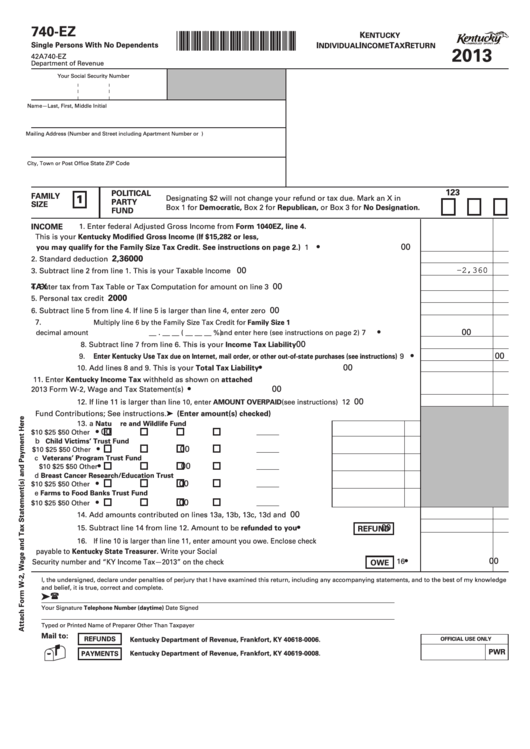

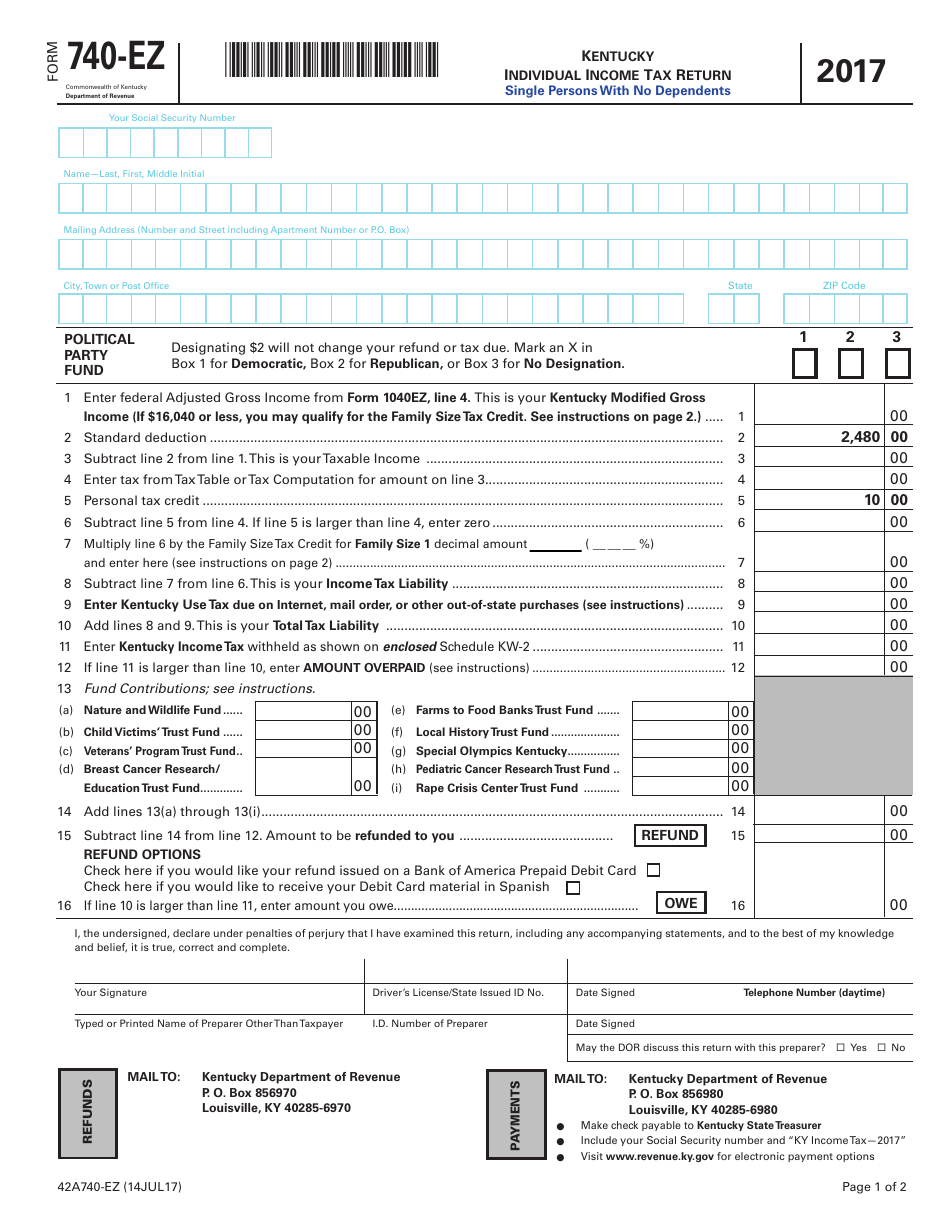

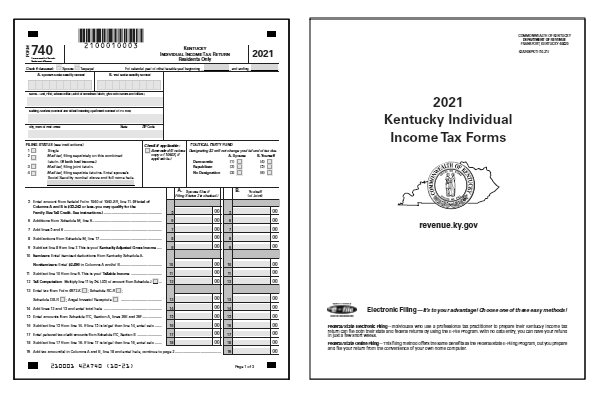

Ky Form 740 Printable We last updated Kentucky Form 740 in February 2023 from the Kentucky Department of Revenue This form is for income earned in tax year 2022 with tax returns due in April 2023 We will update this page with a new version of the form for 2024 as soon as it is made available by the Kentucky government

We last updated the Kentucky Individual Income Tax Return in February 2023 so this is the latest version of Form 740 fully updated for tax year 2022 You can download or print current or past year PDFs of Form 740 directly from TaxFormFinder You can print other Kentucky tax forms here This free booklet contains instructions on how to fill out and file your Income Tax Form 740 for general individual income taxes We last updated the Form 740 Individual Full Year Resident Income Tax Instructions Packet in February 2023 so this is the latest version of Income Tax Instructions fully updated for tax year 2022

Ky Form 740 Printable

Ky Form 740 Printable

Ky Form 740 Printable

https://data.formsbank.com/pdf_docs_html/324/3246/324676/page_1_thumb_big.png

Download the Taxpayer Bill of Rights The Kentucky Department of Revenue conducts work under the authority of the Finance and Administration Cabinet

Templates are pre-designed documents or files that can be used for different functions. They can conserve time and effort by providing a ready-made format and layout for producing different sort of content. Templates can be used for personal or professional jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Ky Form 740 Printable

