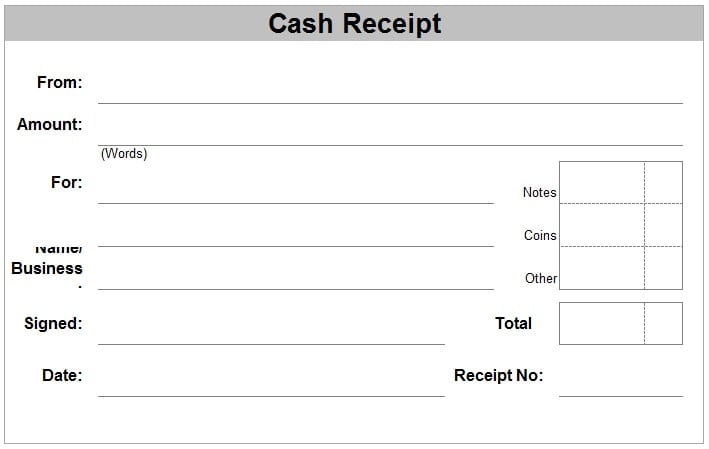

Llc Member Printable Draw Receipt Use this fillable basic receipt template to simplify receipt generation for any product or service that you provide Enter your company name and contact information the salesperson the method of payment the date of purchase and the receipt number

Owner draws are only available to owners of sole proprietorships and partnerships In a corporation owners can receive compensation by a salary or dividends from ownership shares but not owner draws Typically you account for owner draws with a temporary account that offsets the company s owner equity or owner capital account Business records You are required by law to keep records of all your transactions to be able to support your income and expense claims A record is defined to include an account an agreement a book a chart or table a diagram a form an image an invoice a letter a map a memorandum a plan a return a statement a telegram a voucher

Llc Member Printable Draw Receipt

Llc Member Printable Draw Receipt

Llc Member Printable Draw Receipt

https://www.wordstemplates.com/wp-content/uploads/2014/09/cash-receipt-image-1.jpg

To report business or professional income and expenses we encourage you to use Form T2125 We also accept this information on other types of financial statements Form T2125 can also be used to report business income and expenses from self employed commission sales

Templates are pre-designed files or files that can be utilized for numerous functions. They can save time and effort by supplying a ready-made format and layout for developing different type of content. Templates can be used for personal or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, presentations, and more.

