Life Insurance Needs Printable How much life insurance do I need Download the interactive PDF and add it to your Financial Toolkit PDF 213KB Previous Next Date modified 2023 08 31

If income needs exceed available income proceed to Step C Multiply monthly income shortfall B by 12 to determine annual shortfall Divide 5 by assumed net after tax interest rate Life insurance including employer provided Outstanding uninsured debts mortgages if not insured credit card balances income taxes etc Determining your insurance needs When trying to determine your insurance needs consider your circumstances and your stage in life For example you may want to consider getting insurance if you re moving in with your partner starting a family buying a home or renting a home or an apartment starting a business buying a new car

Life Insurance Needs Printable

Life Insurance Needs Printable

Life Insurance Needs Printable

http://www.friedman-group.com/uploads/3/2/0/7/3207324/life-insurance-needs-friedman_orig.jpg

Calculator Just follow these three easy steps to estimate how much life insurance you may need To estimate how much life insurance you need to protect your family in the event of your passing simply enter the required information in three easy steps

Pre-crafted templates offer a time-saving service for developing a varied series of files and files. These pre-designed formats and layouts can be used for different personal and expert tasks, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, enhancing the material development process.

Life Insurance Needs Printable

Life Insurance Needs Calculator Free Excel Templates And Dashboards

Podcast 8 Questions To Consider Before Buying Life Insurance A Needs

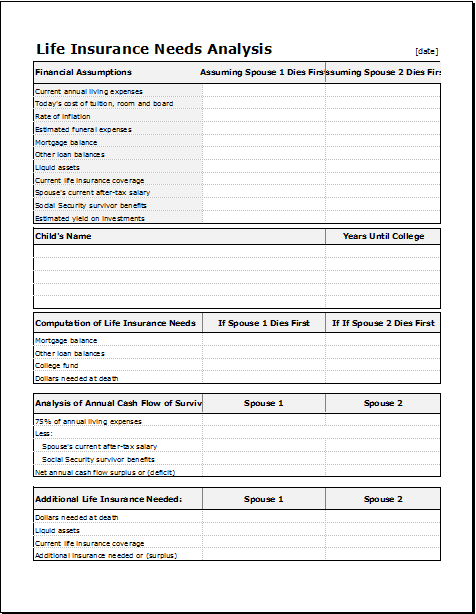

Life Insurance Needs Analysis Template

39 Life Insurance Needs Worksheet Worksheet Was Here

Life Insurance Needs Analysis Worksheet

Life Insurance Needs Analysis Worksheet Canada Resume Examples

https://lifequote.nationwide.com/assets/pdf/life-insurance-work…

Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family Before buying any insurance products you should consult with a qualified insurance professional for a more thorough analysis of your needs This worksheet assumes you died today

https://woodgundyadvisors.cibc.com/documents/1094647/10948…

Manulife s life insurance worksheet provides an estimate of the amount of life insurance you may need based on the information you provide Your insurance needs will change over time so you should periodically review these needs with your advisor 1 Canadian Funerals Online Differences in costs between burials and cremation in Canada

https://www.bmo.com/newsletter/insurance/pdf/Insurance_Ne…

Determining how much life insurance you need doesn t have to be complicated Working with your insurance advisor use the following 3 easy steps to find out how much insurance protection you require today to protect your loved ones

https://www.theglobeandmail.com//tools/life-insurance-needs

Preet Banerjee Visit Globe Investor and use our free Life Insurance Needs Calculator to quickly find out how much life insurance you may need to help protect your family s financial

https://www.empire.ca/node/2526

Printable Y location docs pdf An advisor can show you how Life Insurance provides financial security for your loved ones in the event of a death by Replacing lost income Covering debts and more

Life insurance helps your loved ones deal with the financial impact of your death It provides them with a one time tax free payment called a death benefit They may use the amount to replace your income to allow your family to maintain their standard of living provide for your children or dependents What s the value of your insured mortgage and loans What s the value of your current life insurance plans What s the value of your other death benefits like CPP Use our simple life insurance calculator to find the right amount

Life Insurance Needs Worksheet Financial Requirements Example You Final Expenses 1 Funeral expenses 10 000 2 Probate expenses 3 000 3 Estate taxes 0 4 Uninsured medical costs 0 5 Total 13 000 Existing Debts 6 Credit cards 8 000 7 Auto loans 16 000 8 Mortgage 100 000 9