Irs Printable Quarterly Taxes 1 You expect to owe at least 1 000 in tax for 2023 after subtracting your withholding and refundable credits 2 You expect your withholding and refundable credits to be less than the smaller of a 90 of the tax to be shown on your 2023 tax return or b 100 of the tax shown on your 2022 tax return

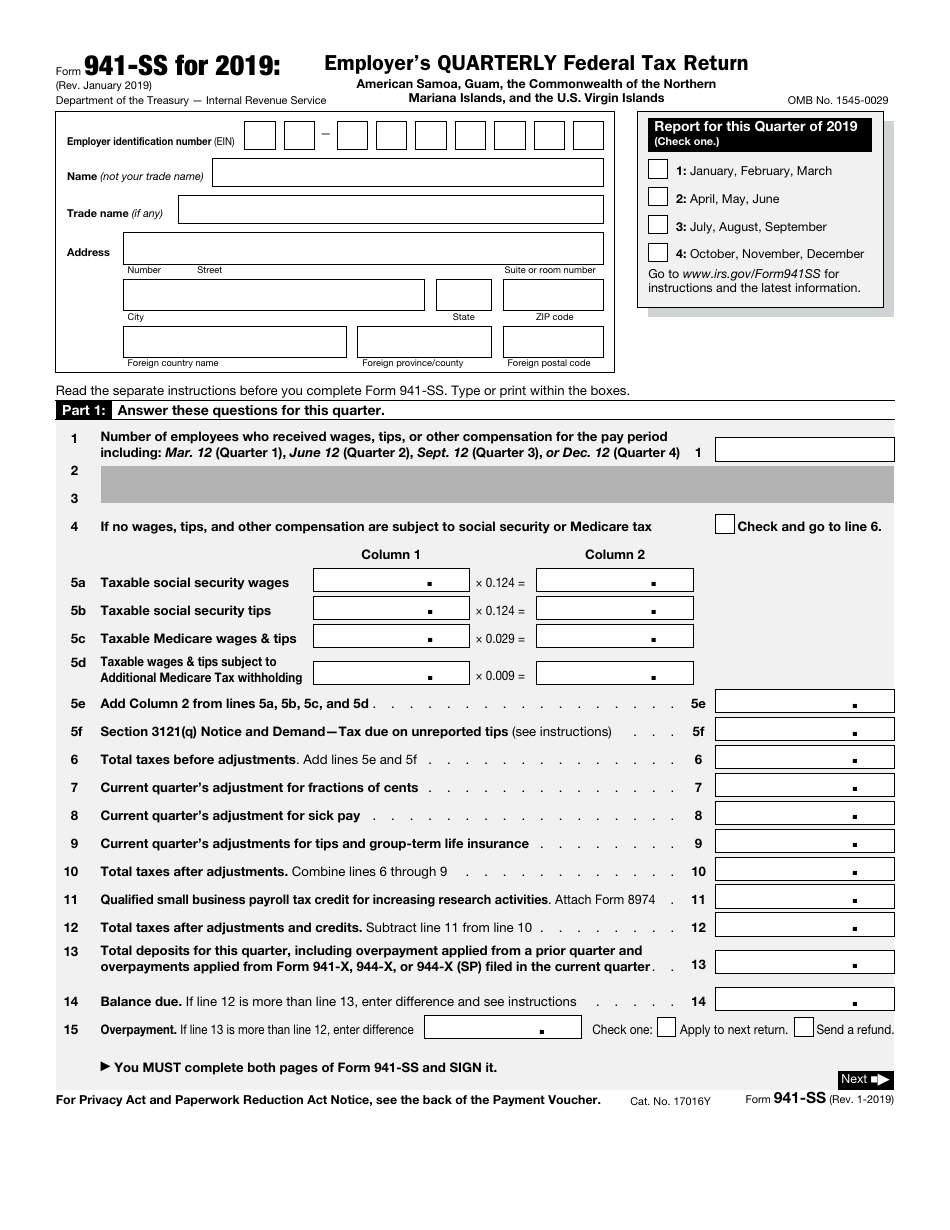

Information about Form 941 Employer s Quarterly Federal Tax Return including recent updates related forms and instructions on how to file Form 941 is used by employers who withhold income taxes from wages or who must pay social security or Medicare tax It provides two ways for taxpayers to prepare and file their federal income tax online for free Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site Our partners deliver this service at no cost to qualifying taxpayers Taxpayers whose AGI is 73 000 or less qualify for a free federal tax return

