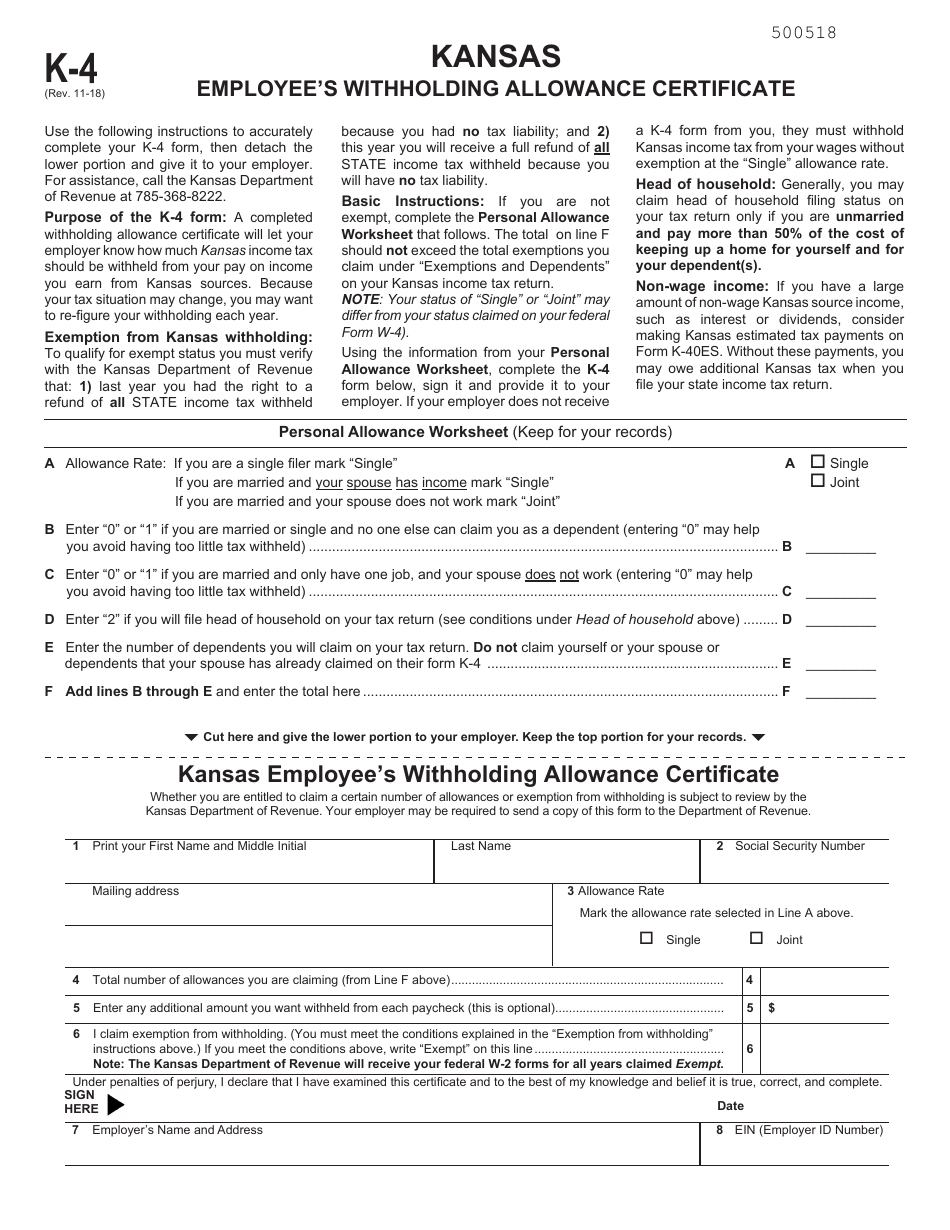

Kansas W2 Form Printable Purpose of the K 4 form A completed withholding allowance certificate will let your employer know how much Kansas income tax should be withheld from your pay on income you earn from Kansas sources Because your tax situation may change you may want to refigure your withholding each year