Kentucky 2023 Tax Form Printable Forms Free Online

Printable Kentucky State Tax Forms

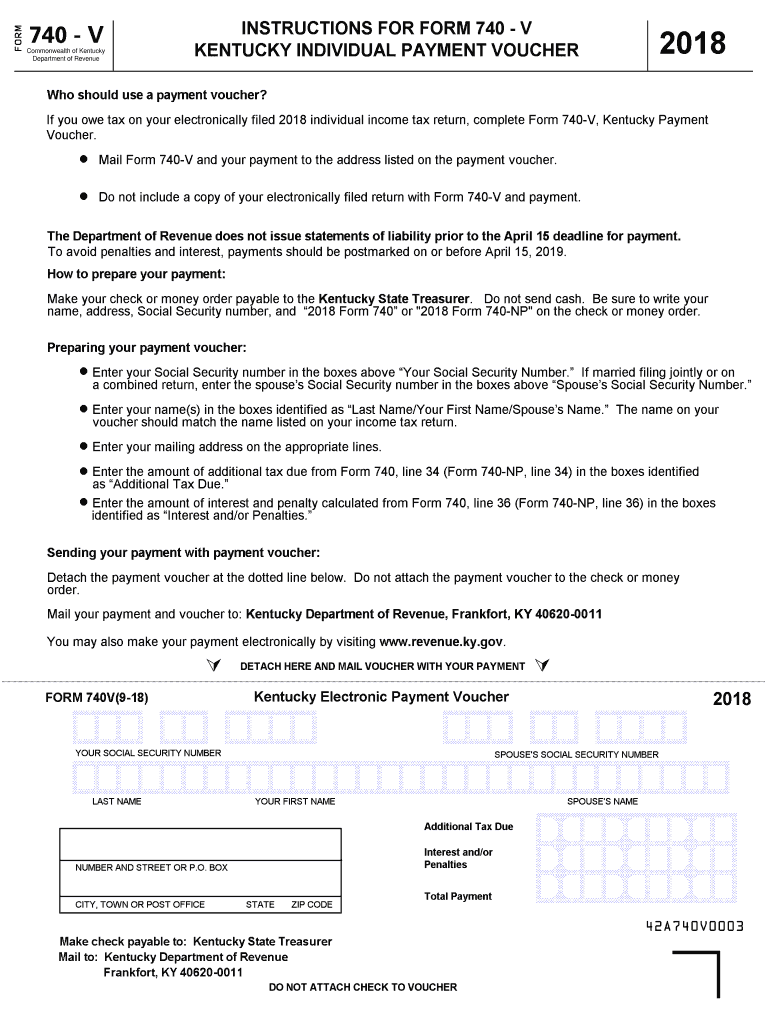

2018 Form KY 740 VFill Online Printable Fillable Blank PdfFiller

740 Es Form Ky Fill Out Printable PDF Forms Online

Kentucky Form 740 Fill Out Sign Online DocHub

2021 Year Planner Calendar Download For A4 Or A3 Print Infozio Your

https://revenue.ky.gov/Forms/Form 740-2021.pdf

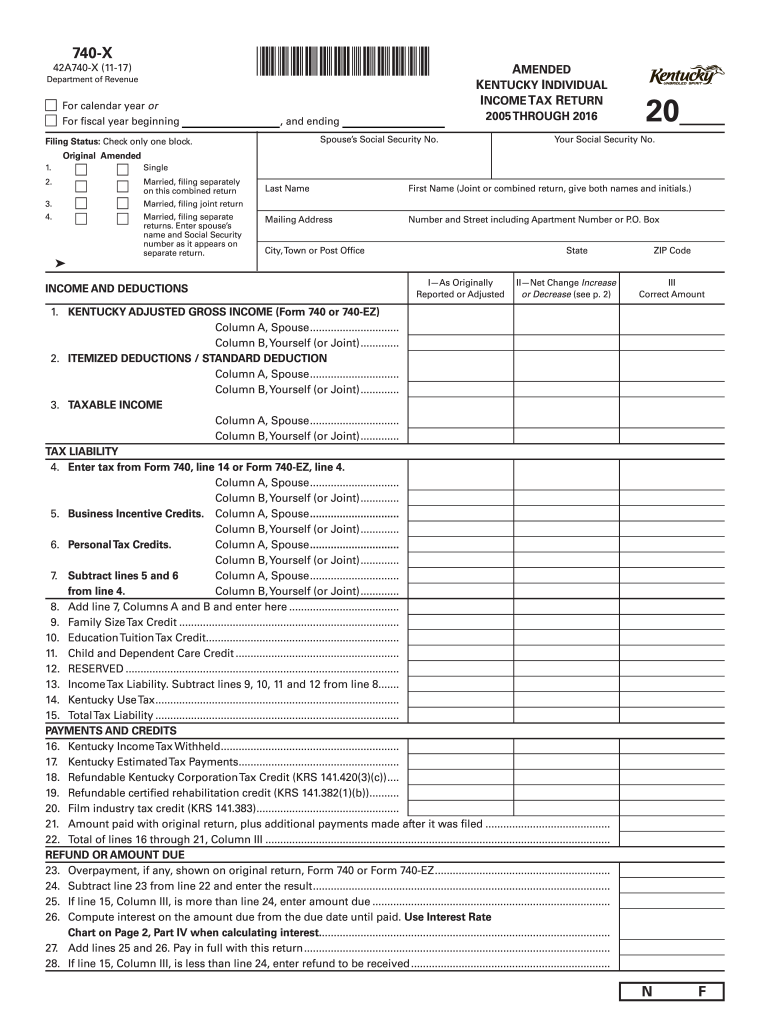

740 2021 Commonwealth of Kentucky Department of Revenue FORM Check if applicable Amended Enclose copy of 1040X if applicable Check if deceased Spouse Taxpayer A Spouse s Social Security Number B Your Social Security Number Name Last First Middle Initial Joint or combined return give both names and initials

