Is There A Printable Tax Witholding Chart Online Find tax withholding information for employees employers and foreign persons The withholding calculator can help you figure the right amount of withholdings For employees withholding is the amount of federal income tax

TurboTax offers a suite of tax tools and calculators to help you save money Input your unique tax situations to find deductions calculate your W 4 withholding and more You can even estimate your tax return or how much you might owe with our tax refund calculator Read more INCOME TAXES For your 2023 payroll deductions we strongly recommend using our PDOC The online calculator makes it faster and easier to calculate payroll deductions The calculator also uses exact salary figures and provides more accurate calculations PDOC is available at canada ca pdoc

Is There A Printable Tax Witholding Chart Online

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png) Is There A Printable Tax Witholding Chart Online

Is There A Printable Tax Witholding Chart Online

https://www.investopedia.com/thmb/gUZXbgsSYvrV3x7Uhtlki1u7cWs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png

If you re an employer with an automated payroll system use Worksheet 1A and the Percentage Method tables in this section to figure federal income tax withholding This method works for Forms W 4 for all prior current and future years This method also works for any amount of wages

Templates are pre-designed documents or files that can be utilized for numerous functions. They can conserve time and effort by providing a ready-made format and layout for producing different sort of material. Templates can be utilized for individual or professional projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Is There A Printable Tax Witholding Chart Online

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

Income Tax Table 2022 Philippines Latest News Update

Irs Tax Tables 2022 Latest News Update

How To Calculate Medicare Social Security Witholding

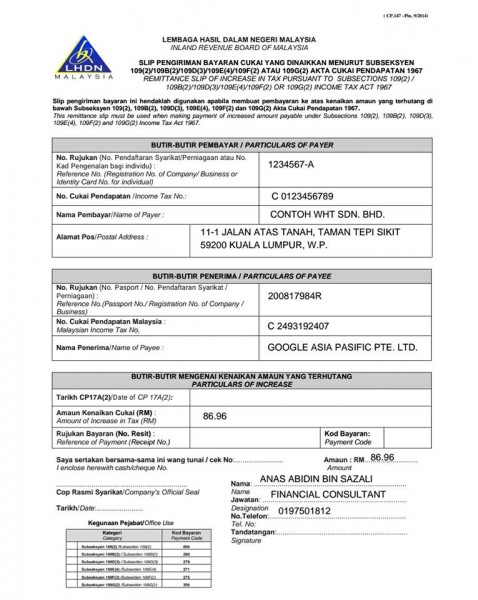

Ini Caranya Bayar Cukai Pegangan Witholding Tax Perkhidmatan Facebook

How To Calculate 2023 Taxes PELAJARAN

:max_bytes(150000):strip_icc()/Screenshot2023-03-17at4.01.40PM-e9aa8d8ea87c496b906b8b35c7c8592c.png?w=186)

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/

Withholding rates for lump sum payments Combine all lump sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use Use the following lump sum withholding rates to deduct income tax 10 5 for Quebec on amounts up to and including 5 000

https://www.canada.ca/en/revenue-agency/services/forms-publications/

The Payroll Deductions Online Calculator PDOC calculates the CPP contributions EI premiums and income tax on bonuses and retroactive pay increases You can use the PDOC by going to the Payroll Deductions Online Calculator

https://quickbooks.intuit.com/payroll/federal-withholding-tax-table

2023 federal withholding tax tables and updates to know Federal tax withholding tables are different from how they used to be The IRS adjusts the income threshold every year for inflation That means federal income withholding tables change every year in addition to the tax brackets

https://www.canada.ca//payroll-deductions-online-calculator.html

The basic personal amount will increase from 10 855 to 15 000 Since employees have received a lower basic personal amount for the first six months of the year a prorated basic personal amount of 19 145 will be prepopulated commencing with the payroll in July

https://www.canada.ca/en/revenue-agency/services/forms-publications/

This guide gives information for Canadian payers and withholding agents who make payments to non residents of Canada for income such as interest dividends rents royalties pensions and acting services in a film or video production It also explains how to fill out the NR4 slip and summary

Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as Resources Page Last Reviewed or Updated 13 Jan 2023 Learn about income tax withholding and estimated tax payments Use the IRS Withholding Calculator to check your tax withholding and submit Form W 4 to your employer to adjust the amount

Withholding and when you must furnish a new Form W 4 see Pub 505 Tax Withholding and Estimated Tax Exemption from withholding You may claim exemption from withholding for 2023 if you meet both of the following conditions you had no federal income tax liability in 2022 and you expect to have no federal income tax liability in 2023