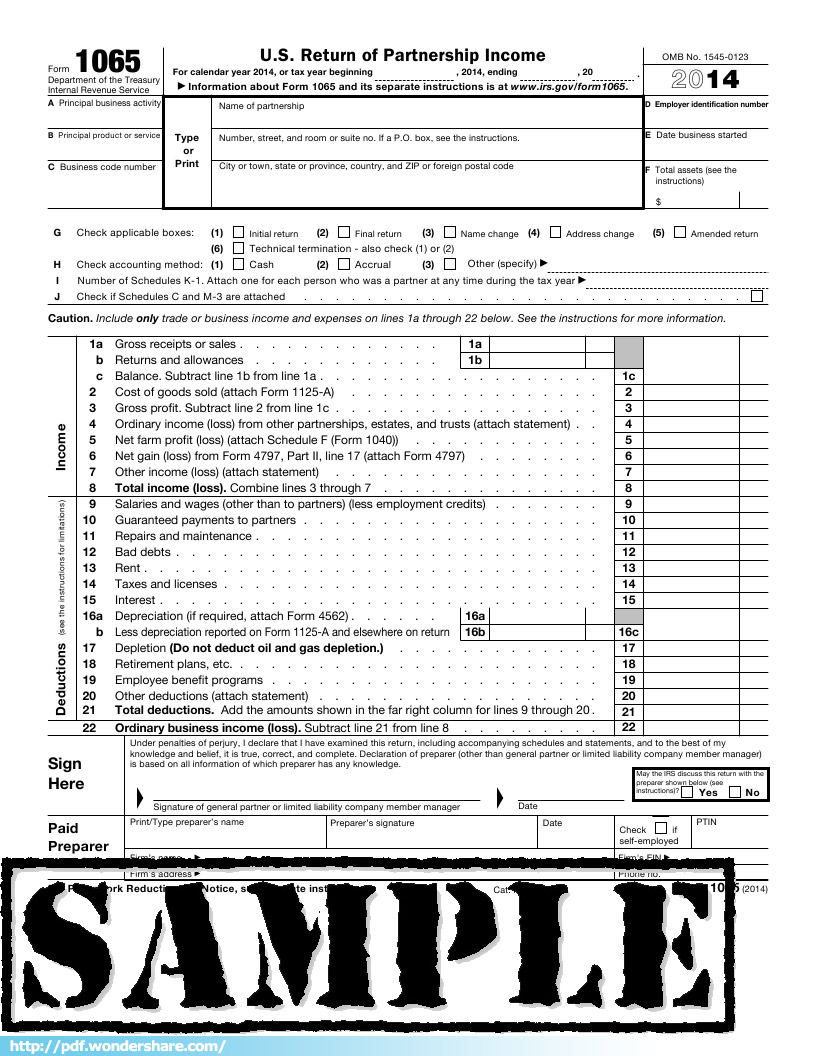

Printable 1065 Tax Form Form 1065 reports the business performance of partnerships to the IRS each tax year Partnerships generally don t pay taxes and use Form 1065 to prepare Schedule K 1s and Schedule K 3s where appropriate to pass through income and losses to