https://revenue.ky.gov/Forms/740.pdf

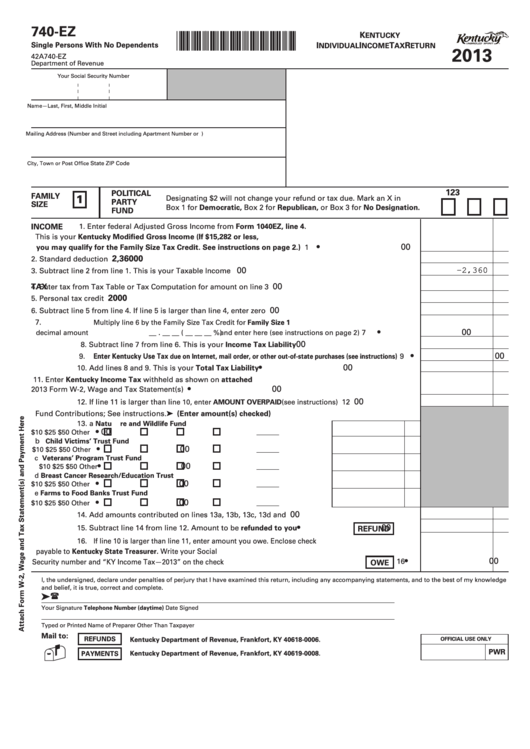

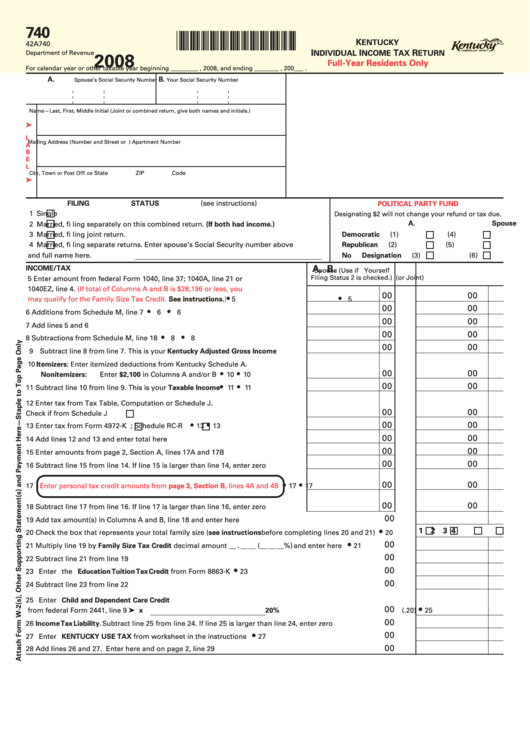

Which form should I file File Form 740 if you are a full year Kentucky resident and meet the filing requirements in the Instructions for Form 740 File Form 740 NP if you are a nonresident and had income from Kentucky sources out your Kentucky forms and Forms and instructions are available ky gov 2020 Kentucky

https://revenue.ky.gov/Forms/740 Packet Instructions 5-9-23.pdf

Form 740 File Form 740 NP if you are a nonresi dent and had income from Kentucky sources or are a part year Kentucky resident and moved into or out of Kentucky during the taxable year had income while a Kentucky resident had income from Kentucky sources while a nonresident File Form 740 NP R if you are a resident of a

https://revenue.ky.gov/Forms/Form 740 Schedule A 2022.pdf

Enter name s as shown on Form 740 page 1 Your Social Security Number K ENTUCKY I TEMIZED DEDUCTIONS FULL YEAR RESIDENTS ONLY Enclose with Form 740 2022 740 SCHEDULE A Commonwealth of Kentucky Department of Revenue FORM Interest Expense Other Miscellaneous Deductions Total Itemized Deductions

https://revenue.ky.gov/Individual/Individual-Income-Tax

A full year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full year nonresident files Form 740 NP Individual income tax laws are found in Chapter 141 of the Kentucky Revised Statutes New Filing Option Free Fillable Forms Kentucky is now offering a new way to file your return

