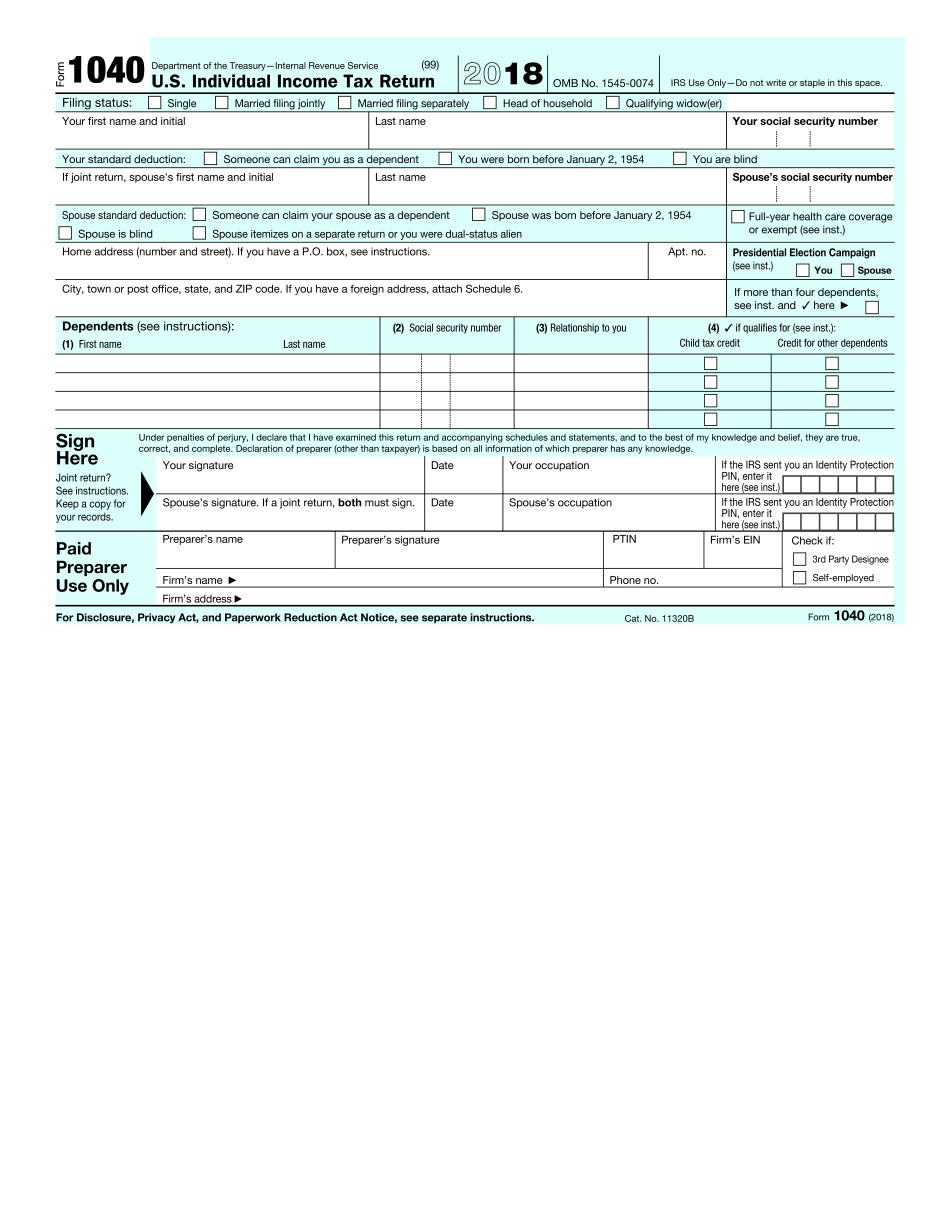

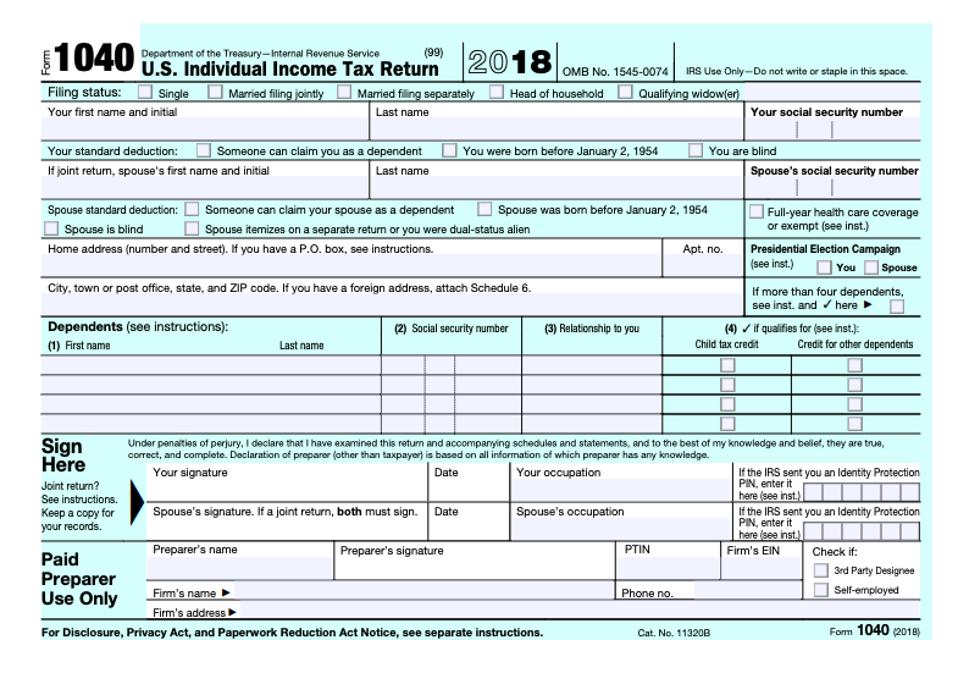

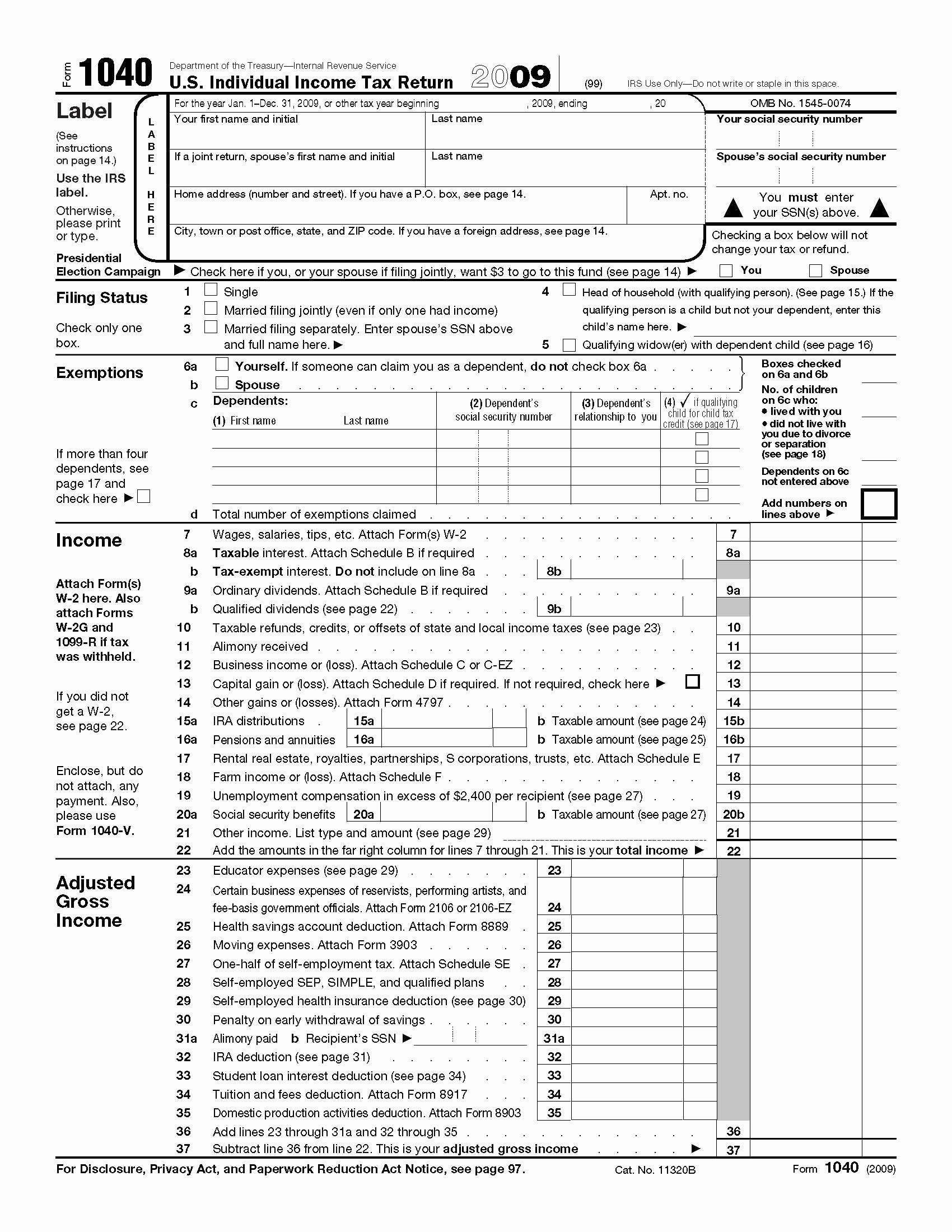

Irs Printable 1040 Tax Form Form 1040 officially the U S Individual Income Tax Return is an IRS tax form used for personal federal income tax returns filed by United States residents The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government

The tax program should then auto populate Form 1040 and any supporting schedules with your responses and e file it with the IRS You can print or download a copy for your records Printable tax form 1040 for tax year 2021 For use with income taxes filed by April 18 2022 Download

Irs Printable 1040 Tax Form

Irs Printable 1040 Tax Form

Irs Printable 1040 Tax Form

https://allfreeprintable4u.com/wp-content/uploads/2019/03/free-fillable-1040-tax-form-free-file-fillable-formspng-forms-form-free-printable-irs-1040-forms.jpg