Llc Member Printable Draw Receipt

Free Llc Membership Certificate Template

Automatic Serial Number Generation For Receipt Books For Corel Draw And

HOW TO DRAW PAYMENT PAPER RECEIPT YouTube

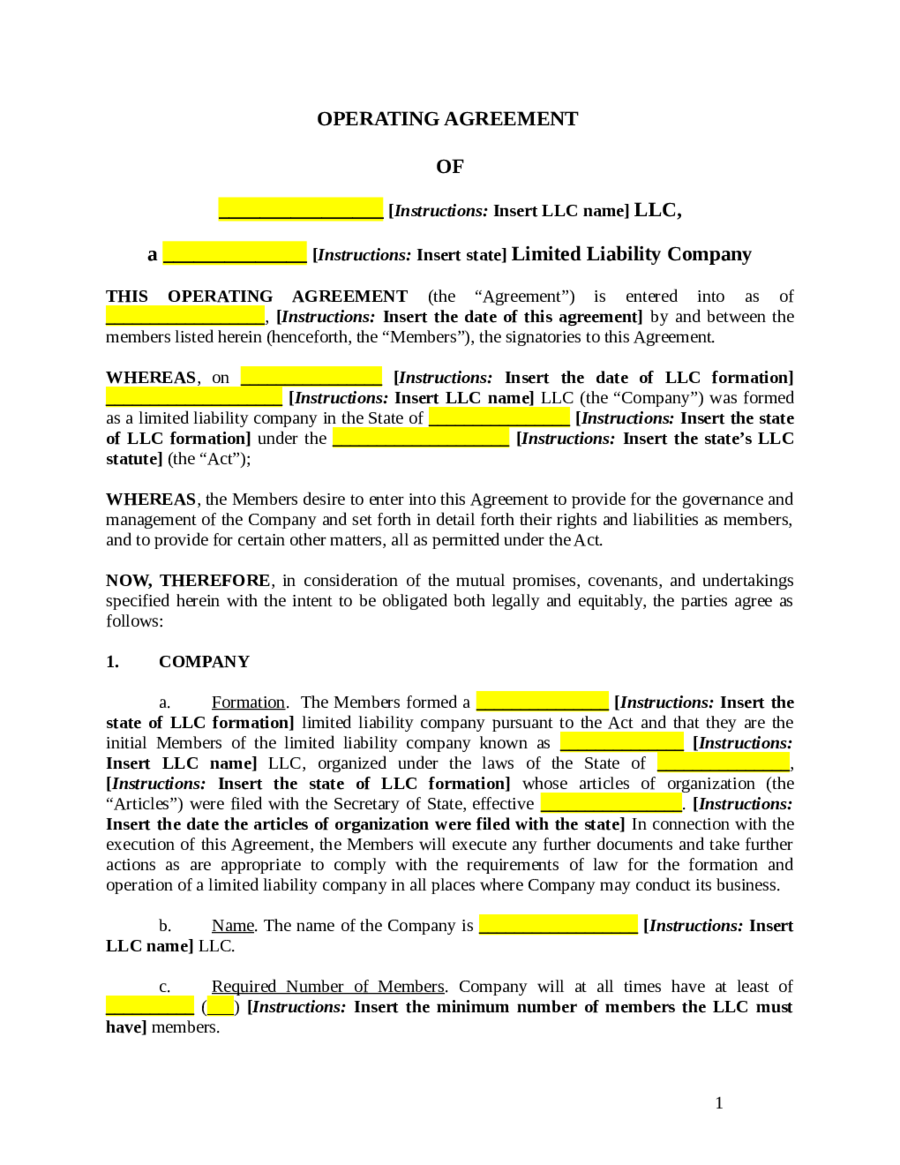

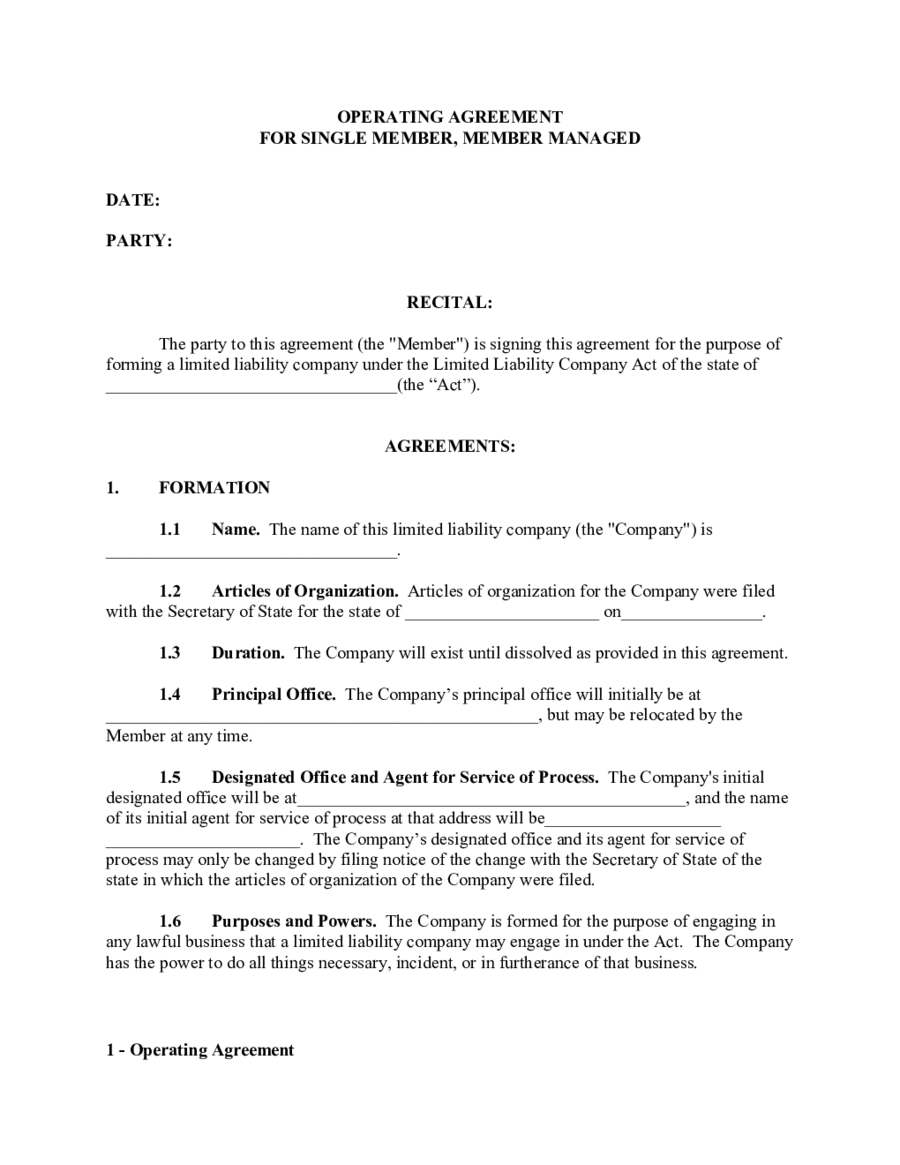

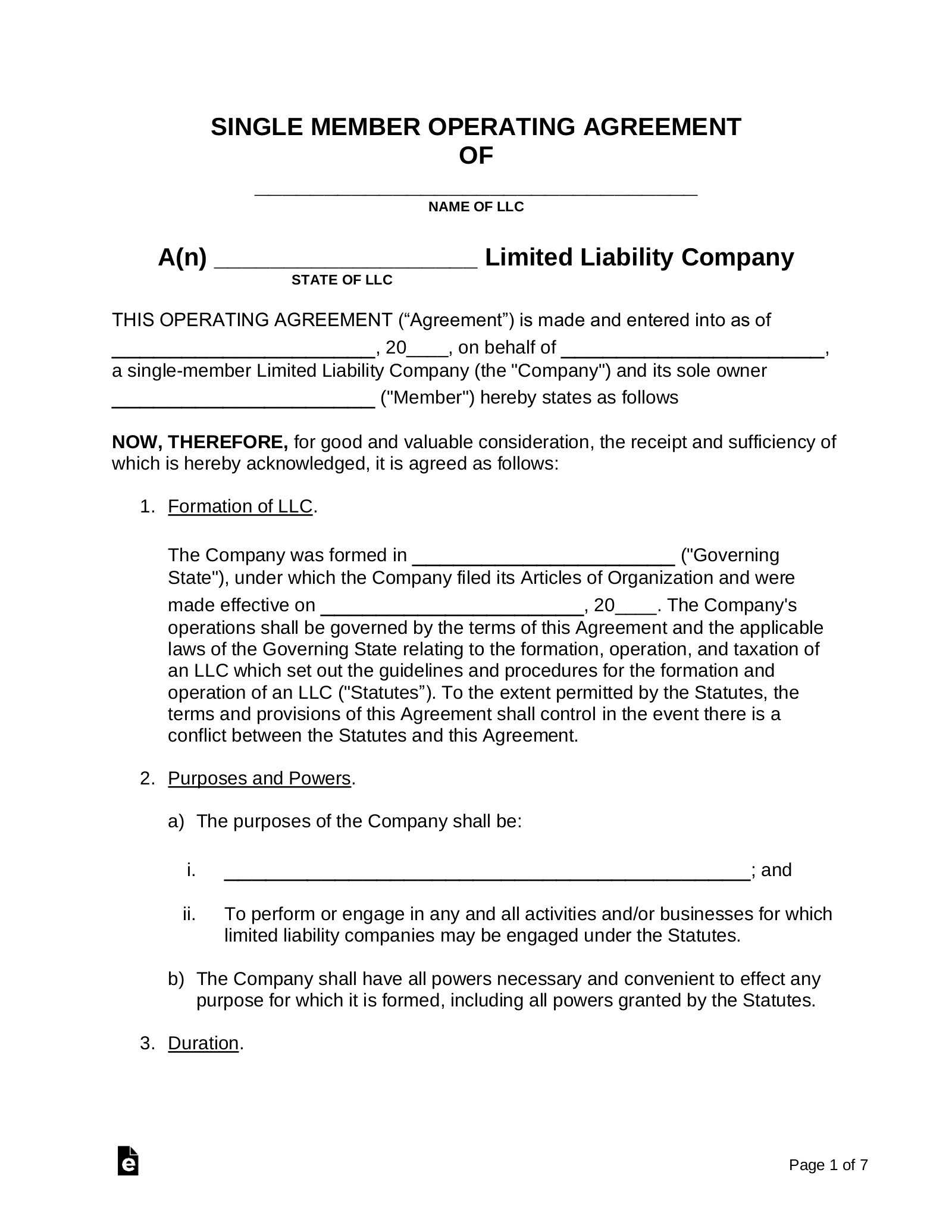

Missouri Single Member Llc Operating Agreement Free Llc Operating 16A

New Super Heavy Duty Full Size Cash Drawer TILL POS DRAW 1 Receipt 4

10 Home Depot Receipt Template Receipt Templates Home 8 Amazing Home

https://quickbooks.intuit.com/global/resources/expenses/how-to-pay

Paying yourself a salary is an ideal option if a certain amount of income is required each month to meet your personal needs You can also receive the owner s draw Remember if you are a multi member LLC you would distribute the profits or owner s draw amongst each member based on the percentages mentioned in the operating

https://www.wonder.legal/en-ca/modele/general-receipt-en-ca