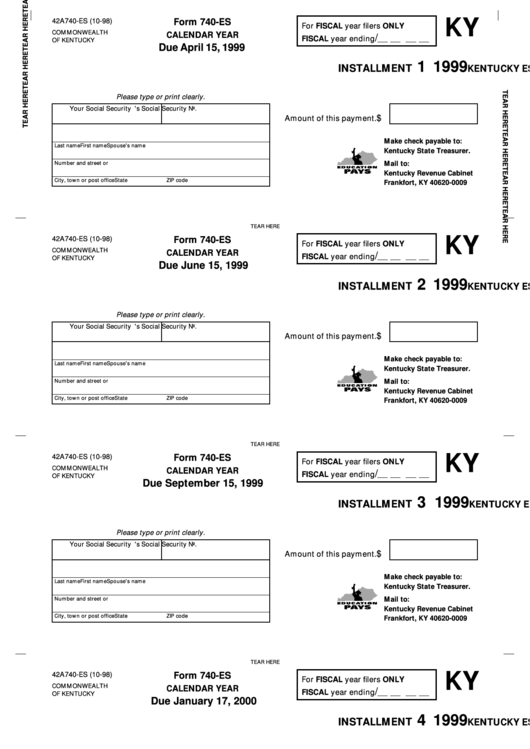

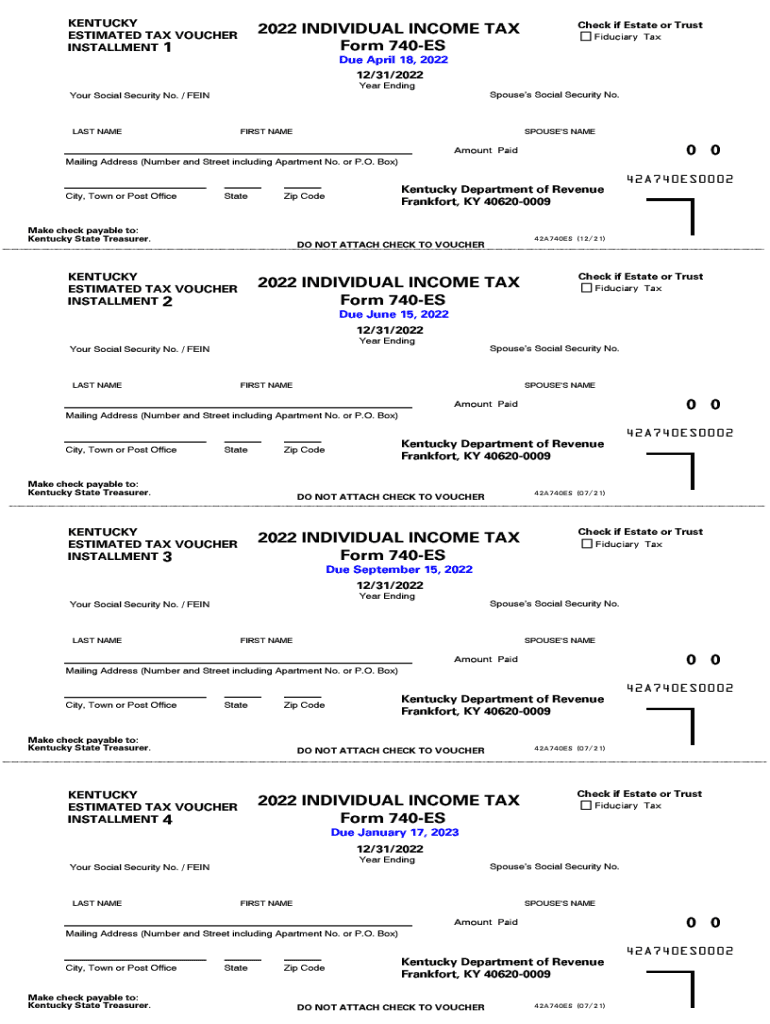

Kentucky state income tax Form 740 must be postmarked by April 18 2023 in order to avoid penalties and late fees Printable Kentucky state tax forms for the 2022 tax year will be based on income earned between January 1 2022 through December 31 2022 The Kentucky income tax rate for tax year 2022 is 5 The state income tax rate Form 740 V is a Kentucky Individual Income Tax form Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to record the purpose of the check and the SSN EIN of the taxpayer who sent it Many states recommend that taxpayers also write their social security number and the

Kentucky Form 740 Fillable Forms Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor Get everything done in minutes