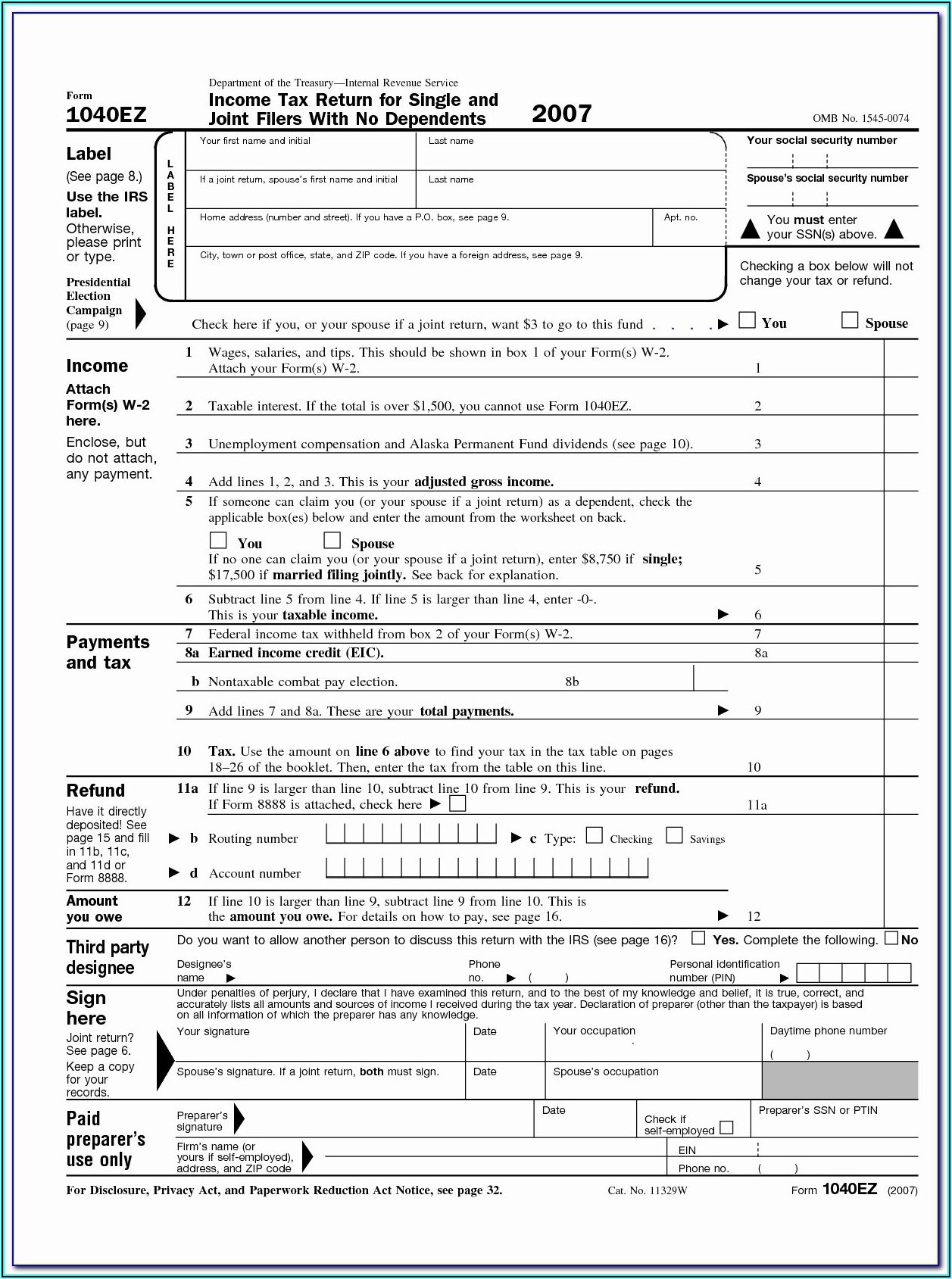

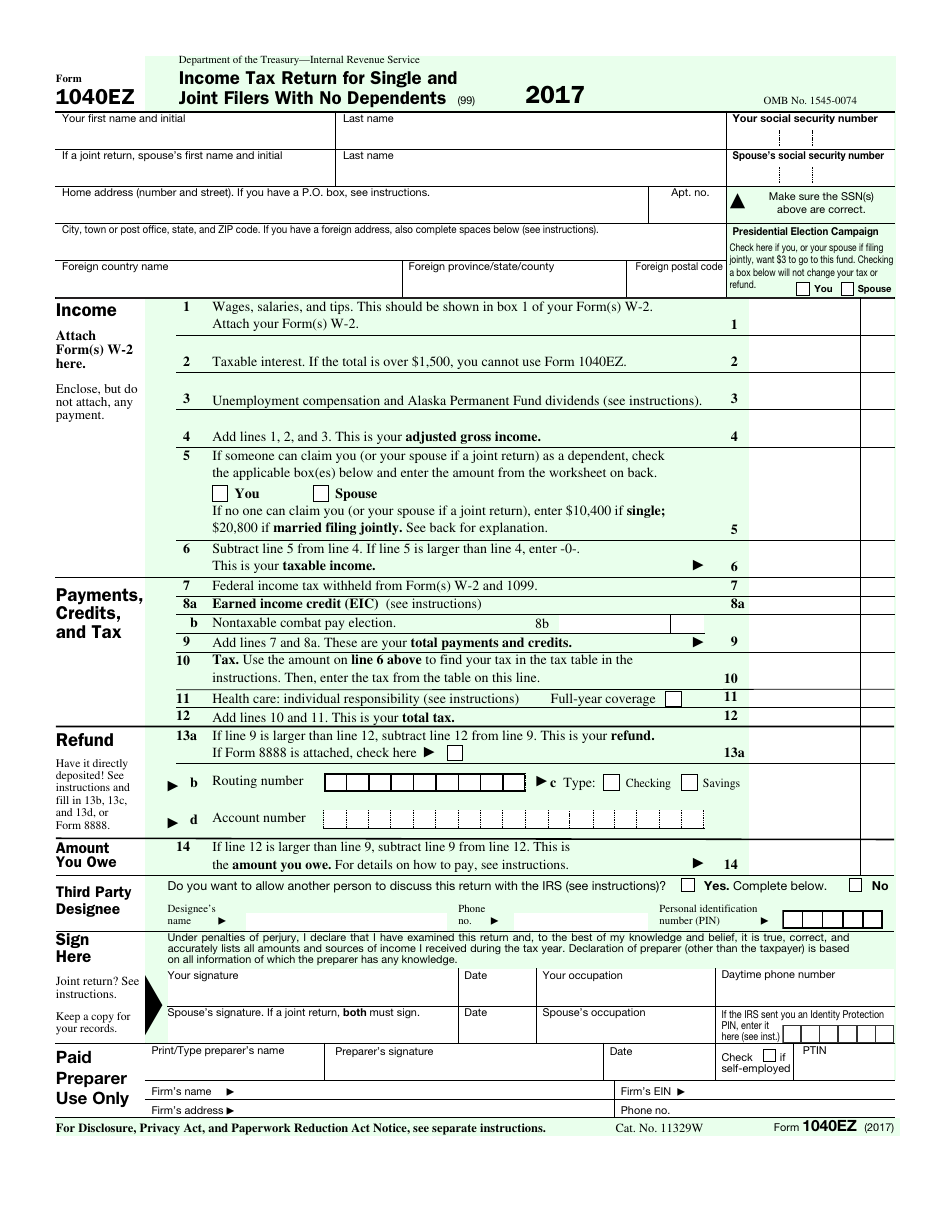

No Form 1040 and Form 1099 are two different federal tax forms Form 1040 is a form that you fill out and send to the IRS reporting your income deductions credits and tax due Form 1099 is used to report non employee income like independent contractors to you and to the IRS you ll use that information when you fill out Form 1040

Templates are pre-designed files or files that can be used for numerous functions. They can conserve effort and time by offering a ready-made format and layout for creating different type of content. Templates can be utilized for individual or professional tasks, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Irs Printable 1040 Tax Form