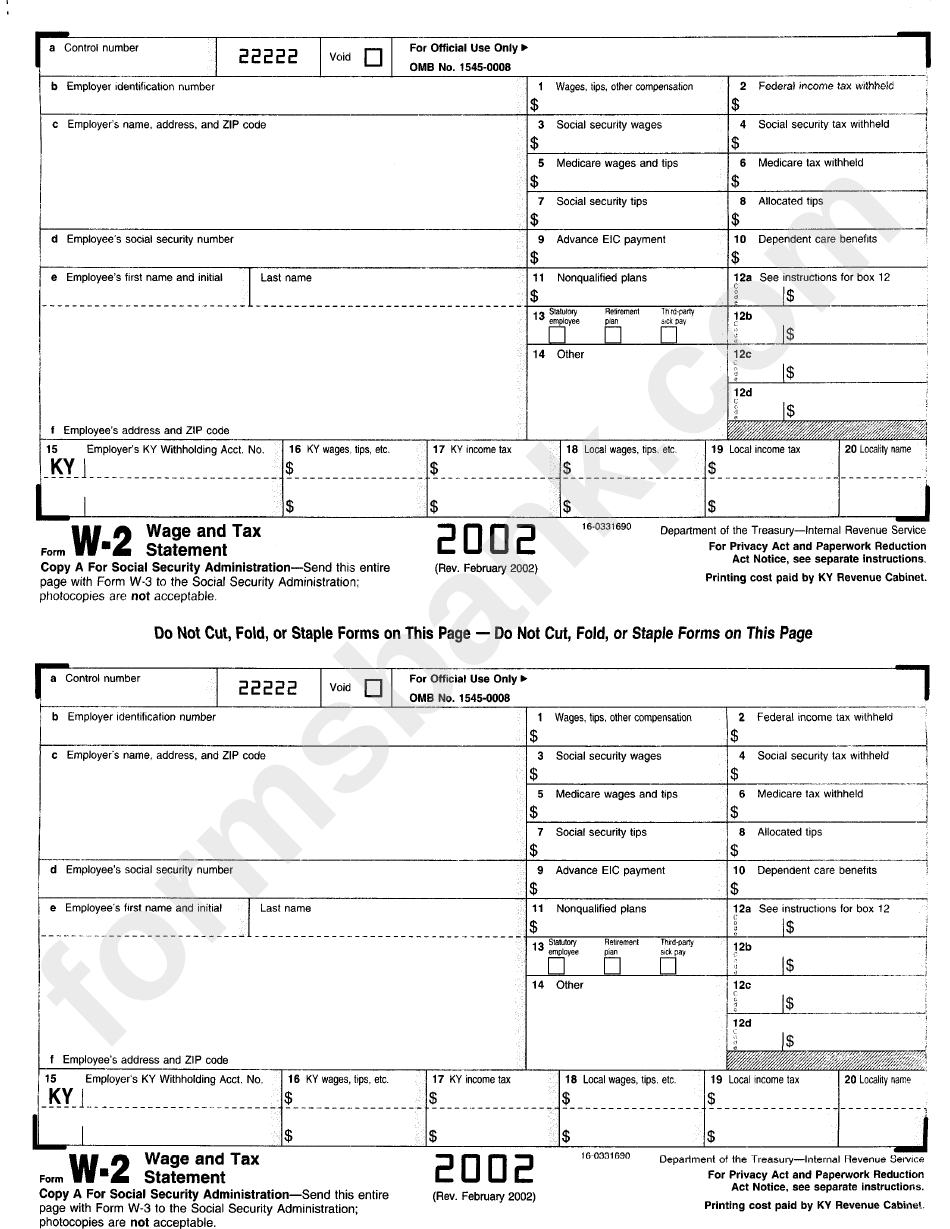

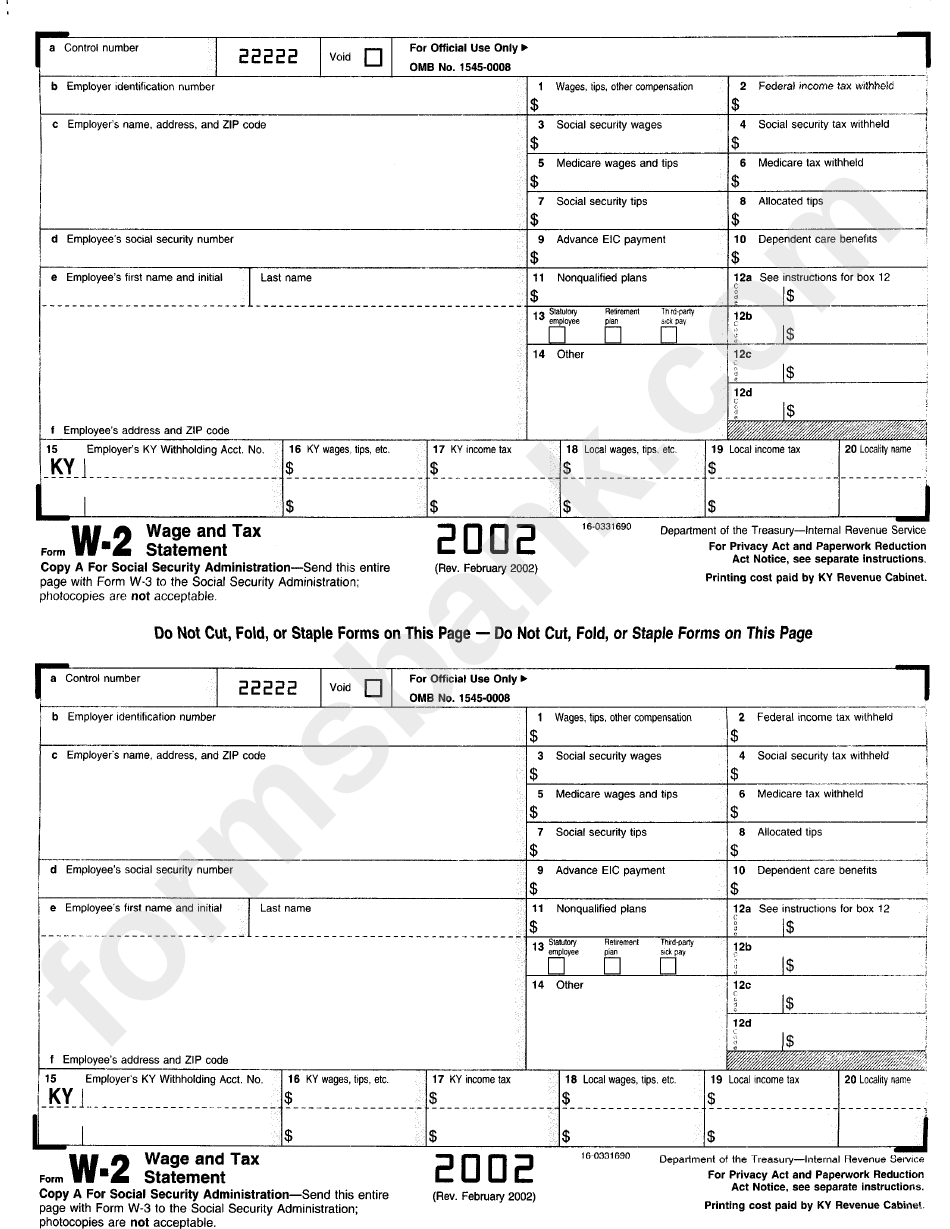

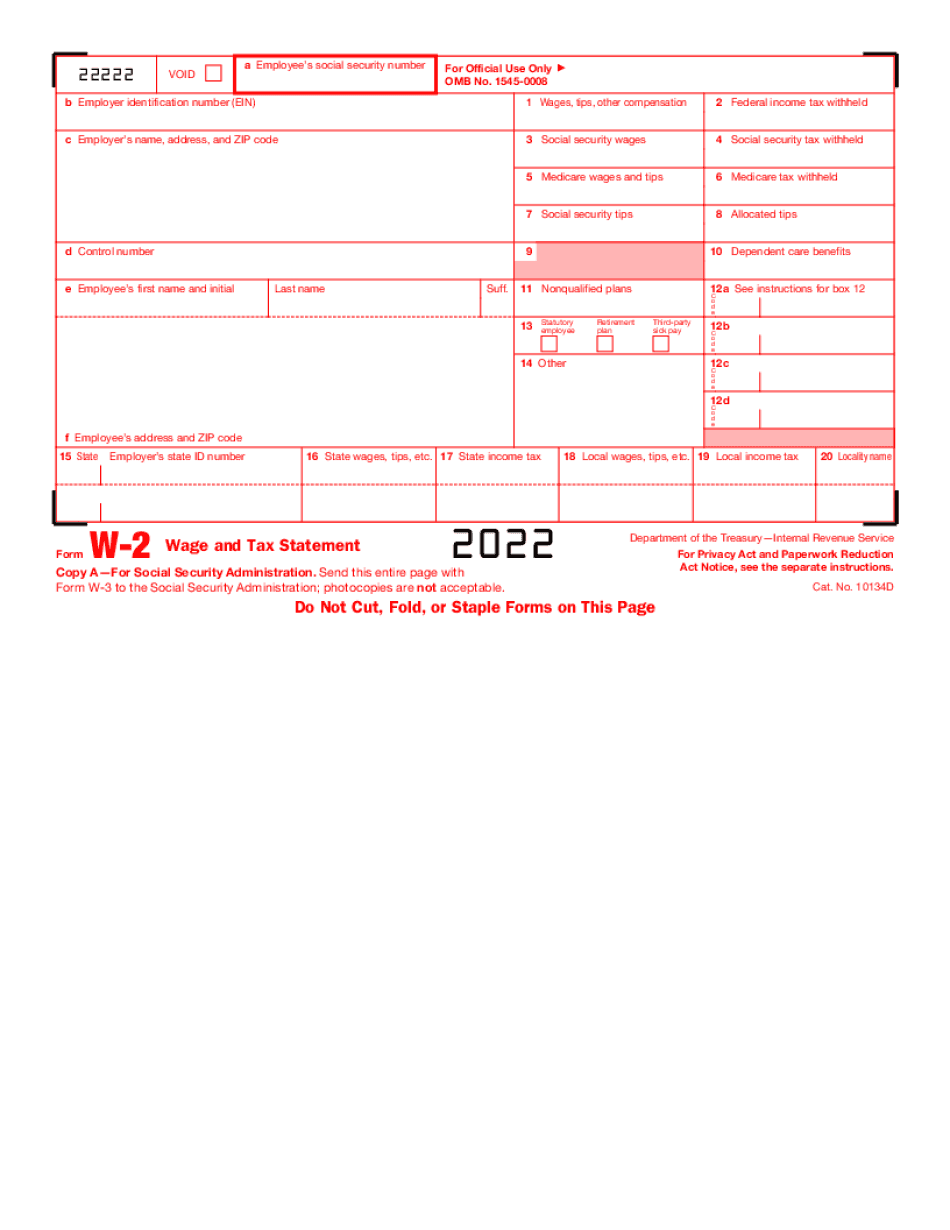

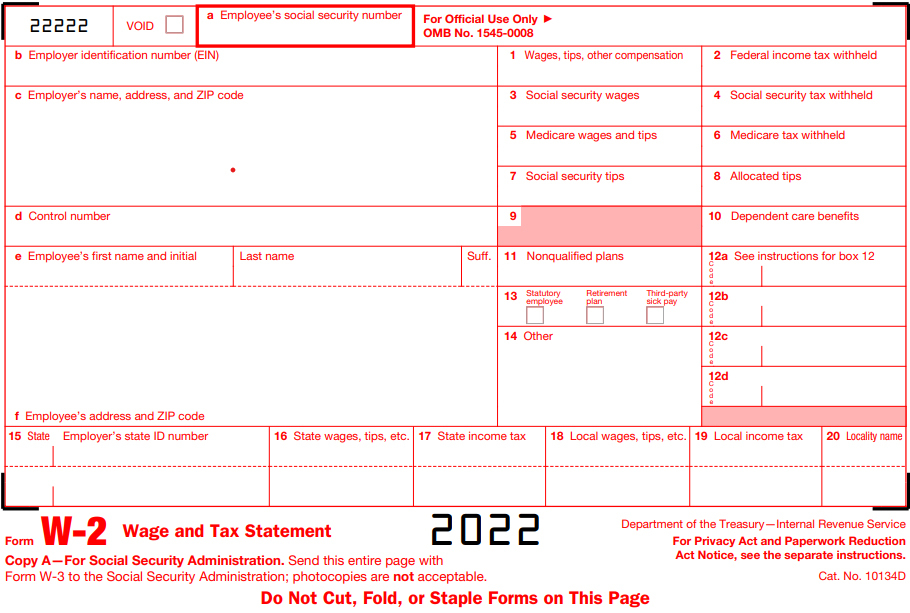

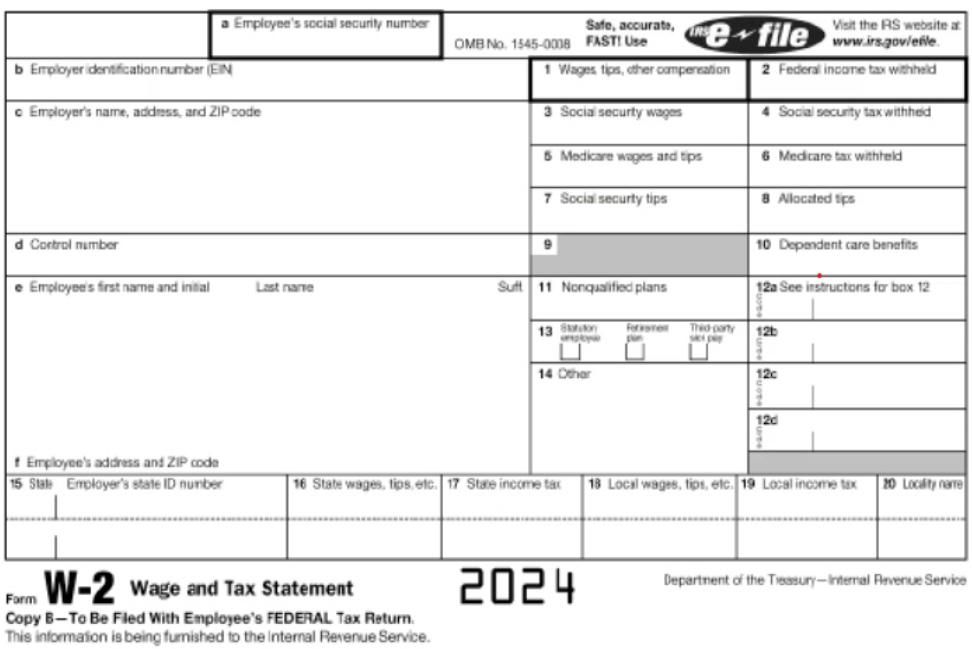

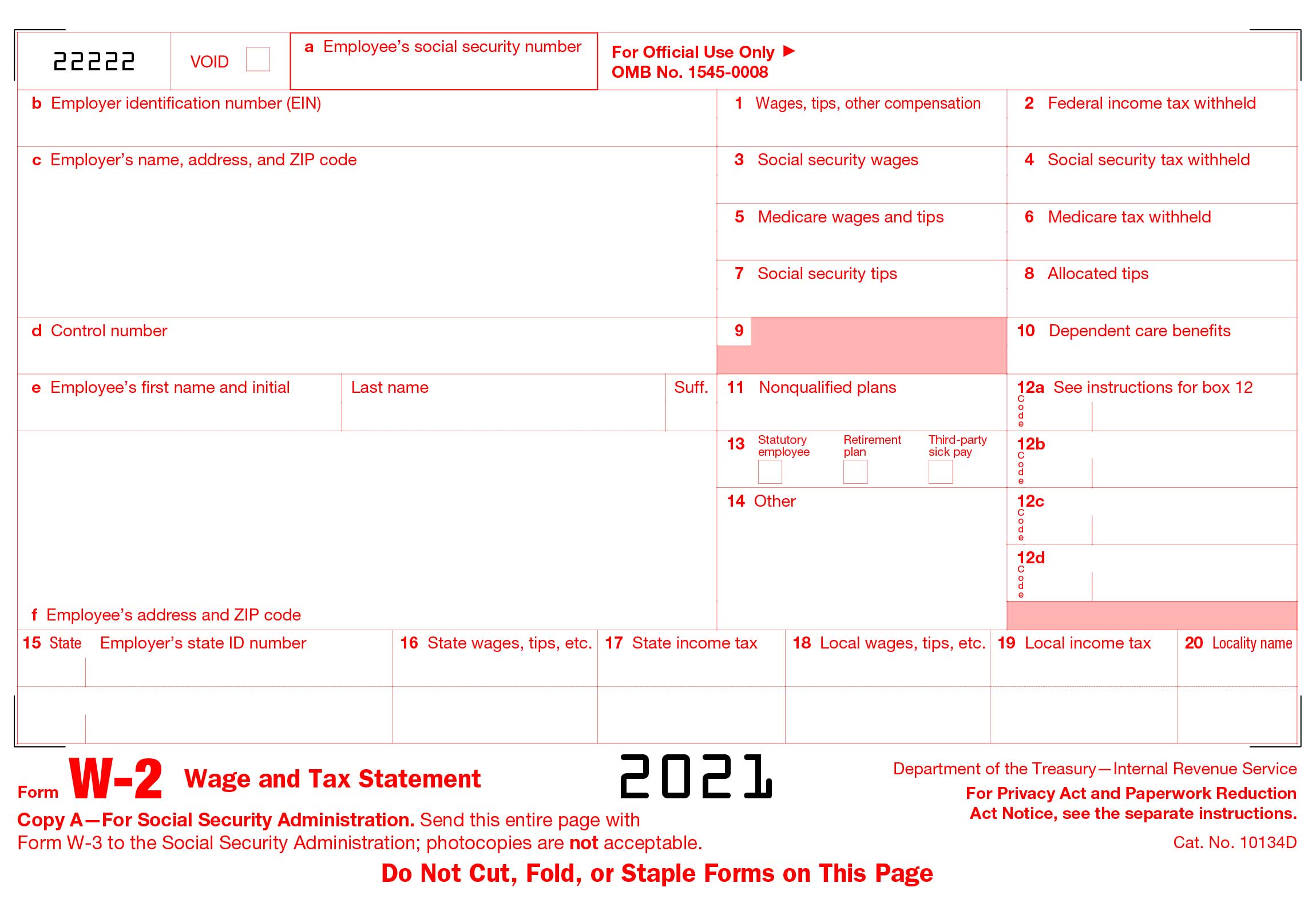

Report Kansas wages and withholding in the state information boxes of the W 2 form You must enter the complete Kansas Withholding Tax Account Number 036 XXXXXXXXXF 01 in the box for the Employer s state I D number on the W 2 If you are completing a W 2 for an employee for whom you have withheld taxes for more File Form KW 3 within thirty 30 days after the business was discontinued or payment of wages ceased LINE A Enter the total Kansas income tax withheld from all employees payees as shown on the Form W 2 and or federal 1099 form s that reflect Kansas withholding LINE D Add lines B and C and enter the total on line D

Kansas W2 Form Printable

Kansas W2 Form Printable

Kansas W2 Form Printable

https://data.formsbank.com/pdf_docs_html/271/2718/271892/page_1_bg.png

A W 2 form reports an employee s annual taxable wages and the amount of taxes withheld from their paychecks The W 2 is used by the employee to file an income tax return after each calendar year The State of Kansas issues W 2s by mail or through an online portal Announcement There is a known glitch with Turbo Tax when uploading your W 2

Pre-crafted templates use a time-saving service for developing a varied series of files and files. These pre-designed formats and layouts can be used for numerous individual and expert tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the content production process.