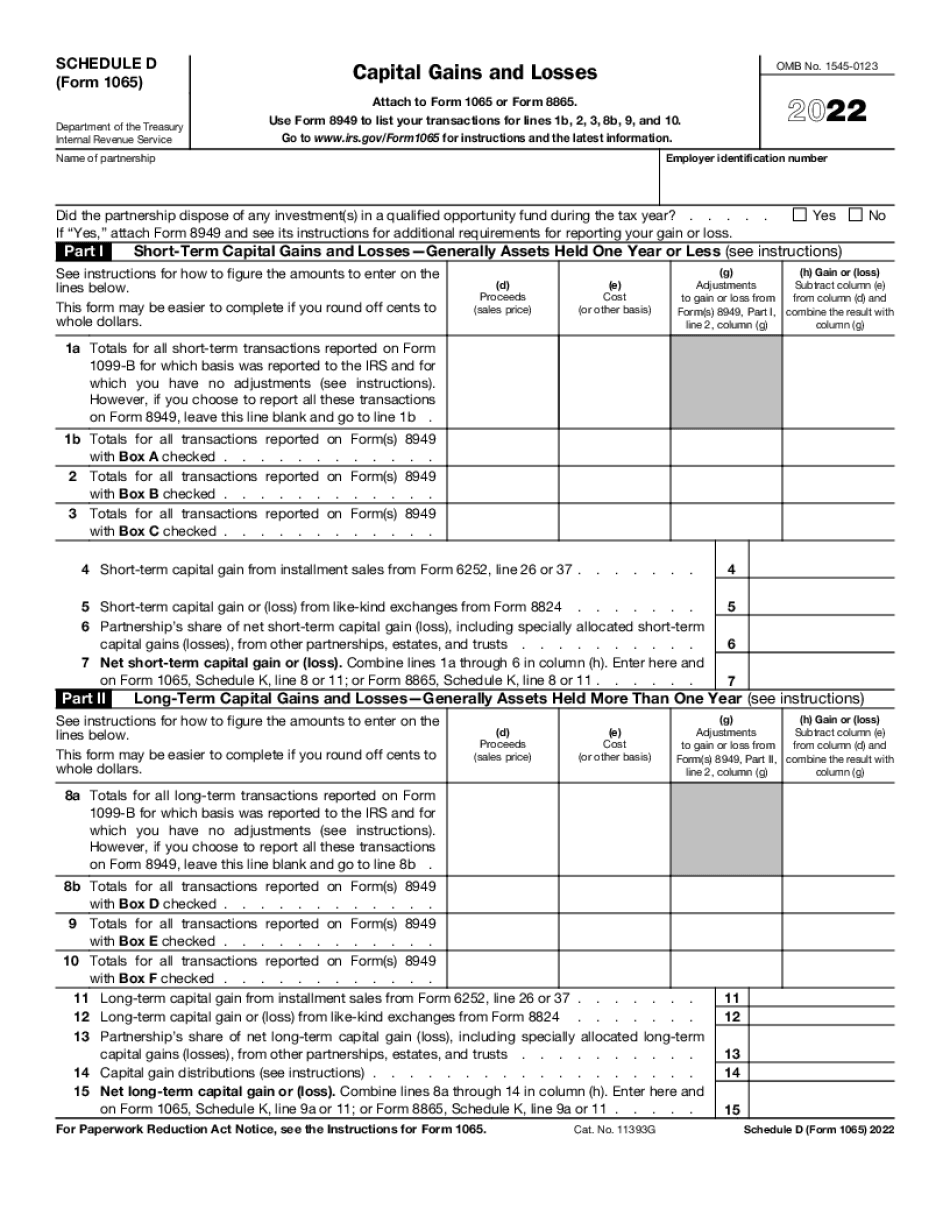

The 2022 Form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023 For a fiscal year or a short tax year fill in the tax year space at the top of Form 1065 and each Schedule K 1 and Schedules K 2 and K 3 if applicable The 2022 Form 1065 may also be used if To file Form 1065 you ll need all of your partnership s important year end financial statements including a profit and loss statement that shows net income and revenues along with all the partnership s deductible expenses and a balance sheet for the beginning and end of the year

Printable 1065 Tax Form

Printable 1065 Tax Form

Printable 1065 Tax Form

https://us.meruaccounting.com/wp-content/uploads/2020/04/Structure-of-Form-1065.png

Form 1065 U S Return of Partnership Income is a tax document issued by the Internal Revenue Service IRS used to declare the profits losses deductions and credits of a business partnership

Templates are pre-designed documents or files that can be used for different purposes. They can conserve time and effort by offering a ready-made format and design for producing various type of material. Templates can be utilized for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Printable 1065 Tax Form