Irs 1040 Form Printable

1040 Form Printable Printable Forms Free Online

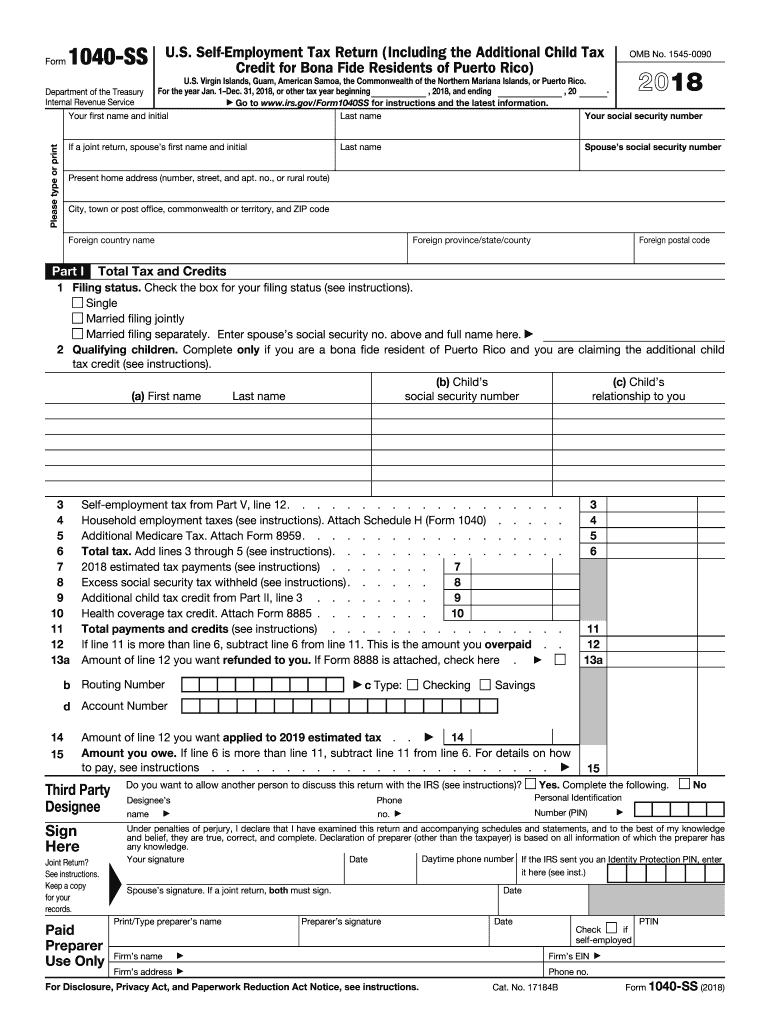

2018 Form IRS 1040 SS Fill Online Printable Fillable Blank PdfFiller

Federal Tax Forms 2023 Printable Printable Forms Free Online

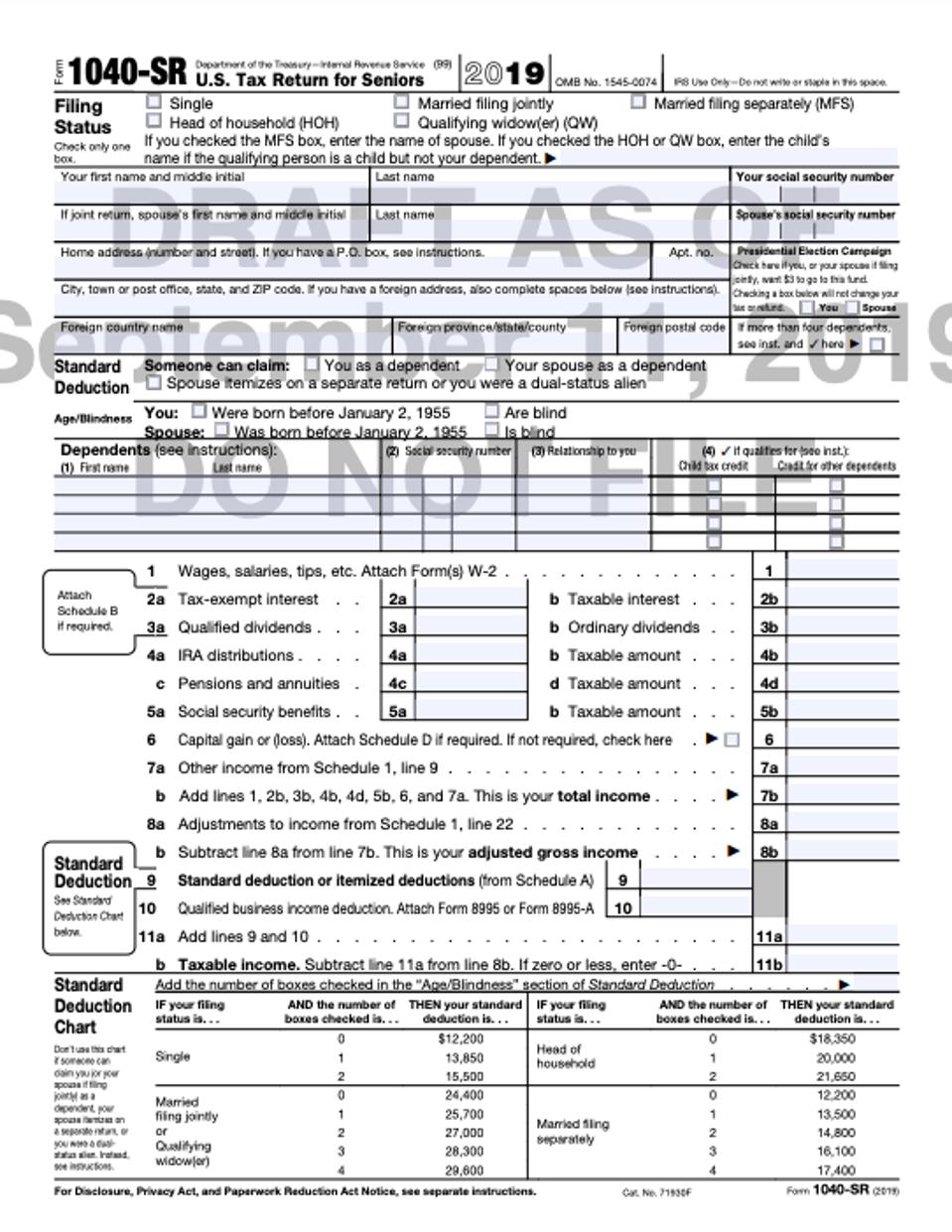

Printable 1040 Sr Form

Printable 1040 Sr Form

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Form 1040 U S Individual Income Tax Return 2022 Department of the Treasury Internal Revenue Service OMB No 1545 0074 IRS Use Only Do not write or staple in this space Filing Status Check only one box Single Married filing jointly Married filing separately MFS Head of household HOH Qualifying surviving spouse QSS