This document can be used for any type of receipt The document is set up to assist the form filler with the most common types of receipts Monetary Receipts Document Receipts Goods Receipts Services Receipts or Donation Receipts If none of these are the correct categorization the receipt also has an option for Other whereby

https://www.patriotsoftware.com/blog/accounting/owners-draw-accounting

Limited liability companies LLC In most cases you must be a sole proprietor member of an LLC or a partner in a partnership to take owner s draws Typically corporations like an S Corp can t take owner s withdrawals However corporations might be able to take similar profits such as distributions or dividends

https://www.forbes.com/advisor/business/pay-yourself-from-llc

Here are four main ways you can receive payments from your LLC 1 Pay Yourself as a W 2 Employee For many LLC owners the most advantageous way to receive payment is to treat yourself as an

https://www.thebalancemoney.com/what-is-an-owner-s-draw-how-does-a

What Is an Owner s Draw A sole owner or co owner can take money out of their business through an owner s draw Owner s draws can be taken out at regular intervals or as needed The draw comes from owner s equity the accumulated funds the owner has put into the business plus their shares of profits and losses

Download Simple Fillable and Printable Receipt Template Adobe PDF As a small business you need a reliable way to provide your customers with a receipt for the goods or services they have paid for Use this free fillable and editable receipt template to input all relevant purchase details 6 Comments john pero Community Champion June 10 2020 05 46 AM They are both equity accounts One adds one subtracts Since they are equal types then negative for draw and positive for contributions is correct To tie them together we recommend you have actually 4 equity accounts for each member You already have draw and contribution

Members who provide services to the LLC other than in their capacity as a member recognize income under the general income recognition rules based on their tax accounting method Likewise the LLC deducts or capitalizes the payment based on its tax accounting methods Sec 707 a 1