Free Fillable Form 1065 Printable Forms Free Online

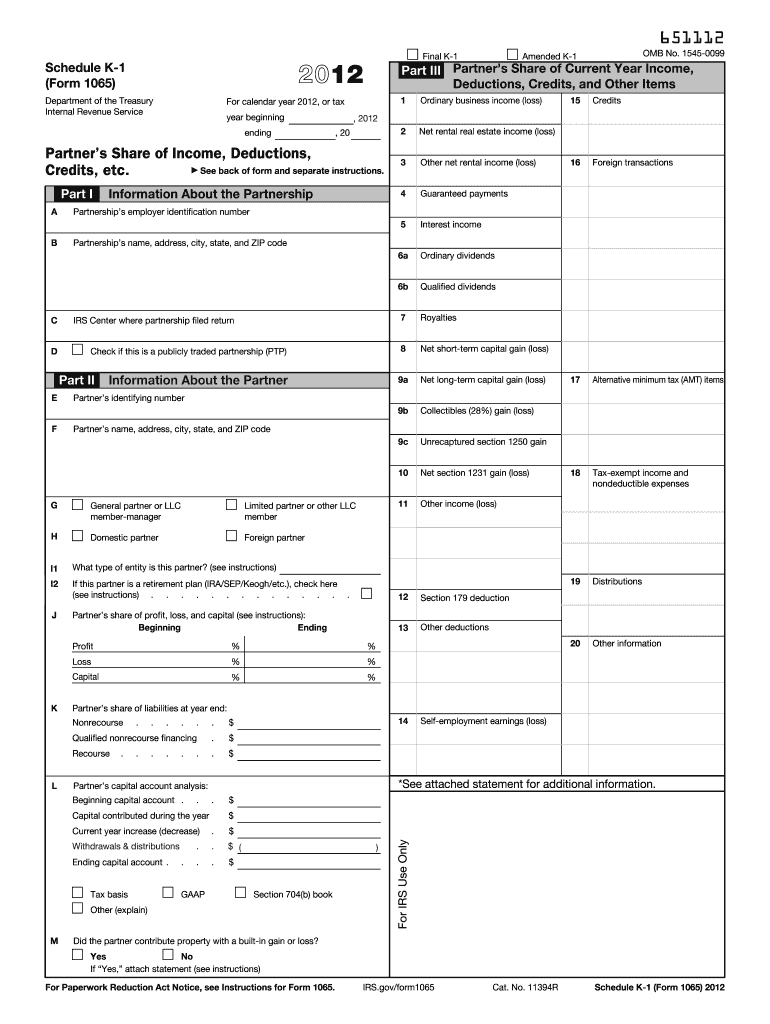

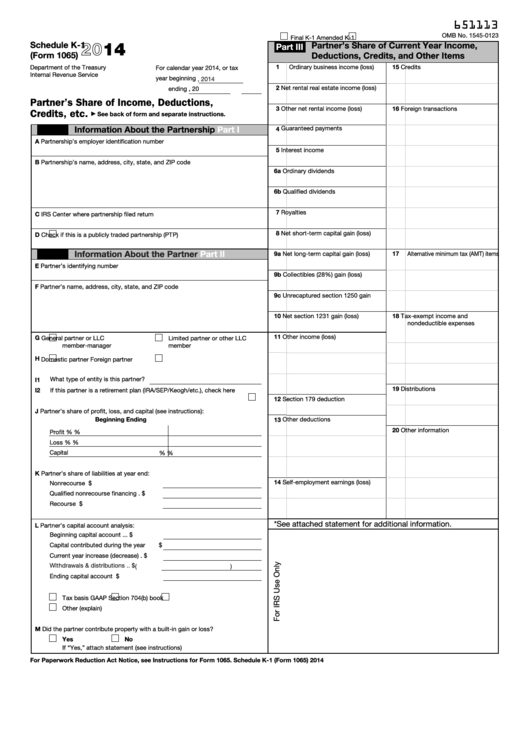

Irs Form K1 Fillable Printable Forms Free Online

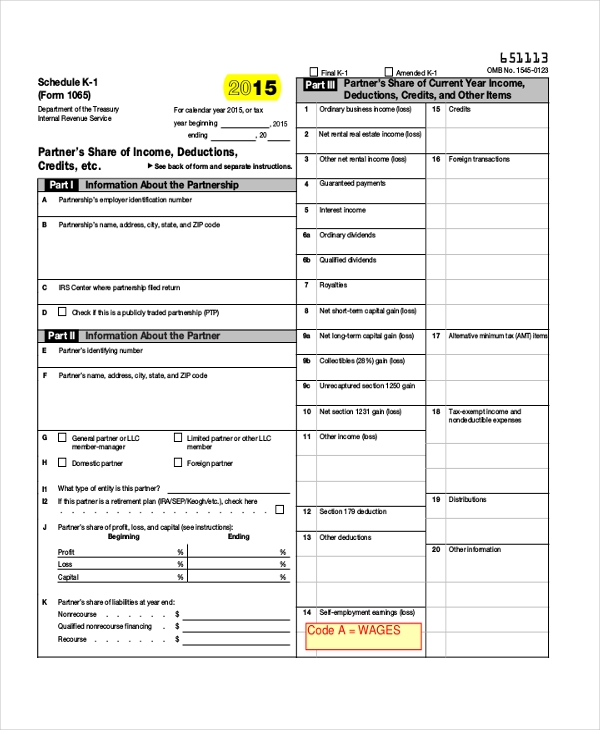

Schedule K 1 Form 1065 Self Employment Tax Employment Form

IRS 1065 Schedule K 3 2021 2022 Fill And Sign Printable Template

Form 1065 City Form Fill Online Printable Fillable Blank PdfFiller

Fillable Schedule K 1 Form 1065 Partner S Share Of Income

https://www.canada.ca/en/revenue-agency/services/forms-publications

View and download forms All Canada Revenue Agency forms listed by number and title

https://www.irs.gov/forms-pubs/about-form-1065

Information about Form 1065 U S Return of Partnership Income including recent updates related forms and instructions on how to file Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the U S or getting income from U S sources

https://www.canada.ca/en/revenue-agency/services/forms-publications/ta…

You can get an income tax package guide return forms and schedules online or by mail Certain tax situations may require a specific return or form For tax filing information go to Get ready to do your taxes On this page Get a 2022 income tax package Get a previous year s income tax package Tax situations requiring a specific return or form

https://www.irs.gov/form

POPULAR FORMS INSTRUCTIONS Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T

https://www.nerdwallet.com/article/small-business/form-1065

Form 1065 is an informational tax form used to report the income gains losses deductions and credits of a partnership or LLC but no taxes are calculated or paid from this form Good

Schedule K 1 is a schedule of IRS Form 1065 U S Return of Partnership Income It s provided to partners in a business partnership to report their share of a partnership s profits losses deductions and credits to the IRS You fill out Schedule K 1 as part of your Partnership Tax Return Form 1065 which reports your partnership s total Each partner is responsible for filing a tax return reporting their share of income losses tax deductions and tax credits that the business reported on the informational 1065 tax form As a result the partnership must prepare a Schedule K 1 to report each partner s share of these tax items

You can find the 1065 tax form on the IRS website You can fill out the form using tax software or print it to complete it by hand If your partnership has more than 100 partners you re required to file Form 1065 online