Kansas W2 Form Printable

Ms Employee Withholding Form 2023 Printable Forms Free Online

2023 Federal W2 Form Printable Forms Free Online

Kansas W2 Form Printable

Kansas W2 Form Printable

Kansas W2 Form Printable

Kansas W2 Form Printable Printable Blank World

https://ksrevenue.gov/forms-ii.html

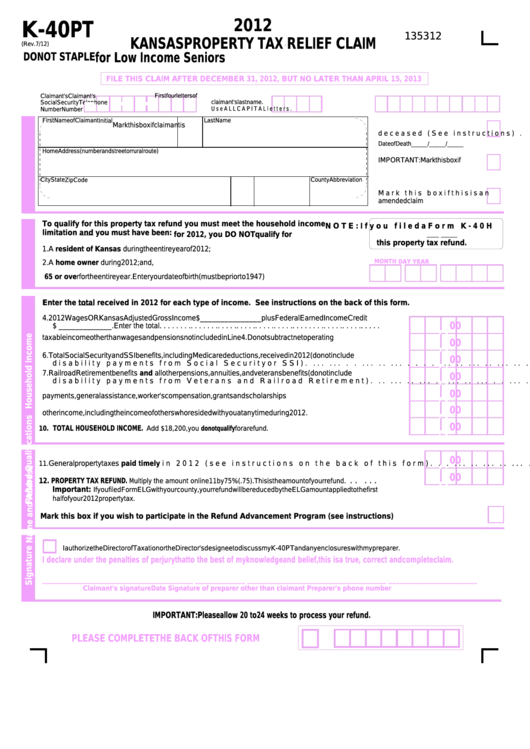

2022 Forms Individual Income Tax K 40 Original and Amended 2022 Individual Income Tax Supplemental Schedule Schedule S 2022 Kansas Itemized Deduction Schedule Schedule A 2022 Kansas Payment Voucher K 40V 2022 Individual Underpayment of Estimated Tax Schedule and instructions K 210 2022

https://ksrevenue.gov/formslibrary.html

Forms Library Click on any header in the table below to sort the forms by that topic or use the search box to search by form name number area or year Show entries Search Form Number Name Division Sub Division Year

https://ksrevenue.gov/k4info.html

Traditionally Kansas has accepted the federal Form W 4 to help employers calculate the Kansas withholding tax for employees However due to differences between State and Federal withholding policies the Department of Revenue has Form K 4 for Kansas withholding tax purposes Who Will Be Affected

https://ksrevenue.gov/kw100.html

FILING THE STATE COPY OF THE W 2 WITH KANSAS Once completed a copy of the W 2 form must be submitted to the Department of Revenue Employers submitting more than 50 W 2 records must file electronically see Electronic File and Pay Options herein Employers reporting less than 51 records can file on paper but are

https://ksrevenue.gov/faqs-w2.html

Does Kansas follow the Federal specifications for W 2s and 1099s Where can I find more information about filing requirements Will you work with me to make sure my information is submitted correctly and on time How can I submit my

Form W 4 Using the information from your Personal Allowance Worksheet complete the K 4 form below sign it and provide it to your employer If your employer does not receive a K 4 form from you they must withhold Kansas income tax from your wages without exemption at the Single allowance rate Head of household Generally you may Purpose of Form Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty If too much is

W 2 information can be uploaded in three 3 file formats Magnetic Media Reporting and Electronic Filing MMREF 1 Pre defined Comma Separated Value CSV IRS Publication 1220 1220 For file format specifications visit KDOR s Forms and Publications Withholding page at https www ksrevenue gov forms btwh html