https://www.irs.gov/forms-pubs/about-form-1040

Information about Form 1040 U S Individual Income Tax Return including recent updates related forms and instructions on how to file Form 1040 is used by citizens or residents of the United States to file an annual income tax return

https://www.irs.gov/forms-instructions-and-publications

POPULAR FORMS INSTRUCTIONS Form 1040 Individual Tax Return Form 1040 Instructions Instructions for Form 1040 Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return

https://www.usa.gov/federal-tax-forms

The IRS has released a new tax filing form for people 65 and older It is an easier to read version of the 1040 form It has bigger print less shading and features like a standard deduction chart The form is optional and uses the same schedules instructions and attachments as the regular 1040

https://omb.report/document/www.irs.gov/pub/irs-pdf/f1040.pdf

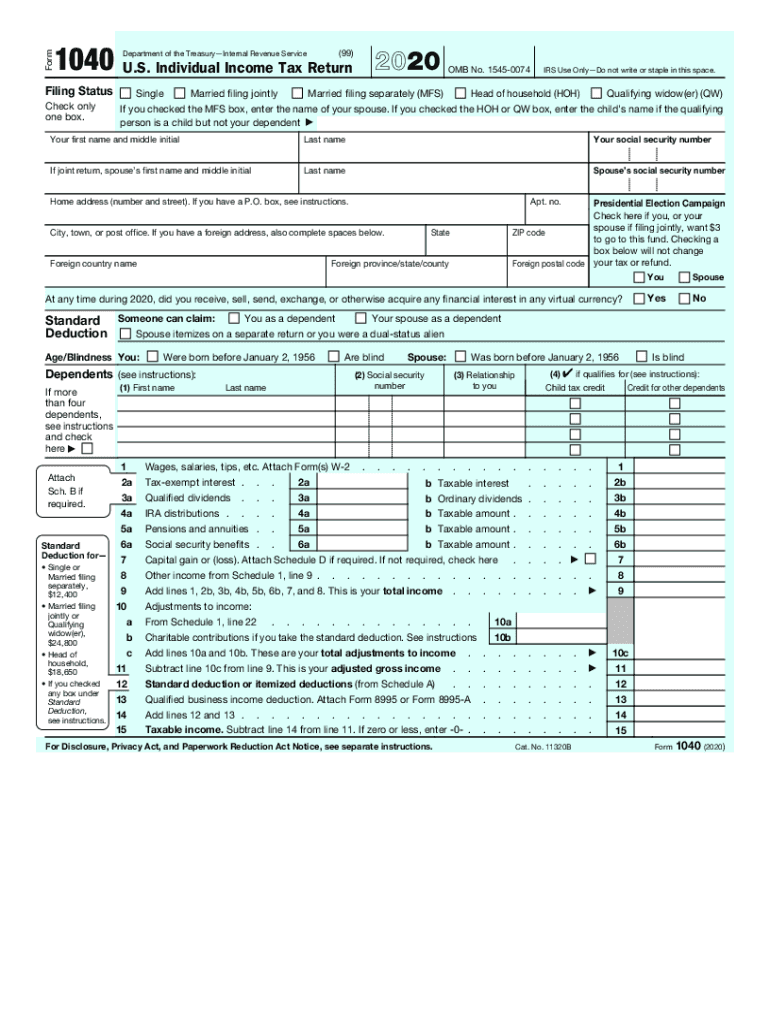

Form 1040 U S Individual Income Tax Return 2020 Document pdf Download PDF pdf Form 1040 U S Individual Income Tax Return 2020 Filing Status Check only one box

As of the 2018 tax year Form 1040 U S Individual Income Tax Return is the only form used for personal individual federal income tax returns filed with the IRS In prior years it had been one of three forms 1040 the Long Form 1040A the Short Form and 1040EZ see below for explanations of each used for such returns Please use the link below to download 2022 federal form 1040 pdf and you can print it directly from your computer More about the Federal Form 1040 We last updated Federal Form 1040 in December 2022 from the Federal Internal Revenue Service This form is for income earned in tax year 2022 with tax returns due in April 2023

The IRS Form 1040 is used to file an individual s federal income tax return The instructions for Form 1040 are updated each year and include information on how to complete the form and what supporting documentation you