Irs Printable Quarterly Taxes

Irs Printable Quarterly Taxes

Irs Printable Quarterly Taxes

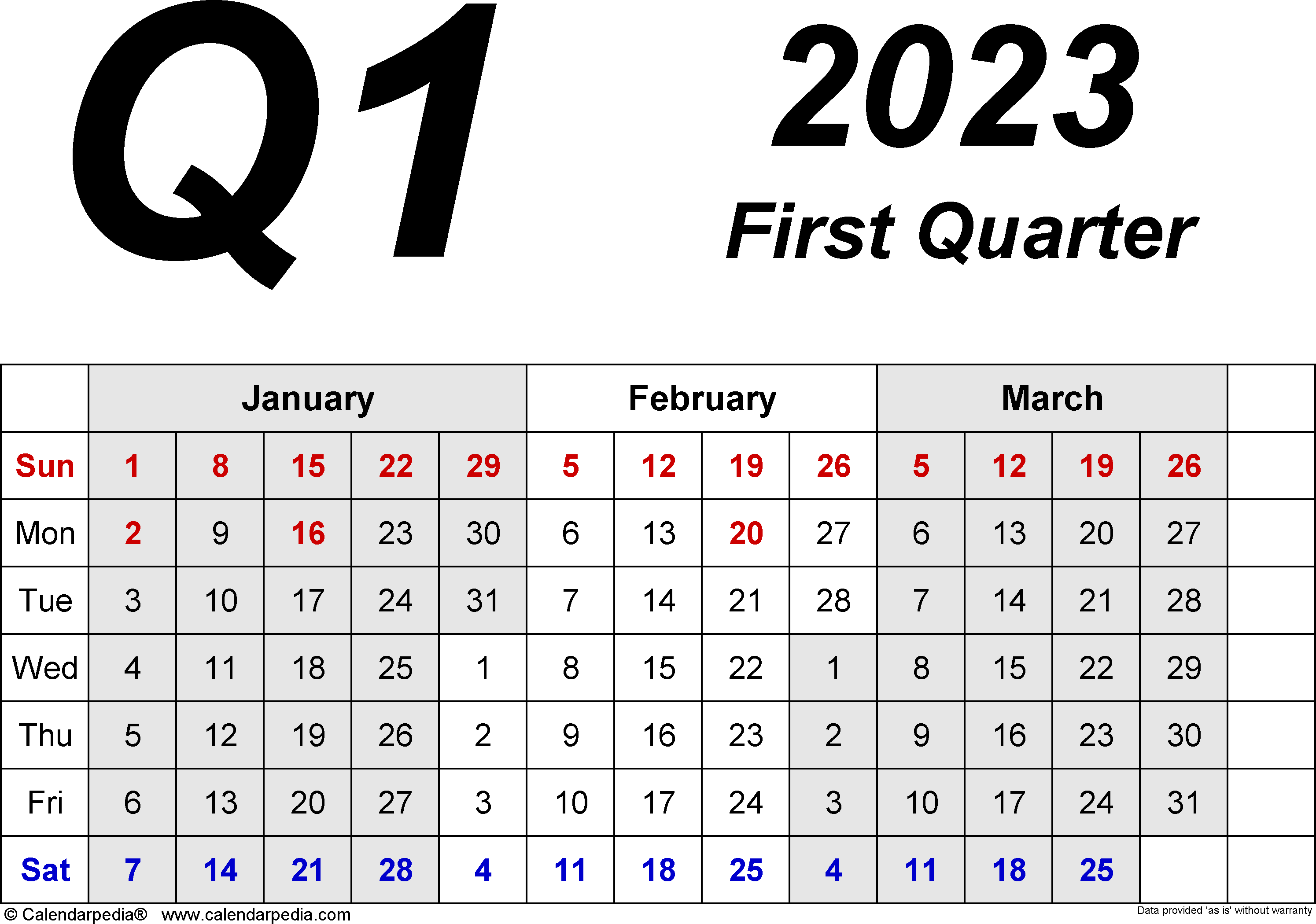

https://www.calendarpedia.com/images-large/quarterly/quarterly-calendar-template-2023.png

Quarterly taxes generally include self employment taxes Social Security and Medicare plus income tax on the profits that your business made and any other income If your income drops during the year or if it increases you can adjust your quarterly payments accordingly

Pre-crafted templates use a time-saving service for developing a varied series of documents and files. These pre-designed formats and designs can be utilized for different personal and expert tasks, including resumes, invitations, flyers, newsletters, reports, presentations, and more, simplifying the material development process.

Irs Printable Quarterly Taxes

Irs Make A Quarterly Payment IRSYAQU

How To Make The 2 Estimated Tax Payments Also Due July 15 Don t Mess

Quarterly Estimated Taxes Due Dates Penalties Cerebral Tax Advisors

How To Pay The Irs Quarterly IRSYAQU

How To Pay The Irs Quarterly IRSYAQU

How Do I Send The Irs A Payment Payment Poin

https://www.irs.gov/pub/irs-pdf/f1040.pdf

U S Individual Income Tax Return 2022 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying surviving spouse QSS

https://www.irs.gov/forms-instructions-and-publications

The latest versions of IRS forms instructions and publications View more information about Using IRS Forms Instructions Publications and Other Item Files Click on a column heading to sort the list by the contents of that column Enter a

https://smartasset.com/taxes/how-to-pay-quarterly-taxes

Therefore the IRS collects income taxes with quarterly tax payments To determine if a taxpayer must make quarterly tax payments they follow several guidelines You anticipate owing more than 1 000 after tax credits when filing your return for 2023

https://www.irs.gov/businesses/small-businesses-self-employed/estimated-taxes

You can use the worksheet in Form 1040 ES to figure your estimated tax You need to estimate the amount of income you expect to earn for the year If you estimated your earnings too high simply complete another Form 1040 ES worksheet to refigure your estimated tax for the next quarter

https://www.irs.gov/pub/irs-pdf/f941.pdf

Employer s QUARTERLY Federal Tax Return Form 941 for 2023 Rev March 2023 Employer s QUARTERLY Federal Tax Return Department of the Treasury Internal Revenue Service Employer identification number EIN Name not your trade name Trade name if any Address Number Street Suite or room number City State ZIP code

IRS Form 941 is a quarterly report that cites Withholding of federal income taxes from employee paychecks based on the information from their W 4 forms Withholding amounts due based on your employees Medicare and Social Security wages Calculation of your employer portion of FICA taxes Employer s QUARTERLY Federal Tax Return Created Date 8 23 2023 2 41 09 PM

Taxes for the first quarter of 2023 are due on April 18 If you expect to have a tax liability of 1 000 or more estimate and pay quarterly taxes on your earnings See Personal Finance